Urgent Dividend Payout Announcement Coming Soon

Guys, the landmark energy opportunity

in America is just beginning…

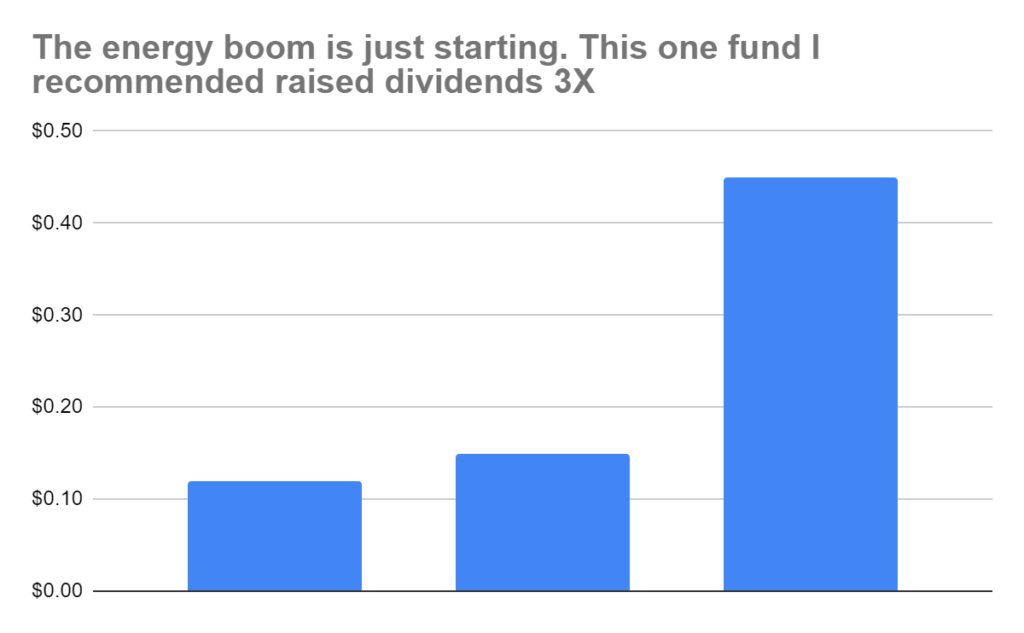

I recommended an oil investment in July…

and they just tripled their dividend

(and they’re still trading at a 11% discount)

On July 5th, 2022, I recommended buying shares of a fund with interests in oil and natural gas…

Within 2 months, the fund raised their dividends 3X…

As the Russia-Ukraine war and energy crisis continues, I expect even bigger payouts

Meaning, if you originally invested earning $2,000 dividends per year…

You’re already up to $6,000 per year.

And this is only going to continue.

As Russia shuts off natural gas to Europe… and OPEC cuts production…

Eyes are going to turn to the US to become a dominant energy producer.

Look, guys, I know you hear all these politicians talk about getting rid of fossil fuels and “electric cars will be the norm.” I’m all for this trend, but it’s not happening anytime in the next decade.

As this energy crisis unfolds, you can profit from this trend as America becomes an energy powerhouse.

The fund I recommended is about to announce its next dividend payment.

They pay out dividends monthly…

And I expect more dividend raises in the future.

They already boosted 25% in January 2022.

Before pushing for a 200% raise in September 2022.

The shareholder list is a “Who’s Who” of investing. Over 40% is owned by massive institutions.

As winter unfolds across the globe, energy will be the main story.

This company is allocated across the sector:

- 26.2% allocated to natural gas

- 12.1% allocated to MLPs (in oil space)

- 4.2% allocated to utilities

And even a percentage towards renewables looking towards the future.

Here’s the rub…

You can buy shares in these energy opportunities for 11% off what others pay.

That’s incredible especially as this fund pays a 15% dividend! Meaning, you’re capturing a near 20% higher yield than those who pay normal price for shares.

Again, this company is about to announced when you can collect your first check soon…

How is this possible?

There’s a unique way I’m able to see huge discounts on stocks.

In fact, I can grab more than 11% discounts.

I’m receiving an 18% discount on dividend stocks

that others pay full price for…

And collecting 2-10X MORE yield from those same stocks

(no options or day trading required)

Over 22 years, buying these discounted shares has beat the market 2-to-1.

I learned this from rubbing elbows with some of the biggest fund managers in US history. They too are buying at these discounts and collecting income while they do it.

If you could buy a stock…

… or even your house…

At an 18% discount, would you do it?

I mean, c’mon. Of course!

It’s not a trick question.

You’d be investing with both hands. You’d be calling everyone you know, “Hey, it’s Tim, I got a screaming good deal!”

Well, every single day, there are stocks on sale… trading for far less than what you see quoted on CNBC… and you could collect higher dividends buying the discounted shares over the full-priced shares!

Sounds fishy, right?

Heck no. It’s awesome.

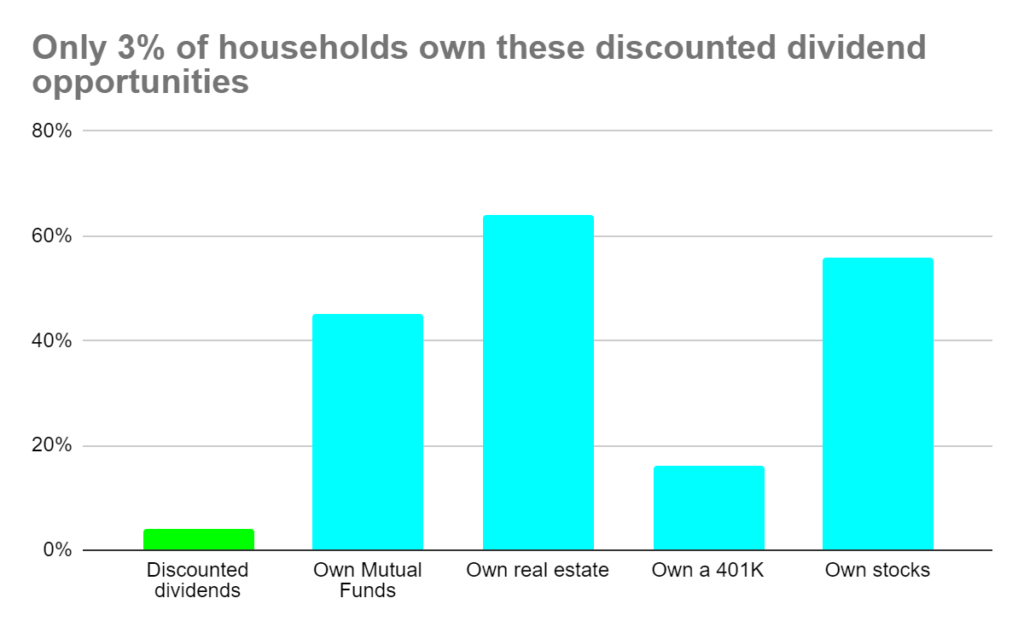

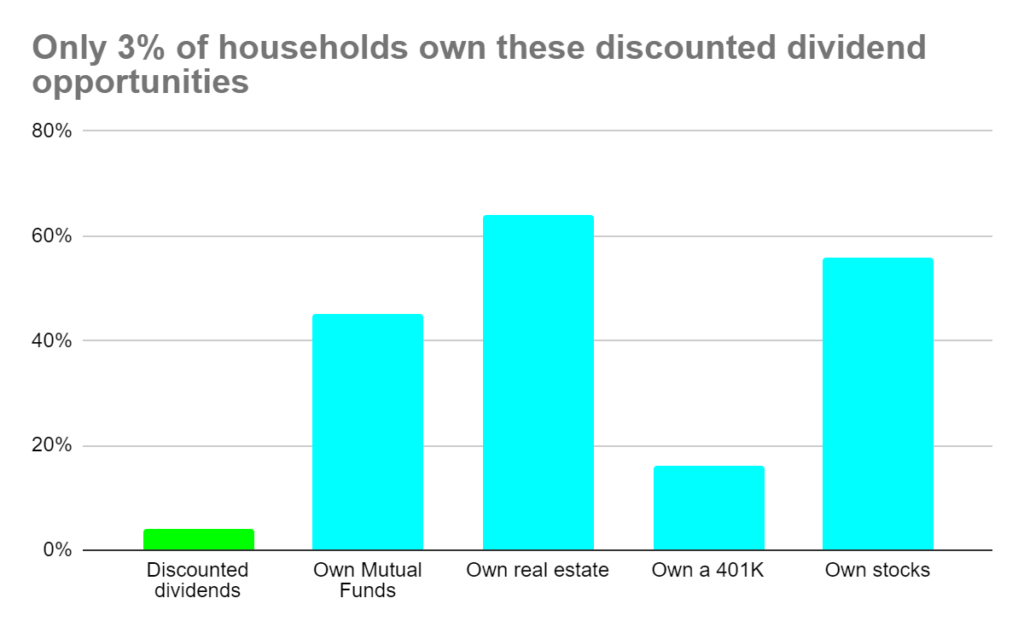

Only 3% of American households know how to get these amazing discounts and collect higher dividends…

You can own them in your IRA…

Some even ship you tax-free dividends…

The New York Times say these assets “offer bargains” to regular investors like you.

The key is knowing how to buy them.

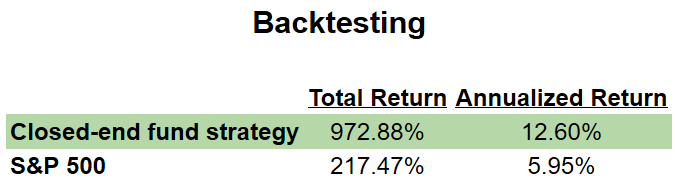

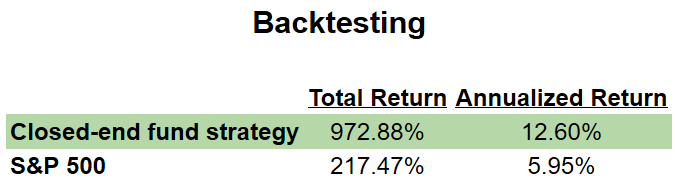

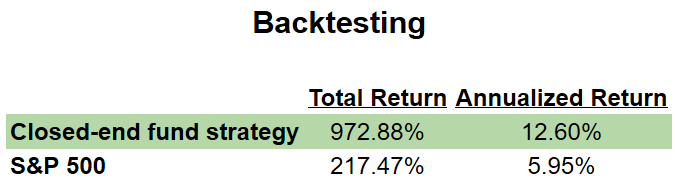

If you knew how to buy these discounted shares, you’d likely have beaten the market 2-to-1 over the last 22 years.

