There has been only one bright spot in what’s turning out to be an annus horribilis for U.S. stocks – the energy sector. The S&P 500 has fallen into a bear market, down more than 20% this year. The benchmark index is on pace for one its worst opening six months since 1970. Historically, there […]

Dividends are Your Best Friend for This Downturn

It’s a giant leap from having your money handled by a professional money manager to following the ETF recommendations from your company’s 401k provider and making your own investment decisions. How stocks, bonds, and funds work is complicated, and decisions about what to invest in have consequences. When stock prices rise, it’s easy to feel […]

How Squeeze Extra Cash From Your Bond Funds With Options

With interest rates moving higher, so are bond yields. However, bond funds still aren’t that exciting from a yield perspective. For instance, iShares 7-10 Year Treasury Bond ETF (IEF) has a dividend yield of only 1.5%. One way to boost the cash flow from popular bond funds like IEF is to sell calls against the […]

Trade of the Week: High Yield Bonds

A massive options trade occurred last week in iBoxx $ High Yield Corporate Bond ETF (HYG). HYG is a massively popular high yield bond fund that also has a very active options chain. A put spread was recently sold on HYG with over 150,000 contracts per leg. This trade is likely meant to boost “yield” […]

Weekly Market Update: Forget Making Money In Stocks Right Now

It’s easy to get sucked into the next “trading indicator” or “market moving software.” During a raging bull market… all these things are fun toys. But, we’re not in a raging bull market anymore. The days of the Federal Reserve raining free money onto America seems to be ending for now. Meaning, you can’t approach […]

3 Best Stocks for the Housing Slowdown

The rate of home purchases has slowed dramatically. Since the start of the year, mortgage rates have doubled from around 3% to more than 6%. The affordability of homes has plummeted, as have sales. Yet individuals and families still have to live somewhere, so slowing home sales will benefit companies with residential rentals. Here are […]

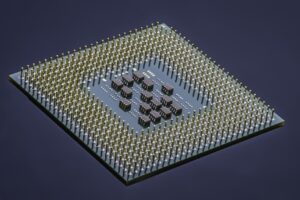

Semiconductor Industry Face Inflation and Shortages

The current state of the global semiconductor industry can be described by the famous opening words of Charles Dickens’s A Tale of Two Cities: “It was the best of times, it was the worst of times…” The global chip supply crunch triggered by the pandemic is likely to be drag on for the next two […]

This Could Be the Best Fed Rate Hike Trade in 28 Years

As expected, the Federal Reserve (Fed) raised rates in it June 15th meeting. Until then, the assumption was that the Fed would incrementally increase rates by 50 basis points (bps) at the next handful of meetings. However, after the hot consumer price index (CPI) number the week prior, the Fed was pushed into a more […]

Are Financial Stocks Stuck Moving Sideways?

Based on a large options trade in the Financial Select Sector SPDR ETF (XLF), it appears a well-capitalized trader believes that financial stocks may move sideways for the remainder of the year. The trader possibly sold a 5,000-lot strangle in January XLF options. A strangle involves selling a call above and a put below the […]

Trade of the Week: Time and Sales

Once you are able to determine where unusual options activity is occurring, the next step is looking at the time and sales list. This is the granular trade information, where you can sort the list and look at what the biggest trades have been, and what caused the underlying instrument to show up on your […]