Paysafe (PSFE) is a recent special purpose acquisition company (SPAC) that began trading on the New York Stock Exchange at the end of March, following its merger with Foley Trasimene Acquisition II Corporation. The company has made a mark everywhere in the gaming world, with digital wallets and eCash solutions in a sector that is expected to expand at an annual growth rate of more than 50% through 2025.

Paysafe is well positioned to capture the emerging trends in the U.S. online gambling sector, which more states are set to legalize over the next few years. Nearly 75% of Paysafe’s revenues comes from electronic and integrated commerce solutions, as brick-and-mortar merchants continue to partner with highly sophisticated payment providers that offer a broad range of solutions.

The company has developed several payment options through its digital wallet, including Skrill, Neteller, and its Paysafe e-cash card. Paysafe services are currently available in 15 states that are supported by nearly 40 operators, which include partnerships with (DKNG) and Caesars Entertainment (CZR).

Paysafe also has a relationship with Microsoft (MSFT) as a payment solution provider for online gaming and is gaining traction in the financial services sector through crypto trading. The company has partnered with another recent IPO, Coinbase (COIN), and is available on roughly 35 crypto sites and exchanges for digital wallets and payment processing.

After reporting a first quarter net loss of $49 million in mid-May, it’s clear Paysafe isn’t profitable, yet—but it will be by the end of 2021. Revenue for the quarter came in at $377 million, versus forecasts of $366 million. For the current year, the company is expected to turn a profit of $0.06 per share on revenue north of $1.5 billion.

For 2022, earnings are expected to grow to $0.19 a share on revenue of $1.7 billion. These numbers could be conservative if growth can continue to accelerate with improving financials going forward. The company currently has $275 million in cash and $2.1 billion in debt, with nearly 13 million users worldwide.

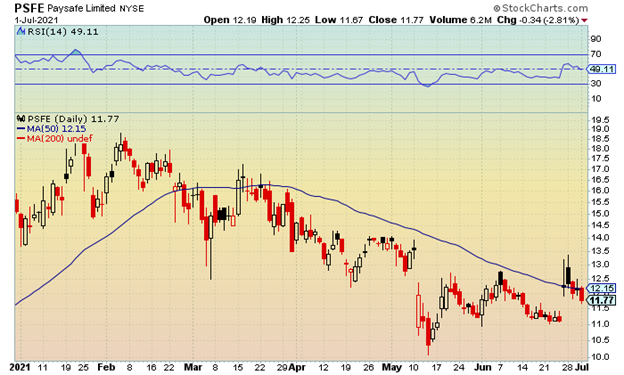

Four analysts currently cover the stock, giving it two strong buy ratings and two buys. As far as the technical outlook, shares are down significantly from the January peak of $19.57, and are at attractive entry levels in the low teens.

The chart shows a recent surge above the 50-day moving average that had been in a downtrend and is showing signs of leveling out. There is still risk towards the $11–$10 area on a close back below the $11.50 level. Resistance is at $12.50–$13.

Curently, options that go out into January 2022 are available to trade. Savvy traders can target a breakout above the $13.50 level and the January 15 calls for a return trip towards prior highs. They are currently trading near $1.25, and would double from current levels if shares are above $17.50 by mid-January.

Conservative traders can write covered calls over the near-term to lower the cost basis if deciding to get in at current levels.