Dear Investor, Recently I heard a TV stock pundit note that ever since Exxon Mobil (XOM) was booted from the Dow Jones Industrial Average, its share price is up over 100%. Meanwhile, the hot tech-sector stock that replaced Exxon is down 21%. This story indicates how often investors don’t take valuation into their investment decision […]

This Stock Could Triple If Bitcoin Can Sustain Recent Momentum

Bitcoin has taken a massive hit. Since topping out at $68,978 in November, the digital currency plunged to a low of $32,990. However, after catching double-bottom support—and pricing in a good deal of negativity—Bitcoin is starting to recover. From a current price of $46,633, we’d like to see it challenge its prior high from November. […]

Add These Energy Stocks to Your Portfolio Now

Dear Investor, Do not believe rumors that the price of crude oil has stopped climbing. Nearly unstoppable supply-and-demand forces point to continued gains for energy stocks – a trend that cannot be controlled by words from the Federal Reserve or other government authorities. So if your portfolio doesn’t have enough exposure to the energy sector, […]

Microsoft’s Activision Deal: Game Changer?

There is no doubt now that Microsoft (MSFT) is a big believer that the future lies in the metaverse—and that the path to the metaverse runs through the video games industry. If Microsoft is correct, its proposed $75 billion cash acquisition of Activision Blizzard (ATVI) may turn out to be the defining deal for the […]

Consumers Are Falling in Love with Dutch Bros

Most initial public offerings in 2021 seemed to be created through SPACs (special purpose acquisition company), a popular and more cost-effective way to get a faster listing. While the jury remains out on many of these SPAC-originated IPOs, there is one company that went public the traditional way. That way involves regulatory filings and several […]

What’s Next For FB?

Last week, shares of Meta Platforms (FB) plunged after the company reported worse than expected earnings. In fact, the stock dropped over 26% in one day, the biggest single-day decline in its history. The company missed on revenues, revenue forecasts, and number of users. Despite the huge down day, about 61% of the 2 million […]

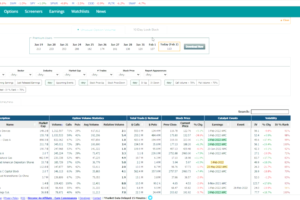

Trade of the Week: GOOGL

On a very busy week for earnings, Alphabet (GOOGL) shares got a huge boost after beating on both the top and bottom line. With the stock up 8% on the day after earnings, most of the options action was in calls. 71% of the options volume was on the call side, which tends to be […]

A New Breed of Dividend Growth ETFs is Here

Dear Investor, As technology stock investors rotate out of money-losing, used-to-be growth stocks, focusing on dividend growth should serve investors well in these volatile times. Two newer ETFs, offering both current yield and potential dividend growth, may be just what investors are looking for. With a dividend growth strategy, dividend income provides a current cash […]

What’s the Value of That Dollar You Earned in 2000?

Since the repeal of the Glass-Steagall Act in 1999, the role of the Federal Reserve has changed. The Fed used to be owned by banks while high-risk investment houses were separated and not considered part of the banking system. Since the repeal, banks have consolidated where the top four banks now account for 50% of all US […]

Don’t Worry – This Market is more 2018 than 2008

Dear Investor, The recent stock market declines have many investors fearing a market crash, such as the 2008 – 2009 bear market. Back then, the major stock market indexes dropped by more than 50%. As I see what is happening in the markets, this recent pullback feels more like 2018. If I am correct, the […]