If you live in a state with a high income tax rate, the extra taxes need to be considered. One of the reasons I chose to in Nevada when returning from South America – besides the beautiful outdoors – is no state income taxes. The area in which I live is booming as Californians run from high taxes as soon as they hit retirement age. Of course, we all still have to pay federal income taxes.

And then there are taxes on our investments to consider.

One question I often receive concerns the tax characteristics of the dividend income from the high-yield investments in my Dividend Hunter service. The financial advising world is very concerned about marginal tax rates and managing investments in order to pay the lowest possible taxes. I think financial advisors focus on taxes because they don’t know how to produce above-average returns.

Dividends earned from companies that pay corporate income tax qualify for a lower tax rate. The rationale is that since the corporation already paid taxes, the dividends should be taxed less. For investors with taxable incomes between $39,376 and $434,550, the qualified dividend tax rate is 15%. Higher-income investors pay 20% in taxes on qualified dividend income.

If an investment pays dividends that don’t meet the criteria for qualified dividends, those dividends will be taxed at the investor’s marginal tax rates. Many higher-yield investments, such as real estate investment trusts (REITs) and business development companies (BDCs), pay non-qualified dividends. A financial advisor may recommend against these types of investments because of the higher tax rates. Let’s make a comparison.

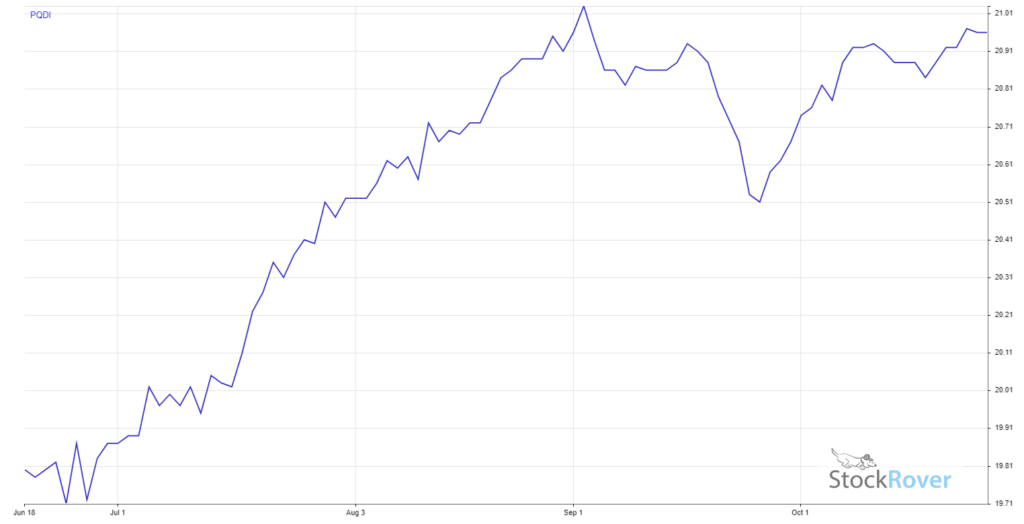

The Principal Spectrum Tax-Advantaged Dividend Active ETF (PQDI) was launched in 2020 to “invest significantly in securities that, at the time of issuance, are eligible to pay dividends that qualify for favorable U.S. federal income tax treatment.” According to an article from ETF Trends, PQDI invests heavily in preferred shares to produce an attractive dividend yield. The fund currently yields 4.5%.

In contrast, I recommend a list of preferred stock investments to my Dividend Hunter subscribers. I don’t care about qualified or not-qualified dividends; I am looking for the best, safest yields. My list of 10 preferred stock investments has an average yield of 8.65%. (More on how to get access to the list here.)

Let’s do the tax math: Using a 15% tax rate on the PQDI yield gives an after-tax cash return of 3.82%. For my list of preferreds, let’s use the 32% tax bracket covering incomes from $160,726 to $204,100. If you earn less than that, you would be in a lower tax bracket. After a 32% tax hit, the 8.65% average yield on my preferred stocks recommendations pays a net yield of 5.88%. Actual smart investing beats “tax-smart” investing by more than 2%.

Here is one more tax planning trick for high-yield investing: Many investors have a large portion of their investment wealth in tax-qualified retirement plans. If you own high-yield investments in a retirement plan, the dividends you reinvest will never be taxed unless you sell the shares. With higher-yield investments, when you reach retirement age, you can draw the current income from the portfolio, pay your regular taxes on the withdrawals, and never pay taxes on the reinvested dividends that provided growth to the income stream. It’s a convoluted thought, so think it through.

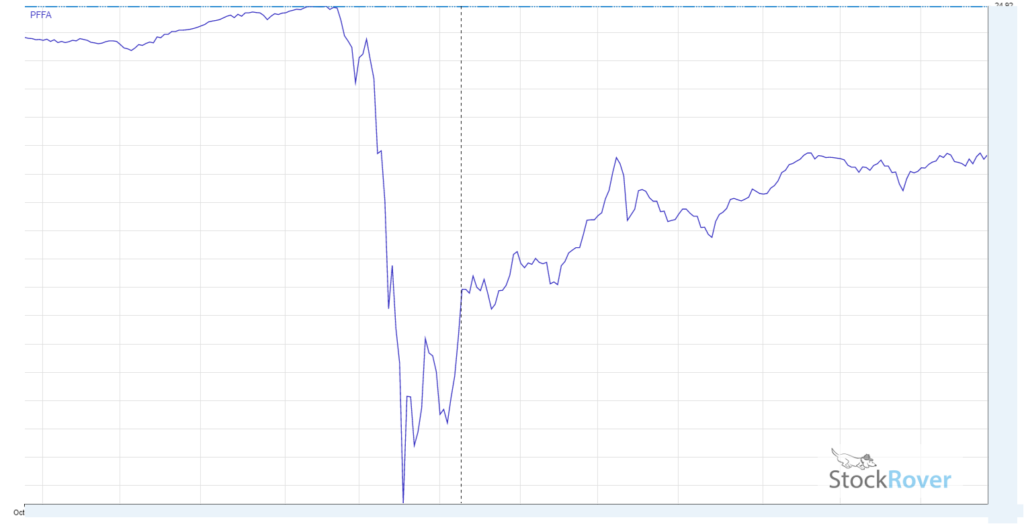

Finally, for a better yield than PQDI from a preferred stock ETF, take a look at the Virtus InfraCap U.S. Preferred Stock ETF (PFFA), which pays monthly dividends and yields 9%.