Want 3 Dividend Deposits Every Friday Morning?

Last week: $1,310 total before lunch. Lock in before Thursday’s deadline. Get details here.

During the course of the day when markets are open Tim will post thoughts, updates, responses to subscriber questions, and buy and sell alerts.

Go ahead and bookmark this page. Please note that all dates and times below are eastern time.

April 7, 2025 - 10:55 am

This is not a trade recommendation but a sharing of what I have done in my Dividend Hunter account. I have sold my shares of BSJP and plan to use them to acquire shares of higher yielding Dividend Hunter stocks “on sale.” Each of us has our own investment situation. I had little cash available, so chose to sell my BSJP to raise some to put to work.

March 28, 2025 - 4:30 pm

On Tuesday I’m hosting a special briefing on a strategy for getting through the current market. Wednesday’s proposed tariffs have ruffled the market and it’s time to take a look at a new approach. Even after Wednesday comes and goes we’ll still be in an unsettled market for some time. Get the details on how to join me at noon eastern on Tuesday, April 1st. Click here.

March 27, 2025 - 4:35 pm

I am having an issues logging into Zoom for the webinar. Hopefully I will get it resolved quickly. Tim

March 27, 2025 - 9:39 am

- Series Portfolios Trust – InfraCap Equity Income Fund ETF (ICAP) declared $CONTENT.195/share monthly dividend, 2.6% increase from prior dividend of $ 0.190.

- Payable March 31; for shareholders of record March 28; ex-div March 28.

March 10, 2025 - 12:56 pm

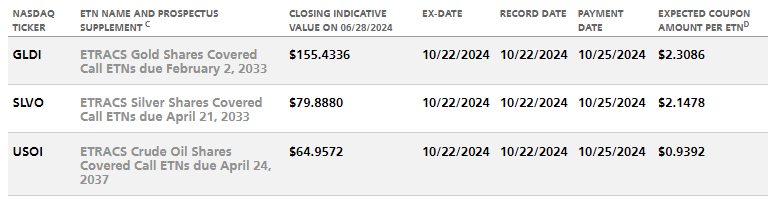

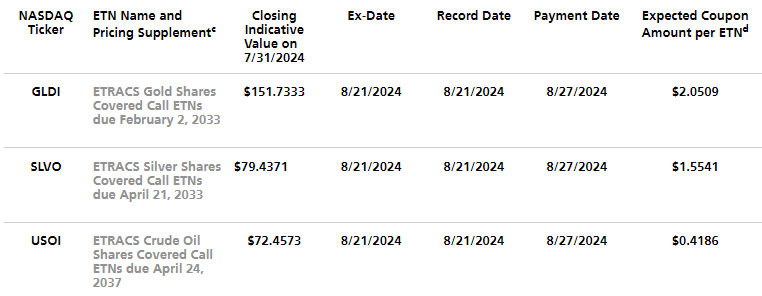

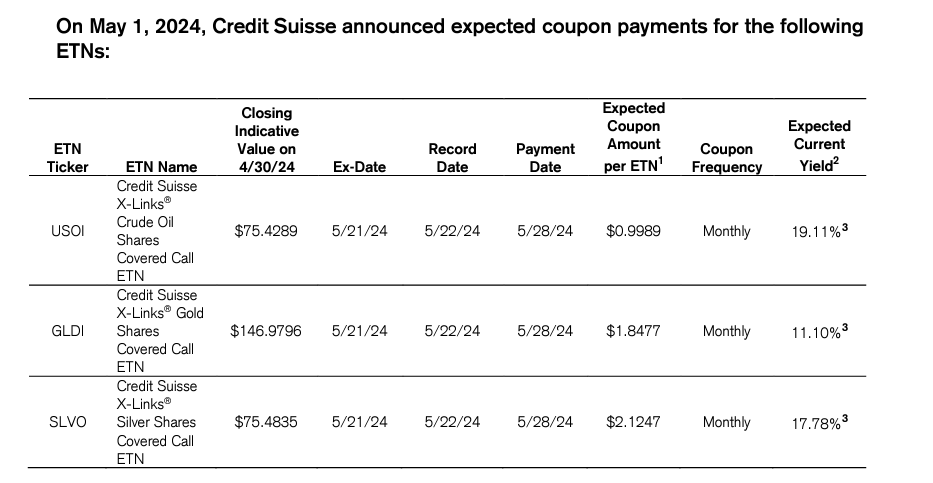

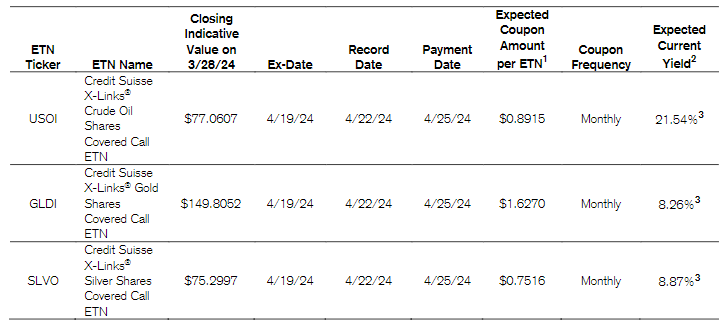

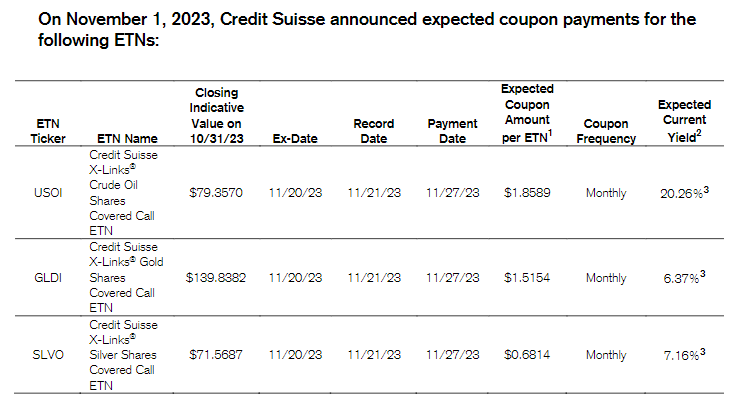

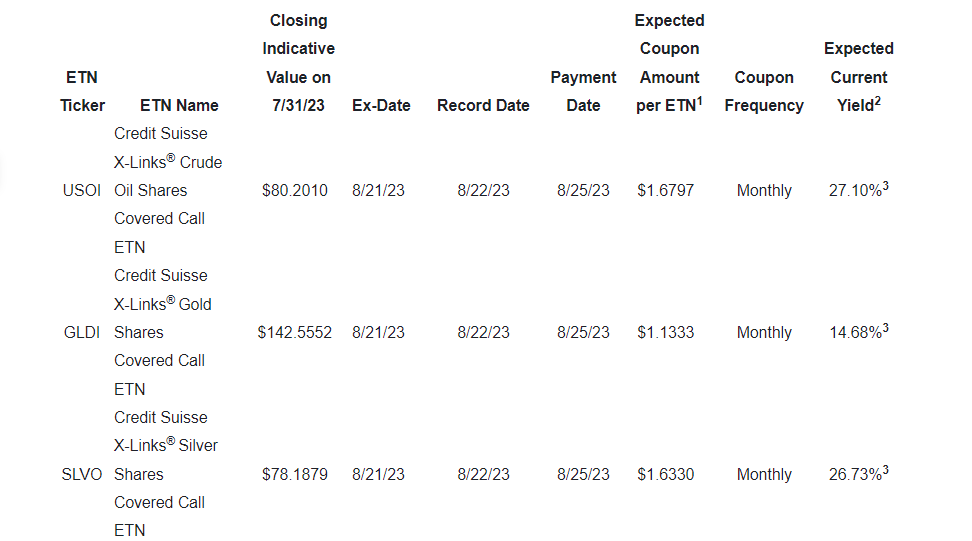

UBS has published the March dividends for SLVO and USOI. Here they are:

On the same dollar amount the SLVO will be 270% larger than that amount invested in USOI. So we will sell USOI and use the proceeds to buy SLVO.

I know that USOI has dropped from the $ 65.60 we paid in November. The share price has followed down the price of oil. And now USOI will pay a relatively tiny dividend. SLVO has been stable for the last six months, so the exchange will also get us away from the falling price of oil and USOI.

You must make the trade BEFORE the March 20 ex-dividend date. With the downward trend in oil, sooner is probably better than later.

March 10, 2025 - 10:01 am

Here is the March update for my Watchlist. These are not recommended investments. They are on the list for a variety of reason that make me want to keep up with their news. I have added several new investments since the last update. I was also surprised at the large number of prices that have gone up.

| Ticker | Price | Ticker | Price | |

| ARCC | $ 22.83 | MDST | $ 26.10 | |

| ARI | $ 10.13 | MSIF | $ 16.98 | |

| BCSF | $ 17.49 | NCDL | $ 17.28 | |

| BLW | $ 14.20 | NG1 | $ 4.49 | |

| BWLP | $ 10.30 | NIE | $ 22.93 | |

| BXMT | $ 20.69 | NREF | $ 16.37 | |

| CCAP | $ 17.31 | PBDC | $ 34.87 | |

| CIM | $ 14.09 | PBR | $ 12.75 | |

| CIVI | $ 33.41 | PDI | $ 20.06 | |

| CLCO | $ 5.12 | PDM | $ 7.36 | |

| FSCO | $ 7.00 | PLYM | $ 17.21 | |

| FSK | $ 22.79 | QVCGA | $ 0.26 | |

| GNL | $ 8.25 | RLJ | $ 9.44 | |

| GSBD | $ 12.30 | RWT | $ 6.55 | |

| HAFN | $ 4.20 | SEVN | $ 12.47 | |

| HIW | $ 29.84 | SPYI | $ 48.78 | |

| INSW | $ 24.35 | TFSL | $ 12.70 | |

| IRM | $ 84.83 | TPVG | $ 7.63 | |

| JBBB | $ 48.80 | TRIN | $ 16.00 | |

| KRG | $ 22.54 | TSLX | $ 22.79 | |

| LADR | $ 11.80 | XFLT | $ 6.20 | |

| LPG | $ 20.72 |

March 6, 2025 - 9:23 am

- TORM (NASDAQ:TRMD) declares $ 0.60/share quarterly dividend.

- Forward yield 13.83%

- Payable April 2; for shareholders of record March 20; ex-div March 20.

March 3, 2025 - 11:24 am

If you have been contacted by mail or phone by OCSL to vote affirmative on the proxy vote to issue shares at a discount, let me know with a short email to tim.plaehn@investorsalley.com Thanks

February 27, 2025 - 9:28 am

EPR Increases Dividend:

The Company’s Board of Trustees declared its monthly cash dividend to common shareholders of $ 0.295 per share payable April 15, 2025 to shareholders of record as of March 31, 2025. This dividend represents an annualized dividend of $ 3.54 per common share, an increase of 3.5% over the prior years annualized dividend (based upon the monthly dividend at the end of the prior year).

February 24, 2025 - 11:30 am

Interesting datapoints:

the S&P 500 has sold off more than -1.71% in a single day (like it did Friday) ~142 times since 1929. And 72% of the time it’s been higher a month later, 77% of the time it’s been higher a year later and virtually 100% of the time higher a decade later.

February 23, 2025 - 9:59 am

Thanks to the subscribers who sent me info on the QRTEP symbol change:

ENGLEWOOD, Colo., February 21, 2025–(BUSINESS WIRE)–Qurate Retail, Inc. (Nasdaq: QRTEA, QRTEB, QRTEP) has officially changed its name to QVC Group, Inc. (“QVC Group” or the “company”). The new name incorporates the brand equity of the company’s largest brand and supports QVC Group’s growth strategy to expand into a live social shopping company. QVC Group, Inc. is a Fortune 500 company with six leading retail brands – QVC®, HSN®, Ballard Designs®, Frontgate®, Garnet Hill® and Grandin Road®. On Monday, February 24, the company’s stock will start trading under the new stock symbols “QVCGA”, “QVCGB” and “QVCGP.”

February 21, 2025 - 8:28 am

- Arbor Realty Trust (NYSE:ABR) declares $ 0.43/share quarterly dividend, in line with previous.

- Forward yield 12.43%

- Payable March 21; for shareholders of record March 7; ex-div March 7.

February 12, 2025 - 8:12 am

From SFL: he Board of Directors has declared a quarterly cash dividend of $ 0.27 per share. The dividend will be paid on or around March 28, 2025. The record date and ex-dividend date on the New York Stock Exchange will be March 12, 2025.

February 11, 2025 - 7:49 am

HTGC declared Total Cash Distribution of $ 0.47 per Share for the Fourth Quarter 2024 is Comprised of a $ 0.40 per Share Base Distribution and a $ 0.07 per Share Supplemental Distribution.

- Ex-dividend: February 26

- Payment date: March 5

February 7, 2025 - 10:08 am

Here’s a neat link that was shared with me. This retirement distribution calculator will run very simple to very complex calculations for you. Check it out!

https://www.key.com/personal/calculators/enough-retirement-savings-calculator.html

Note: We do not have a relationship with KeyBank.

