During the course of the day when market is open Jay will post thoughts, updates, responses to subscriber questions, and more to this page.

Additionally, buy and sell alerts and adjustment notices will be posted here.

Go ahead and bookmark this. Please note that all dates and times below are eastern time.

September 4, 2023 - 10:29 am

Today’s Options Insiders Live Trading Room has been canceled.

March 6, 2020 - 3:19 pm

Just a quick heads up, as you many of you have noted, the VXZ order should be “Sell to close” not “Buy to close” – that was my mistake. I’m used to use closing short positions! Regardless, make sure you close your VXZ today and collect the profits before the weekend.

March 6, 2020 - 11:48 am

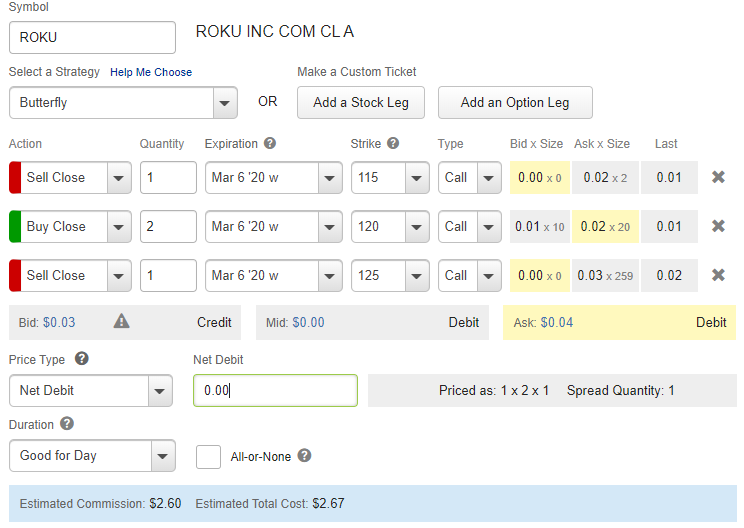

Closing Alert:

We have two trades to close today, well our only two trades. We got the direction right on ROKU but used the wrong type of trade as it blew through our put butterfly (we put it on before the market meltdown, so no real surprise). We still have to close that ROKU fly because it’s in the money and we don’t want to get assigned on anything after expiration. We’ll put in a closing order for zero, as seen below. Second, the VXZ trade was quite a bit more successful than what I would have predicted after just putting on the position earlier in the week. But, we’ll certainly take it! Let’s close it out and take profits. (At a closing price of $ 3.50, we’re looking at 367% gains or thereabouts.)

Trade Details (ROKU and VXZ):

March 3, 2020 - 1:17 pm

Trade Alert:

Our normal trades using butterflies or backspreads are not the best types of trades to do in a very high volatility environment. I want to buy some volatility here as I think the Fed rate cut signifies that there’s more pain ahead and we could have more stock selling to come. VIX and VXX options are expensive right now so I’m turning to VXZ for the solution. VXZ is the middle part of the VIX term structure as opposed to the front months, so it isn’t as expensive. We’re doing a simple trade in VXZ, but the product is more complicated, so watch the video linked below if you have questions.

Trade Details:

Buy the iPath VIX Mid-Term Futures ETN (VXZ) March 20th 20 calls for $ 0.75.

This is a simple call buy (and I explain why a spread isn’t necessary in the video). I recommend a 3-lot.

![]()

Trade Video Link:

https://content.jwplatform.com/videos/itW6r08u-bK67iJnL.mp4

February 27, 2020 - 1:25 pm

Trade Alert:

Tough call on what do with SMH right now. The 132 puts were actually in the money this morning. Tomorrow SMH could be at 125 or 140. I would easily hold this trade as a hedge overnight, except that the options expire tomorrow. The 132 puts have a lot of value today, but tomorrow they will go to zero if they aren’t in the money. We can’t take a chance that we settle around 132, which is max loss. As much as I prefer to see if we can make money on this trade, the risk outweighs the benefit. So, let’s close it here.

Trade Details:

Sell to close the SMH February 28th 139-132 put backspread for around $ 3.12.

Buy back the 139 puts and sell out the 2 132 puts as seen in the trade details below. Anywhere you can filled is fine, as long as you close by the end of the day. The market is volatile so you may get filled anywhere from $ 2.50 to $ 3.50 at this stage. You can hold until the end of the day, but I recommend getting out of this trade before market close.

February 19, 2020 - 1:49 pm

Trade Alert:

The market has been quite exuberant lately, and I feel it’s prudent for us to take at least a small contrarian position. Roku (ROKU) is a TV streaming service that is trading at quite a lofty valuation. The stock is volatile so we’ll use a put butterfly to keep our costs low. I discuss the reasoning behind this trade and the payout in the video linked below.

Trade Details:

Buy to open the ROKU March 6th 115-120-125 put butterfly for $ 0.61.

Anywhere around this price is fine. The most you can lose is the premium spent. The breakeven range is from roughly 115.60 to 124.40. Max gain is right around $ 4.40 if Roku closes at $ 120 at expiration.

Trade Video Link:

https://content.jwplatform.com/videos/ua1xlb7A-bK67iJnL.mp4

February 14, 2020 - 2:50 pm

Closing Alert:

Our IWM butterfly expires today. It is a winner right now, so let’s go ahead and close it with the end of the day approaching and a three-day weekend ahead. The trade details are below. At a closing price of $ 0.87, our return is 27.9%.

Trade Details:

February 14, 2020 - 1:25 pm

Just a heads up that I’ll be closing the IWM position towards the end of the day. If you don’t think you’ll be available then, make sure you close the position now so you don’t end up getting assigned on anything over the long weekend.

February 13, 2020 - 12:18 pm

Closing Alert:

Let’s go ahead and close our GLD butterfly. It expires tomorrow and it’s a nice winner right now. At the closing price of $ 1.28, our return is 156%. See trade details below for how to enter the closing order.

Trade Details:

February 7, 2020 - 12:28 pm

Trade Alert:

It’s been interesting looking at the potential put backspreads this week, but at the end of the day, the best trade is still our old standby SMH. See the trade details below with a full discussion of the trade in the video linked at the bottom.

Trade Details:

Buy the SMH February 28th 139-132 put backspread for around 40 cents. You will be selling the 139 puts and buying double the 132 puts. I recommend doing 2 spreads. See the video for the payout/risk discussion.

![]()

Trade Video Link:

https://content.jwplatform.com/videos/OoSHBxUT-bK67iJnL.mp4

January 31, 2020 - 12:05 pm

Trade Alert:

We have two open positions to manage and a new call butterfly to trade in IWM. We are closing the short puts in both of our backspreads to be safe and buying a call butterfly in case IWM reverses higher in the next couple weeks. I discuss the reasoning behind the trades in the 5 minute video linked below.

Trades:

Buy to close the SMH January 31st 136.5 puts for around $ 0.06.

I wouldn’t try to include the 129 puts in this as it will be harder to get filled. You may have to pay up to 10 cents or more… that’s fine. It’s important that you close this short put today just in case.

Buy to close the TLT February 14th 135.5 puts for around $ 0.04.

With a couple weeks to go to expiration and the long 132 puts only worth about a penny or two, we may as well hold the long puts just in case TLT changes course.

Buy to open the IWM February 14th 162.5-165.5-168.5 call butterfly for around $ 0.68.

Anywhere around this price is fine. I recommend a 3-lot, which means the most we could lose on the trade is around $ 200. The butterfly will be profitable anywhere between roughly $ 163.20 and and $ 167.80.

Trade Details:

Video Link:

https://content.jwplatform.com/videos/Ng3DP13B-bK67iJnL.mp4

January 21, 2020 - 12:40 pm

Trade Alert:

We’ve got a couple put backspreads on, so let’s mix it up a bit with a butterfly trade. I’m bullish on precious metals as they tend to see a lot of investor cash when interest rates are low. Moreover, with no rate increase on the horizon, I think investors will continue to park cash in gold on other safe-haven investments.

The easiest way to invest in gold is through SPDR Gold Shares (GLD), which is based on physical gold. GLD is trading for over $ 146 so it can be expensive to buy calls or even call spreads. However, we can make a moderately bullish bet on gold without spending a lot in premium by using a call butterfly. See video below for details.

Trade Details:

Buy the GLD February 14th 147-150-153 call butterfly for $ 0.50.

We are buying the 147 and 153 calls (outside strikes or wings), while selling double of the 150 calls (middle strike). Anywhere around this price is fine. I recommend a 3-lot which costs around $ 150 in total premium. That’s the most we can lose on the trade. However, anywhere between $ 147.50 and $ 152.50 is a profitable range for us at expiration.

Trade Video Link:

https://content.jwplatform.com/videos/XkuRqVhF-bK67iJnL.mp4

January 17, 2020 - 2:38 pm

I don’t see any new trades I want to do this week in Options Profit Engine. Nothing jumps out as me as a trade we must make. I do have a couple stocks I’m following and I think they’ll be a trade there early next week – market permitting. The market is closed on Monday, so the most likely time for our next trade is Tuesday.

