Since 2008, pundits are screaming – “Inflation is coming!” They are getting louder; do we scoff at the warnings, or take heed? What if they are right? If we take precautions, what harm can we do to our life savings if it doesn’t happen?

Baby boomers worked hard and played by the rules. Most are past their peak earning years and retired. Retirees generally see the largest inflation loss of wealth; they get poorer as they no longer have wages that rise with the tide.

During the Carter years, baby boomers experienced high inflation and Fed Chairman Volcker instituted 20% interest rates while the Fed tried to get things under control. While history is no guarantee of future results, it sure rhymes. What can we learn from our past experiences?

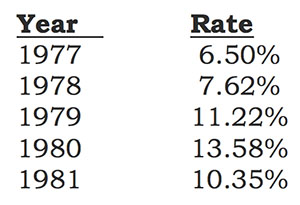

Inflationdata.com supplies the inflation information for us:

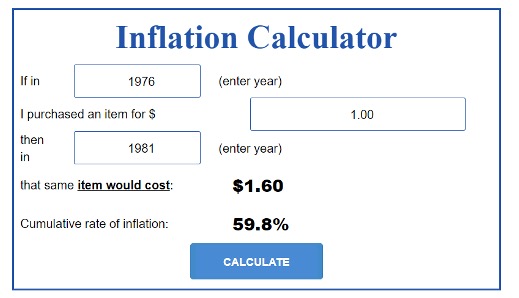

The Inflation Calculator shows us the accumulated inflation was 59.8%.

My parents were ready to retire. They were children of the Great Depression, afraid of the stock market, preferring to invest their life savings in Certificates of Deposit. If they bought a $100,000, 5-year, 6% CD on 1/1/77 they would have received $6,000 annually in interest – before taxes. Their CD income did not keep up with inflation, and their returned principal lost almost 60% in buying power.

For those living on a fixed income, that means downsizing, cutting expenses and possibly dramatic changes in lifestyle.

| The catastrophic potential consequences always warrant evaluation of high inflation warnings. While me may not know exactly when it could happen – are legitimate storm clouds brewing? |

Could history repeat itself?

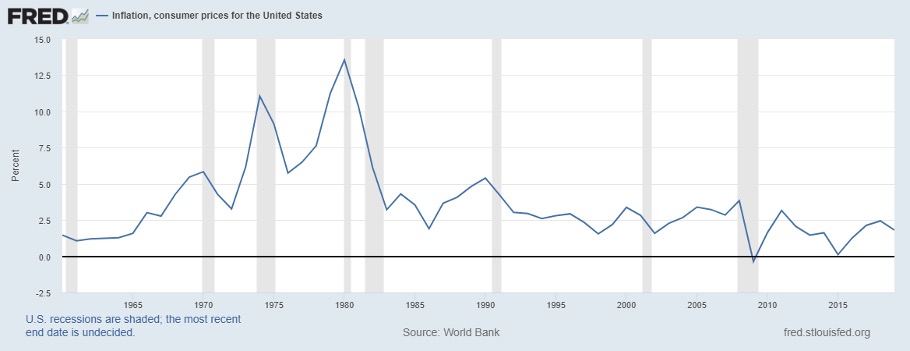

We recently compared the Volcker inflation years to recent times.

The double-digit inflation spikes in 1975 & 1980 prompted Fed Chairman Volcker to dramatically raise interest rates.