February 5, 2025 - 10:08 am

FYI, I sold all of my JFR rights, taking a whole 2 cents a piece for them. I think we will have an opportunity to pick up JFR shares on the cheap after the rights offering goes through.

February 5, 2025 - 10:01 am

Good news for SFL:

The court today issued a judgment in favor of SFL’s subsidiary where certain subsidiaries of Seadrill were ordered to pay SFL an amount equivalent to a total of approximately $ 48 million in compensation, including late payment interest and legal cost, as a result of its breach of contract upon redelivering the rig to SFL.

February 4, 2025 - 10:08 am

OCSL has reduced its regular dividend, but included a supplemental. Here is the info from the earnings press release:

- A quarterly and supplemental cash distribution was declared of $ 0.40 per share and $ 0.07 per share, respectively, payable in cash on March 31, 2025 to stockholders of record on March 17, 2025. The modification to the dividend policy introduces a stable base dividend, which is anticipated to be sustainable across market cycles, amid fluctuations in rates and spreads.

January 26, 2025 - 1:26 pm

Thursday’s webinar replay has been posted.

This past Thursday we hosted a live webinar with Kate Butta from Ignite Funding. She shared how trust deed investing works and how it easy it is for income investors to get started.

I’ve posted the replay of the video in the Dividend Hunter Insiders section of the members area of the website. You can watch it here.

January 21, 2025 - 9:16 am

Final tax status for UTG 2024 dividend. Note that they are almost 100% tax advantage long term gains or qualified dividends.

January 20, 2025 - 8:23 am

InfraCap MLP ETF (NYSEARCA:AMZA) declares $ 0.29/share monthly dividend.

Payable Jan. 28; for shareholders of record Jan. 21; ex-div Jan. 21.

This gives us an 11.5% increase in the dividend!

January 16, 2025 - 3:45 pm

Today’s Dividend Hunter Insiders live session starts at 4:30 p.m. eastern today.

Just use this link at that time to join: https://us02web.zoom.us/j/821281240

January 16, 2025 - 10:30 am

Join me next Thursday – January 23rd – as I host a live webinar with Kate Butta from Ignite Funding. Ignite offers a compelling alternative investment program for steady income in the real estate space. We’ve had Kate join us a couple times previously and her presentation is always well received.

The webinar starts at 8:00 p.m. eastern on Thursday, January 23rd. Here’s the link to attend: https://us02web.zoom.us/j/87263595011

The title of her presentation is “Trust Deeds: The Investment You Shouldn’t Overlook in 2025”

We’ll explore the benefits of trust deed investing. Learn how Trust Deeds offer attractive returns and portfolio diversification. Understand key risks, how working with Ignite Funding helps mitigate risk, and why trust deeds are a compelling choice for 2025.

Here’s the link again, hold on to it: https://us02web.zoom.us/j/87263595011

Presentations like this and private conference calls are another benefit to your Insiders membership.

January 8, 2025 - 11:51 am

KRP is down on the new shares issuance. Share prices always drop when a company puts new shares into the market. These are almost always a good time to add shares. Pick up a few shares of KRP on this drop.

January 8, 2025 - 9:39 am

Plains GP Holdings (PAGP) announced a 20% dividend increase to $ 0.38 per share. Ex-dividend is January 31, with payment on February 14.

January 8, 2025 - 8:36 am

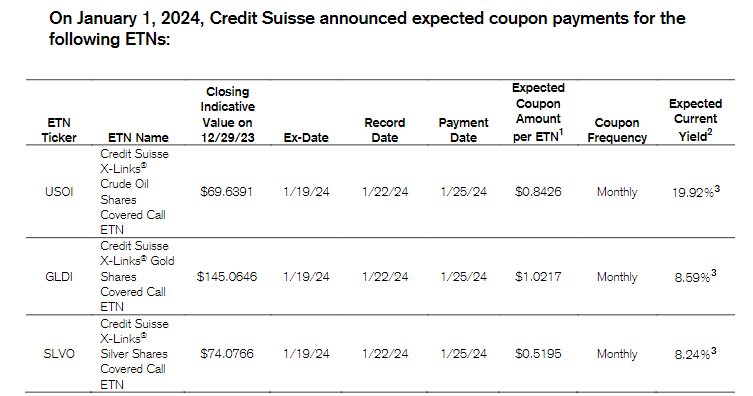

UBS has released the USOI and SLVO dividends for January. We will be staying with USOI whose dividend will be 75% larger based on the same amount of invested money. Ex-dividend is Jan. 22, with payment on Jan. 27.

January 3, 2025 - 11:57 am

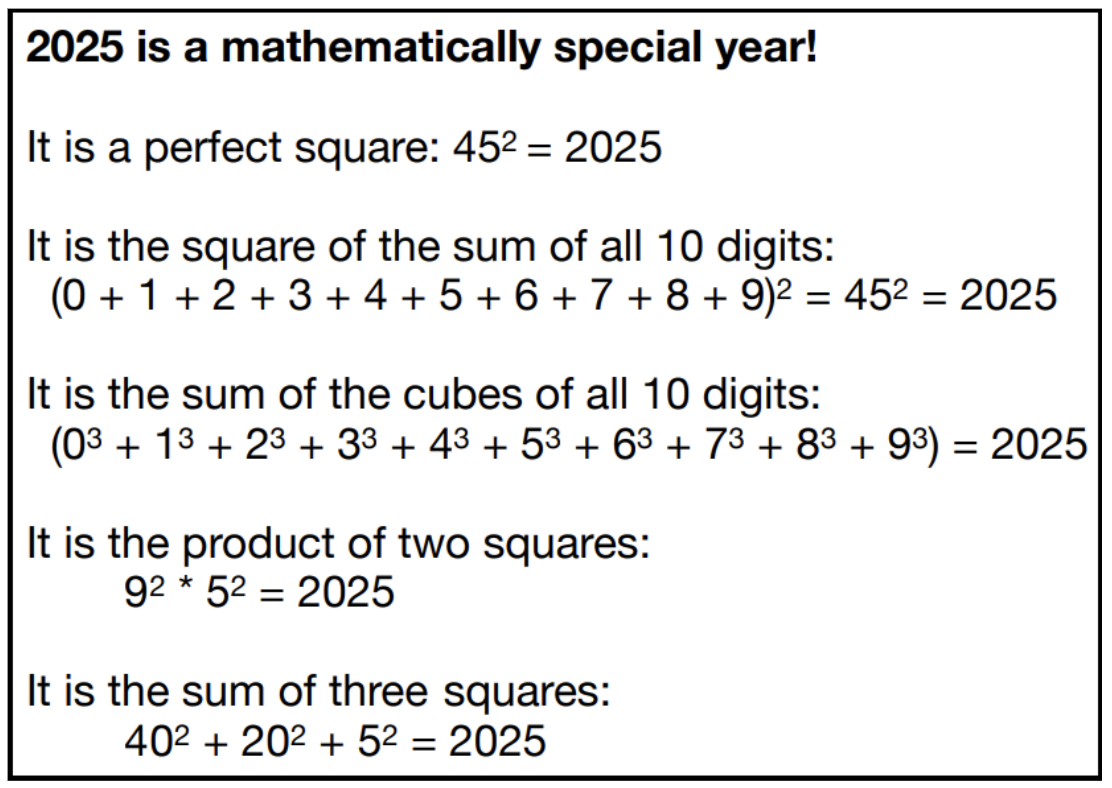

A little math fun with the year 2025:

December 23, 2024 - 1:46 pm

Here’s a very informative article about Plains All American Pipeline (PAA/PAGP):

December 19, 2024 - 10:06 am

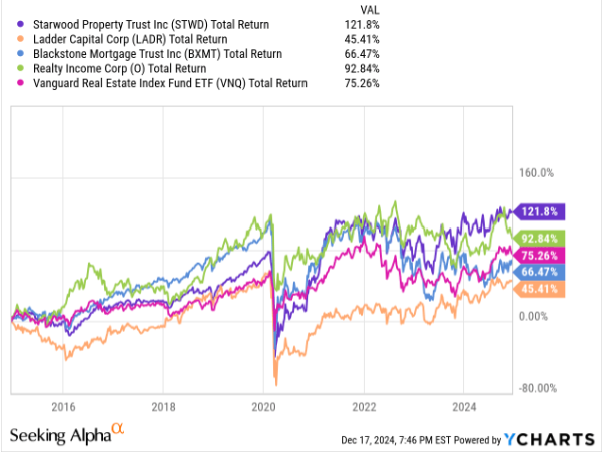

A sharp-eyed subscriber found this chart on Seeking Alpha and shared it with me. Now I am sharing it with you. STWD looks good for the long run.

December 13, 2024 - 4:40 pm

I received this today and thought it was worth sharing…

Tim: An Update!

Morningstar 5-star rating of RISR.

Hi Tim: One benefit of passing the three-year mark is that we became eligible to be rated by Morningstar, which reviews and publishes rating on mutual funds and ETFs.

We recently were assigned a 5-star rating by the widely followed fund rating firm Morningstar. This is their highest rating and is only granted to the top 10% of funds within an investment category

RISR had a 5-star overall rating and ranked #1 against 272 funds in Morningstar’s Nontraditional Bond Funds category over a 3-year period ending 9/20/24 with a > 70% total return since inception. RISR has outperformed the average ETF in our category by more than 55%.

CORRELATION:

Correlation Between RISR and Benchmark Indexes

November 30, 2023-November 30, 2024

Index

Correlation

Bloomberg US Aggregate Bond Index -0.589

ICE US Treasury 20+ Year Bond Index -0.562

ICE US Treasury 7-10 Year Bond Index -0.585

S&P 500 Stock Index -0.129

Nasdaq-100 Total Return Index -0.116

Source: Bloomberg, LP

As the table shows, RISR has exhibited a low or negative correlation to important investment benchmarks. https://mail.google.com/mail/u/0/?ik=3248401ef2&view=pt&search=all&permthid=thread-f:1818340171041550112&simpl=msg-f:1818340171041550112 1/3

12/13/24, 10:22 AM Gmail – Morningstar Rates RISR

For instance, the correlation between RISR on the S&P 500 is -0.129. The correlation to the tech-heavy Nasdaq 100 is even lower at -0.116.

By the standard most professional investor use, this is a very low correlation and suggests that adding RISR to a portfolio holding either of two broad stock market indexes could materially reduce overall risk.

Turning from equities to bonds, RISR’s correlation to the Bloomberg Aggregate Index at 0.589 indicates a strong inverse relationship between returns from RISR and the broad fixed income market. A similar degree of negative correlation has been observed for long term (20+ years) and intermediate term (7-10 years) Treasury bond indexes.

These are highly desirable correlation characteristics for a broad range of investors, many of whom hold balanced portfolios containing a mix of equity and fixed income assets, including but not limited to the classic 60/40 stock/bond blend favored by many financial advisors. Including RISR in such portfolios can meaningfully reduce risk, while not sacrificing yield. RISR’s current yield of [7%], far exceeds the current yield for any of the indexes in Table 1, which range from a high of 3.97% for the 20+ year treasury index, to a low of 0.58% for the Nasdaq 100.

George Lucaci

Global Head of Distribution/Partner

FolioBeyond.com

908 723 3372 cell

December 13, 2024 - 2:29 pm

On this day in 1972, Eugene Cernan and Harrison Schmitt become the last [known] humans to walk on the surface of the moon.

December 12, 2024 - 12:26 pm

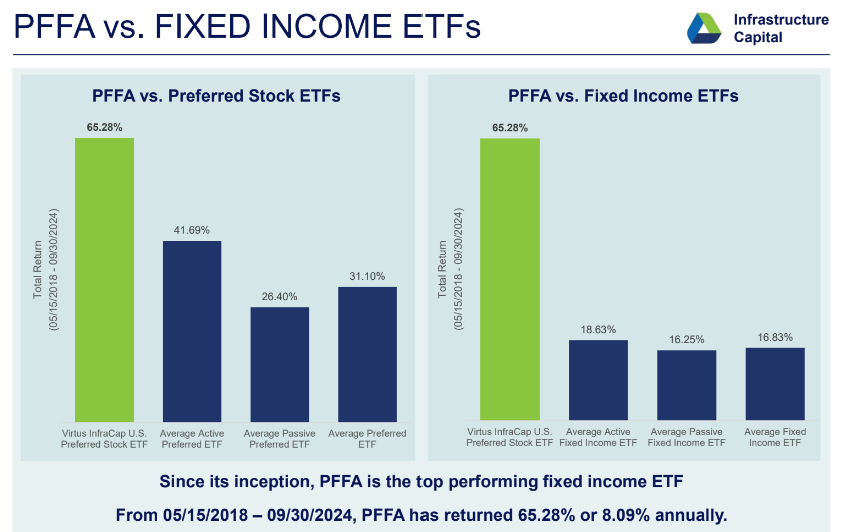

Just a quick reminder about today’s live private conference call with Jay Hatfield from Infracap. He’s joining us at 4:30 p.m. eastern today to share his investing outlook for 2025. Use this link to join us at that time: https://us02web.zoom.us/j/87125082500

A replay will be posted to the Dividend Hunter Insiders section of the members area.

Live conference calls with fund managers and other investing experts are another free benefit of your Insiders subscription.

