Masayoshi’s Son’s Softbank (SFTBY) is in the news again…this time with a $40 billion cash-and-stock deal to sell its chip design architecture firm, ArmHoldings, to Nvidia (NVDA).

SFTBY will receive $21.5 billion in NVDA shares and $12 billion in cash, only a little more than the $32 billion that it paid for Arm in 2016. But it could also receive up to $5 billion in additional cash if Arm hits certain performance targets.

Softbank will become one of Nvidia’s largest shareholders, with a stake of between 6.7% and 8.1%.

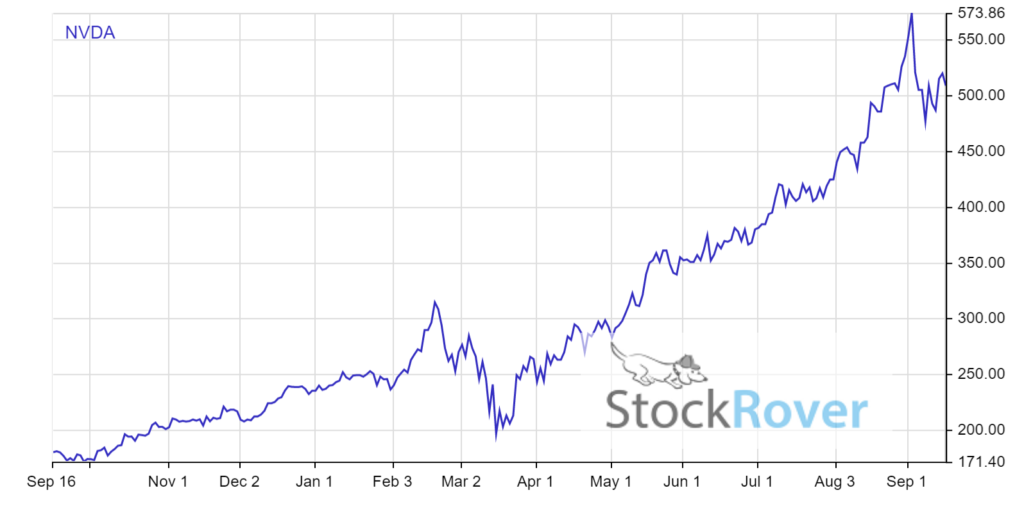

At first glance, it looks like Softbank did well with a $8 billion gain after four years with Arm. But a deeper look would quickly tell you that the purchaser, Nvidia, has done much better since 2016.

Back in 2016, Nvidia had a market valuation of roughly similar to that of Arm’s. But now, Nvidia trades at a market valuation of $300 billion, or nearly 10 times the amount SoftBank paid in cash for Arm.

This deal will keep Nvidia‚—which passed Intel as the world’s most valuable chipmaker—on a fast growth path.

What Arm Does for Nvidia

The future of computing will see the cloud expanding to the “edge.”

So what the heck is edge computing?

It is simply computing that is done at or near the source of the data. Instead of businesses relying on the cloud (at various data centers) to do their computing work, the cloud is coming to the businesses.

This involves so-called parallel computer architectures, which are connected to hundreds of billions of Internet of Things (IoT) devices.

Parallel computing has been around for decades, but the market was held back because programming parallel processing software used to be very difficult. This began to change 13 years ago when Nvidia launched its CUDA software, which is now on its 11th generation. Nvidia’s proprietary CUDA software platform lets developers leverage the parallel architecture of Nvidia’s graphics processing units (GPUs) for a wide range of tasks. Thanks to the many improvements, the technology has evolved to become the leading platform for parallel computing at scale.

Nvidia’s product line-up has been focused on the high end of the chips market. Its powerful graphics processors, which handle data-intensive tasks, and are typically sold to PC gamers, science researchers, artificial intelligence developers and self-driving car manufacturers.

Nvidia has moved its GPUs to data centers, where parallel processing capabilities have made the units the main engines for the data-intensive task of training artificial intelligence systems.

