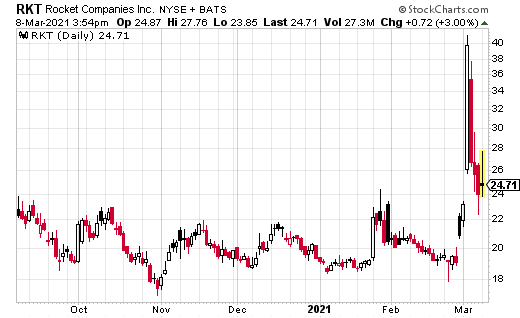

Shares of Rocket Companies (RKT) recently zoomed to a high of $43 without any apparent new news from the company. However, the stock currently has large short bets placed against it by hedge funds and appears to have garnered some bullish interest from day traders on Reddit’s infamous r/WallStreetBets forum.

Roughly 45% of RKT’s available shares are sold short; it is one of the top U.S. companies in terms of the size of short bets initiated by hedge funds.

Aside from the tremendous short interest and volatility, RKT did announce solid earnings in late February. The company reported fourth-quarter earnings per share (EPS) of $1.14 on revenue of $4.78 billion. Expectations were for a profit of $0.87 per share on revenue of $3.92 billion.

RKT also said first-quarter closed loan volume would come in between $98 billion and $103 billion, and would represent an increase of 90%-100% compared to $51.7 billion in the first quarter of 2020. The company also forecasted net rate lock volume between $88 billion and $95 billion, which would represent an increase of 57%–70% compared to $56 billion in the first quarter of 2020.

Additionally, RKT said gains on sale margins should come in between 3.6%-3.9%, which would be an improvement of 35 to 65 basis points compared to 3.25% in the first quarter of 2020. And finally, the company also announced a special dividend of $1.11 per share, payable on March 23 2021, to investors who hold its common stock by the closing bell on March 9, 2021.

I mentioned in December, when shares were below $22, that the stock was a longer-term buy, as RKT was down 35% from the previous September peak of $34.42. I also mentioned aggressive traders looking to play a return trip to the low $30s by this summer could target the RKT June 25 call options, which were trading at just below $3.

When shares zoomed to the $43 level, these options were $18 in the money, up more than 500%. As of this writing, these options were trading near the $4 level.

I still like the company’s prospects over the longer term; however, investing in the stock and the aforementioned options has become much more riskier given RKT’s recent volatility.