December 11, 2024 - 3:22 pm

Tomorrow we’re hosting a special live session with Jay Hatfield from Infracap. He’s going to give us his 2025 outlook and, you’ll be able to ask questions live and in real-time.

Jay manages a number of funds that Dividend Hunter readers are already familiar with including AMZA, PFFA, and ICAP among others.

The presentation starts at 4:30 p.m. eastern on 12/12/24.

Here’s the link to attend: https://us02web.zoom.us/j/87125082500

Hope to see you there!

December 10, 2024 - 10:03 am

More positive news about OCSL:

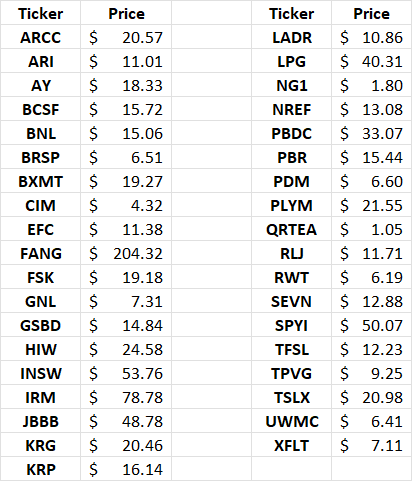

December 9, 2024 - 10:07 am

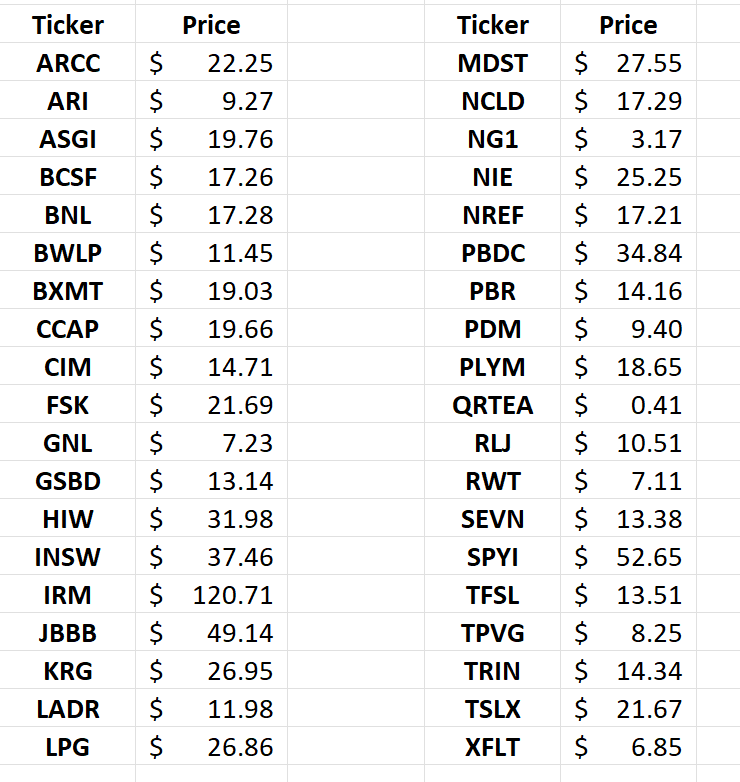

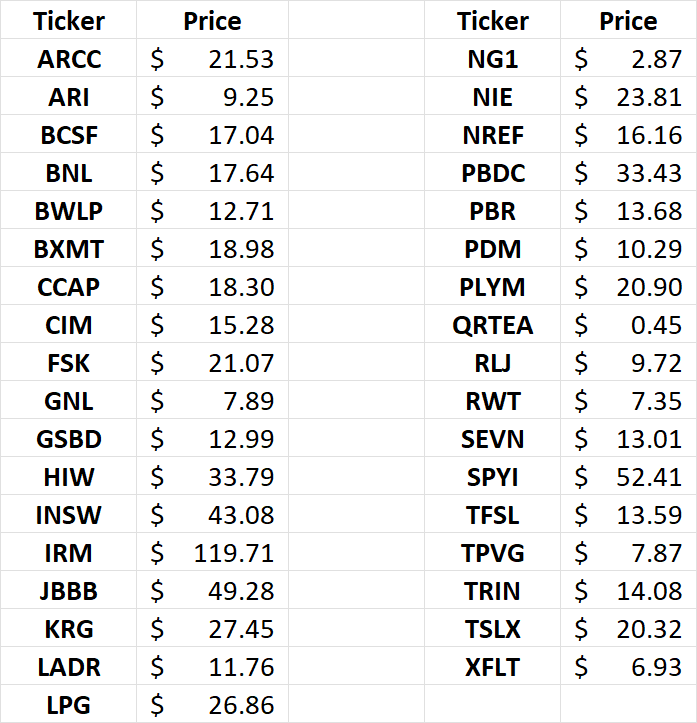

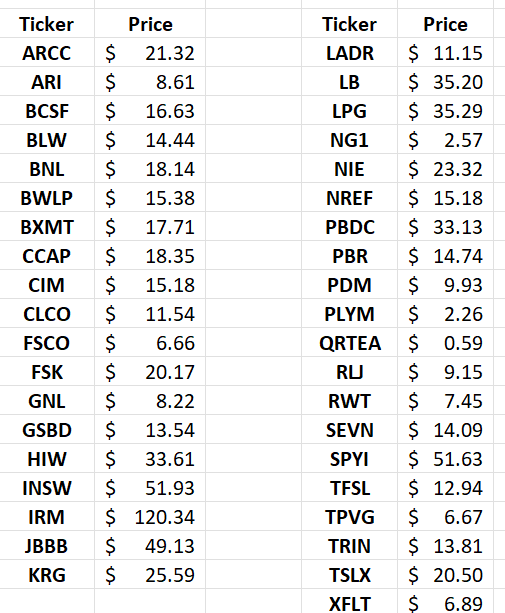

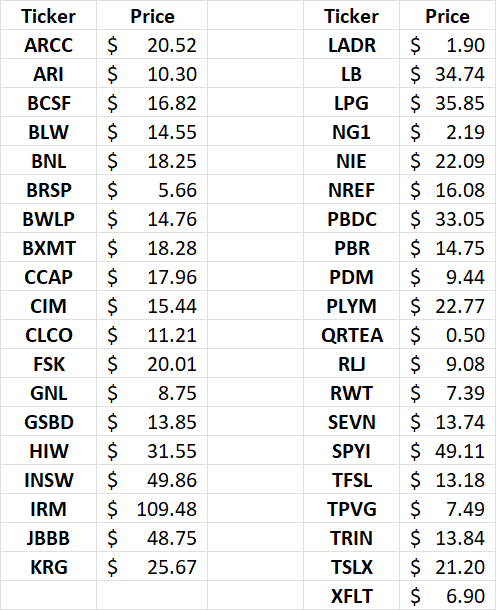

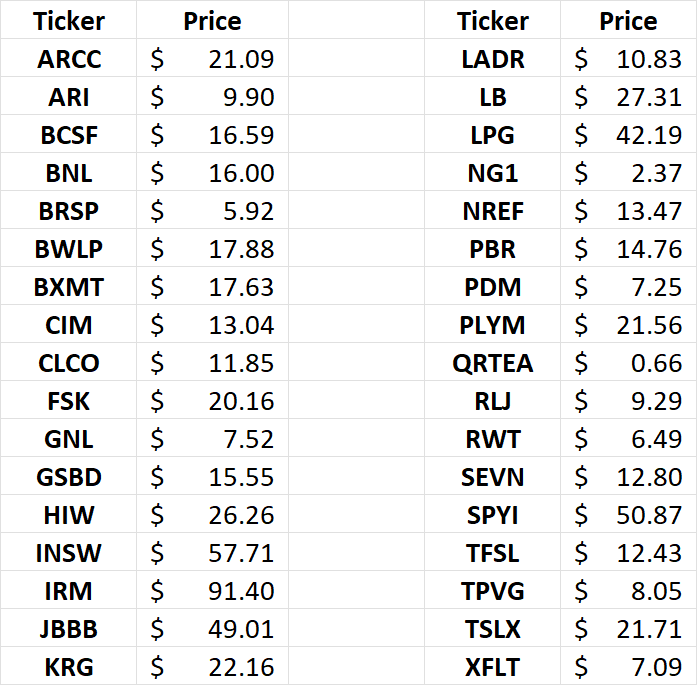

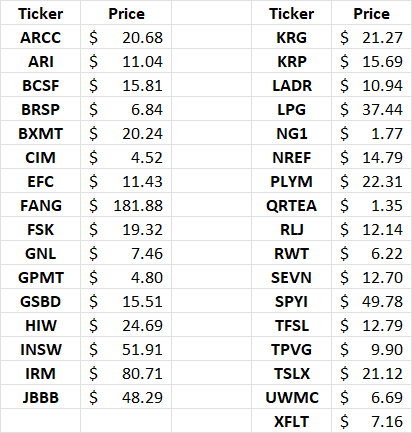

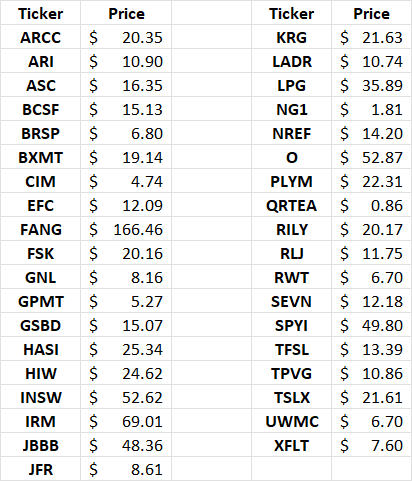

Here is my Dividend Hunter watchlist. These are stocks I keep tabs on for various reasons. For example, some are the common shares of the preferred stocks we own. These are NOT recommended investment.

December 5, 2024 - 10:06 am

Check out this article that I came across outlining why there is strong potential for KRP in the future.

KRP Stock: 25% Upside with This 10.24%-Yielder?

December 2, 2024 - 10:40 am

Today OneGold is selling U.S. Gold and U.S. Silver at the spot price with no added premium. If you don’t have a OneGold account this link will get you if you invest at least $ 1,000.

https://www.onegold.com/join/276abe842a2243d6b249197557566f9f

Sale days when they wave the premium is a good deal. For example the premium for gold is about $ 8.00 per oz. At OneGold you can invest any dollar amount or fractions of an ounce.

December 2, 2024 - 9:35 am

A good read on STWD.

Charles Schwab Investment Management Inc. Has $ 43 Million Stake in Starwood Property Trust, Inc.

November 27, 2024 - 11:04 am

- Qurate Retail 8.0 Cumulative Redeemable Pref Shs (NASDAQ:QRTEP) declares $ 2.00/share quarterly dividend, in line with previous.

- Forward yield 20.4%

- Payable Dec. 16; for shareholders of record Dec. 2; ex-div Dec. 2.

November 21, 2024 - 11:24 am

TRMD went ex-dividend today. $ 1.20 per share will be paid on Dec. 4. I am buying a few more shares on the ex-dividend drop.

November 18, 2024 - 4:50 pm

November 11, 2024 - 10:05 am

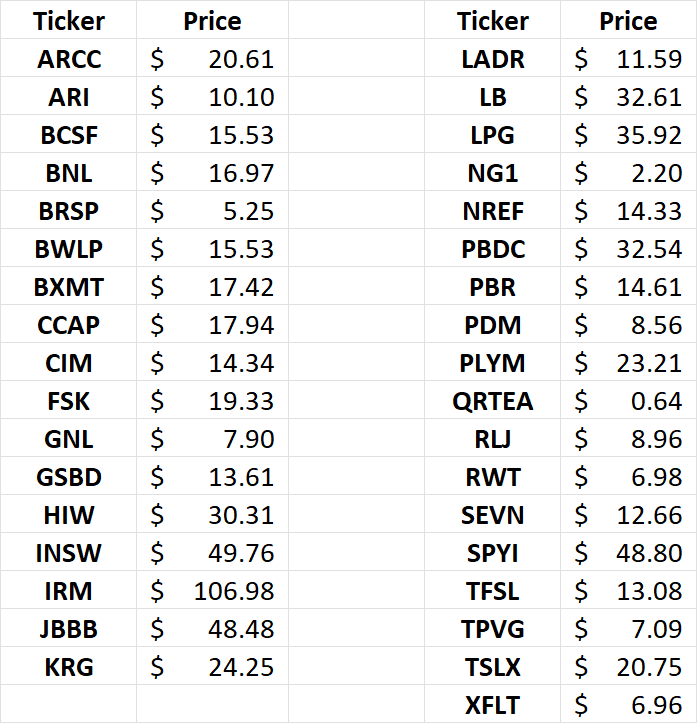

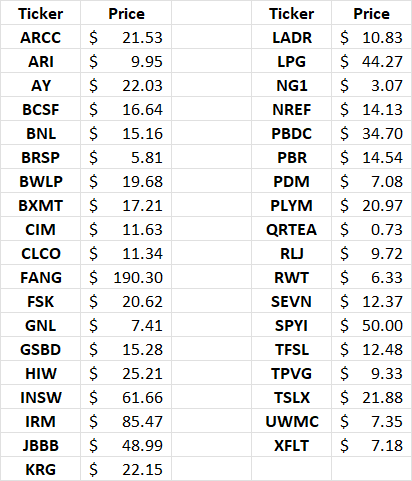

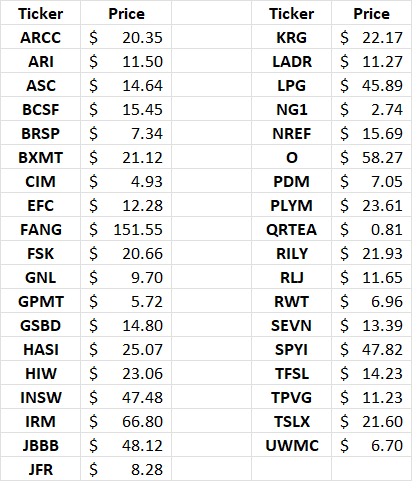

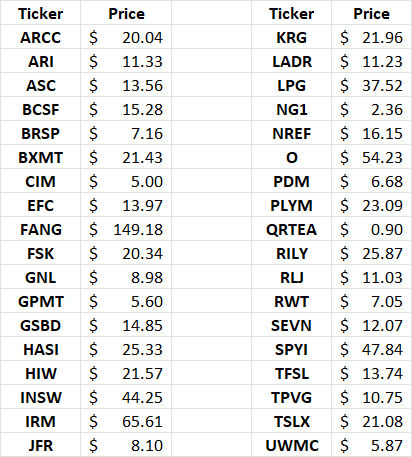

Here is my Dividend Hunter watchlist. These are stocks I want to keep an eye for a variety of reasons. They are not recommended investments.

