Options block trades can be interesting tools to gauge market expectations, even if you don’t know exactly what the purpose of the trade is. For instance, a big put spread traded last week in iShares US Real Estate ETF (IYR). The trade occurred on the same day that lower housing prices were reported across the […]

Add This Cheap Chip Play to Your Portfolio

The pandemic certainly turned the semiconductor industry on its head. Despite record production of semiconductors, shortages everywhere led to months-long waiting lists for many consumer products. To meet consumer demand, semiconductor makers ramped up supply even more. But then inflation arrived and decided to stay awhile. Central banks responded by raising rates, and economies slowed. […]

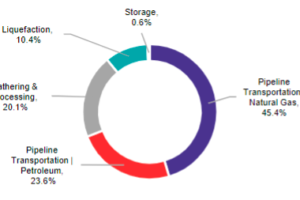

The Yin and Yang of Energy Midstream Stocks

In these uncertain times for investors, energy midstream stocks offer an island of stability. This sector provides an attractive combination of current yield and dividend growth. However, midstream companies divide into two distinct categories, and the differences are important. Energy midstream covers the movement and storage of energy commodities from the upstream drillers to the […]

Preferred Shares Discussion With Jay Hatfield of Infracap Advisors

Not long ago, I had the chance to sit down and chat with Jay Hatfield at InfraCap Advisors and talk about the current market environment. I try to get a chance to speak with Jay several times a year as his insights into markets and the economy always add value and help shape a profitable […]

Trade of the Week: GSAT

Globalstar (GSAT) is a satellite communications company. The stock price is under $1, but the company has a market value of almost $2 billion. Last week, an options trader seemingly purchased a block of 10,000 calls in GSAT that expire in July. This could be a bet on earnings next month or simply a bullish […]

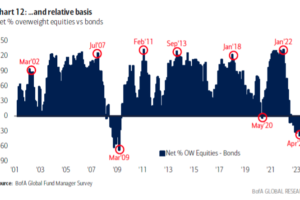

Even the Pros Get Market Timing Wrong

Even with professional investors, herd mentality makes successful investing a daunting task. This year, as you see prediction after prediction about a market decline, stocks have confounded the experts with solid gains. My Dividend Hunter strategy shows investors how to not fall into the “buy high, sell low” wealth destruction cycle. Last week, one of […]

Buy This Pharma Powerhouse With a 4% Yield

Imagine a company whose stock that hit an all-time in December 2021, after soaring 50% that year. And that company’s sales doubled in the two years leading up to 2022. And its operating profits quadrupled. Also imagine a company whose biggest product is set to see its sales collapse in the next three years from […]

90% of All Millionaires Became So Through With This One Method

Real estate has created thousands of millionaires in the United States. The great robber baron and millionaire prototype Andrew Carnegie once said, “Ninety percent of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined. The wise young man or wage earner of […]

Why small cap stocks is hinting where the market’s about to go

Most stocks are correlated to the indexes in some way. However, small cap stocks have been beaten down tremendously in the past couple years. Even with stocks rallying from October 2022 lows… small cap stocks aren’t finding relief. Today, I pulled up a chart showing the correlation between small cap stocks and the S&P 500. […]

Is Amazon Going To Beat Earnings?

Investors never know for sure if a company is going to post better earnings results than expected. That’s why there are always earnings surprises. However, that doesn’t keep traders from making educated guesses. In the case of Amazon (AMZN), a trader recently purchased 17,000 bullish call spreads that expire the day after earnings come out. […]