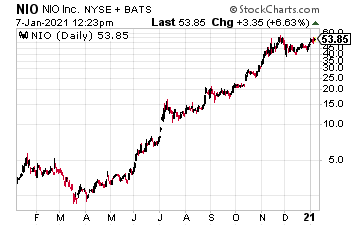

Nio Inc. (NIO) stock price popped on the EV boom, and on news of even more record deliveries. NIO said it delivered another 7,007 vehicles for December 2020, an increase of 32.4% month over month, and 121% year over year. For the full-year, NIO managed to deliver 43,728 vehicles, a year over year increase of 112.6%.

Related: NIO Stock Price Climbs On Record Vehicle Deliveries for December

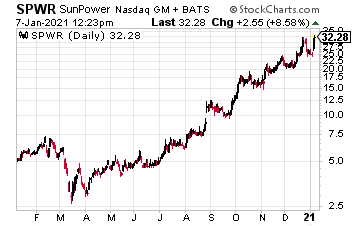

Shares of SunPower Corp. (SPWR) skyrocketed 15% with Democrats looking to control the U.S. Senate and the House. Plus, Joe Biden appears bullish on green energy, which would benefit solar stocks, like SPWR. Remember, Biden has said the U.S. will rejoin the Paris Climate Accord. He also mentioned a $2 trillion clean energy plan, with hopes for net zero emissions by 2050.

“A Biden administration will mean more regulatory scrutiny for financial and energy stocks and probably higher taxes across the board,” says Rodney Johnson, president of economic research firm HS Dent Publishing, as quoted by Kiplinger. “But there will be opportunities. Infrastructure spending, green energy and health care are all Democratic priorities and should do well under a Biden presidency.

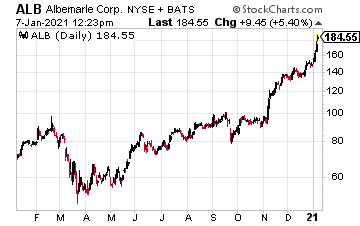

Albermarle Corp. (ALB) had an explosive week, running from $147.51 to a recent high of $170. All thanks to a hot lithium bull market. Helping, analysts at Cairn Energy Research Advisors say we could see a surge in EV sales this year, as countries around the world encourage people to buy them. They added that global sales could jump 36% and top three million shortly.

However, for that to happen, far more lithium supply is required. In addition, according to General Motors’ Chairman and CEO Mary Barra, “Forty percent of the company’s U.S. entries will be battery electric vehicles by the end of 2025. Barra also announced an increase in GM’s financial commitment to EVs and AVs today to $27 billion through 2025 – up from the $20 billion planned before the onset of the COVID-19 pandemic.”

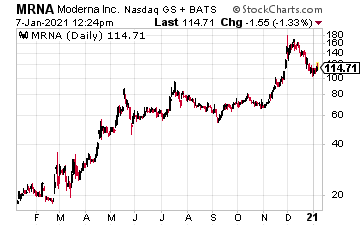

Moderna Inc. (MRNA) jumped from about $108 to $112.30 after the European Medicines Agency (EMA) recommended its vaccine for use in the EU. “EMA’s human medicines committee has thoroughly assessed the data on the quality, safety and efficacy of the vaccine and recommended by consensus a formal conditional marketing authorization be granted by the European Commission,” the EMA said, as quoted by CNBC.

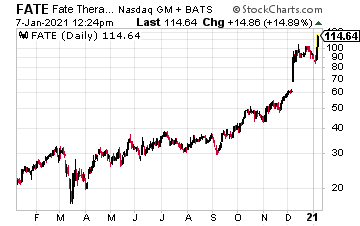

Fate Therapeutics Inc. (FATE) jumped 11%, or $9.41 a share after a brief pullback to $84.17. The company recently announced positive interim data from its Phase 1 study of FT516 in combination with rituximab for patients with relapsed / refractory B-cell lymphoma.

“We are highly encouraged by these Phase 1 data, which clearly demonstrate that off-the-shelf, iPSC-derived NK cells can drive complete responses for cancer patients and that our proprietary hnCD16 Fc receptor can effectively synergize with and enhance the mechanism of action of tumor-targeted antibodies,” said Scott Wolchko, President and CEO of Fate Therapeutics. “Importantly, the safety profile of FT516 continues to suggest multiple doses of iPSC-derived NK cells can be administered in the outpatient setting, and supports potential use across multiple lines of therapy, including as part of early-line CD20-targeted monoclonal antibody regimens, for the treatment of B-cell lymphoma.”

At time of this writing, Ian Cooper did not hold a position in any of the stocks mentioned.