Dear Investor,

Last week, the stock markets were shocked to discover from the Federal Reserve that interest rates might actually move higher this year. Too many years at near-zero interest rates have corrupted the investing process.

While we should welcome higher interest rates, getting there won’t be painless.

Investors should prepare for more stock market volatility as interest rates move towards a more “normal” yield curve.

Traditional portfolio allocation models recommend investing a significant portion into stable, fixed income investments, primarily bonds or bond funds. In the last decade’s low-interest-rate environment, a traditional 60/40 stocks and bonds portfolio allocation would have meant a large percentage of an investment portfolio earned basically nothing.

Investors are not fond of zero-percent returns; as a result, many have committed the bulk of their portfolios to the stock market. It is these investors who will bail out in a down market, locking in losses and wondering why they gambled so much money on those risky stocks.

With a normalized yield curve, on which interest rates look like actual returns on investment, investors will be more willing and better served, due to some sort of traditional portfolio allocation between stocks and fixed income.

A simple, quarterly, or semi-annual rebalancing of this type of portfolio would dramatically increase portfolio returns and take investors out of the “when is the next crash coming?” guessing game.

I believe that over the next few years, interest rates will rise to the point where there is some slope to the yield curve. Getting from here to there will be a challenge since rising rates cause bond prices to fall. Traditional bond funds do not do well in a rising rate environment. Because of how these funds are structured, rising rates cause fund share prices to fall and stay down.

For a steeper yield curve, I am a big proponent of using the traditional bond ladder strategy. If you don’t know how a bond ladder works, check out this information from Charles Schwab.

For my Dividend Hunter newsletter subscribers, I recommend using the Invesco BulletShares ETFs to build a fixed income ladder.

Stock-wise, finance companies most benefit from higher interest rates. Banks and other lenders can increase the spread between what they charge for loans and what they pay for deposits or on their debt with higher rates. One less-followed group of finance stocks is business development companies (BDCs). These high-yield stocks should do very well as interest rates move higher.

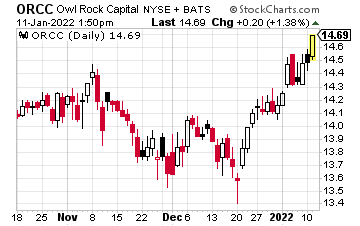

Owl Rock Capital Corp (ORCC) is a fairly new, high-quality BDC that is still under the radar for most investors. ORCC yields 8.6%, and the company should grow its dividend rate in the future.

That’s just one of many BDCs in the Dividend Hunter portfolio. Not to mention dozens of other low-risk, high-yield investments I’ve vetted for dividend stability and growth.

Put all of them together, and you get a simple strategy that potentially turns just $25,000 into a monthly income of $4,808 in 36 months – no matter the market.

Just buy the shares. Your broker will do the rest. Click here to get started.

The move to higher rates will take time – I am thinking two to four years. The investment strategies discussed today are intended to be employed over that period. Form a plan, watch market prices and commit your capital in a disciplined manner.