January 10, 2020 - 1:30 pm

Trade Alert:

First off, this is a reminder that we can let the January 10th SMH put backspread expire. It isn’t close to our short strike of 136 so we can let it expire worthless and collect the full credit. We still have the January 31st SMH put backspread that has three weeks to go to expiration. Today, let’s add another put backspread to the mix, this time in TLT. I talk about the rationale and the payoff for the trade in the video, linked below.

Here’s the trade:

Buy the iShares 20+ Years Bond ETF (TLT) February 14th 135.5-132 put backspread for around a $ 0.28 credit. (Sell the 135.5 and buy double of the 132 puts.)

I recommend 3 spreads (1 or 2 for beginners) since we haven’t traded TLT before using backspreads, but certainly do what you are most comfortable with. 3 spreads requires around $ 1,000 in margin. This trade will generate an 8% yield in 35 days if we capture the entire credit.

Trade Details:

![]()

Video Link:

https://content.jwplatform.com/videos/BnnXWGXj-bK67iJnL.mp4

January 3, 2020 - 2:48 pm

Trade Alert:

We haven’t had a trade in a while due to the holidays, but also because I haven’t found a put ratio backspread worth doing – until now. We are going to use SMH again even though we have a trade on in there already. That trade expires next week and this one won’t expire until January 31st, so there should be very little overlap. Our spread will be a little wider than normal due to the additional volatility today because of the Iran situation. That’s okay. We’ll just do 2 spreads instead of 3 (or 1 for beginners). Please watch the video for detailed reasoning behind the trade and how the payout/risk works.

Trade Details:

Buy the VanEck Vectors Semiconductor ETF (SMH) January 31st 136.5-129 put ratio backspread for a $ 0.43 credit. Sell 1 of the 136.5 puts and buy 2 of the 129 puts per spread.

For every $ 750 needed in margin per spread, we can make $ 43 in credit (5.7% yield in 4 weeks). Remember, this trade can also make money on the downside because of the double long puts.

Trade Video Link:

https://content.jwplatform.com/videos/aGN4tqVz-bK67iJnL.mp4

December 19, 2019 - 1:43 pm

Trade Alert:

Today we are closing our IWM put ratio backspread for near the max credit and opening a new put ratio in SMH. For details of the trades, please see the video linked below.

Trade Details:

Sell to close the IWM December 27th 156-150 put ratio backspread for around $ 0.02.

Remember, to close the trade we are buying back the short 156 strike and selling out the double long 150 puts. Closing at 2 cents will results in 4.7% return on cash. Don’t worry about adjusting the price a bit in order to get filled.

Buy to open the SMH January 10th 136.5 -130.5 put ratio backspread for around a $ 0.35 credit.

As a reminder, you selling the 136.5 strike and buying double of the 130.5 strike. I did a 3 x 6 spread but you can adjust according to your risk level/account size. I discuss the pay out scenario in detail in the video.

Video Link:

https://content.jwplatform.com/videos/EOCyAn66-bK67iJnL.mp4

December 13, 2019 - 12:22 pm

Trade Alert:

We’re going to close MU today for about a 59% winner and open up a new call butterfly on Biogen (BIIB). BIIB volatility has dropped quite a bit and it looks like a good bet to drift higher in the next couple weeks. Because it’s a high priced stock, butterflies are a good choice to use for directional trades as they keep the costs reasonable. I discuss the trades in detail in the video linked below.

Trade Details:

Buy to open the BIIB December 27th 307.5-315-322.5 call butterfly for around $ 0.85.

You may be able to get closer to $ 0.70 if you are willing to wait. I’d start there and move the price up 5 cents at a time. Max loss is whatever we pay for the trade. Max gain is at 315 at expiration, with the profit range between 307.5 + premium paid and 322.5 – the premium. Use the screenshot below to set up your trade if you are new to butterflies.

Sell to close the MU December 20th 47-51-55 call butterfly for around $ 1.21.

With earnings coming up next week, MU isn’t as likely to be at this level after the news. So, let’s not take any chances and close for nearly a 60% gain right now. Start at the midpoint of the butterfly bid/ask and move down 1 cent at a time until you get filled.

Trade Video Link:

https://content.jwplatform.com/videos/cCk8D5u3-bK67iJnL.mp4

December 5, 2019 - 1:04 pm

Trade Alert:

Let’s close our SMH put ratio (backratio) and then add a new ratio spread on IWM. First off, closing the SMH spread for $ 0.09 is a 4.2% return on cash on the trade. We can now open up a new ratio spread on IWM which expires in about 3 weeks. The added volatility this week makes this an attractive trade over a relatively short period of time. As a reminder, it will protect us if the market dives in the next couple weeks, but otherwise, we’ll likely earn a credit of 4%-%5 on cash risked. I discuss the details in the video linked below.

Trade Details:

Buy to open the the IWM December 27th 156-150 put ratio (backratio) spread for a $ 0.29 credit. (Sell the 156 put and buy double of the 150 put.)

Any price around this level is fine. I did a 3 x 6, which is my standard recommendation. Do more or less depending on your comfort level and account size.

The second trade listed is the closing trade for SMH. Sell to close the SMH December 6th 128.5-123 put ratio spread for around $ 0.09.

Trade Video Link:

https://content.jwplatform.com/videos/G14KWlsv-bK67iJnL.mp4

November 22, 2019 - 2:25 pm

Trade Alert:

First off let’s close that IWM trade. You should be able to close it for 1 or 2 cents which works out to a 4.5% return on cash at risk. Here’s what that closing order should look like:

Okay, now let’s open a new trade. Semiconductors have had a really good earnings season, but one big company doesn’t report earnings until mid-December. That company is Micron (MU). I believe MU has the ability to jump higher on or before earnings (December 18th), so we’ll buy a call butterfly expiring December 20th. That gives us some time for it to drift higher or potentially capture a gap after earnings if we hold the trade that long. I discuss the trade in the video linked below. Here’s what that trade looks like:

The most you can lose it the $ 76 in premium per butterfly. Max gain then becomes $ 324 if MU closes at $ 51 at December expiration. More importantly, our profit range is from $ 47.76 to $ 54.24. I recommend doing 1 or 2 for beginners and 3 to 5 for more experienced traders. Remember you buy the wings and sell double of the center strike as seen in that above order entry snapshot.

Trade Video Link:

https://content.jwplatform.com/videos/v0u9laZ6-bK67iJnL.mp4

November 13, 2019 - 11:04 am

Closing Alert:

ARW is right around $ 80 which means it’s probably not going to be at $ 80 on Friday. Let’s close now as this is likely going to be our highest profit point. Butterflies can filled at all different prices so try to get filled first at the midpoint or higher and slowly move your limit order down until it gets filled. I got $ 1.50 which results in the trade being a 173% winner.

Trade Details:

Sell to close the ARW November 15th 77.5-80-82.5 call butterfly for around $ 1.50.

November 12, 2019 - 12:06 pm

Trade Alert:

I’ve been praising the virtues of the 1 x 2 put ratio spreads we’ve been using in IWM. Well, I’ve decided we need to expand the use of that strategy. So, we are doing the same sort of trade in VanEck Vectors Semiconductor ETF (SMH). SMH is also an index fund and trades at a similar price to IWM. It has slightly higher volatility so we collect a bit larger credit for the trade. Other than that, the same concepts apply to this trade as the one we’ve been doing in IWM. For all the details, watch the video linked below.

Trade details:

Buy to open the SMH December 6th 128.5-123 1 x 2 put ratio spread (selling the 128.5 and buying 2 of the 123 puts) for a $ 0.33 credit. (My screenshot shows a 30-cent credit but the price has now moved up to about 33 cents.)

![]()

Your fill price may vary by a few cents. I recommend 1 x 2 up to 5 x 10 depending on your account size and risk appetite. Remember, if SMH stays above 128.5, you collect the credit. If it drops, the 123 puts will go up faster than the 128.5 puts go down. This works out to about 6% return on cash risked in 24 days if we collect the entire premium.

Video Link:

https://content.jwplatform.com/videos/ReXETOxv-bK67iJnL.mp4

October 31, 2019 - 2:14 pm

Trade Alert:

Well, this is closest thing to a real down day that I guess we’re going to get so let’s take the opportunity to place my favorite trade, the IWM put ratio. For those new to the service, be sure to watch the video below where I place the trade and talk about how it works (it’s 11 minutes so there’s a lot of info in there). In brief, this trade will provide us with a small credit (generally 5%-7% on cash at risk) but has the ability to serve as a hedge if the market sells off sharply.

Trade Details:

Buy the iShares Russell 2000 ETF (IWM) November 29th 150-144 put ratio spread (sell the 150 put, buy double of the 144 put) for around a $ 0.27 CREDIT.

You may need to use a custom order entry on your order screen depending on your broker. For new traders, I recommend just doing a 1 by 2 or 2 by 4 to start with. I discuss the payout and risk details in the video below.

