I’m looking at the retail sector right now, and I have a few ideas to try and play it. Many retailers are reporting strong customer traffic, but does that mean we’ll see a Santa Claus rally in retail plays? I’m looking at ONE stock in particular that could be a great play. I shot a […]

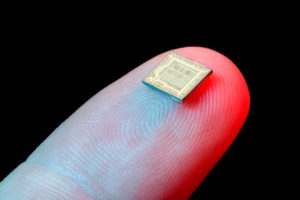

A Good Semiconductor Stock to Buy During the Chip Shortage

According to NVIDIA CEO Jensen Huang, for example, demand could exceed supply through 2022. Intel CEO Pat Gelsinger says the shortage won’t end until 2023. “We’re in the worst of it now, every quarter, next year we’ll get incrementally better, but they’re not going to have supply-demand balance until 2023,” he told The Independent. STMicro […]

Why Stock Buybacks Do Nothing for You

Dear Reader, Corporations’ renewed focus on “returning cash to shareholders” is laudable, but misleading. As with all things investment-related, you can only determine whether something is a good deal for investors by understanding the nuances of how companies implement these policies. When business results are good, corporate boards of directors often choose (as they should) […]

Metaverse Winner: Facebook or Roblox?

Roundhill Ball Metaverse ETF (META) has doubled its net asset value from $130 million to $260 million since Facebook (FB) changed its name to Meta Platforms two weeks ago. Volumes have also soared on the ETF. It may have been a serendipitous case of being in the right place at the right time for the […]

PayPal Shares Continue to Struggle After Near Takeover of Pinterest

Shares of PayPal (PYPL) have lost a third of their value since peaking above the $310 level in late July. Much of the selling pressure has come from a couple of missteps, like its near-acquisition of Pinterest (PINS) and disappointing guidance following PYPL’s most recent earnings report. To start, PYPL’s interest in PINS was a […]

Is Inflation Going To Tank The Corporate Bond Market?

Inflation is what everyone in the market is talking about these days. The financial markets are concerned that the Fed will have to hike rates much sooner than expected. Higher rates will significantly impact fixed income products like Treasuries and corporate bonds. Perhaps that’s why an institutional trader purchased 160,000 put spreads in iShares iBoxx […]

How to Invest with Inflation at 30-Year Highs

Dear Reader, Last week, the CPI inflation was released, showing the highest year-over-year inflation in 30 years. After living and investing in a low-inflation economy for a couple of decades, investors now need to pick some inflation-fighting stocks and funds. In the 1980s, the Federal Reserve killed inflation by quickly and massively increasing interest rates. […]

Trade of the Week: SLV

Last week was a big option week for iShares Silver Trust (SLV). The popular physical silver ETF got a boost as inflation concerns bubbled to the surface following a larger than expected jump in CPI. Over 460,000 options traded in one day last week, with calls making up nearly 90% of the volume. Calls tend […]

Wildly oversold, Activision Blizzard (ATVI) May Be Overdue For a Bounce.

After ATVI’s share priced gapped from $77.50 to $67, the gaming stock is oversold on the relative strength index (RSI), moving average convergence divergence (MACD), and Williams’ %R momentum indicator. In fact, the last few times these indicators were this oversold, shares of ATVI pushed higher shortly after. At the same time, it’s tough to […]

Stop Trading Options Like Stocks (Gamestop Example)

“Options are the same as stocks, just cheaper!” Ever heard a pitch start like that? Well, it’s wrong. Crazy wrong. Options trade much differently than stocks, and thus why it’s easier to lose money with options. (and this is coming from a 20+ year options trader). One key difference is options use of “implied volatility.” […]