For the major indices to stop falling, investors need to see a solution to the crippling spread, and progress from Congress. The Federal Reserve has tried to help. Just this morning, the Federal Reserve announced limitless asset purchases to keep the markets functioning. The central bank will run in the “amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy,” added CNBC.

There’s also hope we can get some sort of relief from Congress. Senate Minority Leader Chuck Schumer said disagreements over the bill could be overcome in the next 24 hours, as noted by CNBC. A spokesman for Schumer later added the senator and Treasury Secretary Steven Mnuchin had a “productive meeting.”

Unfortunately, the stimulus bill failed on Sunday after Democrats warned the measure did not do enough to help impacted workers and instead offered too much for company bailouts, says CNBC. House Speaker Nancy Pelosi signaled she was not on board with the current stimulus plan, saying: “From my standpoint, we’re apart.”

That has created far more volatility in the markets.

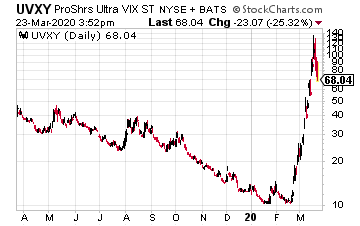

As we noted on March 17, 2020, even in times of panic, there is opportunity, especially as the Volatility Index (VIX) explodes to higher highs. At the time, we mentioned three top ways to trade volatility. Those included:

ProShares Ultra VIX Short-Term Futures ETF (UVXY), which ran from a February 2020 low of $10.75 to a high of $135. The Velocity Shares Daily 2x VIX Short-Term ETN (TVIX), which ran from a low of $39.32 to a high of $1,000. And the iPath S&P 500 VIX Short-Term Futures (VXX), which ran from $13.38 to a high of $78.84.

When the fear begins to subside, the VIX is likely to pull back as volatility falls, as well.

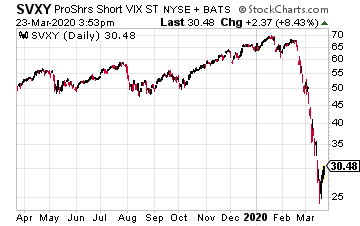

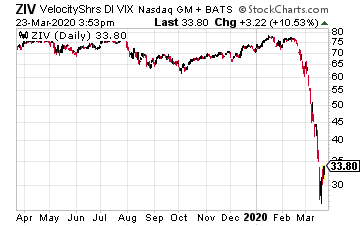

When that happens, some of the top opportunities include:

ProShares Short VIX Short-Term Futures ETF (SVXY)

ProShares Short VIX Short-Term Futures ETF provides short exposure to the S&P 500 VIX Short-Term Futures Index, which measures the returns of a portfolio of monthly VIX futures contracts with a weighted average of one month to expiration, according to Pro Shares.

VelocityShares Daily Inverse VIX Medium-Term (ZIV)

The ETN seeks returns that are -1x the returns of the S&P 500 VIX Mid-Term Futures Index ER for a single day, says Velocity Shares.

As of this writing, Ian Cooper does not have a position in shares of SVXY or ZIV.