Shares of Intel (INTC) are down 20% from their early-April 52-week high of $68.49, despite reporting solid first-quarter earnings in late March. The company reported a profit of $1.39 a share on revenue of $19.7 billion versus forecasts of $1.15 and $17.9 billion, respectively.

While this was great news, INTC lowered current quarterly numbers to a profit of $1.05 a share on revenue of $18.9 billion. Wall Street had expectations of $1.09 and $17.55 billion, respectively. However, Intel also raised its 2021 guidance for a profit of $4.60 per share, versus consensus of $4.58.

A big concern for most of the chipmakers has been the global semiconductor shortage that has weighed on the auto industry and other manufacturers. As demand continues to soar alongside limited manufacturing capacity, the thought is it could take a couple of years to get the supply chains back to normal.

This doesn’t mean INTC plans to sit around and wait for a recovery; the company has already started making big investments to address these issues. Earlier this month, the company announced it will invest $3.5 billion in its New Mexico operations, $20 billion for two new Arizona plants, and $10 billion for a new chip facility in Israel.

These reinvesting strategies could help lead Intel back to its leadership position in process technology and will boost the company’s long-term competitive position. Additionally, Intel been talking to automakers and suppliers about steps it can take to increase automotive chip production in the coming months.

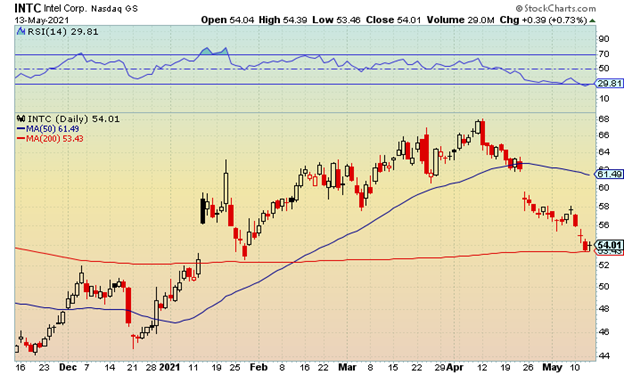

There is near-term risk if shares fall below $53.50 and its 200-day moving average. The chart below shows a further backtest towards the $52–$50 area on a close below these levels and represents the prior breakout area from early January. If shares can $56–$58, it would indicate a near-term bottom.

INTC’s RSI (relative strength index) has been hovering near the 30 level and typically signals when a stock is oversold. However, this doesn’t mean a test into the mid to upper 20’s can’t come into play on further weakness.

Analysts remain bullish on the stock, given the investments Intel is making in its chip manufacturing plants. Of the 43 analysts who cover Intel, there are three “strong buy” ratings and 11 “buy”s. There are 20 analysts that have a “hold” rating on the stock along with six “underperform” and three “sell” ratings.

A relatively cheap way to invest in INTC is possibly using the January 2022 $62.50 call options, which are currently trading near the $2.50 level. These LEAPs (long-term equity anticipation securities) do not expire until January 2t, 2022 and would provide nearly eight months to play a longer-term rebound in the stock.

If INTC can trade back above $67.50 by this expiration date, these call options would be $5 “in the money”, or a double from current levels.