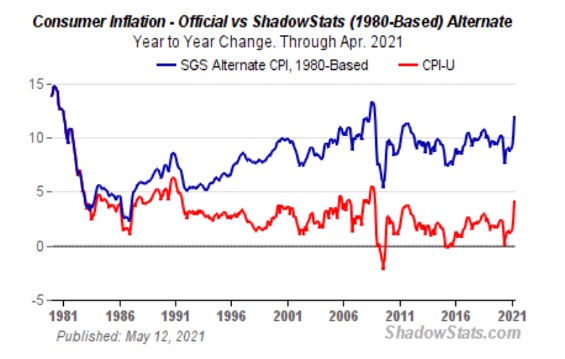

Since then, the Bureau of Labor Statistics has constantly gerrymandered its numbers. If the price of steak goes up, they substitute hamburger, with the goal of underreporting true inflation to the public.

| Each lower-priced substitution represents a downgrade in lifestyle, not an honest reporting of increasing costs for the SAME basket of goods and services over time. |

John Williams at Shadowstats calculates inflation using the same method that was used in the 1980s. The numbers rhyme with what Volcker was faced with.

What causes inflation?

Oxford dictionary defines inflation as, “A general increase in prices and fall in the purchasing value of money.”

When a government creates more currency, the value of each dollar (yen, peso, etc.) decreases; the value of each unit drops (sometimes very quickly) as other currencies become more valuable.

The 2008 bailout, followed by additional government stimulus packages, has taken currency creation to historic proportions.

How do we protect our wealth?

The problem is cumbersome. When Nixon took the US off the gold standard, other countries began dumping our dollar. Volcker raised rates to 20% to stop inflation and make the dollar more attractive.

That solved one problem but caused a recession. Today, if a government official even mentions “tapering” stimulus money, the stock market tumbles.

If interest rates start rising, expect a major market correction as the economic bubble bursts. The Fed and government ignore the problem, creating more fake money to keep interest rates low.

Investors are faced with a myriad of concerns:

What if I am wrong building a defensive portfolio? My broker has me heavily invested and things are going well? Do I want to risk missing out on the continual appreciation?

Barchart shows the market is still climbing.

How do I unload paper dollars that are losing value every day? My parents were locked into long-term CDs and saw the value of their life saving rapidly decreasing. Bonds, CDs and cash are losing value.

If the market tumbles, are any stocks safe? Historically, in a market downturn, even great company stocks may drop dramatically.

Where can I invest in assets that will not decrease in value because of the declining dollar or market crash? If I rebalance, where do I deploy my assets safely?

Exploring the options

Well-diversified investors generally suffer less damage and may profit during an economic downturn.

Investing in assets that historically appreciate ahead of the inflation rate offers good protection; helping to offset losses from those that don’t.

The government pushes Treasury Inflation Protected Security (TIPS) as an inflation hedge. They pay ridiculous interest, offer no umbrella protection and the government keeps the inflation scorecard. I don’t own any TIPS.

Gold – and other precious metals – is frequently touted by the experts. Unlike paper money, gold has a finite supply and has been a universal store of wealth for centuries. Paper money comes and goes, while gold always remains.

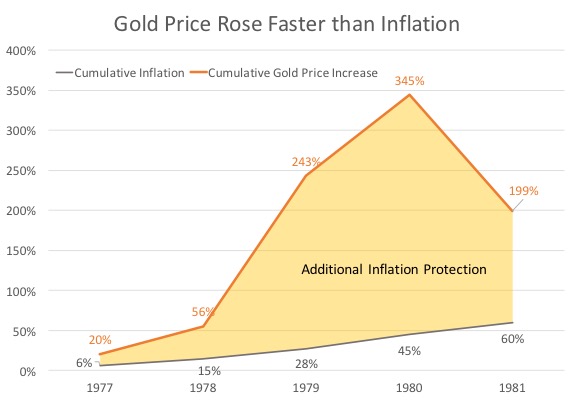

During the Carter years, the gold price rose ahead of the inflation rate.

Other assets – prime real estate, collectibles or other precious metals generally do the same thing. By rising more than the inflation rate, they offer some umbrella protection for all your wealth. Once inflation cools, a portion of those assets can be sold at much higher prices.

I hope I NEVER have to sell my gold. Things will get awfully bad for me to be forced into doing so. I look at our physical metal holdings as insurance against a catastrophe, one I hope we never experience.

