Retail stores and sit-down restaurants were two types of business decimated by the coronavirus pandemic. Now in most of the country, these business types are in the early days of reopening. The big question is how fast consumers will return to in-store shopping and dining out. Investors want to know which companies will see business recover and which will lag.

The latest survey from S&P Global Intelligence surveyed 1,250 people between April 30 and May 18, asking whether they planned to go to restaurants and/or shop in stores. The findings were that when restrictions were lifted, 44% said they would go shop in stores, but only 31% stated they would dine out.

Here’s How Dividend Investors Are Setting Up Plans to Boost Their Income This Summer

One simple plan takes minutes to set up, yet could pay all your bills for life. You won’t have to worry about a mailbox stuffed with ‘payment due’ envelopes like much of the rest of the country.

This is our most powerful plan we’ve ever put together… and over 10,000 retirement investors have already used its recommendations.

There is still time to start generating $4,084 per month for life… but the window is closing. Click here for complete details.

I find the survey results interesting because personally, I couldn’t wait to get back to my favorite restaurants, and I am now eating out a couple of times a week. Yet the survey tells us the brick-and-mortar retailers are likely to see a quicker resumption of post-lockdown business.

The current retail market is a mix of businesses considered to be non-essential that were shut down by government mandate, and those considered essential, allowing them to stay open and benefit from the reduced shopping choices available to consumers.

My focus in stock analysis is income investments. Here are stocks of three dividend-paying companies.

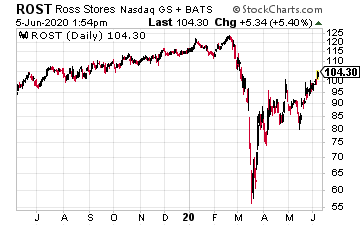

Ross Stores, Inc. (ROST) is the largest off-price clothing and home fashion store chain in the U.S. The company operates 1,546 stores in 39 states and the District of Columbia. Ross also operates 259 dd’s DISCOUNTS stores in 19 states.

Starting March 20, ROST closed all stores due to the pandemic. On May 14, Ross began reopening stores, with 700 opened within the first week.

Discount shopping, like what Ross offers, may benefit first when store restrictions are lifted. As an income stock, the Ross Stores dividend has grown for 25 consecutive years. In March this year, the payout increased by 11.8%. The stock traded above $125 before the pandemic-triggered crash.

The current yield is 1.14%.

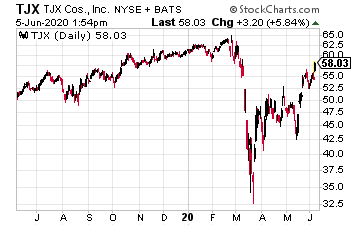

The TJX Companies, Inc. (TJX) operates the TJ-Maxx, Marshalls, HomeGoods, Sierra, Winners, Homesense, and TK-Maxx brand stores.

The 4,500 stores are located in nine countries on three continents (North America, Europe, and Australia). The company started reopening stores worldwide on May 2.

In the May 21 earnings press release, management stated: “While still early, the Company is seeing very strong initial sales overall at stores across all states and countries that have been reopened at least a week.”

The TJX dividend has increased for 23 straight years. The company declared a dividend in February with a 13% increase over the previous rate.

On May 22, The TJX Companies announced a suspension of dividend payments for at least two quarters. A resumption of dividends should give the stock price a nice boost.

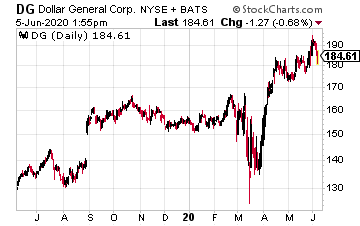

Shares of Dollar General Corporation (DG) have been a winner for investors through the crisis. In fact, Dollar General hit an all-time record high on June 2.

DG operates over 16,000 stores in 46 states. As an essential businesses, Dollar General stayed open through the COVID-19 crisis and economic shutdown. The company plans to execute approximately 2,600 real estate projects in fiscal year 2020, including 1,000 new store openings, 1,500 mature store remodels, and 80 store relocations.

DG started to pay dividends in 2015 and has increased the dividend rate every year since.

The dividend was raised in March 2020 by 12.5%. The current yield is 0.76%.