The economy may be improving, but last week’s Federal Reserve statement made it clear that there will be no tapering anytime soon. In other words, the Fed will continue to purchase bonds, and interest rates will remain near zero. It’s not all that surprising as the Fed has made it clear they don’t want to tighten too soon.

The thing is, it’s pretty hard to escape a recession without a fair amount of collateral damage. The Fed prefers to take a chance on an overheating economy rather than risk unemployment returning to peak pandemic levels.

Fortunately, the economy is improving. The jobless rate is dropping, and COVID-19 infection levels are declining. As the number of vaccinated Americans increases, many states are returning to normal operating levels. That’s undoubtedly good news, especially for small and local businesses.

We have seen a somewhat dramatic rise in prices in raw materials. If you want to see an extreme example, go check out the price of lumber at your local hardware store. Other materials with rapidly rising prices include copper, steel, and corn. Nevertheless, the Fed typically doesn’t consider commodities prices as a significant factor in its views on inflation, because commodities tend to be volatile, and prices can revert quickly.

The financial sector may not be too thrilled about the near-zero interest rate situation. Banks and many asset management companies prefer higher rates because they tend to lead to higher margins.

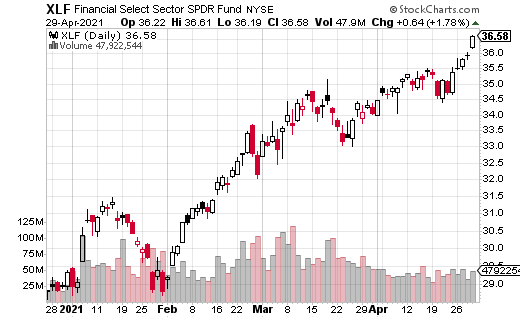

However, financial companies also thrive when the economy improves. As can be seen from the Financial Select Sector SPDR Fund (XLF) chart, it’s been a good year for the sector. XLF is up 22% year-to-date. But how much more upside is there in XLF?

With interest rates fixed at ultra-low levels for the foreseeable future, XLF may not be as appealing for investors to hold, especially since it’s already had a nice run. What’s more, the ETF only pays about a 1.8% dividend.

One way to juice your returns with a stock like XLF is through covered calls. Just last week, a trader purchased 1.7 million shares of the stock at $36.34 while simultaneously selling 17,000 of the June 27 calls for $0.70, which amounts to $1.2 million in premium collected.

The $0.70 received from selling the calls amounts to a yield of 1.9% for a 50-day period. On an annual basis, that’s nearly 14%. So, by using covered calls, the trader can increase the yield from a measly 1.8% per year to 14% without increasing downside risk.

The trader can also capture $0.64 of upside in the stock before the short calls cap it out. That could potentially add another 1.8% upside to the position. By mid-June, the trade could achieve a total return of 3.7%. While it may not seem like a huge number, we’re also talking about the typically very safe and non-volatile financial sector. Suddenly, investing in boring financial stocks doesn’t seem so underwhelming.