Nvidia’s reach is huge: every time you use Alexa, for example, there’s a good chance the speech recognition is being processed and interpreted by a parallel processing software algorithm powered by an Nvidia GPU.

However, Nvidia has one barrier remaining that prevents it from almost complete domination of the data center ecosystem. It still needs the ability to work within an old ecosystem, because the processing units’ architecture in data centers is frequently still Intel-based.

That’s where Arm comes in.

Free Download: Beginner’s Options Guide [ad]

Nvidia’s deal for Arm will fulfill the company’s ambitions to make it the main supplier of core technologies that power large-scale data centers—a market currently dominated by Intel.

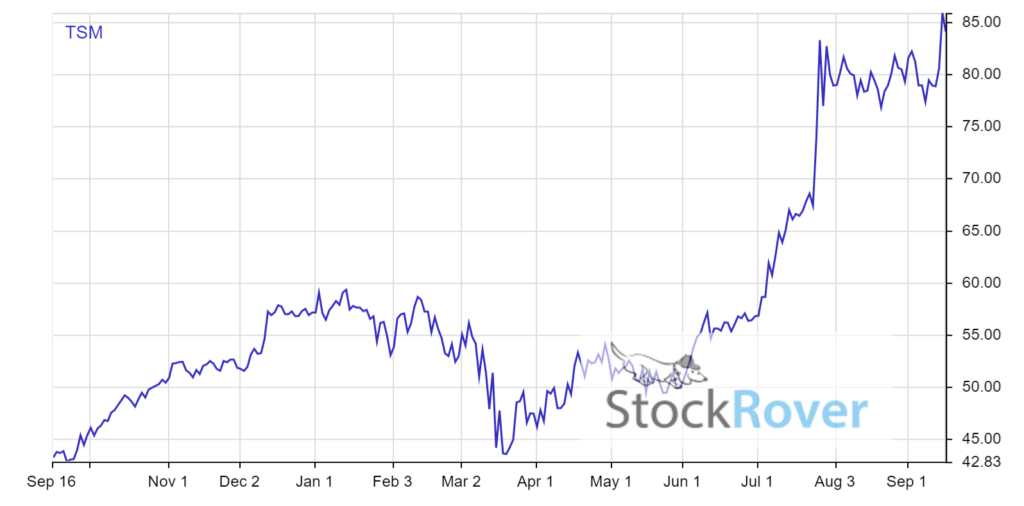

While Arm’s server chips’ market share is still small, but it has been extremely successful performance-wise. With Taiwan Semiconductor (TSM) as a manufacturing partner, Arm is rapidly overtaking Intel in the raw performance for market segments outside of mobile phones.

But now, the purchase of Arm will put Nvidia in a unique position to dominate the edge computing ecosystem. It will be in a strong position to create a hardware-software ecosystem around Arm that could be a serious threat to Intel.

Of course, Nvidia’s rivals and Arm licensees will stand in the way of the deal.

Over the last three years, these licensees have collectively shipped an annual average of 22 billion chips based on Arm’s chip architecture. A large number of businesses, including Apple and Qualcomm, are dependent on Arm and will be highly motivated to unite in opposition to the deal.

Even so, when the deal is done, Nvidia will be a big winner.

With the emergence of faster 5G networks designed to support a large number of devices, edge computing is here to stay. Think about it: next-generation networks will have high-performance computers with parallel accelerators at the very edge of the network. The endpoints—smart sensors, industrial robots, autonomous vehicles, 3D or holographic communications, etc.—will require a much faster and low latency communications system with a distributed computing architecture model. The amount of data produced and processed will increase almost exponentially, driving demand for parallel computing even further.

That will be music to Nvidia’s ears.

SoftBank said the combination of Arm and Nvidia will create a computing company “that will lead the era” of artificial intelligence.

When Softbank bought Arm, Son said it would be the linchpin for the future of Softbank.

This time though, I don’t think Son is exaggerating.