The search for yield has been a long-term theme among investors, for more than a decade. Interest rates have been microscopic ever since the Great Recession, and many fixed income products have lost their allure.

At first, asset classes like muni bonds and high yield corporate debt became the go-to products for those looking for bond-like returns with reasonable yields. But despite the occasional fair amount of risk in credit markets (like in March of this year), even traditionally higher-yield debt has barely paid enough interest to keep the lights on.

Last week, the Wall Street Journal featured an article talking about the “variable denomination floating rate demand notes” offered by some carmakers, which have become popular with investors. These unsecured, callable, changeable rate notes are paid from the car companies’ cash flow—typically 2-3% annually.

So the car company can call these notes (take them back) whenever they want. They can change the rate on a whim. And they are unsecured (no protection from a default). For all these great benefits (sarcasm intended), investors get a whopping 2% return per year. Yay?

In my frank opinion, there are far better ways to generate yield from car companies using options strategies such as covered calls. Yes, covered calls are considerably closer to equity exposure rather than debt, but with the type of risk people are taking for a 2% yield, I think it makes sense to look elsewhere.

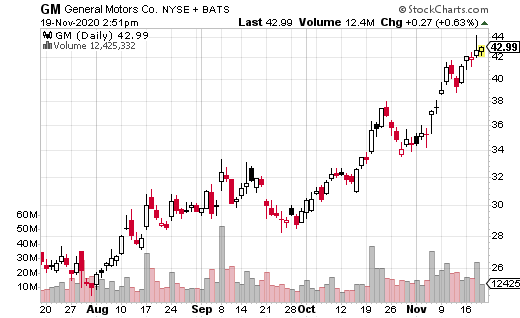

For example, let’s look at a covered call that traded last week in General Motors (GM) options.

A trader purchased 150,000 shares of GM for $44.04 and sold the December 18 46 calls against those shares for $1.35 per contract. The call sale brought in $202,500 in premium, which amounts to 3% in just 30 days. In other words, annualized, this strategy would yield 36%.

With a covered call, the shares are purchased, which means the position does have downside exposure to GM stock. However, the stock won’t get called away if it finishes below the strike price (46 in this case). As such, new calls can be sold each month against the shares while the stock recovers.

What’s more, by using an out-of-the-money strike, the trader is allowing for nearly $2 in stock appreciation for the next month. If GM is at $46 or higher at December expiration, the position will generate $1.35 from the call sale, plus $1.96 in stock appreciation. That works out to a 7.5% return in just a month.

Whatever your opinion of GM, I’d much rather take a chance to earn 7.5% in a month, with a guaranteed 3% payout at the very least, rather than 2% for an entire year. Don’t forget that 2% (from the variable notes) isn’t guaranteed and can change at any time. In the search for yield, taking on a bit more equity risk can go a long way towards getting far superior returns.