Video Link:

https://content.jwplatform.com/videos/PQV41E7Z-bK67iJnL.mp4

October 24, 2019 - 2:25 pm

Trade Alert:

Let’s a do another bullish call butterfly trade. The AMP call fly worked out pretty well a week ago, so I found a similar situation with Arrow Electronics (ARW). Like AMP, ARW is undervalued and is setting up for a possible move higher. The difference is ARW has earnings next week (Oct 31), which I think will be the catalyst for the higher move. We are doing a call butterfly to keep costs low. See trade details below.

Trade:

Buy to open the Arrow Electronics (ARW) November 15th 77.50-80-82.50 call butterfly for around $ 0.55.

Any price around this level is fine. We can only lose the $ 55 in premium per butterfly, while max gain (at $ 80 on expiration) can be $ 195 per butterfly. We’re looking for ARW to end up in the range of $ 78.05 to $ 81.95. I recommend doing anywhere from 1 to 5 butterflies depending on your comfort level with the trade.

Trade Details:

October 17, 2019 - 2:34 pm

Trade Alert:

Okay, we have a new trade today plus we’re closing AMP as a winner. In the video I also talk about the NFLX debacle (their guidance was atrocious as I expected, but the stock still went straight up). In my opinion, volatility is way too cheap here so we’re going to buy a cheap call spread in UVXY. Details and video below.

Buy to open the ProShares Ultra VIX Short-Term Futures ETF (UVXY) November 1st 23.5-27.5 call spread for around $ 0.61.

We are buying the 23.5 calls and selling the 27.5 calls at the same time. The most we can lose is the premium spent or 61 cents. At max gain, 27.5 or above, we can make $ 3.39.

Also, sell to close the Ameriprise Financial (AMP) October 18th 140-145-150 call butterfly for around $ 1.20.

Anything around this price is fine. We paid 95 cents for this butterfly so we’re looking at around a 25% winner here.

Trade Details:

Trade Video Link:

https://content.jwplatform.com/videos/a1Uoj29z-bK67iJnL.mp4

October 14, 2019 - 6:02 pm

A quick break from options talk so you can take a close look at what petrified wood looks like up close. Those are all different minerals that make up the “wood” – it’s really quite amazing to see in person.

October 9, 2019 - 1:26 pm

Trade Alert:

I mentioned in today’s newsletter that I want to move our NFLX trade to include next week’s earnings. With the down move today in NFLX, and that fact that many brokers aren’t charging commissions now, it actually makes sense to close this week’s put butterfly and then open a new one for next week.

Here are the trades:

SELL to close the NFLX October 11th 250-240-230 put butterfly for around $ 0.13.

Trade setup:

![]()

Now the new trade:

BUY to open the NFLX October 18th 250-240-230 put butterfly for around $ 1.12.

Trade setup:

Because the trade costs over $ 100 per butterfly I only recommend doing 1 or 2 of them (either 1-2-1 or 2-4-2). We are looking for a big down move on NFLX earnings, with $ 240 being the max gain NFLX price and a profit range of roughly $ 249 to $ 231. You can only lose the money you spend on the premium. Max gain will generate a little under $ 9 per fly.

October 2, 2019 - 3:01 pm

This text alert may not have come through for everyone the first time, so I’m resending it. The email should also be coming out shortly.

Trade Alert:

Two new trades today – a downside trade in IWM which can also serve as a hedge and an inexpensive upside play in Ameriprise Financial (AMP). The IWM trade is a ratio put spread so it will provide a credit if the market recovers but will gain significant value if the market falls off a cliff. The AMP trade is an attempt to take advantage of a good stock that is oversold because of the broad market selloff and the commission battle between online brokerages. I discuss the trade in much more depth in the video (link below).

Trades:

Buy to open the iShares Russell 2000 ETF (IWM) October 18th 141-135 put ratio spread (sell the 141 put, buy 2 of the 135 put) for around a $ 0.39 credit.

Margin is around $ 600 per spread so I only recommend doing a 2 x 4 or 3 x 6… of course 1 x 2 is fine as well, especially for less experienced traders. Anywhere around 39 cents if fine but just make sure you are setting this up to get a credit. Check the trade details box below to see exactly how to enter the trade. Max gain/max loss are a bit more complex, so check out the video for details.

Buy to open the Ameriprise Financial (AMP) October 18th 140-145-150 call butterfly for around $ 0.95.

Fill prices may fluctuate because the option bid/ask spreads are wider than normal. I recommend doing 2 or 3 of these call flies. Remember it’s 1 x 2 x 1 as seen in the trade details box below. Max gain is $ 405 if AMP stock is at $ 145 at expiration, but anywhere from $ 140.95 to $ 149.05 is a winning trade (not including fees). Max loss is only the $ 95 per spread you pay in premium.

Trade Details:

Video Link:

https://content.jwplatform.com/videos/7D9zz3Fu-bK67iJnL.mp4

October 2, 2019 - 2:30 pm

Trade Alert:

Two new trades today – a downside trade in IWM which can also serve as a hedge and an inexpensive upside play in Ameriprise Financial (AMP). The IWM trade is a ratio put spread so it will provide a credit if the market recovers but will gain significant value if the market falls off a cliff. The AMP trade is an attempt to take advantage of a good stock that is oversold because of the broad market selloff and the commission battle between online brokerages. I discuss the trade in much more depth in the video (link below).

Trades:

Buy to open the iShares Russell 2000 ETF (IWM) October 18th 141-135 put ratio spread (sell the 141 put, buy 2 of the 135 put) for around a $ 0.39 credit.

Margin is around $ 600 per spread so I only recommend doing a 2 x 4 or 3 x 6… of course 1 x 2 is fine as well, especially for less experienced traders. Anywhere around 39 cents if fine but just make sure you are setting this up to get a credit. Check the trade details box below to see exactly how to enter the trade. Max gain/max loss are a bit more complex, so check out the video for details.

Buy to open the Ameriprise Financial (AMP) October 18th 140-145-150 call butterfly for around $ 0.95.

Fill prices may fluctuate because the option bid/ask spreads are wider than normal. I recommend doing 2 or 3 of these call flies. Remember it’s 1 x 2 x 1 as seen in the trade details box below. Max gain is $ 405 if AMP stock is at $ 145 at expiration, but anywhere from $ 140.95 to $ 149.05 is a winning trade (not including fees). Max loss is only the $ 95 per spread you pay in premium.

Trade Details:

Video Link:

https://content.jwplatform.com/videos/7D9zz3Fu-bK67iJnL.mp4

October 1, 2019 - 7:30 pm

Just a heads up that we will be doing a couple new trades tomorrow, including renewing the SPY hedge.

September 27, 2019 - 12:28 pm

Closing Alert:

We’re going to close both the TLT and SPY butterflies since it’s possible both could finish in-the-money (and we don’t want to get assigned on any stock). We didn’t quite get to the profit level I wanted in TLT, but it’s a winner nonetheless.

Sell (to close) the TLT September 27th 137-140-143 for around $ 0. 55.

Sell (to close) the SPY September 27 295-290-285 for around $ 0.20.

Depending on when you close, you may end up getting moderately different prices because on expiration day, these levels can move quite a bit. Use your discretion on when you want to close, but just make sure you get filled before the end of the day.

Trade Details:

September 26, 2019 - 1:35 pm

Trade Alert:

We have an opening and closing trade to make today. I’m not happy with the price action in FedEx (FDX) so we’re going to close it. My goal at the beginning of this year was to close a credit spread if we spend more than a day in-the-money and I’m going to stick to that with FDX, which is back around $ 145. On the other hand, I have a fun trade for us to do in Netflix (NFLX) ahead of next earnings. I believe the stock will sell off ahead of earnings as the crowd expects it to miss due to intense competition in the streaming video space. We’ll use a butterfly so we aren’t spending too much on the trade. See the video and screenshot for details.

Trade Details:

For NFLX I recommend a 3-lot (3 x 6 x 3). Max loss is what we spend on the trade $ 81 per butterfly in this case. Max gain is at $ 240 at expiration which would result in $ 919 per butterfly.

Video Link:

https://content.jwplatform.com/videos/Nh54g0qh-bK67iJnL.mp4

September 24, 2019 - 3:03 pm

Closing Alert:

It’s time to close our CAT trades. We already at max gain on the put ratio spread and now the call butterfly is over a 200% winner. It should help make up for a chunk of the losses we took on the put credit spread a while back. I don’t want to wait any longer to close these trades since the market is looking pretty volatile at the moment and we could be in a very different spot by the end of the week when these trades expire.

I’m going to just post the screenshot here of what the closing trades look like, but feel free to email me if you have any questions on how to close.

September 19, 2019 - 1:15 pm

Trade Alert:

First off, we are upgrading our video hosting software so I have no way to post my trade video at the moment. I did make one and then realized there’s nothing I can do with it! We’ll stick to text/email for now.

