There’s been a lot of talk recently about the yield curve “inverting,” meaning that shorter-term bonds yield more than longer-term ones. That means investors expect that the economy will grow faster now than in the future – that a recession is coming, in other words. But that doesn’t matter much for the stock market. Instead, […]

Two Strategies to Build Wealth Faster Than You Ever Thought Possible

Wes Gray is one of the most innovative and interesting voices in all of finance. A Marine Captain who served in Iraq, he also studied under the legendary Eugen Fama at the University of Chicago, earning both an MBA and a Ph.D. After serving for a period of time as a Professor of Finance at […]

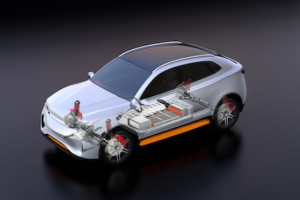

This Car Giant’s Big Bet on Solid-State Batteries Is About to Pay Off

It may have been the Fourth of July, but it was a Japanese titan of the car that set off the fireworks a few weeks ago in the auto industry. The company—and its new CEO, Koji Sato—unveiled ambitions to halve the size, cost, and weight of batteries for its electric vehicles (EVs) following a breakthrough […]

New Name, Same Great Income Stock

Business development companies (BDCs) are a high-yield investment sector benefiting from higher interest rates. One of the largest BDCs recently changed its name, giving me a good excuse to review this under-the-radar, high-yield stock – one of my favorites… On July 6, BDC Owl Rock Capital Corporation, stock symbol ORCC, changed its name to Blue […]

Trade of the Week: Regional Banks

Regional banking stocks saw their prices take a major haircut earlier this year during the banking crisis (perpetuated by the failure of Silicon Valley Bank). SPDR S&P Regional Banking ETF (KRE) saw its stock price drop from about $60 per share to under $40. However, just last week, a large block trade in KRE options […]

What Gen X Can Do to Save Their Retirement

A recent report highlights that many Gen Xers’ retirement savings are woefully short of what they will need to be income secure for their retirement years. Let’s look at the problem and some steps they can take to not reach their retirement years with worries about making ends meet. This month, the National Institute on […]

One More Reason to Buy Exxon

On July 13, Exxon Mobil (XOM) agreed to buy Denbury (DEN) for $4.9 billion. Denbury shareholders will receive 0.84 shares of Exxon for every share of Denbury stock they owned. This acquisition will accelerate Exxon’s energy transition business, thanks to Denbury’s established carbon dioxide (CO2) sequestration operation. And far from being too late, this marks […]

The Most Important Chart to Watch Right Now is Flashing Red

One of the most important charts I watch is the strength of the U.S. dollar. And right now, it’s showing the dollar at an inflection point… Which in the past has had a huge effect on the stock market. In today’s 2-minute video, I show you the chart and explain exactly what this means for […]

Insider Buying is Dead – Except Here

Markets are clearly overvalued at current levels. We are trading at multiples of earnings that have not been seen in over a decade. It did not end well on previous occasions, and it won’t end well this time. Corporate insiders are clearly not impressed by current market conditions either. We are seeing very little insider […]

What the Future of Oil and Gas Stocks Really Looks Like

The International Energy Agency (IEA) predicts crude oil production growth will slow to near-zero by 2028. OPEC, the cartel of mostly Middle Eastern oil-producing countries, disagrees. Some history lessons give us a clue as to which party is probably correct. The answer will have a huge impact on how to invest for income in the […]