November 7, 2024 - 4:39 pm

The email today cancelling the Dividend Hunter Insiders webinar was incorrect. We are live now!

https://us02web.zoom.us/j/821281240

November 6, 2024 - 9:14 am

SFL dividend:

The Board of Directors has declared a quarterly cash dividend of $ 0.27 per share. The dividend will be paid on or around December 27, 2024. The record date and ex-dividend date on the New York Stock Exchange will be December 13, 2024.

November 5, 2024 - 11:06 am

MAIN announces Q1 dividends. The rate grows by one-half cent. Also, a $ 0.30 supplemental will be paid on Dec. 27.

Summary of First Quarter 2025 Regular Monthly Dividends

|

Declared |

Ex-Dividend Date |

Record Date |

Payment Date |

Amount Per Share |

|

11/4/2024 |

1/8/2025 |

1/8/2025 |

1/15/2025 |

$ 0.25 |

|

11/4/2024 |

2/7/2025 |

2/7/2025 |

2/14/2025 |

$ 0.25 |

|

11/4/2024 |

3/7/2025 |

3/7/2025 |

3/14/2025 |

$ 0.25 |

|

Total for First Quarter 2025: |

$ 0.75 |

|||

October 16, 2024 - 12:49 pm

Reaves Utility Income Fund (UTG) just published their quarterly fact sheet. You can find it here: https://www.investorsalley.com/wp-content/uploads/UTG_Fact_-Sheet_20240930.pdf

October 14, 2024 - 10:55 am

Here is the list of stocks on my Dividend Hunter watchlist. These are not recommended investments, but are stocks I want to follow for a variety of reason. Some are competitors to our stocks. Another example would be the common shares for preferred stocks we own.

October 8, 2024 - 10:07 am

The October dividends for USOI and SLVO have been posted. We will be selling USOI and buying SLVO before the Oct. 22 ex-dividend date. This trade will produce a 90% larger dividend compared to keeping USOI. I will repeat the trade in the Weekly Mailbag video and the next Stock of the Week. You have about 2 weeks to place the trade, but I suggest not pushing it to close to the ex-dividend date.

October 1, 2024 - 10:08 am

The October update to the Monthly Dividend Paycheck Calendar has been posted to the website. You can access it here.

September 26, 2024 - 9:52 am

We have several stocks paying out tomorrow. These include SFL, IVR.PC, AMZA, PFFA, and MAIN.

A special note about MAIN: if you hold MAIN in your portfolio then you know the stock paid a dividend last Friday too. That was the regular monthly dividend. Tomorrow’s is a supplemental dividend payment that’s in addition to the regular dividend payment.

September 25, 2024 - 8:24 am

ICAP increases its dividend:

InfraCap Equity Income Fund ETF (NYSEARCA:ICAP) declares $ 0.185/share monthly dividend, 2.8% increase from prior dividend of $ 0.180.

Forward yield 8.12%

Payable Sept. 30; for shareholders of record Sept. 26; ex-div Sept. 26.

September 20, 2024 - 6:01 pm

I am surprised! Good news for us!

In accordance with the terms of Rithm Capital’s Series A Cumulative Redeemable Preferred Stock (“Series A”), the Board declared a Series A dividend for the third quarter 2024 of $ 0.6988563 per share, which reflects a rate of 11.182%. The Series A Preferred Stock accrue dividends at a floating rate equal to three-month LIBOR plus a spread of 5.802%.

September 10, 2024 - 2:39 pm

SLVO to USOI trade is a win-win in September

UBS has announced the September dividends for SLVO and USOI. This month, selling SLVO and buying USOI offers a big financial advantage.

SLVO is at $ 77.10 and will pay a $ 1.7449 dividend. The share price has increased 6.9% (go silver!) over the last month.

USOI is at $ 66.30 and will pay a $ 2.2149 dividend. It is down 5.6% over the last month (oil has been ugly).

I see the trade to sell SLVO and buy USOI as a win-win. With the share prices, we are selling high and buying low.

The swap will leave us with about 15% more shares of USOI than the number of SLVO shares sold. The math shows that the USOI dividend earned will be 48% larger than if we keep SLVO.

The two ETNs go ex-dividend on September 20. Make sure you do the swap trade before that date.

September 9, 2024 - 9:09 am

Listed below is my Dividend Hunter watchlist. I follow these stocks for a variety of reasons. They are not recommended investments. For example, the list includes the common shares of our preferred stocks. Most of the share prices were up nicely compared to a month ago.

September 3, 2024 - 4:03 pm

Correction: the JEPQ dividend to be paid on Friday will be $ 0.55686 per share. Still a nice increase from last month.

September 3, 2024 - 8:52 am

- JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) declares a $ 0.5568/share monthly dividend, up 13 cents from last month.

- Payable Sept. 5; for shareholders of record Sept. 3; ex-div Sept. 3.

August 29, 2024 - 4:04 pm

My coffee brand, Expedition Joe, is having a Labor Day sale. Nice 15% discount. My favorite is the Paddlers Brew.

August 19, 2024 - 11:03 am

Qurate Retail 8.0 Cumulative Redeemable Pref Shs (NASDAQ:QRTEP) declares $ 2.00/share quarterly dividend, in line with previous.

Forward yield 19.68%

Payable Sept. 16; for shareholders of record Sept. 3; ex-div Sept. 3.

August 14, 2024 - 6:20 pm

SFL dividend announcement:

The Board of Directors has declared a quarterly cash dividend of $ 0.27 per share. The dividend will be paid on or around September 27. The record date and ex-dividend date on the New York Stock Exchange will be September 11, 2024.

August 14, 2024 - 3:01 pm

Apparently a few of my readers didn’t receive the email about this afternoon’s webinar so I’m posting details here. It’s at 4:30 p.m. eastern today, so there’s still time.

A possible – some say probable – Fed rate cut is in the cards for September. It will have an impact on the market and on our portfolios. So we’re hosting a live webinar this afternoon to talk about how to plan for it.

Along with my colleague Steve Reitmeister we’ll show you the winning recipe for outperforming in the new landscape post Fed rate cut – that could happen in September 18.

The surprise correction early last week was the perfect example of why you need to attend our exclusive webinar “Market Opportunities Post-Fed Rate Cut”.

In the live webinar you will learn:

- How to capitalize on the surprise correction and buy the dip…

- Which stocks are poised to outperform in the new market environment post-Fed rate cut…

- Actionable insights and proven strategies from me and my special guest, Tim Plaehn.

Plus…

As a webinar attendee, you’ll receive complimentary access to our advanced Ratings System. Uncover the true potential of your stocks and make informed decisions about your portfolio.

Sign up here to get the webinar link and more details.

August 13, 2024 - 11:17 am

August 12, 2024 - 10:00 am

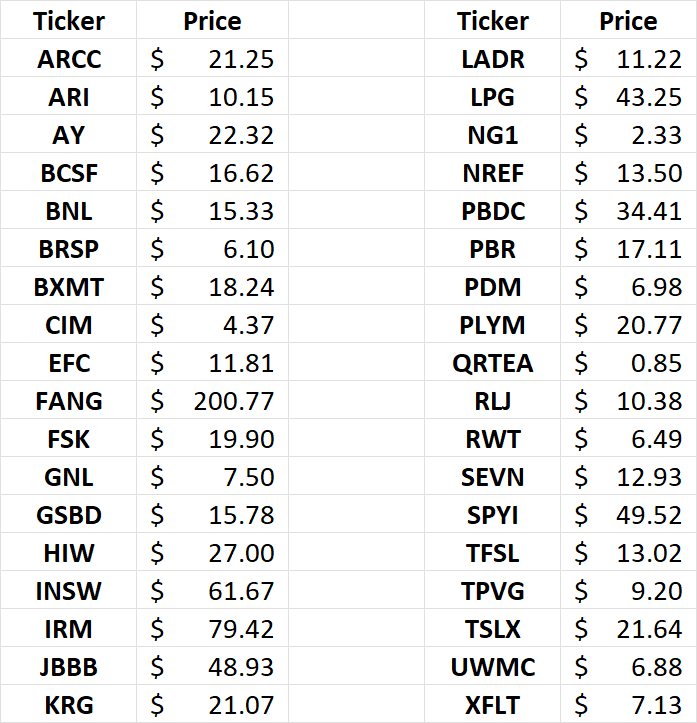

Here is my watchlist for the Dividend Hunter. These are stocks I watch for a variety of reasons, and are not recommended investments. Over the last month stock price trends have been mixed, mostly based on earnings results. REITs have done well. BDC share prices have struggled. It’s a good time for high-yield investing.

August 7, 2024 - 4:46 pm

Blue Owl Capital Corp (OBDC) dividends. Note payment of regular and supplemental are on different dates:

The Company’s Board declared a third quarter 2024 regular dividend of $ 0.37 per share for stockholders of record as of September 30, 2024, payable on or before October 15, 2024.

The Board also declared a second quarter 2024 supplemental dividend of $ 0.06 per share for stockholders of record as of August 30, 2024, payable on or before September 13, 2024.

August 7, 2024 - 4:19 pm

Sitio Royalties (STR) declared a cash dividend of $ 0.30 per share of Class A Common Stock with respect to the second quarter of 2024. The dividend is payable on August 30, 2024 to the stockholders of record at the close of business on August 19, 2024.

August 7, 2024 - 10:31 am

UBS has declared the August dividends for SLVO and USOI. Again this month, SLVO pays significantly more. On an equal dollar amount, the SLVO dividend will be 235% larger. We will keep our money in SLVO this month.

August 6, 2024 - 11:48 am

- Main Street Capital (NYSE:MAIN) declares $ 0.245/share monthly dividend, in line with previous.

- Forward yield 6.25%

- Payable Oct. 15; for shareholders of record Oct. 8; ex-div Oct. 8.

- Payable Nov 15; for shareholders of record Nov 8; ex-div Nov 8.

- Payable Dec 13; for shareholders of record Dec 6; ex-div Dec 6.

- Additionally, the board declared a supplemental cash dividend of $ 0.30 a share payable on Sep 27 to shareholders on record of Sep 20; ex-div Sep 20.

August 5, 2024 - 10:09 am

Outage at Schwab. Subscribers have written me about not being able to log into their Schwab accounts. I am having the same issue. It stinks, but it is something we can do nothing about. I am confident they will get the site working soon. Just don’t panic. Today is a day where staying calm will be better for your mental health.

Tim

August 2, 2024 - 10:39 am

ABR earnings were solid, beating Wall Street estimates for distributable income. A $ 0.43 dividend (unchanged) was declared and will be paid on August 30. I will listen to the earnings call over the weekend.

July 31, 2024 - 10:09 am

Some stock announcements today:

RITM announced is quarterly earnings of $ .47 per share beating the Zacks Consensus Estimate of $ .42 per share. The company has surpassed quarterly estimates over the past 4 quarters now. The latest report shows a 11.9% earnings increase over expectations.

Also today, OMF announced a dividend payout for August 16th of $ 1.04 per share. This is for shareholders of record August 12, ex-div August 12th.

July 30, 2024 - 10:15 am

A couple of dividend announcements:

For those of us that still own GMLPF: Golar LNG Partners LP, an indirect subsidiary of New Fortress Energy Inc. (NASDAQ: NFE), has declared a cash distribution of $ 0.546875 per unit of 8.75% Series A Cumulative Redeemable Preferred Units for the period from May 15, 2024, through August 14, 2024. This will be payable on August 15, 2024, to all Series A preferred unitholders of record as of August 8, 2024.

Hercules Capital (NYSE:HTGC) declares $ 0.40/share base quarterly and $ 0.08 supplemental distribution, in line with previous.

Forward yield 9.01% (based on quarterly distribution of $ 0.48/share)

Payable Aug. 20; for shareholders of record Aug. 13; ex-div Aug. 13.