I know we haven’t done regular put credit spreads in a while – and it wasn’t my initial intention to do so today – but I found a great trade in FedEx (FDX) that makes selling a put spread worthwhile. Also, volatility in the market is way down now that the Fed meeting is past, so I think it’s safer to sell some volatility here. FDX dropped this week on negative earnings, but those earnings were primarily due to the company ending its contract with Amazon (AMZN). That now appears to be a smart move since AMZN looks to be taking their delivery service fully in house. I think FDX made a difficult but correct call and is in a decent position over the long-run. Of course, we’re selling short term put spreads, so we don’t care if the stock rallies over time , we just don’t want it to go lower over the next few weeks. With the substantial amount of premium in the puts, I think this is a very promising trade to make right now.

SELL TO OPEN the FDX October 11th 146-142 put spread for $ 0.95 (credit).

See below for details. We are selling the 146 strike and buying the 142. I recommend a 3-lot for experienced traders and 1 or 2-lots for new traders. Anywhere you get filled around that price is fine. We can lose $ 305 per spread at max loss below $ 142 in the share price, but anywhere above $ 146 is max gain of $ 95 per spread (and the stock price is currently close to $ 151).

We’re also going to close our Avis (CAR) butterfly since it expires tomorrow. We didn’t quite get close enough to $ 28 to get the gains I wanted to see. But, we are still closing it as a winning trade, albeit a small winner.

SELL TO CLOSE the CAR September 20th 26-28-30 call butterfly four around $ 0.52.

You may be able to get a better price than 52 cents if you hold on. I wouldn’t wait until tomorrow though to be safe. If you don’t know how to close a butterfly, just look at the screenshot below and copy the exact format.

September 16, 2019 - 2:39 pm

We’ll get back to trading shortly, but first wanted to share with you this pic I took on my jeep tour between Ouray and Telluride in Colorado this past weekend. This is at the top of Imogen pass, 13,000 feet high. You can only get there with an off-road vehicle and a very skilled driver.

September 11, 2019 - 5:28 pm

Just a quick note that I’ll be off the grid tomorrow and Friday and likely won’t see any emails until Sunday afternoon at the earliest. The Thursday strategy session will still come out tomorrow as usual and you’ll receive the link for the video in your inbox.

September 9, 2019 - 1:31 pm

Trade Alert:

We’ve got two trades today – one a bearish bet on bonds and the other placing a new SPY hedge now that our current one is going to expire today. I was a bit early on our bearish bond trade in TLT a couple weeks ago. Now it finally looks like bonds are losing steam. We’ll attempt to take advantage of that with a put butterfly in TLT. We’ll also use a put butterfly in SPY as a hedge or simply in the event that volatility rears its head once again. Please see the video for more info about the reasoning and payoff profile of these trades.

BUY TO OPEN the iShares 20+ Year Treasury ETF (TLT) September 27th 143-140-137 put butterfly for around a $ 0.57 debit.

As always, anywhere around that price you can get filled is fine. If you haven’t traded a butterfly before, simply place the order in your entry screen as you see in the screenshot below, making sure the middle strike is double the contracts of the outer strikes. I recommend a 3-lot (3x6x3) for this trade. That gives us roughly a $ 5 profit range with max profit at $ 140 (TLT share price) at expiration. You can only lose what you spend in premium on the trade.

BUY TO OPEN SPDR S&P 500 ETF (SPY) September 27th 295-290-285 put butterfly for around a $ 0.48 debit.

Everything I said above about TLT applies to this trade. The difference is we have about a $ 9 profit range with max gain at $ 290 (SPY share price) at expiration. I also recommend a 3-lot for this trade/hedge.

Trade Details:

Video Link:

https://content.jwplatform.com/videos/Y5OeS03x-bK67iJnL.mp4

September 6, 2019 - 2:49 pm

I mentioned doing a TLT trade this week, but I’m going to wait until Monday to send it out. We’ll also have a new SPY hedge to put on at that time (as our current one expires Monday after close). There’s a lot of economic news out and I want the markets to have a weekend to digest the data and see how TLT reacts on Monday – I could see it going either way at this point. Once we see how bonds react Monday morning, we’ll place a new trade – either a butterfly or a ratio put spread depending on the action.

Separately – I’m going to be off the grid on Thursday and Friday of next week, so our monthly webinar will come out on Wednesday.

September 4, 2019 - 3:25 pm

The Options Profit Engine issue is coming out soon via email, but I thought it may be useful to send the link to the online version, which is up and ready to go:

https://www.investorsalley.com/options-profit-engine-weekly-issue-september-4-2019/

August 30, 2019 - 2:58 pm

Trade Alert:

As promised, here is our new CAT trade, well it’s actually two different trades. What I’m doing is more complex than anything I’ve done before in Options Profit Engine and it does require a bit more margin than normal. However, I am a huge fan of this strategy. Please make sure you’re putting in the trades as shown in the Trade Details section. The video discusses the trade in depth along with my thought process as I work through the execution. It’s a 20 minute video.

In the interest of time, I’m going to give you some bullet points on this trade and leave the deeper explanation and payout/risk scenarios to the video.

- If CAT climbs higher, the call butterfly will pay off. There’s probably a cap on how high we can go given the trade war not being close to resolution.

- If CAT stays around where it is, we can only lose the premium paid which is about $ 65 for 1-lot of all strategies combined, $ 130 for 2, etc.

- If CAT plunges, there is no cap on the gains.

- If CAT moves down quickly, the ratio spread will make money due the increase in volatility and put skew.

- If CAT drifts down slowly, we can hit max loss, but “drifting lower” is basically an oxymoron in this market (and in most markets) and is highly improbable.

Basically, we are doing a call butterfly for our upside play and a put ratio credit trade for our downside. We haven’t used a put ratio trade before but it simply means we are buying double the number of long puts. You probably want to do no more than 2 or 3 of these spreads due to the margin requirement. Although the margin is a bit high ($ 600 for each put ratio spread), the risk is actually quite low due the nature of the trade. If we move down quickly, the long puts will gain in value faster than the short puts. It’s getting close to the end of the day so I’m going to let you use the trade details screenshot for the trade execution info. Please watch the video to see about the payoff and risk of the trade as a whole.

Trade Details:

Video Link:

https://content.jwplatform.com/videos/3qTmZEOz-bK67iJnL.mp4

August 27, 2019 - 1:24 pm

Important CAT info:

I’ll send out an official email later today but many of you have emailed me that you’ve gotten assigned on your short 127 puts in CAT. First off, this is a surprise and totally unexpected. Normally early exercise is related to ex-dividend dates, but that happened back in July. Most likely, there was some kind of pricing anomaly in CAT options (perhaps due to a large order) which created a scenario where exercising puts and selling the stock locked in a profit. This was likely all being done by computer programs (algos) that constantly scan the market for such opportunities. They rarely happen in this day and age and there’s no way to predict when it may occur.

For most of you who emailed, I’ve already suggested closing the trade by selling out the stock and the long put. My plan was to roll this trade out next week, but I think that ship has sailed now given this scenario. However, if you are going to more than $ 1,000 loss on this position, there are some alternative strategies I highlight below:

- Sell the 123 puts out and just hold the stock until it rebounds (there’s obviously risk here that the market tanks and you lose even more)

- Roll the 123 puts out and down below the stock price (for example, the October 18th 110 puts or something like that) and keep the stock. That way you have the upside potential of a rebound but are hedged against a further selloff

- Close the 123 puts, keep the stock, and turn the trade into a covered call by selling October calls at a higher strike

I can certainly help you with choices 2 or 3 if you want to email me with questions.

August 26, 2019 - 2:45 pm

Trade Alert:

The market has fortunately held up today so it gives us a chance to put on another SPY butterfly hedge. I don’t buy this rally for a second so I’m very pleased we are getting a chance to get a hedge on at this levels. We’ll go a bit wider on our put butterfly this time to give us some additional protection See the video for details of the trade.

BUY TO OPEN the SPDR S&P 500 ETF (SPY) September 9th 282-276-270 Put Butterfly for a $ 0.59 debit.

I recommend a 3-lot or more if you are extra bearish. Anywhere you get filled around 59 cents is fine. Remember a butterfly is 1 x 2 x 1 so you sell double of the middle strike, or 3 x 6 x 3 in the case of a 3-lot. The most you can lose is the premium x the number of butterflies you do. Max gain is at $ 276 in SPY but the profitable range on expiration is between $ 270.59 and $ 281.41. That’s a nice wide range of protection for the next two weeks.

Trade Detail:

Video Link:

https://content.jwplatform.com/videos/5EvfSZjE-bK67iJnL.mp4

August 23, 2019 - 12:51 pm

Closing Alert:

Big selloff today on the trade war escalation news. It worked out well for our SPY butterfly hedge as the middle strikes are near worthless but the 287.50 put still has plenty of juice. There are a couple more news conferences today between the president and the Fed chair, so let’s go ahead and close our hedge for a profit as the whipsawing could get extreme. We’ll add a new put butterfly to our portfolio on Monday.

SELL TO CLOSE the SPY 287.5-282.5-277.5 Put Butterfly for around $ 1.10 (credit).

