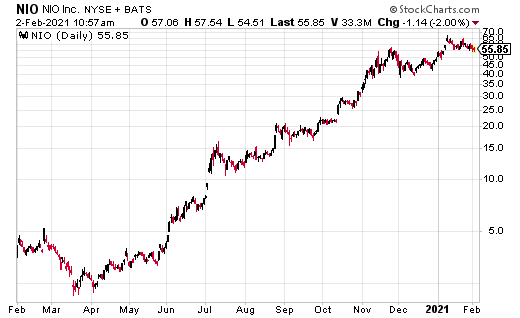

Since August 2020, the stock has now run from $15 to $57.45. All thanks to electric vehicle demand, strong earnings, and even stronger delivery numbers. For January 2021, the company delivered 7,225 vehicles, an increase of 352.1% year over year.

Cumulative deliveries of its ES8, ES6, and EC6 are now up to 82,866.

For December and 2020 full-year delivery results. NIO delivered 7,007 vehicles in December, increasing by 32.4% month-over-month, setting a new record for five consecutive months, and by 121% year-over-year. For the full year, NIO delivered 43,728 vehicles in 2020, representing a year-on-year increase of 112.6%.

Even better, Nomura analyst Martin Heung initiated coverage on the NIO stock with a buy rating and a price target of $80.30. Heung also called Nio, the “epitome of a Chinese luxury brand,” and the “heir apparent in China’s electric vehicle world,” as quoted by Business Insider.

All Thanks to Strong Electric Vehicle Demand

In the U.S., there’s a broader push for more electric vehicles.

For example, in California, Gov. Newsom signed an executive order that will ban the sale of gas-powered passenger cars in the state starting in 2035. That means only EVs will be available for purchase in the next 15 years.

In addition, President Biden recently rejoined the Paris Accord, which is bullish for green stocks. He mentioned a $2 trillion clean energy plan, with hopes for net zero emissions by 2050. Plus, he just said the entire federal fleet of vehicles will be replaced with electric vehicles.

“The federal government also owns an enormous fleet of vehicles, which we’re going to replace with clean electric vehicles made right here in America, by American workers,” said Biden, as quoted by Benzinga, which added, “The U.S. fleet is made up of 645,000 vehicles which include 245,000 civilian vehicles, 173,000 military vehicles, and 225,000 post office vehicles.”

With the EV boom only gaining momentum, NIO could accelerate to higher highs.

As of this writing, Ian Cooper did not hold a position in NIO.