July 29, 2024 - 10:39 am

Last week I came across this interesting piece of information:

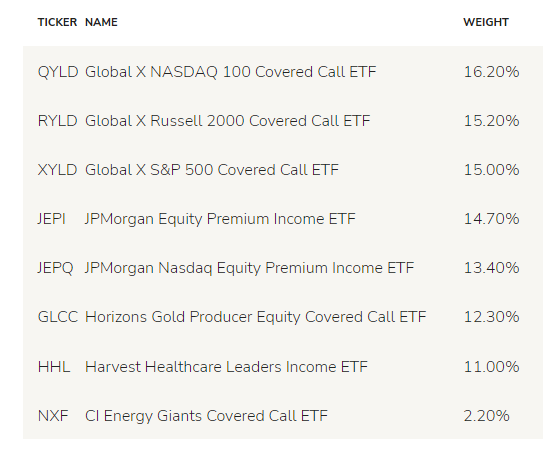

“These hot offerings are known as covered-call or derivative-income exchange-traded funds. Funds in this category recently held $ 87 billion as of July 17 compared with $ 8 billion at the end of 2020, according to FactSet. The number of funds in the group rose to 93 from 14 over the same period.”

I’ve been building out a database of research on these new ETFs – many of them with double digit yields or higher – and am adding more all of the time. You can get details on accessing my research here.

July 24, 2024 - 11:44 am

Yesterday, SFL Corp. (SFL) announced a secondary stock offering of 9.2 million shares. Secondaries almost always produce a short, but temporary share price drop. For a quality company like SFL, this can be a great opportunity to add shares at a great price. SFL is trading for about $ 12.00. Go ahead and pick up some shares.

July 24, 2024 - 11:11 am

So true!!

July 12, 2024 - 1:46 pm

Arbor Realty Trust (ABR) update.

The ABR share price dropped today in a report from Bloomberg that the FBI was looking into the company’s lending and reporting practices. I read the Bloomberg short article. I noticed this line: “…people familiar with the matter…who asked not to be named discussing an ongoing investigation.”

The Bloomberg piece was soon updated with this comment from Arbor:

“We routinely cooperate with regulatory inquiries and are very confident that we conduct ourselves properly,” Arbor said in a statement. “We look forward to our second-quarter earnings call.”

There is heaving insider ownership of ABR including 4 million shares owned by the CEO. I have trouble believing they would commit fraud while being significant owners of the shares.

July 9, 2024 - 2:46 pm

USOI dividend announcement:

| USOI | ETRACS Crude Oil Shares Covered Call ETNs due April 24, 2037 | $ 74.4828 | 7/22/2024 | 7/22/2024 | 7/25/2024 | $ 0.7203 | Monthly | 13.48%g |

July 9, 2024 - 10:50 am

Reminder: I am hosting a webinar on fine wine and whisky investing with Sid from Oeno Futures at 12:00 Eastern today. Here is the link to join:

https://us02web.zoom.us/j/89271938328

July 8, 2024 - 11:36 am

Here is my watchlist for the Dividend Hunter. These are stocks I watch for a variety of reasons, and are not recommended investments. Over the last month stock price trends have been generally positive. It’s a good time for high-yield investing.

June 28, 2024 - 4:26 pm

An informative read:

June 20, 2024 - 9:21 am

My favorite coffee company, Expedition Joe Coffee Company, is having a 4th of July sale, with a 15% discount on all coffee and tea orders through Independence Day. Expedition Joe is veteran-owned and operated. I have tried many of their coffees and all are very good. My current favorite is the Paddlers Brew. I like that I can order the grind that works best in my coffee maker. The sale discount will be applied when you check out. No need for a discount code.

https://expeditionjoecoffee.com/

June 10, 2024 - 9:22 am

Here is my watchlist for the Dividend Hunter. These are stocks I watch for a variety of reasons, and are not recommended investments. Over the last month the number of gainers and losers was pretty evenly split.

May 28, 2024 - 10:41 am

I just received a text message from Jay Hatfield:

” USM buyout by TMobile benefitting PFFA, ICAP and SCAP by about 80bp each.”

May 17, 2024 - 10:00 am

Most weeks I get delivered fresh, fully cooked meals from Factor. It’s really tasty food, and complete meals with listed calories and macros.

I get free boxes to give away. Each box/week includes 6 meals that you select. Cost is about 0/week, but as I said, I have free boxes to give away. You must sign up for a weekly subscription, but can cancel at any time. It’s also easy to skip weeks.

As I said, I really like the food.

If you want to try a box send me an email. You will be sent a free box offer. I have four boxes to give away.

May 15, 2024 - 3:01 pm

- TORM (NASDAQ:TRMD) declares $ 1.50/share quarterly dividend.

- Forward yield 16.33%

- Payable June 4; for shareholders of record May 22; ex-div May 21.

May 15, 2024 - 1:48 pm

A couple of days ago, I sent out a video how I use Magnifi. My inbox has been blowing up ever since. One of my readers wrote in to say “The video you just did with Magnifi was awesome. It really helped me appreciate what Magnifi brings to the table.”

So I wanted to make sure you all got the email. Here it is:

After yesterday’s email about my biggest winners, many of you sent in questions about Magnifi.

So I wanted to share a video from a while a go that will answer most of these questions…

And show you the power of Magnifi.

Take a look – in it, I reveal my favorite Magnifi feature!

Remember – Magnifi works best when you link all your investment accounts to it, letting the AI crunch its numbers on all your holdings.

May 14, 2024 - 12:38 pm

- SFL (NYSE:SFL) declares a $ 0.27/share quarterly dividend, a 3.8% increase from the prior dividend of $ 0.26.

- Forward yield 7.53%

- Payable June 26; for shareholders of record May 28; ex-div May 28.

May 13, 2024 - 12:00 pm

Below you will find my watchlist of stock symbols. These are stocks I want to monitor for a variety of reasons. They are not recommended investments. Many of these stocks are competitors to the Dividend Hunter stocks. Prices are generally higher compared to a month ago.

May 11, 2024 - 11:35 am

If you want to subscribe to The Prism, source of the last post, use this link:

https://www.gurwinder.blog/?r=3tv8r&utm_campaign=referrals-subscribe-page-share-screen&utm_medium=web

May 11, 2024 - 11:30 am

Weekend food for thought:

https://www.gurwinder.blog/p/30-useful-concepts-spring-2024?r=3tv8r&utm_campaign=post&utm_medium=web

May 10, 2024 - 5:42 pm

Before we go too far into the weekend I wanted to tell you about a dividend ETF with a yield of 105%. That’s not a typo.

It’s one of the ETFs in my new ETF Income Edge service that launched recently.

The ex-dividend date is May 16th, meaning if you want part of that dividend you need to own shares by the 15th.

If you’re not an ETF Income Edge member click here for details and find out how to get the ticker and information on this 105% dividend payer.

May 9, 2024 - 11:36 am

- Sitio Royalties Corp. (NYSE:STR) declares $ 0.41/share quarterly dividend, in line with previous.

- Forward yield 8.3%

- Payable May 31; for shareholders of record May 21; ex-div May 17.

May 9, 2024 - 11:12 am

The Board of Directors of Chimera also announced the declaration of its second quarter cash dividend of $ 0.7094 per share of 8% Series B Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock, which reflects a rate of 11.35084%, equal to three-month CME Term SOFR (plus a spread adjustment of 0.26161%) on the dividend determination date plus a spread of 5.791%. The dividend is payable July 1, 2024 to preferred shareholders of record on June 3, 2024. The ex-dividend date is June 3, 2024.

The fixed dividend for CIM.PrB had been $ 0.50 per share.

May 9, 2024 - 9:02 am

Yes, I see the SLVO dividend.

May 7, 2024 - 8:07 am

- Main Street Capital (NYSE:MAIN) declares $ 0.245/share monthly dividend, 2.1% increase from prior dividend of $CONTENT.240.

- Forward yield 5.81%

- Payable July 15; for shareholders of record July 8; ex-div July 8.

- Payable Aug 15; for shareholders of record Aug 8; ex-div Aug 8.

- Payable Sept. 13; for shareholders of record Sept. 6; ex-div Sept. 6.

- Additionally, the board declared a supplemental cash dividend of $ 0.30 per share payable on June 27, 2024, to shareholders on record of June 21, 2024.

May 2, 2024 - 3:38 pm

From the UTG quarterly dividend update:

Reaves Utility Income Fund owned 57 common stocks as of 3/31/24, 54 of which paid a cash dividend in Q1 2024. In the past 12 months, 49 increased their dividend, five maintained the same payment, and none reduced the dividend. The weighted average dividend increase was 7.7%.

May 1, 2024 - 3:00 pm

A quick ticker with some great news for you!

I know many of you use Fidelity to manage your investments – whether it’s in the form of 401(k)s, IRAs, brokerage accounts, or what have you.

If that’s you, you’re in luck!

You now have access to ,000+ worth of financial tools, free of charge, as part of your membership to my services.

Simply click here to link your Fidelity accounts to Magnifi – and start getting AI-powered insights on how to optimize your investments and dividends.

And don’t worry – you don’t need a Fidelity account to take advantage of Magnifi’s research and analysis tools. Link whatever investment or retirement accounts you have by clicking here.

April 30, 2024 - 12:49 pm

- OneMain Holdings (NYSE:OMF) declares $ 1.04/share quarterly dividend, 4% increase from prior dividend of $ 1.00.

- Forward yield 8.18%

- Payable May 17; for shareholders of record May 10; ex-div May 9.

April 30, 2024 - 8:50 am

HTGC dividend:

he Total Cash Distribution of $ 0.48 per Share for the First Quarter 2024 is Comprised of a $ 0.40 per Share Base Distribution and an $ 0.08 per Share Supplemental Distribution

Ex-div: 5/14

Pay date: 5/21

April 29, 2024 - 11:02 am

I have confirmation from a managing director at the company that the Symplify funds and SVOL is off Fidelity’s ticket charge list.

April 26, 2024 - 12:29 pm

If you have some free time at 4:15 p.m. eastern today then join me and Jay Soloff as we’re interviewed by Joe Riley of “Talk Money to Me.” We’ll talk about our new high-yield covered call ETF newsletters, discuss trends in the market, and how we’re helping individual investors overcome some of their most common challenges with investing. This is live, so come ready with questions.

Sign up to get the link here: https://streamyard.com/watch/jifYU8DWj7cp

April 13, 2024 - 10:45 am

Some interesting reading for your weekend:

April 8, 2024 - 9:46 am

Below you will find my watchlist of stock symbols. These are stocks I want to monitor for a variety of reasons. They are not recommended investments. Many of these stocks are competitors to the Dividend Hunter stocks. Most prices are down over the last month. Energy related stocks have done well.

April 5, 2024 - 10:10 am

April 1, 2024 - 12:57 pm

JEPQ declares dividend of $ 0.42728, up from $ 0.38037 last month

JEPI dividend of $ 0.34519, up from $ 0.30085

Payment date is April 4

March 29, 2024 - 11:10 am

Peter Zeihan is a very smart guy (another Iowa born) with a very different approach to looking at what goes on in the world. His 2022 book, The End of the World is Just the Beginning, is a fascinating read. He puts out a daily Youtube video covering a wide range of topics. This is one I think you should share with your children, grandchildren and any other younger people in your life.

March 28, 2024 - 12:39 pm

From a subscriber great baseball quotes:

“Us ballplayers do things backward. First we play, then we retire and go to work.” — Charlie Gehringer

“The funny thing about these uniforms is that you hang them in the closet and they get smaller and smaller.” — Curt Flood

“Sure I played, did you think I was born age 70 sitting in a dugout trying to manage guys like you?” — Casey Stengel, to Mickey Mantle

“The way to catch a knuckleball is to wait until the ball stops rolling and then to pick it up.” — Bob Uecker

“All I remember about my wedding day in 1967 is that the Cubs lost a doubleheader.” — George F. Will

“It ain’t like football. You can’t make up no trick plays.” — Yogi Berra

“You don’t realize how easy this game is until you get up in that broadcasting booth.” — Mickey Mantle

“If you get three strikes, even the best lawyer in the world can’t get you off.” — Bill Veeck

“Bob Gibson is the luckiest pitcher I ever saw. He always pitches when the other team doesn’t score any runs.” — Tim McCarver

“Trying to sneak a pitch past Hank Aaron is like trying to sneak the sunrise past a rooster.” — Joe Adcock

“When you start the game, they don’t say ‘Work ball!’ they say ‘Play ball!'” — Willie Stargell

March 27, 2024 - 1:05 pm

Thought of the day:

Dator’s Law is named after Jim Dator, Professor Emeritus, and former Director of the Hawaii Research Center for Futures Studies.

It posits that, “Any useful statement about the future should appear to be ridiculous.”

March 26, 2024 - 11:04 am

I just notices that the RITM share price is up 41% over the last 12 months. Nice and stealthy!

March 14, 2024 - 11:27 am

The International Energy Agency has just said that global oil markets face a supply deficit throughout 2024, instead of the surplus previously expected.