Anywhere around this price is fine. It could move quite a bit with the volatility today, so just make sure you get it closed by the end of the day.

Trade Details:

August 22, 2019 - 1:44 pm

Trade Alert:

I’m not very comfortable with this market right now. The VIX term structure is still pretty flat which suggests institutional traders are also not comfortable. We’re going to go with trades for the time being where we are risking very little capital. Fortunately, there are some really interesting opportunities out there. I’m looking at Avis Budget Group (CAR) for a bullish call butterfly. The car rental business is being hurt by the rise of ride sharing and concerns over the economy. However, CAR recently had a solid earnings report which ordinary would have been bullish had the market not been collapsing at the time. I think the stock is way oversold and due for a rebound. See trade video for details.

Recommendation:

BUY TO OPEN the CAR September 20th 26-28-30 Call Butterfly for a $ 0.44 debit.

Remember to buy the outside strikes and sell double of the inside strike. Max loss is only what we pay for the butterfly. Max gain occurs at $ 28 at expiration, but anywhere between $ 26.44 and $ 29.56 is profitable for this trade. I did a 3-lot but feel free to adjust volume based on your account size. Don’t worry if you can’t filled right at 44 cents – anywhere around this price level is fine.

Trade Details:

Video Link:

https://content.jwplatform.com/videos/MFwriPRK-bK67iJnL.mp4

August 19, 2019 - 5:37 pm

In case you didn’t see this – I’m presenting for the Options Industry Council on Wednesday as part of their free regular webinar series. My topic is “Options Strategies for Higher Volatility” and it runs for an hour starting at 3:30 CST on Wednesday. Here’s the link if you are interested in signing up:

https://event.on24.com/eventRegistration/EventLobbyServlet?target=reg20.jsp&partnerref=oicwebsite&eventid=2016662&sessionid=1&key=7A237DB985772438EA24DFA77916D465®Tag=&sourcepage=register

August 16, 2019 - 1:11 pm

Trade Alert:

A lot going on today, so I’m going to be brief in my explanations. I discuss the trades in detail in the 17 minute video I linked below. The only thing I’ll mention here is that the new trade is a TLT put butterfly because I believe the parabolic move in bonds has to mean revert to some extent in the very near future. It’s just not how bonds tend to move and I think normalcy will eventually prevail. Beyond that, please watch my video for details.

Trades:

BUY TO OPEN the iShares 20+ Treasury Bond ETF (TLT) August 30th 144-141-138 put spread for a $ 0.50 debit.

Anywhere around 50 cents is fine for a fill. Remember, we are buying the 144 and 138 puts and selling double of the 141. I did a 3-lot so that’s +3 x -6 x +3 for example. Max gain is at 141, but we are profitable anywhere between 143.50 and 138.50. We can only lose what we spend on the trade, so around $ 150 for a 3-lot.

ROLL the iShares US Real Estate ETF (IYR) from August 16th to October 18th.

SELL TO CLOSE the IYR August 16th 89 put and BUY TO OPEN the IYR October 18th 87 put for $ 1.09 net debit.

Once again, anywhere around this price is fine. My trade got split into a 2-lot and 1-lot in the screenshot below but they are both the exact same.

Finally,

BUY TO CLOSE the Disney (DIS) August 16th 140-138 put spread for $ 2.00.

Closing is cheaper than letting it get exercised. Anywhere at $ 2 or below is a reasonable place to close the trade.

Trade Details:

Video Link:

https://content.jwplatform.com/videos/wY8o3xch-bK67iJnL.mp4

August 15, 2019 - 4:24 pm

For tomorrow:

We’ll have a new trade, almost certainly going to be a directional butterfly. We will close DIS, because as a shrewd subscriber pointed out, costs to exercise the options are actually more than commissions to close the trade. Finally, we’ll roll out IYR for a couple more months. Keep an eye out in the morning for a trade alert.

August 14, 2019 - 5:37 pm

Just to clarify, I mistakenly said in the newsletter today that the DIS trade would expire worthless (I have been thinking of it as a debit trade because of the narrow spread). That’s obviously not the case. It will (very likely) expire in-the-money at max loss. There should be no assignment risk at expiration however as the short and long puts will cancel each other out. There is a small early exercise risk, but it should be close zero. If for some reason we have a sharp really over the next two days, we’ll try to close for better than max loss, but I don’t expect that to occur.

August 13, 2019 - 2:35 pm

I mentioned last week that I wanted to do a trade today, or at least early in the week. Frankly though, I don’t like this market. It’s not conducive to trading credit put spreads because of the high intraday volatility (that and the overnight gap risk). I think we need to stick to very low risk trades for the time being. I’d like to expand our usage of butterflies. Right now, we are using them as only market hedges – but making some directional trades with call and put flies is a smart move in this higher volatility environment. I’m going to look at a few different trade ideas for later in the week. Regardless, the theme for now is going to be reducing risk.

On a separate note, I plan to roll out IYR as it’s a debit trade and it fits the “safety” theme. I don’t plan on rolling DIS though, and we’ll look to close it soon – especially if the stock keeps moving higher.

August 8, 2019 - 1:15 pm

Trade Alert:

I wanted to sell a put spread and place a put butterfly on the SPY today, but I really don’t like the market action for selling a put spread. We are back up too much, too fast in my opinion. I think we need to let the dust settle a bit before adding another credit spread to our portfolio. In the meantime, I very much want us to have a butterfly in SPY puts to protect us if we move back down over the next two weeks. See video for details.

BUY TO OPEN the SPDR S&P 500 ETF (SPY) August 23rd 287.5-282.5-277.5 Put Butterfly for a $ 0.32 Debit.

Any price around this level is fine. Remember, you can only lose what you spend on this trade since it is a debit trade. The butterfly means we buy the outer strikes and sell double of the inner strike, so a 3-lot would look like +3 x -6 x +3. I recommend a 3-lot butterfly as it will cost us about $ 100. Max gain is right at the middle of the spread, or $ 282.50. We make money on the trade at expiration anywhere between $ 287.18 and $ 277.82.

Trade Details:

Trade Video:

https://content.jwplatform.com/videos/ZjYjELtB-bK67iJnL.mp4

August 5, 2019 - 1:45 pm

This is what a true selloff and legit spike in volatility look like. We don’t have a lot on right now, so not much to do but wait to see where we bottom… and then there should be ample opportunities to sell to fantastically juicy put spreads. Regarding CAT, it’s a September 6th expiration so plenty of time for that stock to rebound (which I think it will – it’s not some high valuation stock that was just waiting to get pummeled). For DIS, that’s an earnings play, and if earnings are as good as I expect, the stock will recover in a hurry.

Just want to reiterate that when VIX was at 12 not much more than a week ago, I thought it was entirely too low. Now that it’s at 22, I think we’re a bit high, but it very much depends on how the White House responds to the China currency devaluation. Expect a lot of action this week in the markets and new trade or two once the we settle down somewhat.

August 2, 2019 - 1:14 pm

I’m having second thoughts on UVXY and I’ve decided we should close it. We are just about breaking even between the two trades right here. However, with two weeks to go, there’s a lot of time left on the trade and I think the White House may try to salvage the market with positive tweets. I’d rather not take the risk of holding and instead move into a more traditional debit hedge (like a butterfly or vertical spread) which has less capital risk for us.

If we close the UVXY trade here, I’m showing a $ 23 loss on both trades combined (per spread), which I think is a reasonable place to exit given how low UVXY likes to go when the market rallies. I think this time around it’s better to be safe.

BUY TO CLOSE the UVXY August 16th 26-22 put spread for a $ 0.65 debit.

Lower is better, but anywhere you can filled around this price is fine.

Trade Details:

August 2, 2019 - 12:11 pm

Well, I haven’t quite been pounding the table saying the market needs to sell off (and volatility needs to go higher), but I definitely have been strongly suggesting as much. It’s finally happening, with yesterday and today sending the VIX over 19. Our UVXY and SQQQ trades are looking very good right here. Let’s close SQQQ today and we’ll close UVXY next week. I got 22 cents for my closing price of SQQQ. We sold it for 75 cents, so that makes it a $ 53 winner per spread (or 23.6% return on cash).

BUY TO CLOSE the SQQQ August 16th 31-28 Put Spread for $ 0.22.

Anywhere you can get filled around this price is fine.

Trade Details:

August 1, 2019 - 2:02 pm

Trade Alert:

Disney (DIS) is up 30% year-to-date in what may be one of the company’s best years ever. But as good as the year has been, I wouldn’t be surprised to see the stock go even higher after earnings next week. More importantly, I don’t see the company coming close to missing earnings expectations, so I think a near-to-the-money put spread is a safe bet. I want to do what we did with NVDA a couple months back and do a narrow credit spread (2 strikes) but closer to the money than what we normally do. Keep in mind, after earnings next week (on the 6th), implied volatility will also take a dive. We’re also closing our USO puts. See the video for additional details.

SELL TO OPEN the DIS August 16th 140-138 put spread for a $ 0.61 credit or higher.