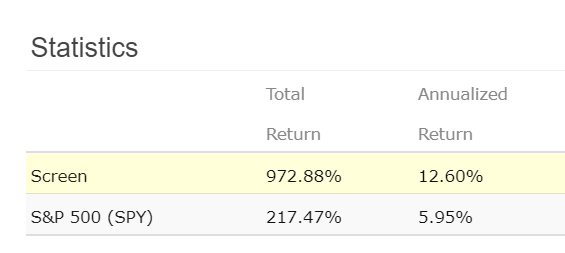

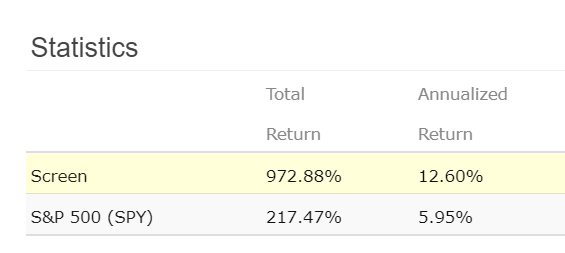

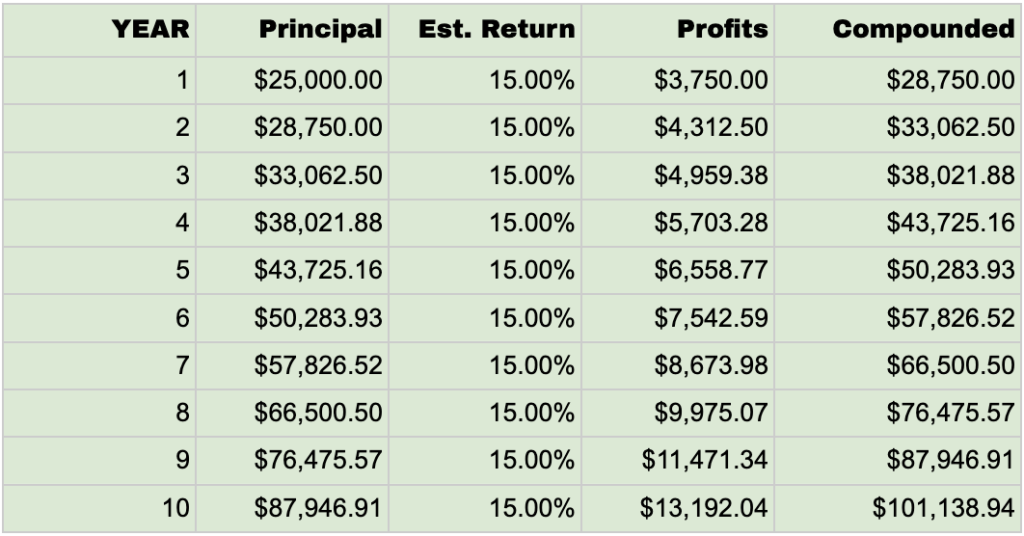

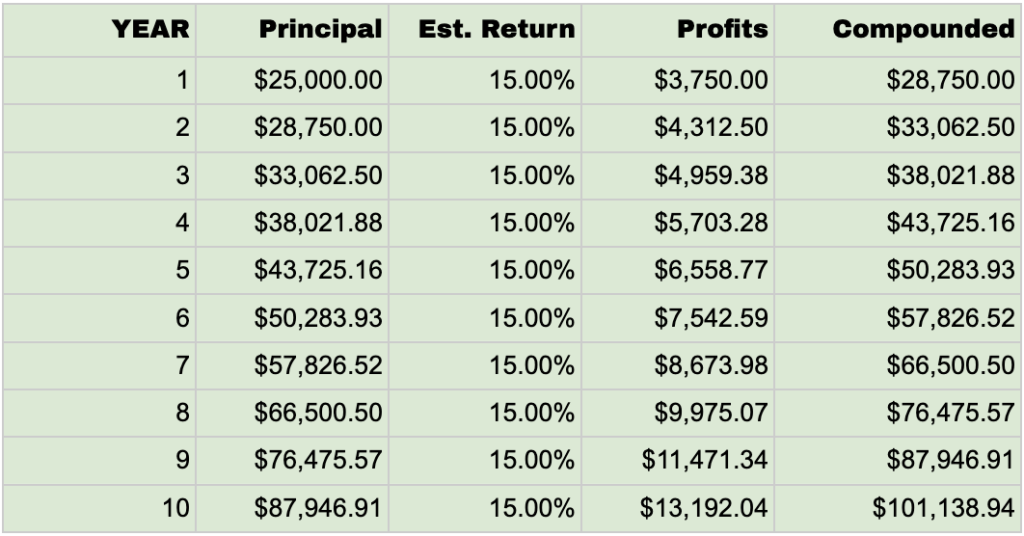

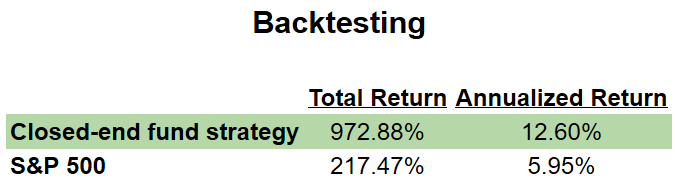

I put the numbers into my proprietary model and these were the back-tested results:

You’re receiving 347% more total returns…

And doubling your annualized.

Not to mention, likely collecting 2-10X more dividends than buying full price shares.

It’s an incredible phenomenon so few know about.

So, of course, most of the folks getting the fat clearance prices are — surprise, surprise — stinking rich.

The rich know what they’re doing.

It’s not because they’re smarter. They simply have legions of analysts and high-paid suits digging up these opportunities for them.

But that’s changing right now.

My name is Tim Melvin.

I came from a scrappy background. Working my way up from a door-to-door salesman, to rubbing elbows with some of the biggest fund managers in history.

I’m talking about the likes of billionaire George Soros, Victor Neederoff, I worked close to Jim Cramer for years… and many others.

It’s from studying these guys that I figured out how to beat the pants off the returns every average American gets investing in the S&P 500.

Because, as I showed you, you’re beating the S&P 500 2-to-1 historically over 22 years.

And the secret isn’t to have money spilling out of your pockets.

I’m going to let you in on these little-known discounted shares you likely have never heard of before.

The Financial Times says “Most investors don’t know these exist.”

Carl Icahn got his start buying up these assets… before going after bigger fish and raiding public companies.

I’m investing in companies through the public markets just like you.

The difference is I’m capturing huge and steep discounts not

found anywhere else.

I’m not interested in paying full price for my shares, and neither should you.

Let me share some specifics that’ll help.

My #1 opportunity right now… let’s check out the numbers.

Right now… in the next 5 minutes…

You could join me, and grab shares in a collection of massive energy companies for an 18% discount.

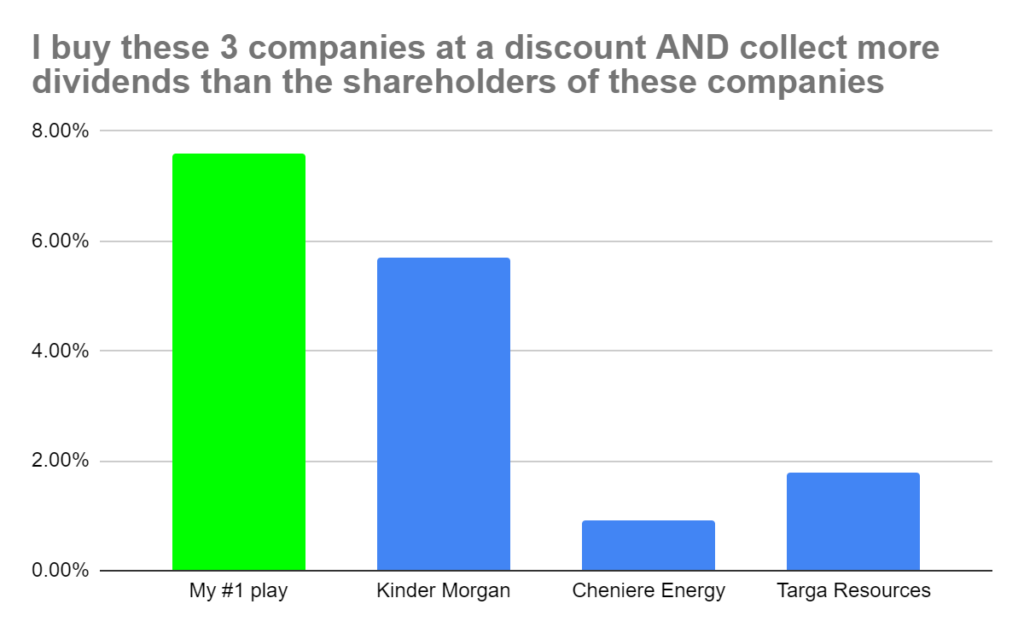

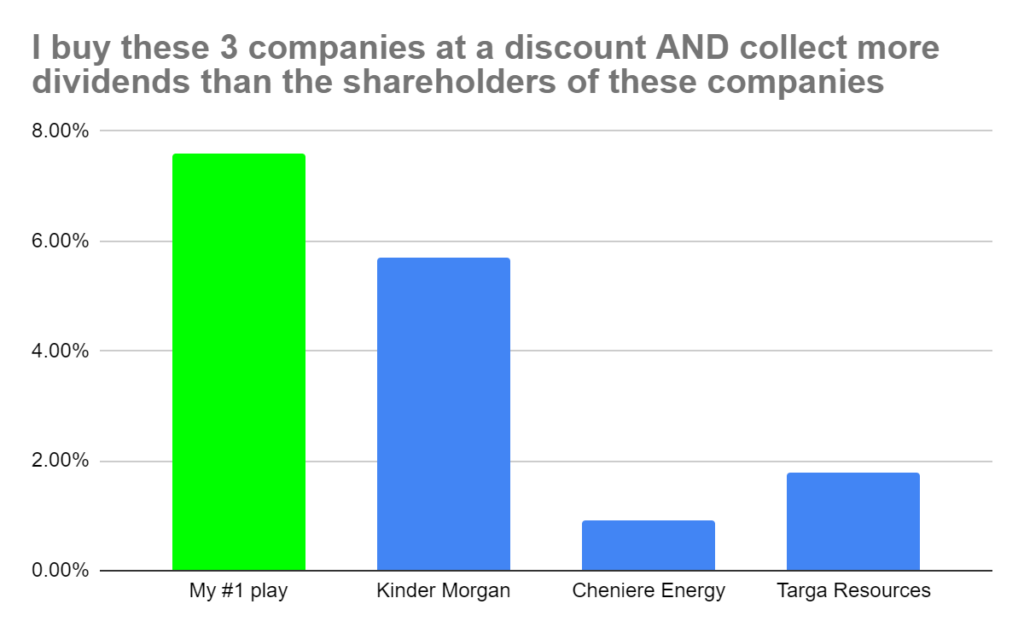

I’m talking 18% off Kinder Morgan, Cheniere Energy, Targa Resources.

These aren’t chump companies. Kinder Morgan is a $43 billion dollar company. That’s larger than Zoom, Pinterest, Coinbase, Peloton, Etsy. All of them.

I’m getting Kinder Morgan at an 18% discount.

I’m buying into their 83,000 miles of pipe… one of the largest energy infrastructure companies in North America… but spending less for shares.

Even better… because I’m an income investor, and love seeing some cash…

I’m able to collect a 7.6% dividend yield to gain exposure to Kinder Morgan.

You’d rather go buy Kinder Morgan stock by itself?

Kinder Morgan pays a 5.7% dividend… almost 2% less yield per year..

Cheniere pays a 0.90% dividend. That’s not even worth the squeeze.

Targa Resources… a measly 1.8%.

What would you rather have? 7.6% like I’ll show you or 1.8% betting it all on one stock’s dividends?

I’m not a betting man, except on my Baltimore Orioles, but I’d bet you’d take the 7.6% dividend. That’s not a hard decision.

I’ll show this unique opportunity today, plus two others I’ll talk about in a moment. One of them allows you to buy everything Warren Buffett invests in at a 17% discount.

Really cool, I know.

So what are these investments?

You may have heard of them.

They’ve been around since 1893… started as a way to fund railroads for building this great

United States of America.

