Last week there was a COVID-19 testing announcement with the potential to let United States citizens and the U.S. economy more quickly return to some semblance of normalcy. The availability of a $5.00, 15-minute COVID test will let life return to a more historical level of activity.

On Wednesday, August 26, Abbott (ABT) announced it received Emergency Use Authorization from the Food and Drug Administration for its BinaxNOW COVID-19 Ag Card rapid test. As the name implies, the test is the size of a credit card and can produce results in 15 minutes.

Abbott plans to sell BinaxNOW cards for $5.00 and says it will ship tens of millions of the tests in September and will be ready to produce 50 million tests per month starting in October. The federal government has ordered 150 million of the tests.

Thousands Started The 3-Step Retirement Plan Yesterday. There’s Still Time For You To Get In [ad]

While a medical professional must administer it, the test is self-contained. The results can be sent to an app on your smartphone, providing what Abbott says will work “like a secure digital ‘boarding pass’ that can be scanned to enter organizations and other places where people gather.” Some might see it as a new “show me your papers” world. You can sign up for notifications and get the app here.

The test opens up new investing ideas as businesses will be able to quickly decide who comes in – those with an app on their phone showing them to be COVID negative – while those who cannot show a negative result can be denied. Many currently or scaled back businesses will be able to reopen.

Here are three to consider.

Senior living and skilled nursing facilities will be able to test anyone and quickly get results. They will be able to test as much as they want, and then isolate and treat positive results while the rest of the population can go back to more normal lives.

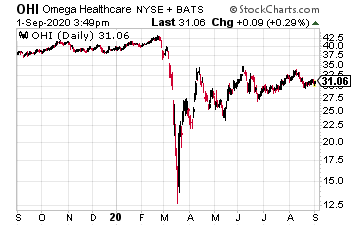

I have steered clear of healthcare real estate investment trusts (REITs) during the pandemic because I wanted to see how much the pandemic increased expenses. Now might be the time to invest in a senior living REIT such as Omega Healthcare Investors (OHI).

Omega has sustained its dividend and currently yields 8.7%.

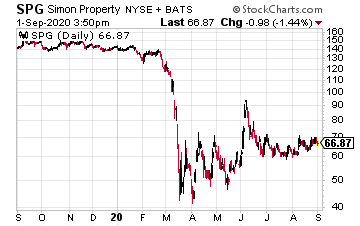

With the widespread use of the BinaxNOW test, shoppers can confidently return to brick-and-mortar stores and shopping centers.

Large-cap mall REIT Simon Property Group (SPG) has been active during the crisis, buying up bankrupt name-brand retailers to keep its spaces occupied.

Simon did cut the dividend by one third, and SPG currently yields 6.7%.

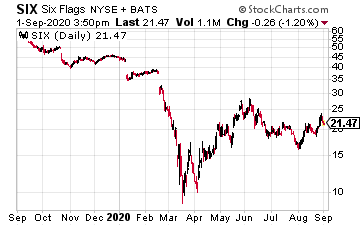

Let’s have some fun! The COVID crisis forced Six Flags Entertainment (SIX) to close its parks and suspend dividend payments.

The COVID-19 rapid test could allow Six Flags to quickly scan the cell phone of everyone coming in to ensure only those without the virus enter. It could reopen its parks and have an excellent 2021 season.

Six Flags is the most speculative play of these three, but also has a couple of turns of upside potential.