Market is moving quite a bit so you may be able to get a better price. Do this trade anywhere above 55 cents. We are only risking about $ 140 on the trade because it’s only 2-strikes wide. Anywhere above $ 140 share price at expiration and we collect 61 cents per spread. I recommend 1 lot for beginners up to 5 for bigger accounts.

SELL TO CLOSE the USO August 2nd 12 Put for $ 0.63 or higher.

USO has been tanking so you may be able to get closer to 70 cents. Close anywhere around this level as this trade will likely expire in the money tomorrow. Don’t worry about the call, we’ll let it expire worthless unless there’s a huge rally in oil tomorrow in which case we’ll close the trade then (not likely).

Trade Details:

Trade Video:

https://content.jwplatform.com/videos/l8NQTcBx-bK67iJnL.mp4

July 26, 2019 - 12:54 pm

For those of you in the UVXY trade (you can ignore this if you don’t already have the UVXY credit spread in your portfolio):

Let’s roll out the UVXY credit spread for a few more weeks. I still strongly believe volatility will rebound, and we just need to buy some more time for this trade to work out. We won’t quite do a straight roll, we’ll drop the spread down one strike. In order to compensate though, we’ll widen out the spread from 3 strikes to 4 strikes. That means we’ll only have to pay about 30 cents extra to make this trade. Here are the details:

So we are closing the 27-24 UVXY put credit spread expiring today and opening the 26-22 put credit spread expiring on August 16th. It should cost around $ 0.31, as you can see above. Anywhere you can filled around that price is fine. Your broker should allow you to roll out trades like this as one transaction.

July 25, 2019 - 1:07 pm

Trade Alert:

Quite a bit going on today, we have two closing trades and a new credit spread to place. We are closing BIDU for a 27 cents which makes it a 16.2% winner. Earnings are next week so getting under 30 cents on the trade was our goal – and it worked out exactly as intended. We’ll also close the front month put on our IYR calendar. We are making money on that trade due to our back month put going up in value more than the front month put. After we close this week’s put, we’ll be long the August 16th put straight up. Finally, we are going to add a credit put spread in Caterpillar (CAT). CAT’s earnings weren’t great but they weren’t unexpected either. The stock should stabilize now and volatility is falling. It’s a good scenario for a short put. I go over more details in the video below. Tomorrow we’ll roll out the UVXY trade.

Trade Details:

Sell (to open) the CAT September 6th 127-123 put spread for a $ 0.65 credit.

Buy (to close) the IYR July 26th 89 put for $ 0.80.

Buy (to close) the BIDU August 2nd 108-104 put spread for $ 0.27.

For BIDU and IYR, closing anywhere around the price I got is perfectly fine. For CAT, try not to go below 60 cents if possible. I did a 2-lot (selling the 127, buying the 123 each two times) and I recommend 1 or 2 for beginners and up to 5 for bigger accounts. At 65 cents, we can make a max gain of $ 65 per spread if CAT stays above $ 127 by expiration, with max risk of $ 335 if the stock drops below $ 123. Remember though, this is a high probability trade in our favor.

Video Link:

https://content.jwplatform.com/videos/dKyml1aw-bK67iJnL.mp4

July 18, 2019 - 2:47 pm

Just a quick correction from the text alert. At one point I say “just over 0 risk on the spread” and then later I say max loss is $ 225. The second part is correct. That should have read “just over $ 200 risk on the spread”. This blogging software doesn’t like the $ in front of numbers so it will set it to “0” unless I put a space after the $. Sorry if that caused any confusion. I wish we could have zero risk spreads! Although I feel this SQQQ trade is overall a low risk trade, but not quite at the zero level.

July 18, 2019 - 1:28 pm

Trade Alert:

I’m growing increasingly convinced that the market needs to sell off, even if it’s slow and steady in nature. I don’t think we have enough risk on at the moment that we need to place an outright hedge, so I came up with something where we can protect against a selloff and collect a credit (similar to the UVXY trade). The ProShares Ultrapro Short QQQ (SQQQ) is a leverages, inverse ETF on the Nasdaq-100 (or the QQQ ETF). That is, it moves -3x the Nasdaq-100 index. The inverse portion means we can sell a put spread on the ETF which profits if QQQ sells off. 3x leverage may seem risky, and generally it is, but due to the nature of the options chain, we can do a 3-strike wide spread and we’d only be risking just over $ 200 per spread. Plus, QQQ is at all-time highs and a major component (NFLX) just got hammered on earnings. Moreover, volatility for SQQQ is dropping, which favors selling options. See the video for details.

Here’s the trade:

SELL TO OPEN the ProShares Ultrapro Short QQQ (SQQQ) August 16th 31-28 put spread for a $ 0.75 credit.

Sell the 31 put and buy the 28 put (at the same time). Anywhere above 65-70 cents is fine. I’m doing a 2-lot, but I recommend 1 for beginners and up to 5 for bigger accounts. Max gain is $ 75 per spread if SQQQ is above 31 at August expiration. Max loss is $ 225 if SQQQ falls below 28 and stays there (very unlikely).

Trade Details:

Trade Video:

https://content.jwplatform.com/videos/2IbJY05G-bK67iJnL.mp4

July 12, 2019 - 1:18 pm

Trade Alert:

The interest rate and economic uncertainty, along with how the Fed will react at the FOMC meeting at the end of July, lends itself well to a calendar trade. Rather than play interest rates themselves, I have decided to use real estate as a proxy. If you look at iShares US Real Estate ETF (IYR), it is close to 52-week highs. However, it is my belief that real estate (along with stocks in general) are set to pull back after the upcoming FOMC meeting. I think the Fed will be less dovish on rates as people expect and it will have a negative impact on real estate. I also believe the slowing economy means a slowdown in real estate as well. However, July may be quiet as investors await the Fed meeting. This describes a situation where using a put calendar trade may be perfect. We’ll sell a put that expires before the Fed meeting and end up long a put which expires in mid August. We’re also closing short straddle part of our USO trade. Please watch the video for details.

Here’s the trade:

BUY TO OPEN the IYR August 16th 89 put for $ 1.10 and SELL TO OPEN the IYR July 26th 89 put for $ 0.54. The total debit should be around $ 0.56. This is a calendar spread.

Anywhere around this price is fine. You should be able to execute this trade all at one time, but if you have to do separate transactions because of your broker, you’ll need to buy the August 16th option first and sell the July 26th option afterwards. I’m doing a 3-lot as this is a low risk debit trade. I still recommend just 1 or 2 for beginners and up to 5 for more experienced trades. Profit and loss is difficult to calculate because of what we end up doing with the trade, but we can only lose what we spend on the debit at this juncture.

For USO:

BUY TO CLOSE the USO July 12th 12 straddle (12 call and 12 put) for $ 0.56.

Anywhere you can get filled around this price is fine. We are closing the short straddle but we’ll be leaving the long August 2nd straddle on for a longer period.

Trade Details:

Trade Video:

https://content.jwplatform.com/videos/DmnX8vwu-bK67iJnL.mp4

July 11, 2019 - 4:21 pm

I’m recording our monthly webinar this afternoon and it will be available tomorrow. We’ll also be closing the front month straddle portion of our USO trade tomorrow and making a new trade, so keep an eye out for texts and emails.

July 5, 2019 - 5:38 pm

Just a note that the OPE issue should be coming out shortly. There was an error with our publishing software and it should have come out early this morning. I apologize for the delay. I also think that’s the reason why the trade email came out so much later than my text. To make it up to you, I’m including a couple nice beach pics from my vacation this week!

July 5, 2019 - 2:44 pm

Trade Alert:

I’m back from vacation so let’s get back to trading! We only have two positions on right now, so it makes sense to start building up our credit spread exposure again. I chose Baidu (BIDU) for this purpose because it has been very stable outside of earnings periods (which we will avoid), but tends to have a nice gap between implied volatility and historical volatility. I discuss the trade in detail along with the impact to our portfolio in the video below.

SELL TO OPEN Baidu (BIDU) August 2nd 108-104 put spread for a $ 0.79 credit.

Sell the 108 and buy the 104 put – anywhere around this price is fine but don’t go below 70 cents. I did a 2-lot, but I recommend 1 for new traders and up to 5 for bigger accounts. Max gain is $ 79 per contract while max risk is $ 321.

Trade Details:

![]()

Trade Video:

https://content.jwplatform.com/videos/CgD74WG6-bK67iJnL.mp4

June 28, 2019 - 2:14 pm

Trade Alert:

One more trade before I go on vacation next week. I’ll be back at the end of the week and our next issue will come out Friday July 5th. By the way, the SPY hedge looks like it will expire worthless so no action needed. I like the UVXY trade we just closed yesterday, so we’re going to do it again except we’ll use lower strikes. I think there’s still a floor on how far volatility can fall. Using UVXY will allow us to get a decent credit on a 3-strike wide spread (so lower risk), while also being a trade that does really well during a market selloff. I discuss more details in the video below.

SELL TO OPEN the ProShares Ultra VIX Short-term Futures ETF (UVXY) July 26th 27-24 put spread for a $ 0.73 credit.

