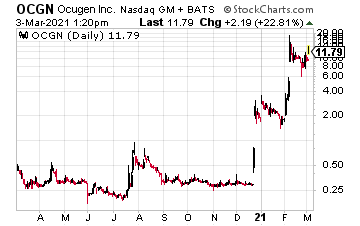

Ocugen Inc. (OCGN) has been explosive this year. Since late December 2020, OCGN ran from a low of just 29 cents to a recent high of $13.

Helping, OCGN just announced that its co-development partner, Bharat Biotech, announced the results of the first interim analysis of its Phase 3 study of COVAXIN, which demonstrated a vaccine efficacy of 81%.

“We are thrilled with the interim efficacy results of Bharat Biotech’s Phase 3 trial of COVAXIN in India. These results, which in part suggest significant immunogenicity against the rapidly emerging UK variant, represent an additional step towards outlining the regulatory pathway for EUA and approval in the United States.

COVAXIN, a whole virion based vaccine candidate, is designed to fill a significant unmet need in our national arsenal of vaccines against COVID-19,” said Dr. Shankar Musunuri, Chairman of the Board, Chief Executive Officer, and Co-founder of Ocugen., as quoted in a company press release.

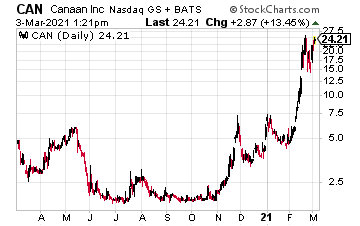

Crypto miner, Canaan Inc. (CAN) is off to the races again thanks to the cryptocurrency rally. In addition,thanks to the growth of Bitcoin, “the global cryptocurrency mining market size is projected to reach US$ 2584.6 million by 2026, from US$ 1015.9 million in 2020, at a CAGR of 16.8% during 2021-2026,” as reported by Industry Research.

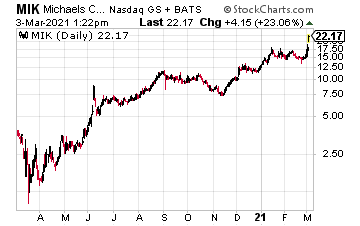

The Michaels Companies Inc. (MIK) soared 23% earlier this week on news it will go private in $3.3 billion deal. According to Barron’s, “The deal has an equity value of $3.3 billion and a transaction value of $5 billion. Apollo will acquire all outstanding shares of Michaels (MIK) stock for $22 per share, a 47% premium to the closing stock price on Feb. 26.”

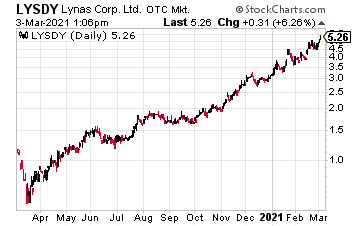

Lynas Rare Earths Limited (LYSDY) is picking up momentum, as the world scrambles to secure rare earth supply outside of China. It’s also running on news of better than expected profits for its half year, helped by rising rare earth prices.

According to Reuters, “Threats from China, the world’s largest producer of rare earth minerals, to stop exports of the minerals used to make weapons and high-tech equipment to the United States has left Washington scrambling for alternative channels of supply. The U.S. Department of Defense awarded $30 million in funds to build a facility in Texas to Lynas, which is the world’s largest producer of rare earths outside China.”

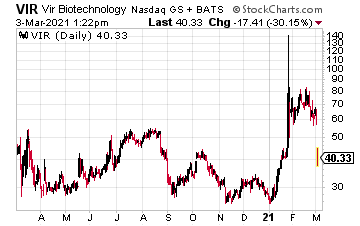

Vir Biotechnology (VIR) plunged earlier this week after being informed that while the VIR-7831 met initial pre-specified criteria to continue to the next phase of the ACTIV-3 trial and there were no reported safety signals.

In addition, sensitivity analyses of the available data raised concerns about the magnitude of potential benefit. The independent Data and Safety Monitoring Board (DSMB) has recommended that the VIR-7831 arm of the trial be closed to enrollment while the data mature.”

At the time of this writing, Ian Cooper did not hold a position in any of these stocks.