And yet only 3% of American households invest.

More people have a 401(k)… than invest in these opportunities.

People just don’t know they exist… and they don’t understand them.

Here’s the deal, and it’s no chilling secret…

You don’t hear about them because brokers and the media

don’t promote them!

I’m not sharing news here… brokers and financial advisors care about their wallet before yours. Doesn’t matter how many letters they have after their name… their first priority is their stash at the end of the day.

With stocks… mutual funds… ETFs…

Brokers are paid everytime they sell you something. You buy a stock. They get paid. You buy a mutual fund. They get paid. ETF? They get paid.

For my discounted shares, brokers only make money when they first go public. After that… almost nothing.

So when I’m picking up my shares at 18% discounts… the brokers receive $0.

You think they’re happy about that?

They’d rather push another junk company on you like Uber, who hasn’t made a penny of profit before 2022.

That makes me a bit ticked… you could buy shares at an 18% discount… collect more dividends than owning shares… but brokers and the media aren’t interested in sharing this with the world.

They don’t get paid, so they won’t do it. So much for fiduciary duty, huh?

Here’s what’s left… owners holding shares in my discounted dividend companies.

They can only sell their stake to a small pool of buyers because 97% of American households aren’t buying.

Small pools of buyers = less competition = lower prices to sell your shares.

Meaning, folks are offering up to me their shares for an 18% discount. They need cash fast.

Huge win for you.

Because

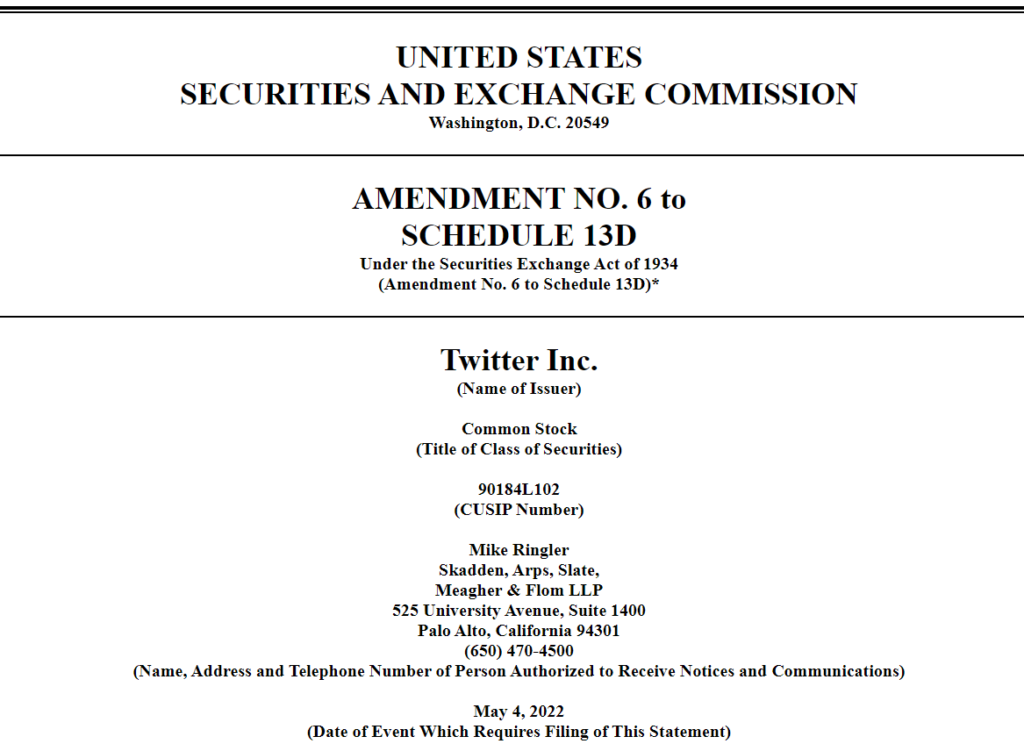

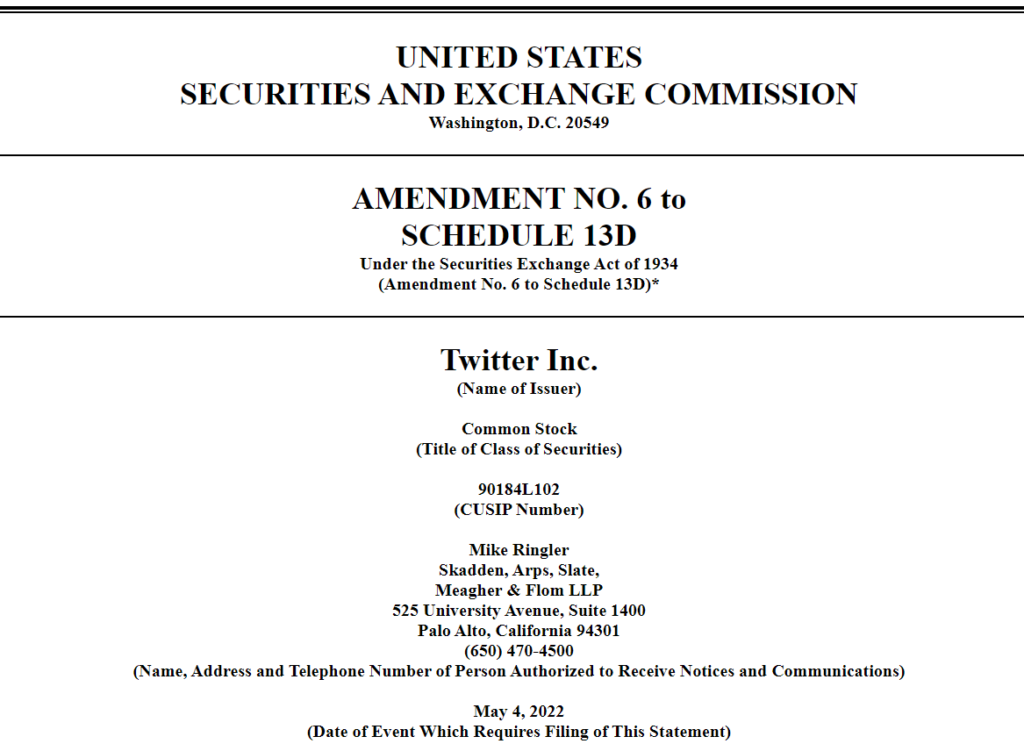

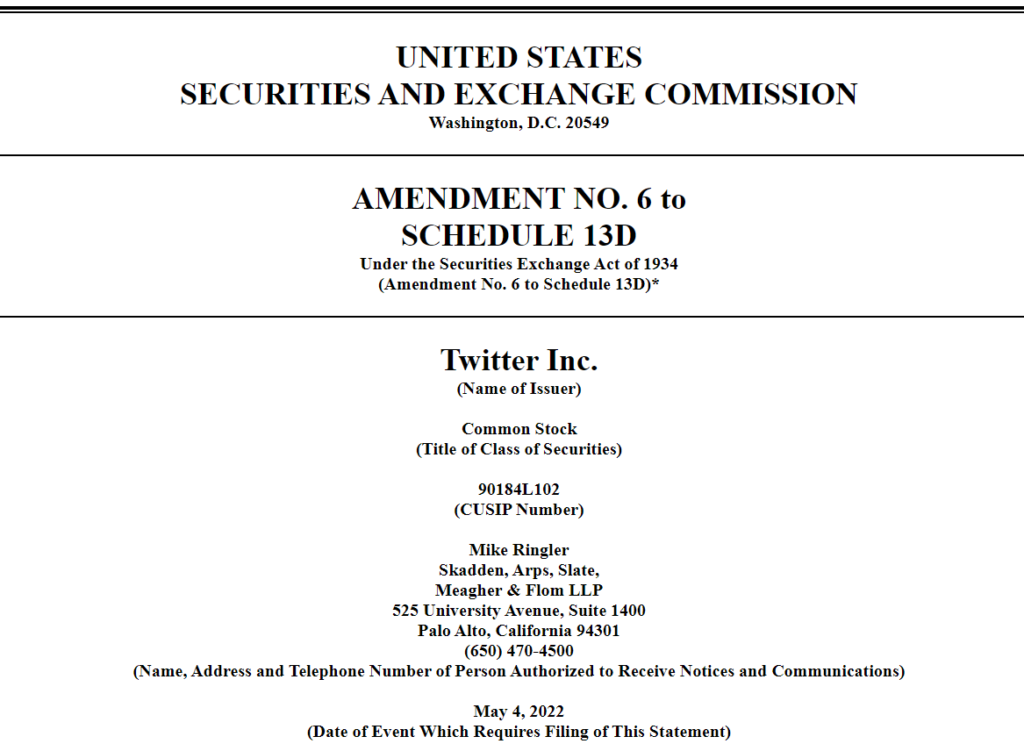

We then use a secret SEC filing to turn that 18% discount into potentially double-digit profits.

That SEC filing opens a window of “arbitrage” in the market to

allow us to profit.

Profits doubling what you can expect in the market.

If more households invested… rather than a measly 3%… we could see those discounts shrink a bit. But that hasn’t started.

However, with the secret SEC filings I’m reading every single day…filings that open up little-known arbitrage opportunities… there’s a massive opportunity blooming.

When stocks fall…

Investors turn to high income assets.

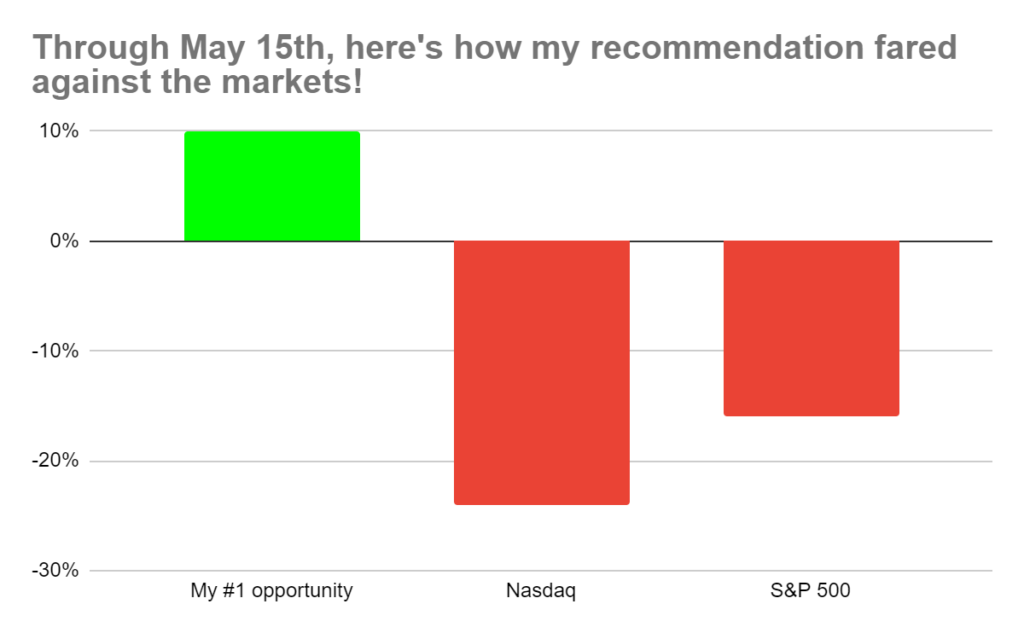

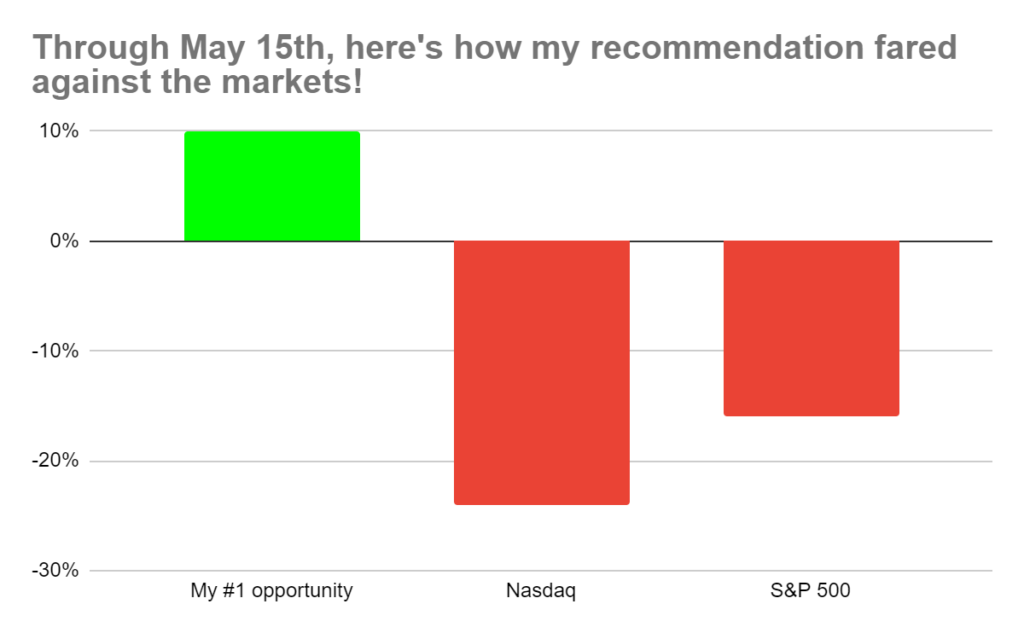

In 2022, stocks are giving their best 2000-tech bubble reenactment..

Buckets of stocks like Peloton, Coinbase, even Netflix are getting decimated for 50-80% losses off their highs.

But my 18% discount play?

Through the first five months of 2022, it was up 10% through May 15th… and that’s NOT including its 7.6% annual dividend!

Income is safety right now.

And it’s a darn good place to be.

Because not only are you collecting your high dividends…

But

You’re taking advantage of a special arbitrage opportunity that could net you even more profits in the

next 12-24 months.

Let me explain.

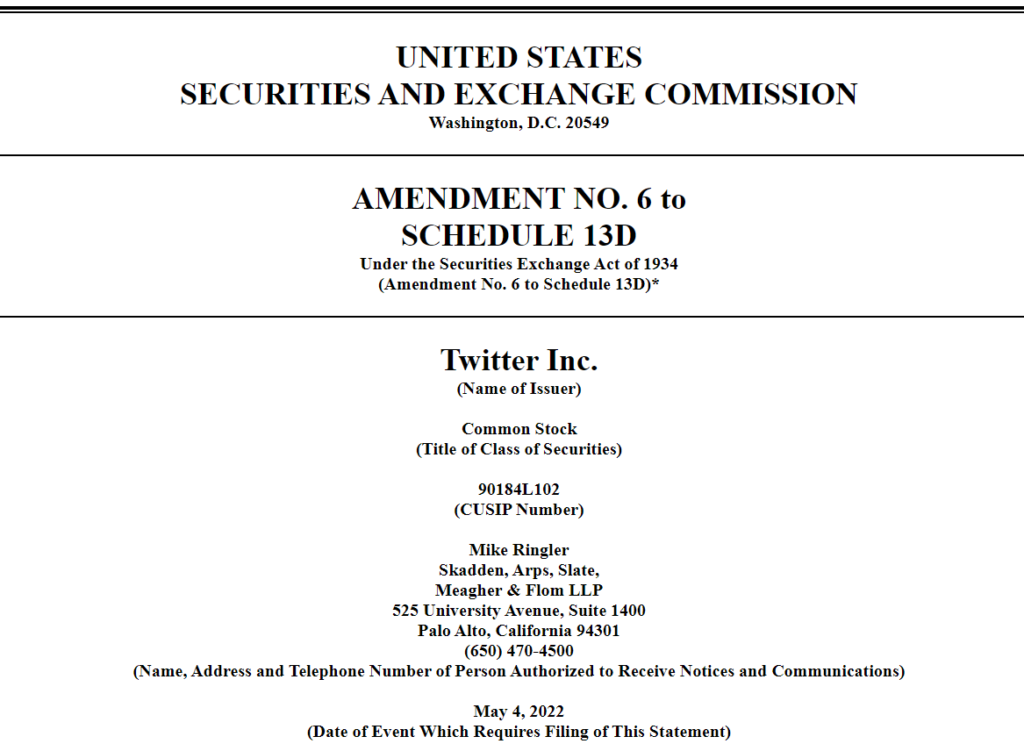

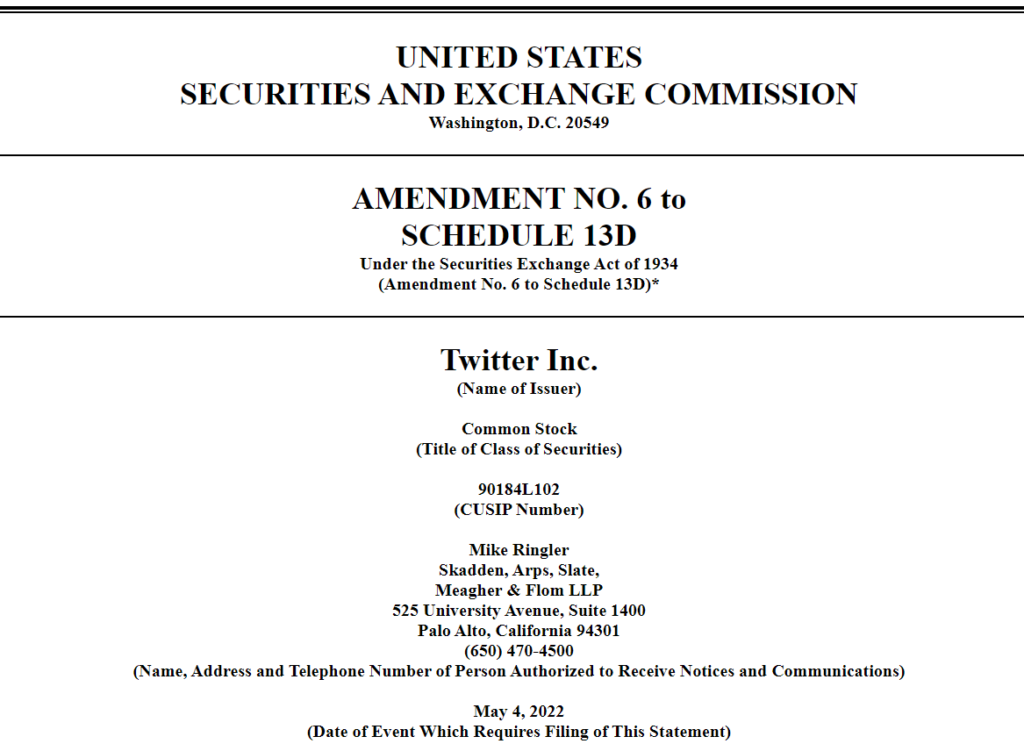

It’s all thanks to this little document here:

This same document was used by Elon Musk in his acquisition of Twitter.

No need to guess this special form.

I’ll explain what it is in a minute.

But it is the key to what makes these discounted dividend shares so exciting, and really powerful for any retirement account.

When this form is filed… watch out.

For a short time in the market, there’s an arbitrage opportunity to ride the coattails of big money into strong profits and cashflow.

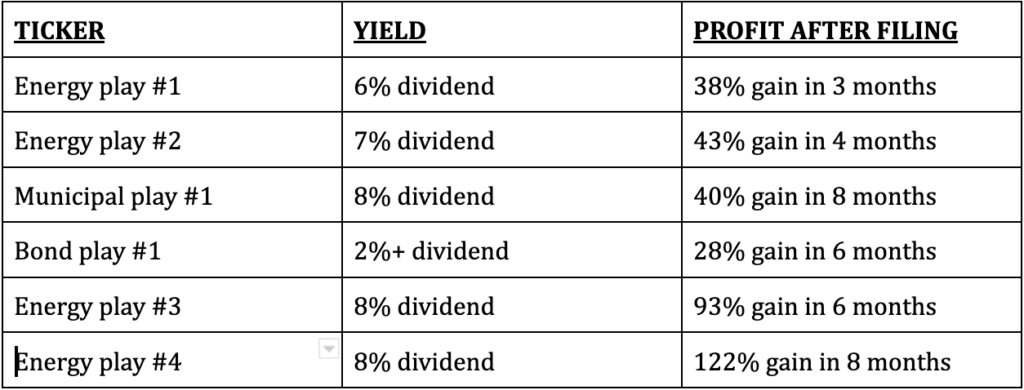

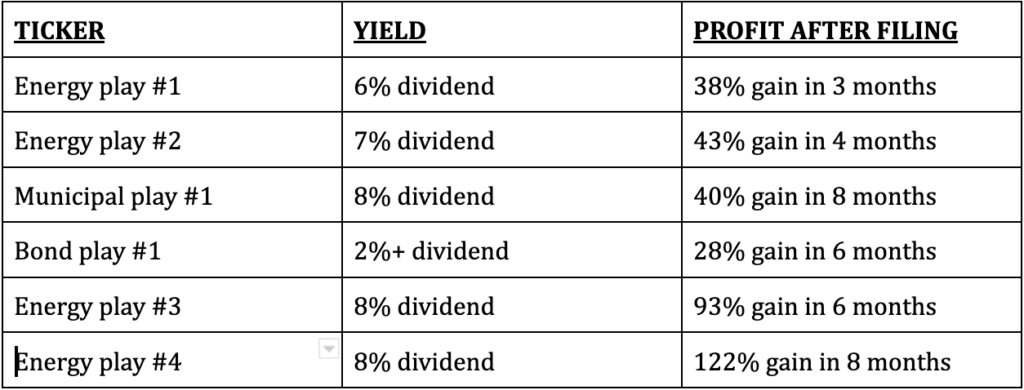

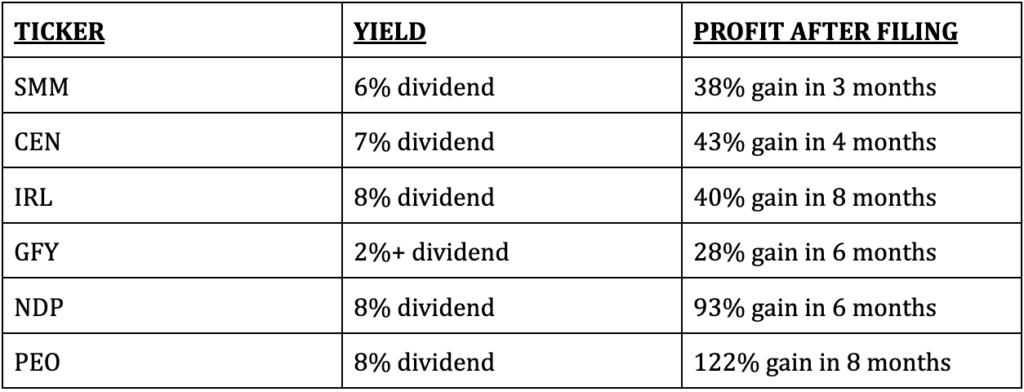

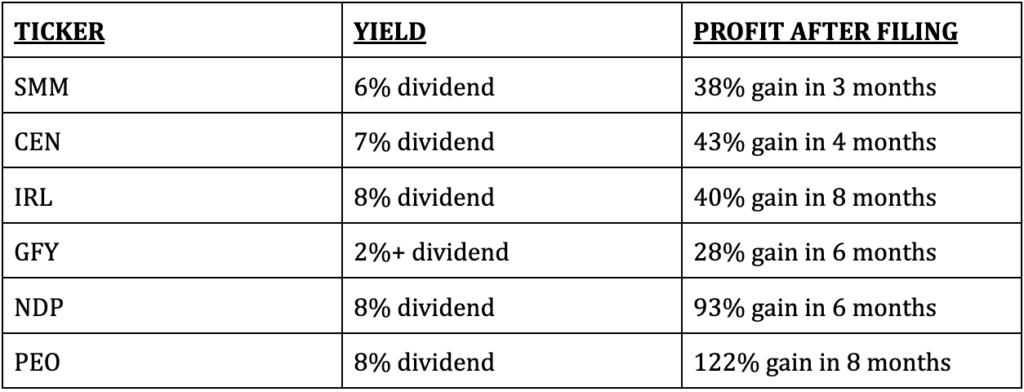

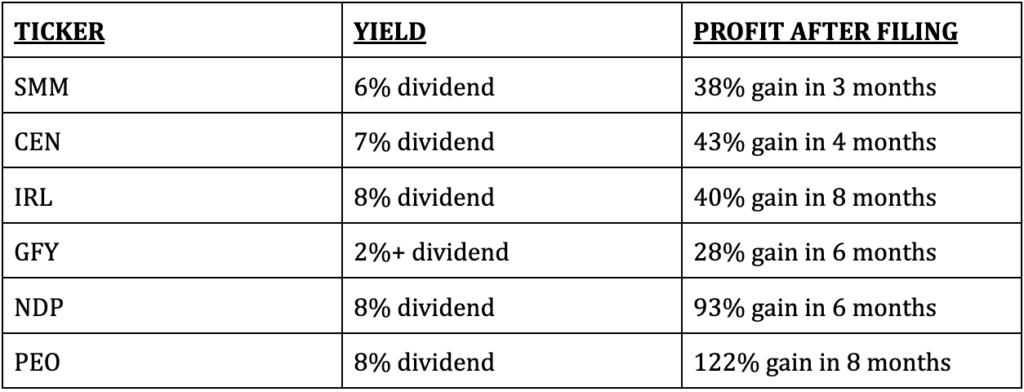

Just in the past 24 months… this has happened when the form above was filed:

4 of the 6 plays here were heavily favored in the energy sector.

Meaning… when the SEC filings started… these became opportunities for those savvy enough to read them.

When SEC filings started for Energy play #3 in May 2021…

Immediately, the price soared… and kept going 93%.

In that same timeframe, the S&P 500 lost 3%.

If that’s not enough…

You could’ve collected up to an 8% yield on your shares at the same exact time!

This is how you build wealth and beat the market… while also enjoying high cashflow.

My #1 opportunity I’ll share with you today is setting up exactly like this.

See…

As you buy discounted shares, you collect your 7.6% annual dividend for the next 12-24 months.

However… something else is going on.

This is the core of my research too…. And it’s all buried in SEC filings…

That 18% discount gap

could close quickly.

And when it closes, you’re looking at additional profit from your shares

on top of your income.

You just saw a 93% boost after the SEC filings went public…

The key is knowing how to find and read these SEC filings.

CNBC isn’t reading these or reporting about them.

I’m the one that’s going to show you that.

Each of the 6 past plays had secret SEC filings happen… then boost the stock.

Now, it’s your turn.

Because I expect my #1 play to have a good double-digit move very, very soon thanks to this little piece of paper filed with the SEC.

You can collect profit along with a steady dividend cashflow.

Who knew boring SEC filings could set the table for you to have the perfect retirement vehicle.

Marketwatch believes:

Retirees searching for income…can use [these discounted stocks] for a stable cash flow in virtually any market environment.”

Collect some cash dividends… and then wait for a big move in your holdings.

Think of it like you bought a car for $20,000… but it’s worth $25,000.

Then, 12-24 months later… after enjoying the car for a bit… someone offers you the full $25,000.

You take that deal and walk with a $5,000 profit plus the memories made.

That’s the opportunity for you and your retirement account.

You just need to know when the heck those SEC filings are going to start happening.

Again…

No mainstream news is talking about this.

Yet, following this ‘arbitrage’ opportunity from reading SEC filings has beaten the market 2-to-1 over the past 22 years.

We’re not buying stocks at dirt cheap prices trying to ‘guess’ which

stock will recover.

We’re going by pure numbers here.

A pure arbitrage opportunity.

It’s what I know best.

Hi, my name is Tim Melvin.

I’ve been in the financial services industry for over 27 years serving as a portfolio manager, broker and advisor.

Now, I’m not like many of the stock guys out there.

I’m old school.

I’m not trying to find the next landmark medical breakthrough, or deciding if Tesla is going to be the biggest company in the world.

I don’t leave my investing to chances.

I have one goal —> Look for inefficiencies in the market.

Where is an asset trading for less than what it’s worth?

We’re talking some real good, old school Benjamin Graham, Peter Lynch, Warren Buffett stuff.

Find value and buy it.

Find the diamond among the rubble.

That doesn’t mean I’m necessarily buying stocks left for dead.

It’s instead looking for arbitrage opportunities..

Good, sound businesses with great cashflow and a bright future…

That are unpopular because they don’t fit in with the current “fad” in investing. If they pay me a juicy dividend for holding them while I wait, even better.

If I can buy an asset trading for less than it’s worth… and turn it around and make money, I’m as happy as a guy at the bar on payday.

When I’m buying an asset at 18% off the regular price, it’s the first step of an arbitrage play.

The key is then knowing how to realize the profit on your discount.

If I’m buying at 82% of the value of the assets… Eventually, I want to sell at 100%.

And it takes work.

The work starts before I buy anything

I mean, and I’m serious, I’m up late reading financial statements, studying SEC filings, on top of learning about the overall market.

I’m doing this literally every single day.

After taking my granddaughter to the zoo, I drop her back home and I’m off to read SEC filings on a Sunday afternoon.

Studying financials and SEC filings isn’t unique in itself…

It’s knowing how to dig up an arbitrage opportunity in the market.

Knowing when a company files a very specific SEC form…and the asset is already trading at a discount…

A quick move up in price could happen…

As it did here with a recent bond opportunity:

SEC filing activity October 2021…

Big move soon after.

This is a very unique way to approach stocks which is why I’m excited to share everything today.

But I didn’t start out like this.

I wasn’t born on Wall Street.

In high school, I was a door-to-door salesman for 5 years. Sweating my socks off, getting dogs turned on me for ‘intruding’ on people’s property.

That job prepared me for life. I owe everything I’ve got to those summers of doors getting slammed in my face.

I didn’t even graduate high school. Got my GED.

Never went to college either.

You might be thinking, “his resume isn’t looking too stellar so far…”

But what I lacked in formal education I made up with grit and an attitude to never give up.

Had a GED and no college degree, but I was fascinated with the markets and decided to become a broker.

There were no online job boards back then.

I dusted off my door-to-door selling to cold call every broker I could find in California.

Guess how many hired me?

Zero.

“We want guys with MBAs and an Ivy League diploma.” Sadly, not much has changed since.

This was the mid-80s.

Suddenly, in 1987… when the market crash started… all these hot-shot MBAs quit their jobs at Dean Witters and others.

What do you know… these firms reached back out to me. I played it cool, but accepted a job and got my start as a broker.

Everything was running smooth… then in the early 90s, I saw a column by famed money manager, Victor Neederhoff. He had made an egregious miscalculation about the markets.

I wrote to him and called him out, “Your math is wrong.”

Well, that worked. We met up and I talked regularly with Victor. Eventually being a regular at prestigious parties for Wall Street and the wealthy. There, I met George Soros and other fund managers you’ve heard of.

What I realized after chatting with many of them was, “These guys aren’t that much smarter than me. If they can make a living from the market, so can I.”

That sounds pompous, but it’s very true.

I started writing a newsletter for friends and family about my stock picks. Turns out, they liked it.

From that newsletter…

- I called the top in 2007

- I called the bottom in 2009

I’ve been helping thousands and thousands more since with my research including writing for Jim Cramer and James Altucher.

Another product of mine also uses an arbitrage strategy…

Here’s my tracked return over 8 years:

I recorded these winners:

- A 165% winner on MFNC over 8 years

- A 100% winner on EVBN in 19 months

- A 150% winner on BOCH in 5 years

- A 163% winner on SVBI in 8 years

- A 192% winner on SLCT in 7 years

Those are just recent trades closed in 2021 and 2022.

Not all my trades were winners… but the last 10 trades closed were all 50%+ winners. Even in this bear market!

I’ve had subscribers read my stuff for a decade.

This is what they’ve said:

- [Tim’s] the best and most thorough analyst… five star – Michael B.

- Well researched and informative. Explained in a way that can be understood by home traders. – Brena P.

- Tim – you really know what you are doing! Truly very impressive! I only wish I would have devoted a larger portion of my portfolio to it earlier. – Richmond B.

- Melvin’s results speak for themselves. He is shooting the lights out in a completely underfollowed sector. I wouldn’t trust anyone else. – Tobias C.

- Tim Melvin is the greatest expert in deep value investing. That says it all ! – Walker

- Tim Melvin has a no nonsense approach to investing. He has decades of experience. He has perspective, wisdom, and a sublime sense of humor. If you wish to trade your own account and pick your own stocks, Tim’s advice is first rate. – Steve L.

- Tim’s a fantastic original thinker. He digs down into a stock to find the key drivers of future performance. – Steven W.

- I have been following Tim Melvin’s work for at least a decade. I have learned quite a bit about value investing, particularly in financial companies, which have always been a weak point for me. – DRod

This is all great… and I’m flattered…

However, here’s what is relevant right now…

In 2007, I learned about SPAC arbitrage. SPACs trading below a certain benchmark — usually the benchmark is $10 — are designed to be redeemed at their benchmark price.

That means shareholders will be paid at least the benchmark price if the SPAC acquires a company, as they are meant to do, or even if they go under.

So if a SPAC is trading at $4/share… but the benchmark is $10… you have $6/share of profit potential.

In other words, $6/share of arbitrage.

I spent most of 2007 trading SPAC and risk arbitrage for a handful of clients.

Since 2007, I’ve used my own research technology to build models that can locate arbitrage opportunities.

Meaning, for the past 15 years, I’ve been quietly mastering the

income opportunity today.

Nowhere else am I sharing this.

But you have an opportunity right now… on this page… to join me in the next investment.

An investment that you can buy at an 18% discount… and pay 7.6% dividends…

The investment may be one

you’ve heard of.

They’re called closed-end funds.

If you’ve invested in dividend stocks before, closed-end funds aren’t new.

Like I said, they’ve been around since 1893. Then, they were expanded from the 1940 until the 80s when closed-end funds went more mainstream.

A closed-end fund works like a mutual fund. The fund takes your money and invests in shares of public companies.

But closed-end funds differ from open ended funds.

(Open-ended funds are things like mutual funds, etfs.)

For a mutual fund, if you want to invest, they simply create a new share for you, and the “assets under management” pot grows bigger.

Brokers love that because they receive commissions every time that happens.

Money managers love that because they’re paid based on how many assets they manage… not always by performance (funny, right?).

With a closed-end fund, money is raised at IPO, and that’s where it sticks forever.

If a closed-end fund raises $500 million at an IPO, that money is fixed.

The valuation of the fund changes as the stocks they invest in go up and down, but no new money is ‘allowed’ in.

You only gain access when someone in the fund sells.

Think of it as an exclusive club you can buy into.

Most brokers prefer mutual funds, though.

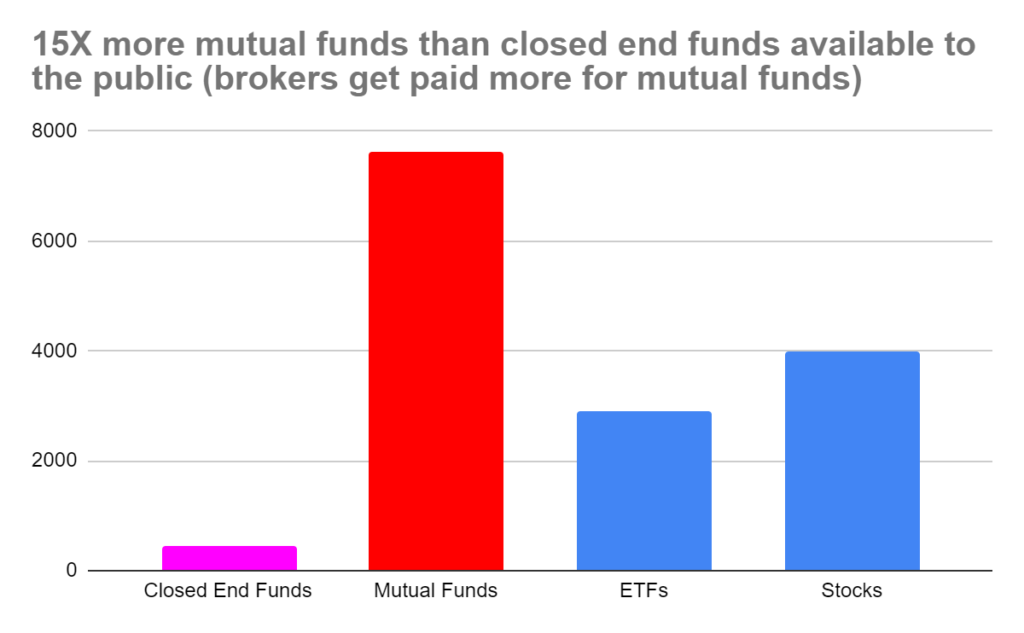

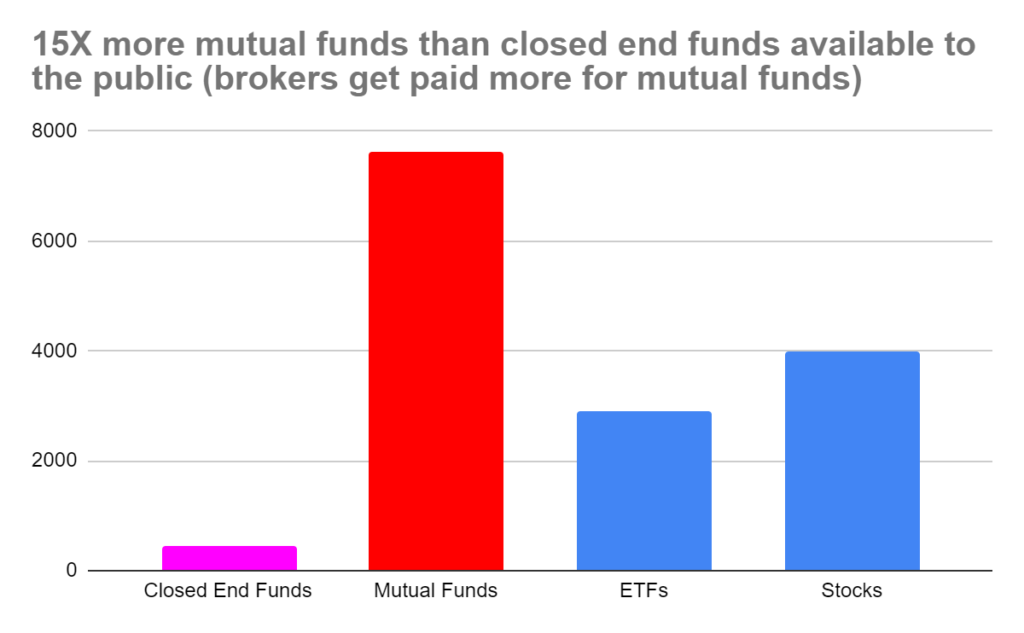

There are 15X more mutual funds than closed-end funds available on the market:

There are 10X more stocks to trade…

And 5X more ETFs to buy than closed-end funds.

Brokers would prefer fund managers to open mutual funds or ETFs.

Brokers make more commissions selling mutual funds and stocks than they do closed-end funds.

They then push their mutual funds, ETFs, and favorite stocks on TV, commercials, to their clients…

Not because that’s what’s best for you. But because that’s how they make the most money.

It’s all marketing. That’s it. Marketing. Not what’s best for you.

Even though, if you invested in their SPY index funds… or bought Peloton stock in 2021 when everyone loved it…you’d be down as much as 82%.

Meanwhile, my closed-end fund strategy beats the market 2-to-1 in this 22-year model.

That’s why you’re reading this today.

You’ve been tricked this whole time thinking mutual funds are the absolute best vehicle for your IRA.

Well, that’s not the whole truth.

Closed-end funds can land you huge profits AND high cashflow at the same time.

“Open your eyes”, Investopedia says.

Closed-end funds trade somewhat like stocks.

You buy them just like stocks. No extra steps required.

But… here’s where they get interesting.

In the stock market, shares are traded at what the market perceives the value is.

If Tesla wants to trade for $1,000… shares are worth $1,000. Doesn’t matter whether you agree with it or not… Mr. Market answers to no one except the Mrs.

Closed-end funds work exactly like that.

Doesn’t matter if Tesla is overvalued or undervalued based on their balance sheet or profit statement.

If shareholders want to pay a discount or premium, that’s up to them.

On the flip side, when a mutual fund buys shares in public companies, the “Fund” is then valued at the fair market value of the shares. When you buy a share of the mutual fund, the fund manager values your new share at what the fund valuation is.

That’s a mouthful.

Essentially, if their “Fund” is worth $100 million… you buy in at that valuation. They create a new seat at the table for you, and you’re in at a $100 million dollar valuation.

Meaning, you can never ever get a discount.

Closed-end funds work a bit differently.

Because no new shares are created… the “valuation” of the closed-end fund is left up to the shareholders aka you and me.

If shareholders want to sell their share of the closed-end fund for less or more than the valuation of the shares in the fund… that’s their choice.

And that happens a lot…

All of the time.

Energy stocks have been in the dog house since 2014.

Suddenly… starting in 2021… they’re the darlings of the ball while tech gets destroyed.

That’s why I expect my #1 closed-end fund… in the energy space… to do very well.

It trades at an 18% discount…

Likely because investors haven’t made their way back to closed end funds after all these years.

Human emotions are a funny thing.

People want to get out of their stake and go invest in Bitcoin or something.

Ever sold your car to a dealer for less than what you could get privately? The transaction was easier and so on.

Same thing here. Folks get distracted by other asset classes or stocks and will just take a discount to give up their shares.

Closed-end funds don’t pop 10-20% overnight like stocks do. There isn’t enough volume.

That’s why when you locate a closed-end fund early, you can make a move before the rest of the market catches up.

Closed-end funds aren’t marketed by brokers… so when a bunch of folks sell to go invest in Bitcoin, the price of the closed-end fund will keep going down.

Which is why:

For the most part… the majority of closed-end funds trade for less than what the fund is actually worth

That’s the opportunity for you and me.

You get to buy assets at a massive discount.

Imagine buying Apple, Google, Berkshire Hathaway at 11%… 21%… 28% discounts.

Everyone else is paying full price.

You aren’t.

My sweet spot is finding funds trading at over a 10% discount.

Those are where the best arbitrage opportunities are. Higher chances of rewards.

The first step is locating this SEC form.

From here…

We’re looking for which closed-end fund could see a massive move in price or even a liquidity event.

This SEC form is filed in order to close the discount gap…

If it starts closing…

Suddenly, you can make some killer profits in a short amount of time.

It doesn’t happen overnight.

That’s what happened with these opportunities… they skyrocketed:

These profits can happen in a few ways:

- Shares go up in demand, so they become worth more

- The fund is liquidated of all stocks… which would be at fair value. (think, you bought Tesla at $800 instead of $1,000… but fund is liquidated at $1,000)

- The fund is merged with another fund at fair value (less common)

- The fund is converted into an open fund (i.e. a mutual fund). When this happens, all assets are then valued at fair value. (Much like #2 above).

When we find funds that go through ONE of these steps… we can make money.

4 of the examples above saw shares go up in demand.

GFY (#4) doesn’t even exist anymore…

The fund was liquidated at market prices.

Meaning everyone who owned stock in the GFY closed-end fund got a check not for the discounted price they paid, but for their share of the fund’s assets. In other words, they got a check for up to 28% more than they had paid.

Check out PEO…

This form was filed in July 2020:

Another in August

From there, the fund skyrocketed 122%.

Meanwhile… while you wait to see if the discount gap will close, you collect their 8% dividend

Cashflow and profit together

That’s the benefit of buying the funds at a discount.

But all closed-end funds don’t trade at a discount.

Some, like Pimco Municipal… they currently trade around a 33% premium!

Pimco invests in a lot of California municipalities in order to generate income. So what’s happened is the underlying assets have cratered in value… but the shares in the closed-end fund have not.

The shareholders hope California bounces back, and likely enjoy the 5% dividend income. So they’re not selling their shares in the fund.

See…

Municipal income is tax free. Can’t argue with that.

Maybe I’ll invest in some municipalities, maybe not. What I know is, I’m looking for value. I sure as heck ain’t going to pay a 33% premium to make some tax-free income from San Diego!

Instead,

We look for 3 things when investing in a closed-end fund.

#1 We’re getting a discount that pays dividends.

We want to collect dividends while we wait for any moves in price.

That way, we enjoy cashflow, lower our cost basis, and have more money to deploy.

On top of collecting cash… we want a discount.

There are 452 closed-end funds… step one is eliminating all the ones trading at a premium.

Doesn’t mean we don’t look at them in the future if the premium decreases… but for now, no.

75% of closed-end funds trade for a discount.

But, we’re also looking at the quality underneath.

Some things trade at a discount because they’re junk.

Next…

#2. We want to be in an industry with tailwinds

I’m an arbitrage investor.

Not a value investor, per se.

I look for assets that are going for less than their intrinsic value and the market hasn’t found out yet.

I’m NOT the guy who’s bottom scraping stocks that just happened to go down 50%.

Arbitrage focuses on sectors that are doing well… or could do very well in the future.

Those industries see money flowing in.

For example… growth stocks and the entire technology sector are seeing a mass exodus in 2022.

So I don’t want to be in a closed-end fund around tech even if it’s trading at a discount.

