Not long ago, I had the chance to sit down and chat with Jay Hatfield at InfraCap Advisors and talk about the current market environment. I try to get a chance to speak with Jay several times a year as his insights into markets and the economy always add value and help shape a profitable […]

Trade of the Week: GSAT

Globalstar (GSAT) is a satellite communications company. The stock price is under $1, but the company has a market value of almost $2 billion. Last week, an options trader seemingly purchased a block of 10,000 calls in GSAT that expire in July. This could be a bet on earnings next month or simply a bullish […]

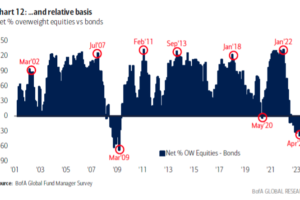

Even the Pros Get Market Timing Wrong

Even with professional investors, herd mentality makes successful investing a daunting task. This year, as you see prediction after prediction about a market decline, stocks have confounded the experts with solid gains. My Dividend Hunter strategy shows investors how to not fall into the “buy high, sell low” wealth destruction cycle. Last week, one of […]

Buy This Pharma Powerhouse With a 4% Yield

Imagine a company whose stock that hit an all-time in December 2021, after soaring 50% that year. And that company’s sales doubled in the two years leading up to 2022. And its operating profits quadrupled. Also imagine a company whose biggest product is set to see its sales collapse in the next three years from […]

90% of All Millionaires Became So Through With This One Method

Real estate has created thousands of millionaires in the United States. The great robber baron and millionaire prototype Andrew Carnegie once said, “Ninety percent of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined. The wise young man or wage earner of […]

Why small cap stocks is hinting where the market’s about to go

Most stocks are correlated to the indexes in some way. However, small cap stocks have been beaten down tremendously in the past couple years. Even with stocks rallying from October 2022 lows… small cap stocks aren’t finding relief. Today, I pulled up a chart showing the correlation between small cap stocks and the S&P 500. […]

Is Amazon Going To Beat Earnings?

Investors never know for sure if a company is going to post better earnings results than expected. That’s why there are always earnings surprises. However, that doesn’t keep traders from making educated guesses. In the case of Amazon (AMZN), a trader recently purchased 17,000 bullish call spreads that expire the day after earnings come out. […]

The Cure for a Directionless Market

High current yields and growing dividends are the cure for the directionless market. And if we are in for a “lost decade” from the stock market, yield plus growing dividends is one strategy that will still produce positive total returns. The strategy works in any market—bull, bear, or stagnant. Let me show you. Over the […]

This Sports and Entertainment Tie-Up Is Going to Be a Winner

It may come as a surprise to some, but when sports and entertainment are joined together, it is very popular—and therefore a real moneymaker. That’s why the recent news of one of the biggest names in entertainment is moving to take over one of the biggest in sport entertainment piqued my interest. Let me show […]

Trade of the Week: Metals & Mining

ETFs can often make for effective covered call trades because the price tends to be more stable than single stocks. In the case of SPDR S&P Metals & Mining ETF (XME), the stock has been range bound for much of the last six months. From a block trade we saw last week, a trader is […]