March 12, 2024 - 10:53 am

March 11, 2024 - 10:20 am

Below you will find my watchlist of stock symbols. These are stocks I want to monitor for a variety of reasons. They are not recommended investments. Many of these stocks are competitors to the Dividend Hunter stocks. Most prices are up over the last month. The ones that have fallen I would classify as poor quality companies.

March 10, 2024 - 2:24 pm

The folks from Goldbacks had a booth at the Las Vegas MoneyShow. I spent some time talking to them, and I was very intrigued. This weekend I placed my first order for some South Dakota (my home) Goldbacks. There is a lot of good info on their website at https://www.goldback.com/

I ordered my Goldbacks from this reseller: https://defythegrid.com/product-category/gold/aurum/goldbacks/

I find this new (launched in 2019) gold product very interesting. They can be an investment. One Goldback has appreciated from about $ 2.50 in 2019 to a current $ 4.70. They can be collectibles, with the different State offerings, and possibly more to come. They can be used as currency, with over 2,000 businesses now accepting them as payment, and more joining all the time.

I have no business relationship with Goldbacks. I am sharing this with you because I find it interesting and I have just started my Goldback collection.

March 8, 2024 - 12:09 pm

TRMD dividend of USD 1.36 per share to be paid to the shareholders corresponding to an expected total dividend payment of approximately USD 126m. The payment date is 24 April 2024 to all shareholders of record as of 16 April 2024, and the ex-dividend date is 15 April 2024.

February 28, 2024 - 6:41 pm

EPR announces Increase in Monthly Dividend – Based on the Company’s expectation of its

financial results for 2024, the Company is announcing an increase in its monthly dividend of

3.6%.

February 22, 2024 - 5:31 pm

From the MAIN earnings release:

“Our distributable net investment income exceeded the total dividends paid to our shareholders by over 13% for the fourth quarter and over 17% for the full year,” he added, even with a 25% climb in the total dividends paid to shareholders last year.’

February 21, 2024 - 5:20 pm

Great results from the OBDC earnings release, including a dividend increase:

- Total dividends of $ 1.59 per share paid to shareholders in 2023, an increase of approximately 25% from the prior year

- Delivered a total return of greater than 40%1 for 2023

- For the first quarter 2024, increased quarterly dividend by $ 0.02 to $ 0.37 per share, marking the third dividend increase since the fourth quarter 2022

- NAV per share increased to $ 15.45 compared to $ 15.40 as of September 30, 2023

February 14, 2024 - 9:37 am

- SFL (NYSE:SFL) declares $ 0.26/share quarterly dividend, 4% increase from prior dividend of $ 0.25.

- Forward yield 8.65%

- Payable March 28; for shareholders of record March 15; ex-div March 14.

February 13, 2024 - 10:43 am

Also from HTGC:

Board of Directors has declared a new supplemental cash distribution of $ 0.32 per share.

The New Supplemental Cash Distribution is in Addition to the Regular Quarterly Cash Distributions and will be Distributed Equally over Four Quarters Beginning with the Fourth Quarter of 2023 Distribution Payable in March of 2024

The New Supplemental Cash Distribution of $ 0.08 per Share for the Fourth Quarter of 2023 is in Addition to the Regular Quarterly Cash Distribution of $ 0.40 per Share

February 13, 2024 - 10:37 am

- Hercules Capital (NYSE:HTGC) declares $ 0.40/share quarterly dividend, in line with previous and $ 0.08 per share supplemental distribution.

- Forward yield 9.2%

- Payable March 6; for shareholders of record Feb. 28; ex-div Feb. 27.

February 12, 2024 - 12:42 pm

Below you will find my watchlist of stock symbols. These are stocks I want to monitor for a variety of reasons. They are not recommended investments. Many of these stocks are competitors to the Dividend Hunter stocks. Earnings season is in full swing, and I will be looking at comparative results.

February 9, 2024 - 12:02 pm

Credit Suisse has announced the February dividends for SLVO and USOI. The payment date is 2/26 with ex-dividend on 2/20. Here are the dividend amounts:

- SLVO: $ 0.4387

- USOI: $ 1.5447

The USOI dividend is attractive, but the SLVO payout is unacceptable. I will be recommending the sale of SLVO with Monday’s Stock of the Week email. I have not yet decided if there will be a replacement investment. More information will be available next week during the live Insiders webinar and on the Weekly Mailbag video.

February 6, 2024 - 1:49 pm

This is a test of the Daily Ticker texting service. No action required.

January 31, 2024 - 3:46 pm

I gave bad info to a few subscribers via email, you can preregister for the InfraCap webinar coming up in about an hour. Here is the registration link:

https://us02web.zoom.us/webinar/register/WN_VfwxTHn8SRiTAlBNFVsF7A

January 31, 2024 - 11:44 am

I have been building my position in ABR since 2017. As a result, my holdings are nicely positive based on average cost and current share price. I couldn’t resist the big share price drop today and I bought some more ABR. The company will report earnings on Feb 15, and declare the next dividend at that time.

January 31, 2024 - 9:21 am

The first of our upcoming guest webinars is this afternoon. Here are the links to join:

-

01/31/24 at 4:30 Infracap webinar: https://us02web.zoom.us/

webinar/register/WN_ VfwxTHn8SRiTAlBNFVsF7A -

02/07/24 at 8:00 Energea webinar: https://my.demio.com/ref/

1U6EBCGC1OdOMDuB

January 30, 2024 - 11:54 am

As always, Doomberg provides detailed and balanced analysis of the recent LNG rulings by the administration:

January 29, 2024 - 11:49 am

Here are the log-in links for two upcoming webinars. You can always come back to this page to get the links.

-

01/31/24 at 4:30 Infracap webinar: https://us02web.zoom.us/

webinar/register/WN_ VfwxTHn8SRiTAlBNFVsF7A -

02/07/24 at 8:00 Energea webinar: https://my.demio.com/ref/

1U6EBCGC1OdOMDuB

January 21, 2024 - 8:32 am

PFFA dividend increased by 1/4 of a cent to $ 0.1675

January 21, 2024 - 8:12 am

- InfraCap MLP ETF (NYSEARCA:AMZA) declares $ 0.26/share monthly dividend.

- Payable Jan. 30; for shareholders of record Jan. 23; ex-div Jan. 22.

AMZA dividend increased by 8.3%

January 17, 2024 - 4:47 pm

- ONEOK (NYSE:OKE) declared $ 0.99/share quarterly dividend, 3.7% increase from prior dividend of $ 0.955.

- Forward yield 5.73%

- Payable Feb. 14; for shareholders of record Jan. 30; ex-div Jan. 29.

January 12, 2024 - 4:25 pm

EPR just released the tax characteristics of the 2023 dividends. We can talk about it on Thursday’s live webinar.

January 12, 2024 - 4:02 pm

QRTEA/QRTEP information. Yes, real information. A subscriber sent me this article that covers and interview with the Qurate Retail CEO:

https://finance.yahoo.com/lifestyle/qurate-ceo-talks-turnaround-growth-223148955.html

January 8, 2024 - 6:42 pm

New PAGP quarterly dividend of $ 0.3175 per share, up 19% from the 2023 rate. Payment date is February 14, with ex-dividend on January 30. The new rate brings the yield back up to 8%. PAGP dividend up 76% in the last two years.

January 8, 2024 - 2:17 pm

USOI and SLVO projected January dividends. Higher than last month for both.

January 8, 2024 - 9:56 am

Below you will find my watchlist of stock symbols. These are stocks I want to monitor for a variety of reasons. They are not recommended investments. Many of these stocks are competitors to the Dividend Hunter stocks. Earnings season will be here soon, and I will be looking at comparative results.

January 4, 2024 - 1:09 pm

I have received a few questions about Sittio Royalties (STR). The impression is the share price is falling and should we sell. The company completed its merger with MNRL at the start of 2023. You can see from this 2-year chart of the STR share price that the price has been pretty stable over the last year.

December 18, 2023 - 9:21 am

It appears that the 2023 BulletShares ETF (BSCN) has stopped trading. The shares will soon (in a day or two) be replaced by the cash value of the shares in your account. In the Dividend Hunter portfolio BSCN will be replaced by BSCQ. The new fund, BSCQ, has a current yield-to-maturity of 4.96%.

December 12, 2023 - 5:30 pm

I will not host the Dividend Hunter Insiders bi-weekly webinar this week. It will be next week on Thursday, 12/21. The next webinar starts a new every two week cycle. Here are the dates for next year:

TDHI bi-weekly webinar 2024 dates for your calendar: 01/04/24, 01/18/24, 02/01/24, 02/15/24, 02/29/24, 03/14/24, 03/28/24, 04/11/24, 04/25/24, 05/09/24, 05/23/24, 06/06/24, 06/20/24, 07/04/24, 07/18/24, 08/01/24, 08/15/24, 08/29/24, 09/12/24, 09/26/24, 10/10/24, 10/24/24, 11/07/24, 11/21/24, 12/05/24, 12/19/24

December 11, 2023 - 1:11 pm

Below you will find my watchlist of stock symbols. These are stocks I want to monitor for a variety of reasons. They are not recommended investments.

As I updated the prices, most of the share prices have increased over the last month.

December 7, 2023 - 2:31 pm

On December 7th, 1941 our country was forever changed by a sudden attack on the naval base at Pear Harbor. In the decades that have come to pass, we’ve continued to honor the 2,403 individuals lost and reflect on that fateful day.

We remember the names, we commemorate the valor and we salute those who came together during our darkest hour.

December 5, 2023 - 12:11 pm

From OneGold today:

Due to popular demand, we’ve lowered the buy premiums on U.S. Gold and Silver. We received a lot of positive feedback following last week’s Cyber Monday Sale.

As a result, we’ve decided to once again lower pricing on U.S. Gold and Silver. Right now, you can buy U.S. Gold for a premium of only 0.30% and U.S. Silver for only 1% over spot.

You can open and account and get $ 5.00 if you use this link (I also get $ 5.00: https://www.onegold.com/join/276abe842a2243d6b249197557566f9f

December 5, 2023 - 9:35 am

- Credit Suisse X-Links Silver Shares Covered Call ETN (SLVO) declares $ 0.3258/share monthly dividend.

- Credit Suisse Crude Oil Shares Covered Call ETN (USOI) declares $ 0.7674/share monthly dividend.

- Payable Dec. 27; for shareholders of record Dec. 20; ex-div Dec. 19.

Based on the last three dividends, SLVO has an indicative yield of 6.8%, and USOI yields 21.6%

November 30, 2023 - 10:35 am

Next week I am hosting an investment webinar you don’t want to miss. Joining the live webinar is an exclusive perk for Dividend Hunter Insiders.

Tuesday, December 5th at 8:00 p.m. eastern: Ignite title deed investing. Our guest will be Kate Butta who will share with us just what trust deed investments are, how they can fit into a diversified portfolio, and the typical returns that investors see. No registration required, just use this attendance link on the 5th: https://us02web.zoom.us/

November 29, 2023 - 10:20 am

This is from Keith Fitzgerald’s morning email:

Charlie Munger, Warren Buffett’s sidekick of 50+ years, died peacefully in a California hospital yesterday at the age of 99. He’s best known for his take on investing, but the single most important lesson I learned from him had nothing to do with money.

Munger’s optimism made him tick, especially when it was dished out with a slice of wit.

-

On competency, which he called a relative concept… “What I needed to get ahead was to compete against idiots. And luckily, there’s a large supply.”

-

On being profitable versus being right… “Warren, if people weren’t so often wrong, we wouldn’t be so rich.”

-

And on mixing something bad with something good and the inherent need to distinguish between the two… “If you mix raisins with turds, they’re still turds.”

November 22, 2023 - 10:33 am

An exerpt from today’s Doomberg post:

Energy has driven much of geopolitical strategy since the advent of commercially developed fossil fuels. World wars have been decided by which side had the readiest access to oil, and diplomats around the globe seem to grasp why the Middle East sits at the center of much political jockeying—it isn’t because of the sand. Our entire financial system is predicated on cheap, abundant energy and would surely collapse in its absence. Energy is life, the lack of energy is death, and there is not much nuance in between.

Ignoring these widely understood and deeply fundamental axioms of power, the current slate of Western leaders demonstrates a complete lack of knowledge of how the global energy markets work.

https://open.substack.com/pub/doomberg/p/whack-a-mole?r=3tv8r&utm_campaign=post&utm_medium=web

November 21, 2023 - 12:08 pm

Fun headline of the day:

“Leading Economic Index” Predicts Recession for Early 2024, after Having Predicted a Recession for Late 2022, Early 2023, Mid-2023, and Late 2023

November 13, 2023 - 9:02 am

Below you will find my watchlist of stock symbols. These are stocks I want to monitor for a variety of reasons. They are not recommended investments.

As I updated the prices, most of the share prices have increased over the last month.

November 8, 2023 - 1:43 pm

I recently guested on the Aviation Geeks podcast. My part starts about 30 minutes in.

November 8, 2023 - 10:51 am

SFL dividend increased by 4.1%

The company has declared a quarterly cash dividend of $ 0.25 per share. The dividend will be paid on or around December 28, to shareholders of record as of December 15, and the ex-dividend date on the New York Stock Exchange will be December 14, 2023.

