Although the U.S. elections are garnering most of the media attention, the bigger deal for investors is the potential success of a coronavirus vaccine. The Pfizer (PFE) and BioNTech (BNTX) vaccine, with its 90% success rate in trials, could be a significant game changer for a world desperately seeking to find its way out of the pandemic.

That’s not to say the election doesn’t matter. Certainly, the January 5 Georgia runoff, which will determine who has control of the Senate for at least two years, will be closely watched by the financial markets. Nevertheless, when it comes to stocks, economics almost always outweighs politics. Ending the pandemic will do a lot more for companies than just about any type of new legislation.

In fact, we’ve seen significant action across sectors as news of the Pfizer vaccine becomes public. The most noticeable activity was the buying of pandemic-suppressed stocks (like movie theaters and cruise lines) and the selling of pandemic-friendly stocks (video communications, social media, etc.).

Here’s How You Find Next Trade Like TSLA and NIO [ad]

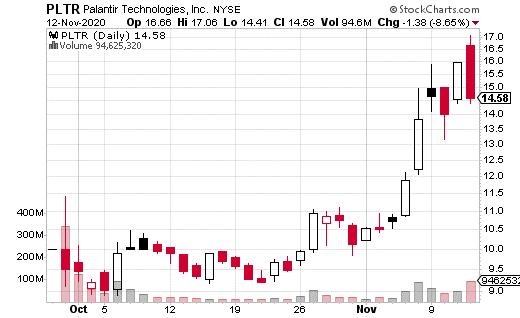

Volatility in the tech sector has masked what would otherwise be noteworthy movement in Palantir Technologies (PLTR). PLTR was one of the more anticipated IPOs in the last couple of years, finally going public at the very end of September. The stock initially traded for $9, but it has jumped over 68% this past month and is trading around $14 per share as I write this.

PLTR provides software platforms for data analysis and integration. Its primary product is used heavily in the defense and intelligence industries (primarily by governments). The company reports about $900 million in sales and a market cap of over $22 billion. The valuation seems rich, but revenues are growing rapidly.

Ultimately, though, it seems the bullish activity in PLTR shares is related to Biden winning the presidency. The thought process is that a Democratic White House will spend less on the military and turn to more efficient alternatives such as Palantir products.

It remains to be seen whether this will be the case, but options traders apparently believe it. On average, 80% of options trades over the last 30 days have been bullish.

Despite the overall bullishness of options action, at least one trader believes there’s a cap on how high PLTR can go over roughly the next year. This trader used a credit call spread to express this opinion.

In particular, the 20-25 call spread expiring in January 2022 was sold for $1.00 around 800 times. That means the 20 calls were sold, and the 25 calls were purchased. The full premium will be kept at expiration if PLTR isn’t above $20. Breakeven is $21, and max loss is $4 per spread if the stock is at $25 or higher.

This trade was made with the stock at $14.67, allowing for plenty of upside in the share price (over 30%). So it’s not a bearish position per se but suggests there’s a limit to how high PLTR can go over the next year.

Leaving room for upside potential is likely the result of the company’s impressive growth to date. However, the capped trade probably suggests that the valuation is already a bit too excessive. Using an out-of-the-money credit spread is a way to take into account both growth and valuation in a single options position.