We are selling the 27 puts and buying the 24 puts. Anywhere you can get filled around this price is fine, down to about $ 0.63. I did a 4-lot because we just freed up a bunch of capital and because it’s only a 3-strike wide spread. I still recommend 1 or 2 lots for beginners though. We can earn $ 73 per spread with max risk being $ 227 if UVXY goes below $ 24 by expiration (not likely).

Trade Details:

Trade Video:

https://content.jwplatform.com/videos/GEok7lqH-bK67iJnL.mp4

June 27, 2019 - 2:03 pm

Closing Alert:

We have several positions to close right now. Three of them are no-brainers (below 20 cents). The only one I debated on was UVXY, but since it expires tomorrow and we’re at the short-strike, I think it’s better to be safe. Plus, it’s still a 17.9% winner even closing at 56 cents. The only position we may have left to close tomorrow is the SPY hedge. If the market drops, we’ll be able to cash it in. Otherwise, we’ll probably let is expire worthless (at this point, it’s not worth closing by the time you factor in commissions).

Here are the trades:

All trades below are BUY TO CLOSE:

UVXY June 28th 32-29 put spread for $ 0.56 debit.

NVDA July 5th 142-140 put spread for a $ 0.05 debit.

LYFT July 12th 54.5-50.5 put spread for a $ 0.13 debit.

XLNX July 5th 103-98 put spread for a $ 0.10 debit.

For more concise details, see the trade details screenshot below. Anywhere around these prices are fine for closing. Remember, we are buying back the higher strike to close and selling out the lower, long strike to close. UVXY is a 17.9% winner. NVDA is a 53.5% winner (less cash risk means it’s a higher percentage winner). LYFT is a 19.1% winner. XLNX is part of a series of trades which we aren’t finished with yet, so I’ll wait to calculate the return.

I don’t normally intend to have so many trades to close at once, but the holiday week next week means a lot of premium is coming out of trades early.

Trade Details:

June 25, 2019 - 6:44 pm

We have our OPE issue coming out tomorrow where we’ll look at open trades including the two new ones from the previous week (SPY, USO). Next week, I’ll be out of town on Wednesday, so the issue will come out Friday (July 5th).

We’ll definitely have some closing trades this week, maybe as many as 3. I’m not sure about a new trade yet, but at the moment I am planning to put on another credit spread before I leave town this weekend. Stay tuned.

June 24, 2019 - 2:19 pm

Trade Alert:

We’re doing a brand new type of trade today, the calendar straddle or straddle swap (or double calendar/double diagonal)… there are lots of names for it. You may have to use the “Custom” setting in your trade software to enter this trade if you aren’t using Think Or Swim. It sounds like a complex trade, but it should make a lot of sense once you see how it works. I highly recommend watching the video as it would take several pages of text to cover what I talk about in the 11 minute video below! Basically, we are betting on a short-term drop in oil volatility, but we are preparing for a big move in oil in either direction in early August. We are using the United States Oil Fund (USO) for the trade.

Here’s the trade – you have to do the whole thing at once or you won’t be able to execute it due to margin requirements on short straddles:

BUY TO OPEN the USO August 2nd 12 straddle (call and put)

SELL TO OPEN the USO July 12th 12 straddle (call and put)

The total should cost you $ 0.34 DEBIT, give or take a couple cents.

I did 3 of these since we can only lose what we spend on the trade. The payoff is complicated because it depends on if we hold the back month straddle once the short trade is closed (which is the current plan). For more about the payoff and trade management scenarios, please watch the video.

Trade Details:

Trade Video:

https://content.jwplatform.com/videos/0ph56FnP-bK67iJnL.mp4

June 21, 2019 - 1:59 pm

Closing Alert:

I’m a little bit worried about weekend risk (a large gap down on Monday) just because of Iran. The only trade we have expiring next week that would be hurt by a big down move is EA. I has originally planned on closing EA when it was at $ 0.30 or below. Well, we’re pretty much there – so let’s close it!

Here’s the trade – no video today as it’s just this one closing trade.

BUY TO CLOSE the Electronic Arts (EA) June 28th 90-85 put spread for around $ 0.33.

We are buying back the 90 puts and selling out the 85 puts. Anywhere around this price is fine.

Trade Details:

![]()

June 19, 2019 - 1:03 pm

Trade Alert:

It’s FOMC day so let’s add a hedge to our portfolio in case we have a negative reaction to the news. We’ll stick with a put butterfly in SPY, but we’ll only do a short-term trade so we can get closer to the money without having to spend a fortune. Once the dust settles on the Fed news, we can add a longer term put fly to the mix. Try to get this trade on today even if you can’t get it done before the FOMC results; there may be a delayed reaction by the markets.

BUY TO OPEN the SPDR S&P 500 ETF (SPY) June 28th 290-285-280 put butterfly for a $ 0.73 DEBIT. (Buy the 290 and 280 puts, sell double of the 285 puts)

See the video for details, but remember we are buying the outsides strikes and selling double the middle strike, so a 2-lot would look like 2 by -4 by 2 for example. You can only lose what you spend and max gain is at the short middle strike. I recommend doing the same number of butterflies as you do for your typical credit spread, so if you normally do 2-lots, stick to a 2-lot here.

Trade Details:

Trade Video:

https://content.jwplatform.com/videos/N3KWMnHv-bK67iJnL.mp4

June 14, 2019 - 2:06 pm

Trade Alert:

Market conditions have remained calm enough to that I feel comfortable closing our CAT spread and putting on a new trade in LYFT. The idea behind the LYFT trade is pretty simple – basically implied volatility is dropping at a very rapid rate but is high enough that we can get a solid credit at a lower delta spread. See the video below for details.

SELL TO OPEN the LYFT (LYFT) July 12th 54.5-50.5 put spread for a $ 0.75 credit.

Sell the 54.5 put and buy the 50.5 put to open. I got filled right away so you may be able to get a higher credit than 75 cents. Anywhere around this level is fine though. I only did a 1-lot in my small account, but I recommend doing a 2-lot to as much as a 5-lot for bigger accounts. With a 75-cent credit, our max risk is $ 325 per spread.

BUY TO CLOSE the Caterpillar (CAT) July 5th 116-113 put spread for a $ 0.19 debit.

Anywhere around this price is fine. We are buying back the 116 strike and selling the 113 strike to close. At this price, we are earning a 13.7% return in just 2 weeks.

Trade Details:

Trade Video:

https://content.jwplatform.com/videos/JwltVgSk-bK67iJnL.mp4

June 13, 2019 - 2:29 pm

Just some quick notes:

- No new trades today, but I’m looking at something for tomorrow – but I’m only adding a new trade if I can close an existing position because I don’t want to have more than 5 credits spreads on at one time. With 5, it starts to get harder to manage everything in case we have roll out any spreads.

- Most likely our SPY put butterfly will expire worthless tomorrow and requires no action on our part

- We’ll place a new butterfly at some point next week – almost certainly before the FOMC meeting results come out.

June 12, 2019 - 4:31 pm

Just a heads up that I recorded a video not that long ago with my friends at marketchameleon.com – a great options analytics site. This particular video is basically a Q&A on calendar and diagonal spreads. If you’re interested, check it out here:

https://www.youtube.com/watch?v=iQz7BT8kvac

June 10, 2019 - 2:15 pm

I’m not a fan of this current stock market rally. Judging by the VIX – which is still at elevated levels – neither are volatility traders. That’s not to say that we can’t have several more days or weeks of bullish stock activity. However, unless the economic fundamentals change, I would be cautious about going all in right now. We are on the verge of another recession and the only thing propping up the market right now is the promise of lower interest rates. I don’t believe that’s a sustainable environment for stocks to reach new all-time highs and keep going. At the very least, I think it makes sense to hedge your portfolio with index/ETF puts (SPY, QQQ) or long VIX ETF calls (VXX, UVXY).

June 7, 2019 - 1:03 pm

Trade Alert:

I’m happy the market is going up, but I don’t trust this rally. Sometime in the coming weeks (or maybe months) the market will realize that a recession is not a good thing even with interest rates going lower. We’re going to take a more cautious approach with our portfolio in case the market decides to fall off a cliff. One thing we can do which is good for collecting income and protecting against the downside is selling a put spread in a volatility fund like VXX or UVXY. For today, I picked UVXY. I believe there is a floor on how far market volatility will fall given the macroeconomic environment. We’re also closing SQ as it is below 20 cents and we can free up some additional capital. I get into details in the 10 minute video below.

BUY TO CLOSE the Square (SQ) June 14th 59-63 put spread for a $ 0.14 debit.

Anywhere around this price is fine to close.

SELL TO OPEN the ProShares Ultra VIX Short-term Futures ETF (UVXY) June 28th 32-29 put spread for a $ 0.93 credit.

You can sell down to $ 0.80. We are selling the 32 put and buying the 29 put. For a 1-lot trade, you can generate $ 93 profit versus $ 207 max loss. I suggest a 1 or 2 lot for beginners and 3 to 5 for more experienced traders.