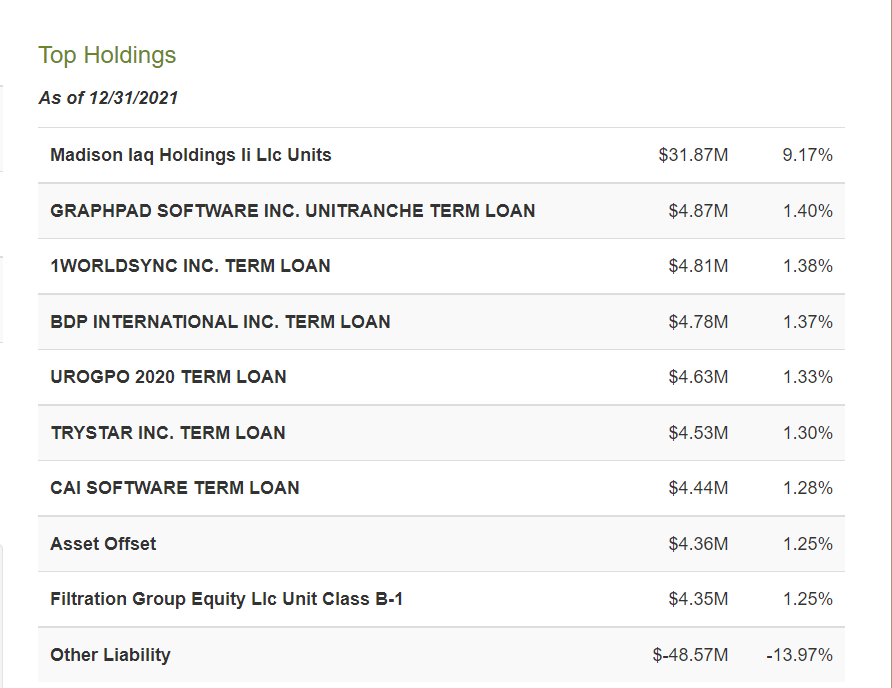

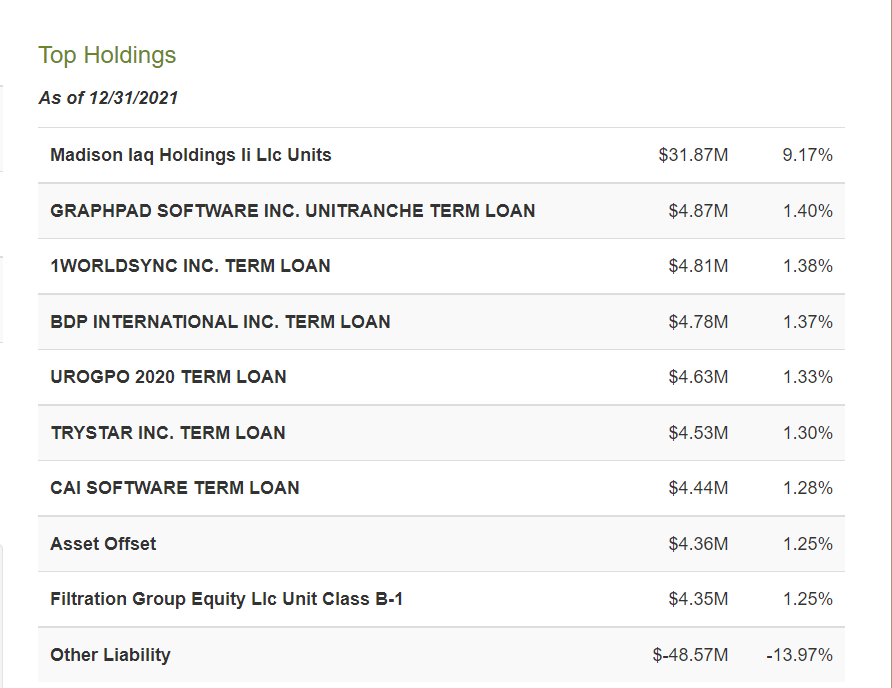

Here’s one — Barings Corporate Investor.

They lend corporate debt to various companies.

Look at the heavy dependence on software here.

Software has gotten crushed in 2022… some software stocks like Salesforce are down 45% from highs.

Zoom is down 84% from their record peak.

Who wants to lend money to software? Not me.

Yet, with this closed-end fund, you’d be exposed here.

Barings Corporate trades at a 16% discount.

Doesn’t mean I want to jump into that trap.

After the tech crash in 2000… growth stocks didn’t get back into favor for a few years.

I wouldn’t be surprised if that same movie played out again.

Instead, I’m looking at industries seeing great opportunities — energy, utilities, commodities, consumer staples.

My #1 closed-end fund is in the energy space, as I mentioned.

Huge tailwinds ahead.

But here’s where the real profits come in… and this is what we’re looking for.

#3 Activist investors are piling into the closed-end fund

This is really my secret sauce, so pay attention.

See this SEC form again:

This is the exact form filed by Elon Musk before he finally bought Twitter.

Here, he is purchasing a 5%+ stake in a public entity.

This SEC form is called a 13D filing

Per the SEC, anyone who plans to buy 5% or more of a public company in order to have an active role in the company must file this form.

Elon Musk obviously planned to be an active investor (vs. being a passive investor who was a silent partner).

These filings happen daily.

I’d estimate there are 100s per day similar to these 13Ds. They are long and boring to read.

However, they are necessary to find these arbitrage opportunities.

This is why it matters to us.

Closed-end funds began to become targets of Activist investors thanks to billionaire Carl Icahn.

See…

These big pockets looked at closed-end funds, saw them trading at a discount and saw an arbitrage opportunity.

Activist investors are called activists because they “act” on behalf of the shareholders if they feel management is not doing their job.

Of course, with a closed-end fund, the only thing management is doing is picking stocks.

However, even though about 75% of closed-end funds trade at a discount, it doesn’t make sense for them to do so.

That’s why, an Activist investor with large financial backing, may swoop in and start buying up 8-25% of the closed-end fund.

Why?

To force a vote in order to —> decrease the discount.

Decreasing the discount = big profits for the fund holders.

If our #1 closed-end fund… trading at an 18% discount… suddenly only trades at a 10% discount… that’s 8% of profit in your pocket.

An Activist investor has a goal to decrease the discount gap…

But they could also make you and me money in other ways

And I have good reason to think that’ll happen soon. More on that in a bit.

But first, you may be wondering how they can decrease the discount. It’s pretty simple:

- Forcing management to liquidate the fund at fair value

- Force management to merge the fund with another

- Or, force management to convert the fund from closed to open

All of these mean shareholders of the fund get paid based on the value of the fund’s assets…

Regardless of how little they paid for a share in the find.

In other words, all of these can close the discount gap and generate you a profit.

#3: We make money my appreciation from discount gaps closing

Columbia University study:

“Activist arbitrage is found to have a substantial

effect on CEF discounts.”

Of course, you’d need to sell your stake to realize the profit… and these discounts may not last forever.

Sometimes, the discount may narrow for a month due to the ‘news’, then the Activists depart and nothing is done. However, the Activists walked away with a profit.

That’s why I’m checking SEC filings daily… to see when they liquidate.

Activism is on the rise in closed-end funds again, according to Harvard Law.

Skadden, one of the largest US law firms, says “Activist closed-end fund investors are continuing to escalate, and in some cases accelerate, their campaigns against many closed-end funds.”

As these tick up… there’s going to be more and more opportunities every single month.

Not just with my #1 closed-end fund… but for many others.

Here’s what I believe could happen just from looking at the past 6 activist moves:

GFY…

In May 2020, Bulldog Investors filed 13Ds against the Western Asset Variable Rate Strategic Fund (GFY) closed-end fund.

At the time, GFY was in the process of being acquired by Franklin Templeton.

Bulldog, an Activist, then swoops in… and acquires a large, controlling interest… and they block the purchase.

Bulldog refused to approve a new investment by Franklin Templeton.

That left GFY in a pickle.

By November 2020… just 6 months later… GFY, realizing fighting Bulldog wasn’t economically beneficial, instead liquidated the entire closed-end fund.

So if you type in GFY, you won’t see a live ticker trading.

Owners gained 28% as the difference between the fund’s low share price and its high asset value closed and collected a 2% dividend as they waited for the fund to liquidate.

Pre-liquidation, the fund was selling at a 8-12% discount.

Right at liquidation, that discount disappears and you’d realize 100% fair value of the assets in the closed-end fund.

You likely would’ve bought the closed end fund around $14.75 in May… and then realized all the profits when it liquidated at the price of $16.39 in November.

Discount gap = closed.

Profits from dividends, share price movement, and discount gap closing.

Isn’t that great?

Every Activist investor may not succeed in closing the discount gap…

But it could still move the share price and you’re collecting dividends to boot.

I love these arbitrage plays.

You don’t hear about these opportunities anywhere, but they’re out there.

There is more I can share about all these stories.

It’s really fascinating watching these cat-and-mouse games or chicken fights. I love this stuff.

Still…

I promised I’d share with you my #1 closed-end fund opportunity today.

You’ve already heard it’s trading at an 18% discount…

Paying a 7.6% dividend…

But, not only that, it is riding one of the biggest trends in the market.

Energy.

Not just oil, per se. I believe we will indeed see more transitions into ‘greener’ energy uses.

However, let’s be real, it’s not happening anytime soon. We’re still a good many years out from full adoption.

That’s why I love my #1 closed end fund.

It invests in what works today… oil.

Oil, now trading at prices as high as we’ve seen in 15 years.

But they don’t stop there.

The fund invests in not only oil but also in the ‘next generation’ of energy.

Like other funds, closed-end funds aren’t invested in just one stock, but many. And that means you can collect more dividends than if you simply owned these individual shares.

Inside my #1 closed-end fund:

…you’re invested in natural gas.

Seen huge spikes recently.

…you’re invested in utilities.

Your electric bill has been going up. Utilities printing money.

…of course, you’re invested in oil.

Nothing more to say here.

Not only do you own shares of oil mammoths like Kinder Morgan and Cheniere through my #1 closed-end fund…

But now you also gain exposure to new energy opportunities.

Like DT Midstream. Founded in 2021. They are owner, operator, and developer of natural gas midstream interstate and intrastate pipelines; storage and gathering systems; and compression, treatment, and surface facilities.

They’re among the first midstream companies gunning for zero greenhouse emissions.

With my #1 closed-end fund… you also gain a share of Brookfield Renewable Partners.

Like their name says, they own tons of clean energy assets. 200 hydroelectric plants, 550 solar facilities, a few football fields of wind farms.

There’s no better energy play out there at the moment.

Sure, you could invest in Exxon or even buy shares of Kinder Morgan on your own.

But you’re paying full price. I’m buying at an 18% discount.

Worse, you’re betting the horse on oil. Not to mention, earning even less in dividends than my #1 play.

Brookfield Renewable doesn’t even pay a dividend.

If you’re not interested in income, this isn’t for you.

We’re going to enjoy our 7.6% dividend.

At the same time… that 18% discount gap is set to close.

I believe once an activist takes hold and files the 13D form… as I showed you Elon Musk did…

We could quickly see our fund shoot up in value especially as energy makes headwind

4 of the 6 latest activist moves I shared above were in the energy space.

My #1 closed-end fund is set to be the next Activist investor target.

This won’t happen overnight, and I’ll monitor it for you.

The key is if you want to invest in this on your own… you’re going to need to regularly read and check SEC filings.

