Each year I am asked by the MoneyShow folks to submit two stock recommendations for the new year. These recommendations are published on the MoneyShow website as well as mainstream financial websites, such as Forbes. I always put out one aggressive stock pick and one conservative one.

Since my focus is the Dividend Hunter, both stocks will be higher-yield dividend-paying companies. This year I have a pandemic recovery play for the aggressive stock. The conservative stock also is one that suffered a severe, short-term whack to its business results due to the pandemic. Both of these stocks have the potential to both raise dividends and post significant share price appreciation through the new year.

Here’s How You Could Start Getting an Extra $3,464 Each Month For 2021 [ad]

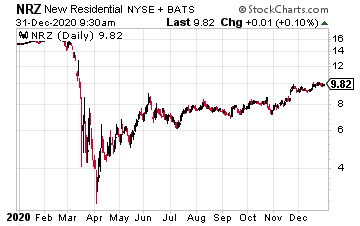

My aggressive stock for 2021

New Residential Investment Corp (NRZ) is a finance real estate investment trust (REIT) that faced near-collapse during the early days of the pandemic-fueled economic crisis. Due to disruptions in the financial markets during the 2020 first quarter, New Residential sold off $28 billion in investment assets, reducing the portfolio by 61%. The sales were made to preserve book value, which still took a 34% hit—down to $10.71 at the end of the 2020 first quarter. To preserve cash, the company slashed the dividend by 90% to $0.05 per share paid in May 2020. The previous $0.50-per-share dividend had been paid since the last increase in June 2017.

From core earnings of $0.61 per share for the 2019 fourth quarter, New Residential was in survival mode by the end of the 2020 first quarter. After selling off most of its investment portfolio by the end of the first quarter, New Residential went quickly to work to rebuild the company’s book value and core earnings.

In June, New Residential doubled its common stock dividend to $0.10 per share. For the second quarter, core earnings came in at $140.2 million, or $0.34 per share, and the book value was $10.77. Cash on hand of $1.077 billion at quarter-end was up from $360 million at the end of the first quarter. At that point, the company was again looking for investment opportunities. For the second quarter, the fledgling mortgage origination and servicing business generated $205 million of pre-tax income.

In September, the common shares dividend was again increased five cents to $0.15 per share. You can see where the New Residential board is going with its dividend recovery plans. For the third quarter, core earnings were $131.6 million, or $0.31 per share. Book value increased to $10.86. Of greater interest was the massive increase in origination and servicing profits. Origination posted a pre-tax income of $312.3 million, up 72% compared to the second quarter. Servicing pre-tax profits of $30.3 million were up 24% quarter over quarter.

To recap, coming out of the 2020 first quarter coronavirus related market crash, New Residential has been slowly rebuilding its investment portfolio. Still, at the same time, it has profited greatly from the surge in home buying and mortgage refinancing. New Residential jumped into the mortgage origination business in September 2019 when it acquired Ditech Holding Corp. The move into mortgages with the newly named NewRez was perfect timing.

While the New Residential share price has marched steadily higher from the Spring lows, there remains tremendous upside for investors. It is possible, even likely, that the company will in 2021 spin-off NewRez as a separate company. If that happens, expect an investment in New Residential at the start of 2021 to be doubled by the end of the year.

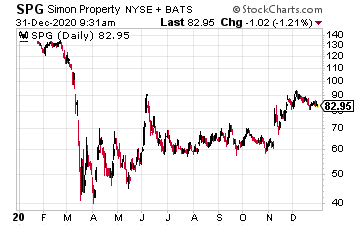

My conservative stock for 2021

With a $32 billion market cap, Simon Property Group (SPG) is a top-five REIT by size. As the owner of enclosed shopping malls and premium outlet malls, Simon was battered by the coronavirus pandemic and related economic shutdown. In March 2020, the company closed all of its U.S.-based properties. To preserve cash, The SPG dividend was reduced from an $8.40 annual rate to $6.00 paid in 2020.

In reaction to the coronavirus pandemic, Simon Property Group became aggressive to ensure it would survive and thrive in the post-covid world. Here is a list of moves and acquisitions made in 2020:

- As of May 11, Simon had reopened 77 properties. By June 29, 199 of the company’s 204 U.S. properties had reopened.

- In February 2020, Simon put together the acquisition of fast fashion retailer Forever 21. Simon and Authentic Brands Group each own 37.5%, and Brookfield Property Partners owns the balance. Buying name-brand retailers out of bankruptcy will allow Simon to keep stores occupied and help manage the brands back to profitability.

- In November, Simon and Taubman Centers (TCO) agreed for Simon to acquire Taubman for $43.00 per share in cash. In February, the companies had agreed on $52.50 per share; however, Simon later withdrew that offer. Taubman owns 26 super-regional shopping centers in the U.S. and Asia. Before the pandemic, Taubman had generated roughly $3.60 per share in annual funds from operations. The purchase by Simon closed in the final week of 2020.

I expect Simon Property Group to be a leading beneficiary of a reopening economy, with vaccinated shoppers ready to hit the malls again. During 2020, Simon focused on strengthening its retailer relationships, including taking equity stakes in several that faced bankruptcies. As in-person shopping results, Simon will benefit from both full occupancy rental payments and share in some tenants’ profits.

For full-year 2020, SPG will report an FFO of about $9.00 per share. This amount will be down 25% from 2019, but that puts the company in a great position to grow the dividend as the FFO returns to normalized levels.

As we advance, I expect SPG to return to its status as one of those excellent dividend growth companies, with a 6% yield and double-digit annual dividend growth. In a few years, buying SPG for $80 per share will look like the post-pandemic deal of the decade.