There are two big forces at work that show why the inflation beast will not be easy to tame for the Federal Reserve. First, although overall consumer demand is slowing, it still remains strong in many sectors. Second, many supply chain woes are still resolved. Supply chain disruptions due to the coronavirus pandemic were expected […]

When THIS stock crashes…that could be the bottom

Retail investors are resilient. While institutions have de-risked their portfolios… Retail investors have kept record amounts of money in equities despite the markets wavering. There’s one stock I’m watching… it’s held up fairly well during this beatdown. While other stocks in the sector have dropped 90%… it’s only down 20% or so. But, I believe, […]

My #1 Pick for Making Money from the Housing Crash

With inflation running rampant, the Federal Reserve is responding by ratcheting up interest rates. The result is that mortgage rates have more than doubled over the last year. Higher rates have pushed many potential buyers who could have afforded to buy in 2021 out of the market in 2022. For a $300,000 mortgage, a buyer […]

Trade of the Week: Volatility

Volatility is back to high levels after the Fed sounded increasingly hawkish after last week’s FOMC meeting. At least one volatility ETF, the ProShares VIX Short-Term Futures ETF (VIXY), saw an unusual increase in options volume during the period. However, it seems there was a fair amount of put buying, suggesting traders believe volatility may […]

Make Your Fixed Income ETFs More Interesting With Options

Even with rates going higher, fixed income ETFs don’t tend to move all that much. One way to amplify your cash flow from a fixed income product is by using options. Last week, some appeared to have sold 25,000 put spreads in the Invesco Senior Loan ETF (BKLN). BKLN has only moved in a $2 […]

The Two Best “Stock-Bond Hybrids” for Rising Interest Rates

Preferred stock shares feature a mix of common stock and debt security traits. In other words, they’re the best of the stock and bond worlds, and offer excellent, secure yields… if you understand how they work. So today, let’s dig into that – and see the two best preferred stocks to buy today… Preferred stocks […]

How Banks Can Deliver Monster Returns

I am always hunting for ideas that can boost portfolio returns for individual investors. I read, I ponder, I imagine, I study, and I test these ideas. Many of them end up in the junk pile as good ideas gone bad—these are usually the ones that sounded the most exciting when I first had or […]

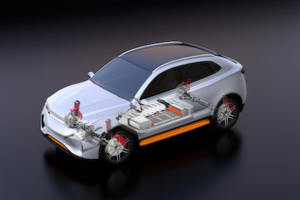

The Best Battery Gigafactory Stock You’ve Never Heard Of

When it comes to the companies that produce batteries for electric vehicles (EVs) and industrial users, many investors don’t think very far past Tesla (TSLA) and its famed gigafactories. But the industry is a lot more than just Tesla—in fact, it’s filled with a number of exciting young companies. One of the most exciting is […]

Is Europe a preview of what’s coming in the US?

There’s a ton of macro factors going on with Europe and the US. Energy issues… Obvious war going on in Ukraine… Mass inflation on all goods… But I’m looking at something else. The Euro compared to the US dollar. On the next page, my free weekly video discusses how the Euro correlates to movement in […]

Top 5 Midstream Companies for This Energy Crisis

From the 1980s until crude oil crashed in 2015, the master limited partnership (MLP) structure dominated energy midstream—your gathering, pipeline, processing, and storage companies. Midstream revenues come from committed fee structures and are very predictable and MLPs pay tax-advantaged distributions, so the structure can be very profitable for the sponsor/general partner/owner. But many investors don’t […]