There are hundreds of SEC filings made daily… you need to be poring through them like clockwork.

I’m doing that.

You’ll need to start here:

And start going down the list.

I’m assuming if you’ve read this far, you have better things to do than read SEC filings until the cows come home… which is why I want to share this opportunity with you inside my new special report,

FREE REPORT

The #1 Energy Fund to buy at an 18% discount.

In the end…

If everything works out as my research suggests…

We’ll collect a 7.6% yield over the next 12 months…

Meanwhile, we’ll have a shot at potentially 10-12% capital gains as the discount gap closes and energy makes headwinds.

That’s a total return of nearly 19.6%.

In this down market, if that doesn’t get you jumping out of bed, then I’m not the guy for you.

Closed-end fund arbitrage is all about consistent singles and doubles.

Think of this #1 closed-end fund as a retirement gem you can count on… until we move on to another.

That’s right.

This is no “buy and hold” asset.

If after 24 months, we haven’t seen the discount close, we pack up the dividends we’ve collected and move on.

In this current market environment, sitting on your hands is no longer an option. You have to be more nimble with your money.

That’s why Marketwatch suggests to:

We aren’t “day trading” or even “swing trading.” However, we likely won’t be holding positions for 5-10 years.

It’ll be 2 years tops.

These opportunities continue to pick up.

Once the SEC filings hit… closed-end funds could move in price.

Like PEO when it jumped 122% in 8 months.

However, if you plan to do this…you’ll need to read the SEC filings daily…

And do more in-depth research to discover if Activist investors plan to move on the closed-end fund.

It’s a lot of work. Honestly, I spend most of my day reading and finding these opportunities.

They don’t happen all the time…

I expect 1-2x per month an opportunity pops up.

But you have to know where to look.

So you can take what I’ve shared today and do it yourself…

Or, you can join me inside my brand-new product, Underground Income

I call it “Underground” as only 3% of families invest in these assets. Not to mention, Activist investor campaigns don’t make the mainstream news headlines… you have to dig deep for them.

That’s my job.

I’ve followed closed-end funds since the 90s.

I found bonds trading at 25%+ discounts.

Many wanted to buy them… but I’d tell them, “No. These are junk.” You can’t just look at the discount and pick the deepest value.

You have to do deep research.

You have to comb the 13D filings to find the funds being targeted by Activist investors…

The funds with a big discount gap that’s about to quickly shrink.

I see more and more of these opportunities in the months and years to come, starting with my #1 closed-end fund.

I’ll find 1-2x of these opportunities every month.

That’s my job inside Underground Income.

The mission of Underground Income is simple — Find dividend-paying closed-end funds trading at 10-20% discounts, which have a high probability of going up in value.

We’re targeting profits.

We’re targeting income.

This is a product for you if you’re retired or close to retirement.

We’re not trading options. We’re not buying speculative stocks.

While growth stocks lost 25% in the first five months of 2022…

My #1 closed-end fund is up 10% through May 15th!

That’s before adding in the dividends received.

If you’re concerned about retirement, staying retired, collecting income on your savings, and having an ‘all weather’ asset in your portfolio…

Underground Income is for you.

This is the first ever launch for this product…

So I’m going to give you a huge 50% discount for joining today.

Let me share what you receive as a subscriber:

#1. My brand-new special report , The #1 Energy Fund to Buy at an 18% Discount.

I shared how this fund is invested in oil but also new energy sources.

Inside this report is my #1 closed-end fund pick that could return us up to 19.6% in the coming 12-24 months.

That’s double the inflation rate… plus, green in your portfolio vs. what the stock market has delivered the past few months.

Collect a 7.6% dividend as we wait for the 18% discount gap to close… or for Activist investors to push the value of the fund higher.

BONUS: I’ll include a 2nd closed-end fund to add to your portfolio today.

It’s a 2nd play at energy to diversify. With it, you’ll gain exposure to the more prominent energy names such as Exxon, Chevron, Conoco.

The fund is trading at 13% discount, and it is 80% invested in petroleum plays. So, while we wait for green energy to find its footing… you can ride the oil boom invested in multiple stocks in the sector.

While Chevron’s stock trades for $162+…

This closed-end fund can gain you exposure to all these giants for just a $20 bill.

It’s traded with a large discount gap for years, so could be a great target for Activist investors. At the same time, it delivers a solid dividend in the meantime.

This bonus play is inside for you… get your copy today.

Next…

#2. Weekly mailbag videos from me, Tim Melvin

Every week, I’ll record a quick 3-5 minute video and send it to your email.

I may answer some of your questions, go over breaking news on one of our holdings, share research about the economy… and more.

This is pure, unfiltered Tim in your inbox. I’ve recorded videos from my office for 8 years, thousands regularly read my stuff.

Every important move in our positions…

Every burning question you have…

All addressed each week.

#3. 1-2x trade alerts each month (up to 24x per year)

I call these “trades”, but really we’re opening a position we’ll hold for 12-24 months.

I’m not going to bore you with long, drawn out issues.

You’ll receive an alert as needed.

…when to buy.

…when to sell.

“What if I don’t see the trade alert for a couple days?”

That’s ok. These opportunities don’t develop overnight. There’s plenty of time to purchase, and the price likely hasn’t changed much. (Closed-end funds aren’t mega volatile like stocks.)

I’ll give you an alert with a write-up as to why we’re getting in (or out).

Then, I’ll have follow-ups during the Weekly Mailbags.

#4. Monthly LIVE calls with you

I’m not just a face behind a screen…

Every month, you, me and the other Underground Income subscribers will hop on a Zoom call and go deeper.

We can talk about closed-end funds I’m watching, maybe ones you’re watching.

Answer questions, of course.

Live Q&A about the overall market, what sectors are hot, what sectors are up-and-coming and more.

These are purely optional and I’ll have a recording for you.

#5. A login portal to house all your special reports, alerts, videos

It’ll be at Investors Alley.com.

Once you join Underground Income, I’ll send you a secure and personalized login link.

The value for 1-year of Underground Income is easily $2,000 per year.

Think about it…

If you can collect 7.6% dividends…

On top of having a shot at 10-12% gains…

A mere $25,000 investment is throwing off $1,900 in dividends…

Plus, the potential for $3,000 in capital gains.

Obviously, nothing is guaranteed. However, if that dividend keeps up… and my research says it should… you’re near that $2,000 value.

However, I’m not going to charge you $2,000…

My retail price for 1-year of Underground Income is $997.

A full 50% off.

And to show you I’m serious about the value you’ll be getting…

I’m going to add in a 3rd closed-end fund that is honestly one of my all-time favorites.

I’ll share it with you in my special report,

FREE BONUS

Buying Warren Buffett at a 17% discount

37% of the assets in this fund are simply shares of Berkshire Hathaway.

1 share of Berkshire Hathaway is around $473,000.

1 share of my closed-end fund is $13.

And you’re getting Berkshire at a 17% discount!

That’s like paying $85,140 LESS than someone else who just bought a share.

While the rest of the market tanked double-digits the first two quarters of 2022…

BRK.A (its ticker) was in the green.

That means it likely will lead the pack going forward.

And you’re in at a massive discount.

Here’s the kicker…

Berkshire pays $0 in dividends. Which is odd as the Oracle of Omaha, Buffett, loves his dividends.

But this closed-end fund pays nearly 4%.

Collect 4% dividends while we wait for Activist investor activity.

Berkshire’s been public since 1964… and weathered many recessions and technological advances. It ain’t going anywhere.

That should make this fund one of the top targets for Activist investors.

Inside this special report, I’ll share the ticker and more about the fund.

Easily a $197 value… FREE.

Listen to what subscribers of other services of mine have said:

These subscribers were happy, and I believe you will be too.

To make this service an easy yes for you…

I’m giving you 60-days to try out Underground Income.

If after 60 days, you don’t think I can help you land income and profits from closed-end funds… get a 100% refund. No questions asked.

This is a new product, so I want you to be completely protected… and be excited to invest alongside me.

I have another product that is also an arbitrage service I’ve had for years. I charge $1,000 for it.

Here’s the reviews for it.

4.5 stars.

That’s hard to find in the financial publishing space.

Don’t believe me… here’s a snapshot of other products in our space and their reviews:

Some of these go for a much higher price than what I’m charging!

To join Underground Income, click the link below. You’ll go to an order page to finish joining. The page is secure and your information is safe.

Click the button below.

When you do…

You’ll notice something else.

Because this is a special launch of the service, I felt it only makes sense to give you the very best price.

I’m talking about the best price

I’ll ever offer for this service.

Others, in the future, will have to pay $997… but, for this special launch… you can have an additional 50% off!

That’s right.

For joining me for the inaugural launch of Underground Income, cut another $500 off the entry price.

Meaning, for just $595, you can become one of the first to invest in these closed-end funds.

That’s a huge discount. You won’t find it anywhere else.

The clock is starting.

Not just to join Underground Income… but also grabbing your shares of these closed-end funds before these discount gaps are gone.

Discount gaps can evaporate quickly.

Once activists close the discount gap… they may dump their shares soon afterwards. Not always, but sometimes.

That’s why, once the discount gap narrows, we are out. We aren’t sitting around unless the long-term prospects are better.

Reading 13Ds is boring…but you have to be on top of it every single day.

If you can’t commit to that, this entire strategy makes no sense for you to follow.

That’s why I read the 13Ds for you. I’m reading dozens per day. It’s fun for me. It’s ok if that sounds weird, but I don’t care.

I like tracking Activist investors filing 13Ds.

They could be filing one as you read this.

Activity is ramping up…

Your best bet in order to profit is to join Underground Income.

When you do, you gain access to three of my best closed-fund picks.

The #1 being a fund trading at a whopping 18% discount, and paying 7.6% in dividends.

Just a few thousand dollars in this fund alone could pay off your Underground Income subscription

Our fund pays 7.6% in dividends alone… just $10,000 lands you $760 in potential income over the next 12 months.

That’s nearly twice the $595 price I’m asking for right now.

You then receive 1-2x more picks each month, mailbag videos, alerts, monthly calls, and more.

In this market, you need to be going for more sure bets.

The days of betting big on some tech stock that’s never made money… that may well be over for a while.

Now, it’s time to compound your money over time.

If we fall short and don’t hit 19.6% returns on my #1 play…

What if we hit 15%. A 7.6% dividend, plus a 7.4% drop in the discount gap.

Over the long term… this could turn a small $25,000 stake into a nice portfolio for years to come

None of this is guaranteed… nor am I promising you this.

I’m simply showing you a hypothetical example.

And that’s just my #1 closed-end fund. I have more than a dozen more to show you over the next 12 months.

You’ll have at least 12 new plays each year… some could do better, some could do worse, others could lose money.

With my testing, this strategy holds up over the long haul.

It’s doubled the S&P 500 over the last 22 years with my backtested model.

The only reasons more people don’t do this are because:

- Remember, only 3% of families even own closed-end funds

- This isn’t super sexy. It’s more “fun” to gamble on some out-of-the-money options or the next Gamestop

I’m not here to waste your money or your time. I don’t want to waste my time.

Underground Income can be a steady source of income and capital gains for your account.

I believe you’ll love how easy it is to use the service, but also the potential to beat the market again and again.

…especially during bear markets and choppy environments.

Take 2 minutes, click the link below and join me inside Underground Income.

You’ll get a full $500 discount when you take action now.

Can’t wait to see ya inside,

Tim Melvin

Editor of Underground Income