November 6, 2023 - 11:24 am

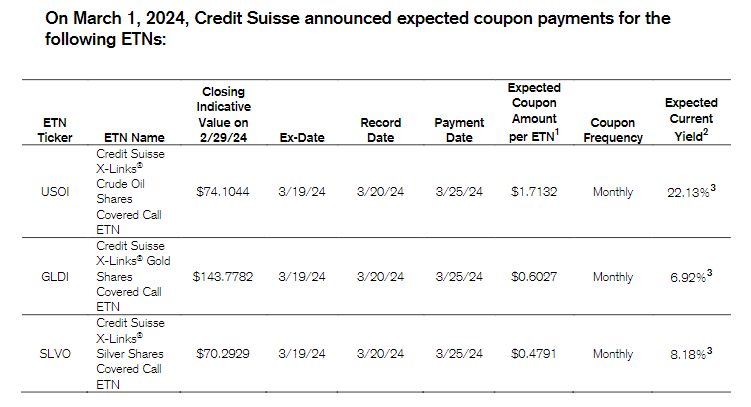

SLVO and USOI expected November distributions. GLDI is not a Dividend Hunter recommendation.

November 4, 2023 - 9:50 am

Small cap ETFs last week:

- Vanguard Russell 2000 Index Fund ETF (VTWO): +6.03%

- Global X Russell 2000 Covered Call & Growth ETF (RYLG): +4.57%

- Global X Russell 2000 Covered Call ETF (RYLD): +2.74%

November 3, 2023 - 8:28 am

Qurate (QRTEA)(QRTEP) reported Q3 earnings of $ 0.10 per share. The expectation was 2-cents per share. This is good news!

November 1, 2023 - 10:09 am

- Main Street Capital (MAIN) declares $ 0.24/share monthly dividend, 2.1% increase from prior dividend of $ 0.235.

- Forward yield 8.65%

- Payable Jan. 12; for shareholders of record Jan. 4; ex-div Jan. 3.

- Payable Feb. 15; for shareholders of record Feb. 7; ex-div Feb. .

- Payable Mar. 15; for shareholders of record Mar. 7; ex-div Mar. 6.

- The Board of Directors also declared a supplemental cash dividend of $ 0.275/share; payable Dec. 27; for shareholders of record Dec. 20; ex-div Dec. 19.

The 2024 Q1 dividend rate is 6.7% higher than what MAIN paid in Q1 2023.

October 26, 2023 - 10:45 am

I just listened to the RITM management earnings call. The potential for this stock over the next few years is mind-bogglingly good. I added some shares to my position.

October 25, 2023 - 9:44 am

OMF reported solid earnings, much better than for Q2 and on par with Q3 2022. Declared a $ 1.00 dividend to be paid on November 10, with ex-dividend on Nov 3.

October 21, 2023 - 2:30 pm

A long but interesting read: https://open.substack.com/pub/robertbryce/p/powering-the-unplugged?r=3tv8r&utm_campaign=post&utm_medium=email

October 18, 2023 - 12:53 pm

- Credit Suisse Crude Oil Shares Covered Call ETN (USOI) had declared $ 1.3448/share monthly coupon payment, 65% increase from prior $ 0.8151.

- Payable Oct. 25; for shareholders of record Oct. 20; ex-div Oct. 19.

October 9, 2023 - 9:25 am

Below you will find my watchlist of stock symbols. These are stocks I want to monitor for a variety of reasons. They are not recommended investments.

As I updated the prices, share prices have fallen, sometimes sharply over the last month.

| Ticker | Price | Ticker | Price | |

| APLE | $ 15.04 | LPG | $ 29.06 | |

| ARCC | $ 18.96 | MPW | $ 5.10 | |

| ASC | $ 12.56 | NG1 | $ 3.35 | |

| BCSF | $ 14.94 | NREF | $ 15.11 | |

| BRSP | $ 5.95 | PDM | $ 5.19 | |

| BXMT | $ 20.92 | PLYM | $ 20.90 | |

| CIM | $ 5.13 | QRTEA | $ 0.48 | |

| EFC | $ 12.35 | RC | $ 9.88 | |

| FANG | $ 151.23 | RILY | $ 39.64 | |

| FSK | $ 19.36 | RLJ | $ 9.76 | |

| GNL | $ 8.46 | RWT | $ 6.96 | |

| GPMT | $ 4.61 | SEVN | $ 10.19 | |

| GSBD | $ 14.08 | SPYI | $ 47.17 | |

| HIW | $ 19.18 | TFSL | $ 11.69 | |

| INSW | $ 42.71 | TPVG | $ 10.00 | |

| IRM | $ 58.08 | TSLX | $ 19.94 | |

| JFR | $ 8.02 | UWMC | $ 4.93 | |

| KRG | $ 20.19 | WHLR | $ 1.28 | |

| LADR | $ 9.72 |

October 5, 2023 - 6:18 pm

SLVO and USOI have announced expected dividends to be paid on 10/25 with ex-dividend on 10/19.

- SLVO: $ 0.2991 per share. Current yield: 12.82%

- USOI: $ 1.3448 per share. Yield: 18.20%

October 4, 2023 - 1:39 pm

ABR report link: https://arbor.com/research/reports/special-report-fall-2023/

October 4, 2023 - 1:12 pm

Here is the link to a newly released special report by the CEO of Arbor Realty Trust (ABR)

October 3, 2023 - 1:35 pm

JEPI declared dividend of $ 0.36333 up from $ 0.33817 pays on 10/05

JEPQ dividend of $ 0.41719 down from $ 0.45056 pays on 10/05

October 3, 2023 - 9:40 am

With the Dividend Hunter strategy, stock market downturns, as we have experienced for the last month, and more steeply over the last week, are opportunities to add shares and boost your portfolio income stream.

I like to buy a few shares at a time, sometimes buying something daily. Today I added a few shares of STR.

I also bought 10 oz. of silver in my OneGold account.

October 1, 2023 - 5:46 pm

For years, I have wanted to find a way to publish my flying stories. Today is the official launch of my substack blog, Land, Fly or Die.

There will be no investment discussion. In the early posts I will talk about how I became an Air Force pilot. You can see the first post here:

https://landflyordie.substack.com/?r=3tv8r&utm_campaign=pub&utm_medium=web

September 30, 2023 - 7:01 pm

Interesting facts to start the week:

There have been 5 government shutdowns since 1995 and the S&P 500 traded positive during each one with an average return of 3.2%. And the most recent government shutdown, which was the longest in the last 30 years, saw the $SPX trade higher by more than 10%.

September 26, 2023 - 11:34 am

A few months ago, a subscriber shared with me a tool to add closed captions to my Weekly Mailbag videos. I can’t find the email. If you have a method to show closed captions on the Mailbag video, please email me at tim.plaehn@investorsalley.com

Thanks!

September 21, 2023 - 2:12 pm

I want to share my investments made today. The markets are down as are many of the Dividend Hunter investments. I looked through my account and decided to add 100 shares of Rithm Capital (RITM). I didn’t have a lot of cash available, so 100 shares was the right number for me.

Spot gold is also down sharply today. Also, OneGold is having a sale where you can buy Canada gold and silver at the spot price and not pay the usual $ 15.00 premium for gold or $ 0.50 per ounce for silver. I bought small amounts of each metal.

If you don’t have a OneGold account, you can get .00 for opening and making an investment using this link: https://www.onegold.com/join/276abe842a2243d6b249197557566f9f

September 21, 2023 - 11:15 am

Magellan Midstream (MMP) holders voted to approve the company’s $ 18.8 billion sale to Oneok (OKE).

Holders of the oil pipeline operator voted to approve the deal at a Magellan Midstream (MMP) shareholder vote on Thursday, according to preliminary results of the vote. Oneok (OKE) holders earlier approved the combination at a separate vote.

September 15, 2023 - 9:03 am

SLVO will pay their next monthly dividends on 9/25 with ex-dividend on 9/18. Buy shares today to earn the dividend on those shares.

- SLVO: $ 0.3001

- USOI: $ 0.8150

These dividends are down significantly from the previous few months. USOI has paid smaller dividends at times this year. The SLVO payout is a surprise, but one data point does not define a trend.

September 14, 2023 - 8:26 am

The merger of The Necessary REIT (RTL) into Global Net Lease (GNL) is complete. The RTLPP preferred shares now have the symbol GNL.PD.

September 11, 2023 - 8:44 am

Below you will find my watchlist of stock symbols. These are stocks I want to monitor for a variety of reasons. They are not recommended investments.

As I updated the prices, Share prices are generally higher compared to last month.

| Ticker | Price | Ticker | Price | |

| APLE | $ 16.15 | MPW | $ 7.64 | |

| ARCC | $ 19.57 | NREF | $ 17.13 | |

| ASC | $ 12.77 | PDM | $ 6.79 | |

| BCSF | $ 15.96 | PLYM | $ 22.74 | |

| BRSP | $ 6.80 | QRTEA | $ 0.62 | |

| BXMT | $ 23.10 | RC | $ 10.73 | |

| CIM | $ 5.85 | RILY | $ 46.52 | |

| FSK | $ 20.63 | RLJ | $ 10.10 | |

| GNL | $ 11.27 | RTL | $ 7.53 | |

| GPMT | $ 5.36 | RWT | $ 7.64 | |

| GSBD | $ 14.44 | SEVN | $ 10.90 | |

| HIW | $ 23.77 | SPYI | $ 49.10 | |

| INSW | $ 43.47 | TFSL | $ 13.50 | |

| IRM | $ 62.68 | TPVG | $ 11.15 | |

| JFR | $ 8.25 | TSLX | $ 20.20 | |

| KRG | $ 22.64 | UWMC | $ 5.28 | |

| LADR | $ 10.89 | WHLR | $ 4.76 |

September 9, 2023 - 11:29 am

A good read:

https://open.substack.com/pub/doomberg/p/cop-out?r=3tv8r&utm_campaign=post&utm_medium=web

September 4, 2023 - 9:30 am

Higher dividends from JEPI and JEPQ for September (pay date 9-7)

JEPI will pay $ 0.33817 up from $ 0.29037

JEPQ will pay $ 0.45056 up from $ 0.36588

September 1, 2023 - 12:41 pm

Interesting quote from today’s Doomberg article. It is not applicable to Dividend Hunter investing. I just liked the idea and the tone.

“If any industry is sorrily lacking in effective advocacy, it is the civilian nuclear energy sector. Despite having the full weight of physics behind it, the industry quivers like a litter of beaten puppies under the routine flogging carried out by radical environmentalists. As a consequence, civilian nuclear technology is regularly overlooked as a solution to environmental challenges, despite possessing an unparalleled energy density, an unmatched safety track record, and the capacity to provide society with a virtually limitless amount of carbon-free energy.”

August 29, 2023 - 11:02 am

If I have become a fan of Peter Zeihan and his analysis of economic trends and geopolitics. His book, The End of the World is Just Beginning, was an eye-opener. I now get his daily video commentary. Today’s was especially interesting so I am sharing it with you:

IF the video does not show up for you please click here.

August 14, 2023 - 2:52 pm

Below you will find my watchlist of stock symbols. These are stocks I want to monitor for a variety of reasons. They are not recommended investments.

As I updated the prices, I it appeared that the stock market rally has stalled. Some stocks were up and an equal number had dropped in price. Price changes were due to how investors viewed the Q2 earnings results.

| Ticker | Price | Ticker | Price | |

| APLE | $ 14.86 | MPW | $ 7.79 | |

| APLY | $ 20.23 | NREF | $ 17.40 | |

| AQN | $ 7.24 | PDI | $ 19.01 | |

| ARCC | $ 19.54 | PDM | $ 6.91 | |

| ASC | $ 13.17 | PLYM | $ 22.44 | |

| BCSF | $ 15.42 | PRT | $ 6.29 | |

| BRSP | $ 6.85 | QRTEA | $ 0.88 | |

| BXMT | $ 21.64 | RC | $ 10.90 | |

| BXSL | $ 27.23 | RILY | $ 52.56 | |

| CIM | $ 5.72 | RLJ | $ 9.73 | |

| FSK | $ 20.17 | RTL | $ 7.32 | |

| GNL | $ 11.04 | RWT | $ 7.77 | |

| GPMT | $ 5.39 | SEVN | $ 10.58 | |

| GSBD | $ 14.47 | SJT | $ 7.33 | |

| HIW | $ 23.91 | SPYI | $ 49.44 | |

| ICL | $ 6.32 | STAG | $ 35.64 | |

| INSW | $ 45.08 | TFSL | $ 14.84 | |

| IRM | $ 60.37 | TPVG | $ 11.33 | |

| KRG | $ 23.08 | TPZEF | $ 16.58 | |

| KRP | $ 14.61 | TSLX | $ 20.36 | |

| LADR | $ 10.69 | UWMC | $ 6.12 | |

| LPG | $ 24.44 | WHLR | $ 0.46 |

August 9, 2023 - 1:02 pm

August 8, 2023 - 6:24 pm

In two weeks USOI (Credit Suisse X-links Crude Oil Shares Covered Cal) will go ex-dividend.

| Dividend: $ 1.68/share Ex-Div Date: 08/21/23 Payment Date: 08/25/23 Dividend Frequency: Monthly |

August 8, 2023 - 6:09 pm

Sitio Royalty Corp (STR) declared a cash dividend of $ 0.40 per share of Class A Common Stock with respect to the second quarter of 2023. The dividend is payable on August 31, 2023 to the stockholders of record at the close of business on August 18, 2023.