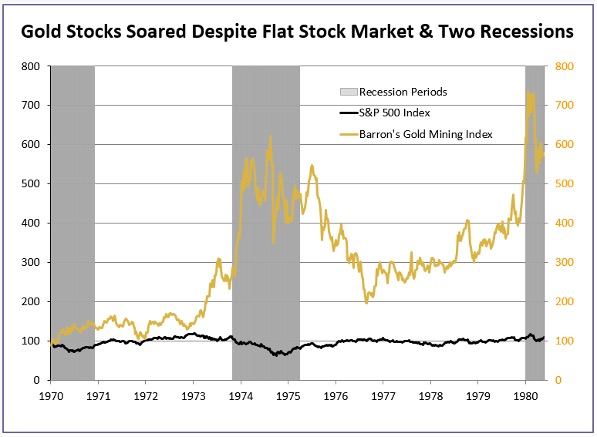

I contacted gold expert Jeff Clark at Gold/silver.com about gold stock performance when the market is down and rising inflation.

He supplied a chart comparing gold stocks and the S&P 500 during the 1970s. Gold stocks outperformed gold during the 1977-1981-time frame, despite a lagging stock market.

In addition to physical metal, my wife and I also own gold and silver stocks. We hold them for appreciation and dividend yield.

Should we have high inflation, we would sell those holdings first, intending to use the proceeds to buy other assets that are on sale because of a market crash. Many solid companies, capable of maintaining their dividends will be a bargain hunter’s delight.

What about those who are reluctant to cash out some of their current investments?

In a recent interview with Chuck Butler, he said:

“There are also some who feel they can time the market perfectly and, when things turn on a dime, think they are smart enough to beat everyone out the door. They will get clobbered!”

James Rickards warns “Hyperinflation Can Happen Much Faster Than You Think”:

“Money printing first turns into inflation, and then hyperinflation, when consumers and businesses lose confidence in price stability and see more inflation on the horizon. At that point, money is dumped in exchange for current consumption or hard assets, thus increasing velocity.

As inflation velocity spikes up, …. the process accelerates and feeds on itself. In extreme cases, consumers will spend their entire paycheck on groceries, gasoline and gold the minute they receive it.

They know holding their money in the bank will result in their hard-earned pay being wiped out. The important point is that hyperinflation is not just a monetary phenomenon – it’s first and foremost a psychological or behavioral phenomenon.” (Emphasis mine)

Hyperinflation is generally defined as prices increasing 50% or more in a single month. You can have terrible, destructive inflation without meeting the hyperinflation standard.

Rickards points out that, from 1919-1922, Weimar Germany did not experience hyperinflation, yet the reichsmark lost 96% of its value during those three years.

Investors must weigh the options of taking profits, rebalancing their portfolio and adjusting to a more defensive mode. Is the potential loss of upside worth the risk of a huge downturn?

You can burn the candle at both ends, not selling all, but rebalancing your allocation percentages. Personally, I would rather move a couple years early; being a few days late could be an expensive mistake.

Summing it up!

Learn from my parents. Keep your cash positions short, you don’t want to be locked into long-term bonds or certificates of deposit.

Own gold and precious metals as insurance; hoping to never see hyperinflation. We hope these assets pass down several generations and never have to be sold.

Use mining stocks for income and appreciation. While Jo and I own individual mining stocks, GDX is a fund which some experts have suggested. Do your homework, it may be a good option.

Hold enough cash to snap up unexpected bargains. Yes, it is hedging. You don’t want so much that could quickly lose value as inflation accelerates. As prices rise, you may need cash to pay the bills and you don’t want to be forced to sell something at the wrong time.

Don’t let the fear of missing out cause you to lose your existing gains. Brokers want to keep you invested in their fee-based products. What do you have to lose by taking some profits? Taking profits is always good!

The bubble will eventually burst, quickly and dramatically. When? No one knows for sure.