The upcoming 2020 third-quarter earnings season has the potential to be the most critical news period for investors that I can remember. The previous earnings season covered the 2020 second quarter, a period when much of the economy was in lockdown. The third-quarter results will, for many companies, be our first look at how the business has gone since those darkest days of the coronavirus crisis.

The second quarter, from April through June, mostly showed which companies were most affected by the shutdown of a large swath of the economy, forced by the pandemic. While there are data points that help with individual stock analysis, for the most part, the results for the quarter have little correlation to companies’ investment potential.

When we get third-quarter results, I will be looking for the magnitude of recovery compared to the second-quarter results. The country remained largely in the grip of the pandemic for the period of July through September, but many business sectors were able to move toward more normal business conditions. Companies will release their quarterly results between the last ten days of October and the first week of November. My focus will be on the recovery in revenue, profits, and cash flow compared to the second quarter.

John wrote, “my dividend flow from an average of $4,500 to $8,500 per month since I joined up with [you] 2 years ago!” Here’s how to jump start your dividend income like John, click here. [ad]

With third-quarter earnings, I will watch closely to see what company management teams say about their expectations of future business results. The truth for many companies in many parts of the economy is that 2020 will be a lost year. However, the crisis forced management teams to re-evaluate their business operations. I am very interested to hear what businesses will say about their plans, prospects, and expectations for 2021. I want to be making investments in November and December that will pay off nicely through the new year.

Main Street Capital (MAIN) is one company that illustrates the effects of the coronavirus shutdown and potential recovery. Since coming out of the financial crisis more than a decade ago, Main Street was the premier company for investors in the business development company (BDC) sector.

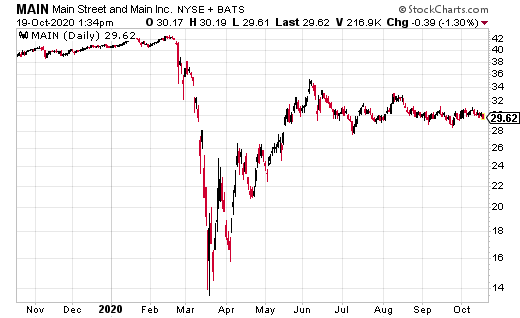

From the end of 2008 through the last day of 2019, MAIN investors earned a compound annual growth rate of 19.37%. But year-to-date for 2020, the stock price has dropped by 30%.

A BDC like Main Street Capital operates under special laws and rules. BDCs were created by Congress to provide financial solutions for small to medium corporations, and must pay out most of their earnings as dividends. To evaluate a BDC, I look at current yield, dividend growth, and the share price to book value. Higher-quality BDCs trade at a premium to book. The dogs in the sector are usually priced at a discount.

At the end of 2019, business for Main Street Capital was excellent, and the stock was a great investment. For the 2019 fourth quarter, before the start of the pandemic, Main Street reported a distributable net investment income of $0.66 per share and a net asset value (book value) of $23.91. As of the end of 2019, the company was paying a $0.205 monthly dividend ($0.615 per quarter), priced to yield 5.8%, and traded at 1.8 times book value.

For the pandemic-marred 2020 second quarter, distributable net investment income had dropped to $0.52 per share. At the bottom of the pandemic-triggered stock market crash, Main Street traded for less than $15 per share, compared to a peak of $45 in mid-February. Despite not generating enough investment income, Main Street Capital continues to pay the $0.205 per share monthly dividend. Since the crash, the stock price has recovered to the low $30s, giving a current yield of 8%.

When third-quarter earnings for Main Street come out on November 6, I will first check the net investment income and book value numbers. These two figures will show how well the business recovered through the first quarter following the pandemic shutdown. I expect a significant improvement over the second-quarter numbers, but I want to see the actual results.

If the net investment income again covers the dividend and the book value has improved, MAIN will be back on its way to $40 per share. If management is confident about resuming growth in 2021, next year could be a resumption of dividend growth and the share price cracking $50.

Main Street Capital is a recommended investment in my Dividend Hunter service. My subscribers will be the first to learn what happens with the third-quarter results. They will also get my analysis concerning the other two BDCs on the recommendations list.