Livent (LTHM) is a pure play and vertically integrated producer of high-quality lithium products, most notably in the energy storage and electric vehicle markets. Along with lithium compounds and metals, LTHM produces lithium-ion batteries, which play a major role in the mobile phone and electric vehicle industries.

Given its array of products, LTHM is a stock to own for the longer term, as the world continues its shift toward renewable energy sources. The demand growth for lithium over the coming years is becoming more certain as electric vehicle batteries and electric vehicles become more affordable for consumers.

That said, there has been a gradual decline in industry supply recently, but analysts expect a meaningful improvement in lithium prices starting in the second half of 2021. Prices have begun to inch higher, especially in China, the world’s largest electric vehicle market, but must rise at least 10% to make any expansions worthwhile.

To help boost U.S. lithium production, some companies are studying ways to produce the metal from clay reserves. Additionally, the industry could face further changes as EV battery recycling gains in popularity and ways to reuse the white metal from batteries at the end of their life cycle.

LTHM stands to benefit from these longer-term strategies and currently has supply agreements with Tesla (TSLA) and BMW Group (BMWYY). Given the company’s differentiated position and global capabilities, LTHM should continue to be a partner of choice, as they are well positioned to take advantage of this opportunity for years to come.

The stock is not without risks, however. The company has posted losses in the past two quarters. Most recently, LTHM reported a fourth-quarter loss of $0.02 per share. However, for 2021, analysts expect the company to earn $0.11 per share.

Revenue for LTHM’s most recent quarter came in at $82 million, and for 2021, should clear $352 million. For 2022, Wall Street is forecasting the company to post a profit of $0.32 per share, on average, with revenues clearing $420 million.

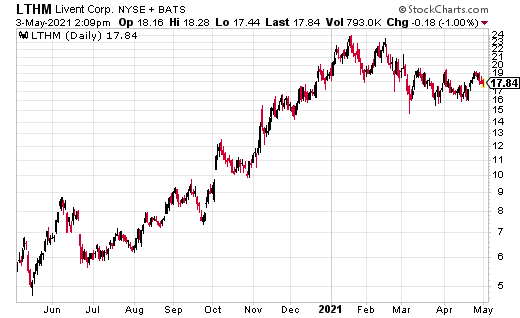

This chart shows shares are down from their 52-week peak just south of $24, which was reached in mid-January, and are currently holding their 50-day moving average. There is risk towards the $16–$15 area if shares fail to hold this level with the early March low at $14.73.

If shares can regain the $20 level, momentum could come back into the stock to set up another run towards the $24–$25 area. Options are available and currently go out into December.

Aggressive traders can target the LTHM December 22.50 calls as a way to play a run towards new highs by the end of 2021. They are currently trading for $2.75. These options would double from current levels if shares are trading at $28 by mid-December, as they would be $5.50 in the money.