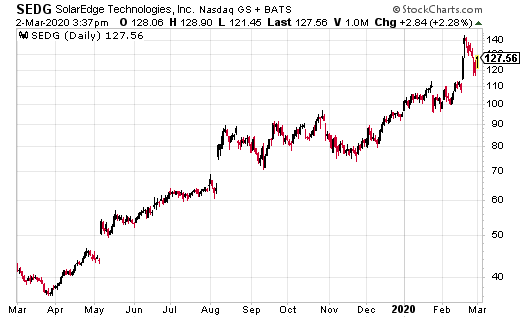

Over the last trading session, shares of SolarEdge Technologies (SEDG) were slightly at $127.20 a share. Year over year, the stock is now up nearly 245%. That’s double the return of the Invesco Solar ETF (TAN). It also beats the S&P 500 return of 18%.

SolarEdge Technologies, designs, develops, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations worldwide. Its SolarEdge system consists of power optimizers, inverters, communication and smart energy management solutions, and a cloud based monitoring platform. The company’s products are used in a range of solar market segments, such as residential, commercial, and small utility-scale solar installations.

The company also provides pre-sales support, ongoing trainings, and technical support and after installation services; and lithium-ion cells, batteries, and energy storage solutions for various industries, including energy storage systems, residential and commercial solar systems, uninterruptible power supplies, electric vehicles, aerospace, marine, and others.

CEO Zvi Lando helped cool fear over the impact of the coronavirus, noting that he “did not expect any disruption to revenue in the first or second quarters, given the pre-outbreak actions taken to meet growing demand.” Actions taken included building up inventory to shipping it to distribution centers in the quarter, and securing an agreement with its contract manufacturer, Jabil Inc. (JBL).

“As a result, when the Chinese New Year vacation was extended due to the coronavirus, the manufacturing lines at our CM in China continued to operate and manufacture products,” Lando said, according to a FactSet transcript. “These two measures, combined with increased capacity in our factories in Hungary and in Vietnam enables us to continue to meet capacity needs of our customers despite the unfortunate circumstances that developed.”

Plus, just days ago, the company posted fourth quarter net income of $52.8 million, or $1.03 per share from the $12.9 million, or 27 cents per share posted year over year. While impressive, it did miss analyst estimates for $1.05 a share. Excluding non-recurring items, adjusted EPS did rise to $1.65 from 63 cents year over year. Revenue jumped 59% to $418.2 million, which was above estimates for $413.8 million.

Going forward, SEDG expects first quarter revenue of $425 million to $440 million, which is above estimates for $388.9 million.

CFRA’s Angelo Zino raised his price target to $140 from $78, saying he sees a “healthy” residential/commercial market through 2021 and that he remains optimistic about the long-term trajectory of the company’s recent investment in areas such as electric vehicles, as noted by MarketWatch.

As of this writing, Ian Cooper does not have a position in shares of SEDG.