August 7, 2023 - 5:48 pm

Hercules Capital (HTGC) announced a 6 million share secondary offering. Because of that, the share price is trading off about $ 1.00 after hours and will trade lower in the morning.

For a BDC, regular common stock offerings are necessary to continue to grow the business. Since HTGC trades at a premium to NAV ($ 10.96 at end of Q2), these offerings are automatically accretive on a per share basis. Secondaries trade at an initial discount to get institutional investors to pick up the shares.

It’s a good deal for us and if you can, buy some HTGC tomorrow.

August 3, 2023 - 8:31 am

OCSL

- A quarterly cash distribution was declared of $ 0.55 per share. The distribution is payable in cash on September 29, 2023 to stockholders of record on September 15, 2023.

August 2, 2023 - 9:31 am

- Main Street Capital (MAIN) declares $ 0.235/share monthly dividend, 2.2% increase from prior dividend of $ 0.230.

- Forward yield 6.68%

- Payable Oct. 13; for shareholders of record Oct. 6; ex-div Oct. 5.

- Payable Nov. 15; for shareholders of record Nov. 8; ex-div Nov. 7.

- Payable Dec. 15; for shareholders of record Dec. 8; ex-div Dec. 7.

- The company also announced a supplemental dividend of $ 0.275 per share payable Sept. 27; for shareholders of record Sept. 20; ex-div Sept. 19.

August 1, 2023 - 8:25 am

HTGC increases dividend to a total of $ 0.48

The Increased Total Cash Distribution of $ 0.48 per Share for the Second Quarter 2023 is Comprised of a New Base Distribution of $ 0.40 per Share, Increased from $ 0.39 per Share Previously, and an $ 0.08 per Share Supplemental Distribution

Record Date August 18, 2023

Payment Date August 25, 2023

July 31, 2023 - 10:47 am

Today’s price drop by AMZA is due to an adjustment to the NAV to account for some changing tax liabilities. It is likely a one-time adjustment. I have learned some interesting facts about ETF share prices and tax liabilities. I will cover those in the Weekly Mailbag Video on Friday. Today is a good day to grab a few shares of AMZA. I have.

July 28, 2023 - 8:25 am

ABR increases dividend by one-cent:

The Company announced today that its Board of Directors has declared a quarterly cash dividend of $ 0.43 per share of common stock for the quarter ended June 30, 2023. The dividend is payable on August 31, 2023 to common stockholders of record on August 15, 2023. The ex-dividend date is August 14, 2023.

July 20, 2023 - 6:04 pm

Cedar Realty Trust, Inc. (the “Company”) announced today that its Board of Directors (the “Board”) declared the payment of a cash dividend of $ 0.453125 per share on the Company’s 7.25% Series B Cumulative Redeemable Preferred Stock (NYSE:CDRpB), payable on August 21, 2023 to shareholders of record as of the close of business on August 10, 2023.

The Company also announced that the Board declared the payment of a cash dividend of $ 0.40625 per share on the Company’s 6.50% Series C Cumulative Redeemable Preferred Stock (NYSE:CDRpC), payable on August 21, 2023 to shareholders of record as of the close of business on August 10, 2023.

July 18, 2023 - 9:05 am

Main Street Capital (MAIN)

Preliminary estimates of second quarter 2023 net investment income (“NII”) is $ 1.05 to $ 1.07 per share and distributable net investment income (“DNII”) is $ 1.11 to $ 1.13 per share. Net asset value (“NAV”) per share as of June 30, 2023 is $ 27.66 to $ 27.72, representing an increase of $ 0.43 to $ 0.49 per share, or 1.6% to 1.8%, from the NAV per share of .23 as of March 31, 2023, with this increase after the impact of the supplemental dividend paid in June 2023 of $ 0.225 per share. Main Street estimates that it generated a quarterly annualized return on equity for the second quarter of 2023 of 18% to 20%

July 11, 2023 - 4:27 pm

| ETN Ticker | Closing Indicative Value on 6/30/23 |

Ex-Date | Record Date | Payment Date | Expected Coupon Amount per ETN1 |

Coupon Frequency |

Expected Current Yield2 |

|

| USOI | $ 73.9291 | 7/19/23 | 7/20/23 | 7/25/23 | $ 1.1788 | Monthly | 30.85% | |

| SLVO | $ 73.3259 | 7/19/23 | 7/20/23 | 7/25/23 | $ 1.3573 | Monthly | 28.41% |

July 10, 2023 - 11:19 am

Below you will find my watchlist of stock symbols. These are stocks I want to monitor for a variety of reasons. They are not recommended investments.

As I updated the prices, I noticed that most of the stocks were up significantly since last month. This was the second month in a row with nice share price gains. It’s nice to see high-yield stocks starting to rally.

| Ticker | Price | Ticker | Price | |

| APLE | $ 15.45 | MPW | $ 9.22 | |

| APLY | $ 21.73 | NREF | $ 15.75 | |

| AQN | $ 7.79 | PDI | $ 19.05 | |

| ARCC | $ 19.11 | PDM | $ 7.59 | |

| ASC | $ 12.42 | PLYM | $ 22.98 | |

| BCSF | $ 13.81 | PRT | $ 5.88 | |

| BRSP | $ 6.86 | QRTEA | $ 1.12 | |

| BXMT | $ 21.39 | RC | $ 11.00 | |

| BXSL | $ 26.86 | RILY | $ 21.00 | |

| CIM | $ 5.59 | RLJ | $ 10.50 | |

| FSK | $ 19.41 | RTL | $ 7.13 | |

| GNL | $ 10.82 | RWT | $ 6.36 | |

| GPMT | $ 5.27 | SEVN | $ 10.60 | |

| GSBD | $ 13.91 | SJT | $ 7.50 | |

| HIW | $ 24.77 | SPYI | $ 49.26 | |

| ICL | $ 5.62 | STAG | $ 35.95 | |

| INSW | $ 37.78 | TFSL | $ 12.88 | |

| IRM | $ 58.25 | TPVG | $ 12.21 | |

| KRG | $ 22.28 | TPZEF | $ 15.78 | |

| KRP | $ 14.77 | TSLX | $ 18.93 | |

| LADR | $ 10.92 | VNOM | $ 25.36 | |

| LPG | $ 25.90 | WHLR | $ 0.57 |

July 10, 2023 - 8:52 am

From my weekend reading. A concise description of what AI can and cannot do:

In a conversation with Goldman Sachs’ Jenny Grimberg, Marcus explains how generative artificial intelligence (AI) tools actually work today?

At the core of all current generative AI tools is basically an autocomplete function that has been trained on a substantial portion of the internet.

These tools possess no understanding of the world, so they’ve been known to hallucinate, or make up false statements.

The tools excel at largely predictable tasks like writing code, but not at, for example, providing accurate medical information or diagnoses, which autocomplete isn’t sophisticated enough to do.

Contrary to what some may argue, the professor explains that these tools don’t reason anything like humans.

AI machines are learning, but much of what they learn is the statistics of words, and, with reinforcement learning, how to properly respond to certain prompts.

They’re not learning abstract concepts.

That’s why much of the content they produce is garbage and/or false.

Humans have an internal model of the world that allows them to understand each other and their environments.

AI systems have no such model and no curiosity about the world. They learn what words tend to follow other words in certain contexts, but human beings learn much more just in the course of interacting with each other and with the world around them.

July 6, 2023 - 8:51 am

Today Owl Rock Capital Corp changes its name and stock symbol to Blue Owl Capital Corporation (OBDC).

July 5, 2023 - 10:11 am

H1 Dividend Hunter returns.

This weekend I was researching and writing the Monthly Dividend Multiplier newsletter sections and I found an interesting fact. For the 2023 H1, the S&P 500 posted a 16.5% gain. The “Magnificent 7” large cap tech stocks accounted for 110% of those gains. It boggles the mind. The other 493 stocks in the index had a negative average return for the six months.

We did quite a lot better than the “less than magnificent 493” over the last six months. Here are the category returns through the end of June:

- Stable Dividend investments: +13.10%

- Variable Dividend investments: +9.32%

- Fixed Income investments: +5.40%.

I am very pleased with those returns. You can see why I have been pounding the table about adding shares to the Stable Dividend investments.

June 23, 2023 - 11:22 am

Breaking news:

As of July 6, Owl Rock Capital Corp (ORCC) will change its name to Blue Owl Capital Corp (OBDC).

June 18, 2023 - 12:47 pm

An interesting read for your Sunday afternoon.

June 16, 2023 - 11:00 am

I have asked my team for a survey of you subscribers. It’s 3 easy questions. You can find it here:

June 15, 2023 - 4:18 pm

Starwood Property Trust, Inc. (NYSE: STWD) (“the Company”) today announced that the Company’s Board of Directors has declared a dividend of $ 0.48 per share of common stock for the quarter ending June 30, 2023. The dividend is payable on July 17, 2023 to stockholders of record as of June 30, 2023.

June 15, 2023 - 10:10 am

I spent the first few days of this week out with my travel trailer. I stayed in a very nice county park campground in SE Minn. I met the couple in the next space. They were there to get Jim to the Mayo Clinic. I spent quite a lot of time talking to them, and they are super nice, salt of the earth people. Jett the wife, set up a go fund me page while they were there. She asked if I would share the link. The goal is to buy husband Jim a tracked wheelchair.

It is entirely up to you whether you donate. I am sharing this link because Jett asked and I liked them.

https://www.gofundme.com/f/help-jim-regain-his-lifestyle-with-a-new-trackchair

June 12, 2023 - 9:06 am

Below you will find my watchlist of stock symbols. These are stocks I want to monitor for a variety of reasons. They are not recommended investments.

As I updated the prices, I noticed that most of the stocks were up significantly since last month. It’s nice to see high-yield stocks starting to rally.

| Ticker | Price | Ticker | Price | |

| APLE | $ 15.50 | MPW | $ 9.19 | |

| AQN | $ 8.65 | NREF | $ 15.89 | |

| ARCC | $ 19.11 | PDI | $ 18.46 | |

| ASC | $ 12.20 | PDM | $ 6.89 | |

| BCSF | $ 13.07 | PLYM | $ 22.43 | |

| BRSP | $ 6.42 | PRT | $ 4.90 | |

| BXMT | $ 19.62 | QRTEA | $ 1.01 | |

| BXSL | $ 26.03 | RC | $ 10.92 | |

| CIM | $ 5.19 | RILY | $ 37.28 | |

| FSK | $ 19.85 | RLJ | $ 10.84 | |

| GNL | $ 10.38 | RTL | $ 6.78 | |

| GPMT | $ 5.11 | RWT | $ 6.37 | |

| GSBD | $ 13.84 | SEVN | $ 9.63 | |

| HIW | $ 22.56 | SJT | $ 8.42 | |

| ICL | $ 5.53 | SPYI | $ 49.26 | |

| INSW | $ 36.83 | STAG | $ 36.06 | |

| IRM | $ 56.07 | TFSL | $ 12.77 | |

| KRG | $ 20.99 | TPVG | $ 11.72 | |

| KRP | $ 15.01 | TPZEF | $ 15.98 | |

| LADR | $ 10.51 | TSLX | $ 18.93 | |

| LPG | $ 23.64 | VNOM | $ 25.96 | |

| WHLR | $ 0.62 |

June 6, 2023 - 3:35 pm

Double-digit dividend growth coming from PAGP. I caught this out of a recent CEO interview. Current annual dividend is .07 per share.

“Central to Plains’ framework is distribution growth. This includes a $ 0.20 per unit annualized distribution increase implemented earlier this year and $ 0.15 per unit annual distribution increases until distribution coverage reaches 160%. With 2022 coverage at 273% (read more), there is a long runway to reach 160%, and $ 0.15 per unit annual distribution growth will be targeted for several years. Management cited a 12.5% compound annual growth rate for the distribution as a differentiating factor for PAA relative to peers.

May 30, 2023 - 10:21 am

Here is the link for the recording of the webinar with Craig Baker of Mobility Trust. It was a very interesting presentation and investment opportunity.

https://www.investorsalley.com/the-dividend-hunter-video-replays/

May 25, 2023 - 11:03 am

I am hosting a repeat today of the webinar with Craig Baker of Mobility Trust. Craig offers a unique investment opportunity with very attractive returns.

The webinar will be at 7:00 pm eastern time. If you want to join in to listen, use this link:

https://us02web.zoom.us/j/88122809677

May 15, 2023 - 9:43 am

Yesterday Dividend Hunter stock ONEOK, Inc (OKE) announced an agreement to acquire Magellan Midstream Partners (MMP) in an $ 18.8 billion cash and stock deal. The deal is expected to close in the third quarter.

This is a big purchase for OKE. As of Friday, OKE had a $ 28 billion market cap, while MMP was valued at $ 11 billion.

The purchase allows ONEOK to expand into crude oil and refined products pipelines.

In the presentation, ONEOK the deal to be 3% to 7% accretive to EPS for 2025 through 2027. This should push total EPS growth into double digits.

Also, they expect annual free cash flow accretion of greater than 20%, driven by transaction synergies and tax benefits.