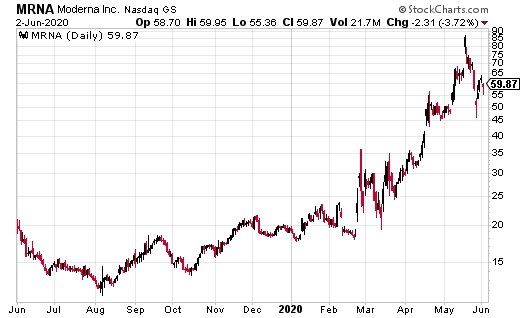

Moderna’s (MRNA) stock has given investors heartburn recently. Moderna first announced promising news related to a COVID-19 vaccine in mid-May. After the news sent MRNA skyward, the company announced it would be doing a secondary offering, in an attempt to raise just over $1.3 billion.

Then, a few days later, vaccine experts started questioning MRNA’s sparse data related to the announced vaccine trials. This brought investor ire, a tumble in the stock price, and news of a number of investor lawsuits accusing MRNA of releasing the data in order to facilitate the secondary offering.

Over the course of this soap opera like two weeks, the stock rose from $67 to $87, then fell to just over $46 at the lows. And has now recovered in the past few days to trade just under $60.

Now, Moderna is trying to get back into the good graces of investors, announcing Friday that it has given its trial vaccine to over 600 candidates, half over the age of 55, and half under. The company will monitor the 600 individuals in the study over the next month, and then provide a booster shot.

In a note put out to investors on Monday, Goldman Sachs analyst Salveen Richter reiterated her buy recommendation on Moderna. She believes the stock could go as high as $105 given the current health crisis, and the work the company is doing on a vaccine.

Moderna uses a somewhat unusual approach to finding a COVID-19 vaccine. The company’s drug sends genetic instructions to human cells which cause them to mimic harmless pieces of the virus, which results in antibody production.

Richter believes a combination of a successful COVID-19 vaccine, which she estimates is a 75% probability for Moderna, plus other vaccines addressing diseases such as ebola, could vault Moderna’s revenue to over $10 billion by 2022.

In its latest quarter, CEO Stephane Bancel, said the company’s revenue was $8.4 million for the quarter, a decrease of almost 50% from the year-over-year quarter. The decrease in revenue was mainly attributed to “catch-up adjustments in revenue” related to contracts with several large pharmaceutical collaborators, including Merck (MRK).

If the company can produce a viable COVID-19 vaccine, the plan is to apply to the U.S. Food and Drug Administration (FDA) for approval in early 2021, and implement manufacturing plans that are already in place, to produce up to 1 billion doses per year.

Steven Adams’s personal position in Moderna: none.

[insert CTA: GSA – SEM – Top 10 2020 – Explosive – 5G – Adams]