Trade Details:

Video Link:

https://content.jwplatform.com/videos/8dE6oK6s-bK67iJnL.mp4

June 6, 2019 - 2:35 pm

I just sent out the XLNX roll trade. We’ll probably do more related to XLNX in the coming weeks – but this trade buys us more time.

I’m still looking at adding to our portfolio with a new trade, but would like to trim our number of positions a bit first. This may happen tomorrow, or it could be early next week. I’ll keep you posted through texts.

June 6, 2019 - 2:25 pm

For XLNX holders only:

I’ve been debating on the best way to do this and settled on rolling the trade out to July 5th and setting the strikes slightly below the stock price of around $ 105. If XLNX stays where it is or goes higher over the next month, we will earn back about half of what we lost on the 108-112 spread. We could be more aggressive, but I’m feeling a bit more risk averse given the current market environment. We could also add to this trade down the line, but for now, let’s keep it simple and roll it out and down.

We are buying to close the June 7th 108-112 put spread (buying back the 112, selling the 108) and then selling to open the July 5th 103-98 put spread (selling the 103 and buying the 98 puts). The total cost should be anywhere from around $ 2.25 to $ 2.50. I’d start low and work your way up until you get filled. We are extending to spread to 5 strikes wide for the July trade in order to bring in a bit more premium.

Trade Details:

June 5, 2019 - 3:51 pm

Just a quick heads up if you haven’t read through the weekly issue yet – we will be making a XLNX trade tomorrow for those of you who are in the trade. Besides rolling XLNX, I’m not yet sure if we’ll also initiate a new position in a different stock , but I’m leaning towards yes at the moment.

May 31, 2019 - 1:13 pm

For those holding the EA 89-94 put spread (you can ignore this if you aren’t in the EA position):

I was hoping we’d get a chance to close EA today for good, but we need another $ 1 rally in the stock for that. Considering the share price seems to have a strong floor above $ 90, I think the best course of action is to roll out another four weeks. If we roll to the 85-90 put spread expiring on June 28th, we only add about $ 0.50 to our tab – and we can close on pretty much the first big rally in the stock.

Here’s what that trade looks like:

BUY TO CLOSE the EA May 31st 89-94 put spread and SELL TO OPEN the June 29th 90-85 put spread for around $ 0.50 DEBIT.

It may be easier to look at the screenshot below to look at the entire roll trade by its components. The price will fluctuate quite a bit, but you definitely want to execute the trade by the end of the day so as not to get assigned on shares. Remember, for a trade like this, the lower the debit the better.

Trade Details:

May 30, 2019 - 2:13 pm

Trade Alert:

We have two trades to do today: one new put credit spread and one debit put spread for a market hedge. The credit spread is in CAT, which I like because options traders don’t seem too concerned about the stock’s down move (as seen by the lack of movement in implied volatility). It’s also a good company that has recently posted strong numbers but has dropped on trade war concerns – which should mostly be built in by now. The hedge is a put spread in SPY, which we’re adding because the market is making me a bit nervous lately. I discuss these trades in detail in the 15 minute video below, along with the impact on our portfolio.

Trades:

SELL TO OPEN the Caterpillar (CAT) July 5th 116-113 put spread for a $ 0.65 credit (or higher).

Do this trade down to about 60 cents or so. We are selling the 116 and buying the 113. I did a 2-lot, which can make $ 130 and has max risk of $ 470 but with roughly a 75% probability of success.

BUY TO OPEN the SPY June 21st 268-272 put spread for $ 0.88 debit (or lower).

This is a hedge trade, so get filled wherever you can – no limit on the price. It’s a debit spread so we are buying the 272 and selling the 268. I did a 2-lot, but you can increase the volume if you tend to trade more than 2 contracts on our credit spreads.

Trade Details:

Trade Video:

https://content.jwplatform.com/videos/QcleOZf7-bK67iJnL.mp4

May 24, 2019 - 2:13 pm

Trade Alert:

We have a lot of stuff going on today, so I recorded about a 20 minute video. It’s really just me streaming my thoughts aloud as I make trades, but hopefully you’ll find it useful in terms of how I go through making trading decisions. We are going to do three different trades today. I closed TWLO because I’m working with a $ 3,000 account and I need to free up capital. However, if you have more capital available, you can hold TWLO for a bit longer if you want to get a higher return. There isn’t much risk left in that particular trade. I also closed the XLNX hedge because we don’t want to exercise our long puts into shares if the stock closes below $ 102. Finally, we do a brand new trade in NVIDIA (NVDA). It’s closer to the money than what I normally do but only a 2-strike wide spread so our risk is much lower in terms of what we could lose. Once again, there’s a lot going on so I highly recommend watching the video for more details.

Trades:

SELL TO OPEN the NVDA July 5th 142-140 put spread for $ 0.73 CREDIT or higher.

Try to get this trade above $ 0.70. Do up to 3 contracts. We are selling the 142 and buying the 140. Max risk is only $ 127 per spread, with max gain at $ 73 – so not a lot of dollar risk.

BUY TO CLOSE the TWLO June 7th 119-115 put spread for $ 0.33 DEBIT or lower.

Anywhere you can filled around this price is fine. You can hold this trade until next week if you want to make a little bit more because the trade is very low risk at this point. I needed to free up capital but you may not have to the same.

SELL TO CLOSE the XLNX May 24th 97-102 put spread for $ 0.20 CREDIT or higher.

We have to close this hedge trade in order to make sure we don’t exercise the 102 strike if XLNX closes lower on the day Close anywhere around this level.

Trade Details:

Trade Video:

Click here to watch (opens new window).

May 23, 2019 - 1:59 pm

A few thoughts on our portfolio:

I was planning on doing a new trade today but market conditions are not conducive. We’ll try again tomorrow. I’d also like to close TWLO before adding something new to free up some capital.

Regarding XLNX, we’ll close the put spread hedge tomorrow if it has any value. However, we don’t need to roll out the credit spread right away since it doesn’t expire for another couple weeks.

The SPY put fly hedge is paying off right now but we may also want to add another butterfly at lower strikes in case the selloff escalates. We’ll look at that tomorrow or next week.

May 17, 2019 - 3:58 pm

I’m glad we put on the SPY and XLNX hedges early as the market looks like it may close towards the lows. I didn’t mention this in the video, but no need to make that XLNX trade unless you have the credit spreads from a couple weeks ago in your portfolio. However, you certainly can do the trade if you want to purely speculate on XLNX downside. Speaking of XLNX, just saw someone wrote 2,000 covered calls for June at the 110 strike. Could suggest there isn’t much short-term upside in this stock. We’ll try to cash in on our debit put spread next week, but I’m guessing the credit spread may need to be rolled out and down. We’ll give it another look next week.

May 17, 2019 - 1:25 pm

Trade Alert:

We are hedging both our overall portfolio with a SPY put butterfly and hedging XLNX with a long put spread for the next week. I get into a lot of detail in the video, so please watch it for information on both trades and commentary on portfolio and trade management in general. It’s an 18 minute video so chalked full of good info!

Trades:

BUY TO OPEN the XLNX May 24th 97-102 put spread for a $ 0.52 debit or lower.

This is a debit trade so we are buying the 102 and selling the 97. Anywhere around this price is fine (the market may be volatile so get whatever price you can). I’d use a 1-lot spread for every 2 credit spreads you have on in XLNX.

BUY TO OPEN the SPY June 14th 275-280-285 put butterfly for $ 0.43 debit or lower.

Anywhere around this price is also fine. Remember to make the butterfly look like in the trade details below in terms of structure.

Trade Details:

Video:

May 16, 2019 - 2:18 pm

Trade Alert:

We’ll look at adding a market hedge tomorrow, for now let’s add to our credit spread portfolio by selling a put spread in SQ. I spend a while talking about my reasoning for this trade in the video below. Just briefly, I think there is a floor in SQ at around and I think options traders are suggesting the stock is going to go up or sideways in the coming weeks judging by the divergence between implied volatility and historical volatility. There are far more details in the video, so please check it out.

Here’s the trade:

SELL TO OPEN the Square (SQ) June 14th 63-59 put spread for $ 0.70 credit or higher.

I’m good with this trade down to about $ 0.65. I executed a 2-lot but I recommend anywhere from 1 to 5 depending on your comfort level with the trade. We are selling the 63 puts and buying the 59 puts.

Trade Details:

Trade Video:

May 16, 2019 - 12:50 pm

The US just put Huawei on a blacklist of sorts, restricting the company’s access to components made by US companies. XLNX is one of its suppliers, so that stock has dropped 5% today as a result. With the fundamentals now changing, it makes sense for us to close this trade. However, the initial reaction to bad news tends to be an overreaction, so I plan on waiting until tomorrow to close the trade at what I expect to be a better price. I also think XLNX will make a good credit spread opportunity after the dust settles from the Huawei situation. First things first though, look for a closing trade on XLNX tomorrow.

May 14, 2019 - 1:17 pm

Closing trade alert: