For the moment, short-term craziness in the market has evaporated. Volatility is returning to more normal levels—well, normal for the last year anyhow. Most of 2020 as well as January 2021 were anything but ordinary. Nevertheless, we can’t ignore the future…and the future certainly includes potential interest rate movement.

After the pandemic hit, the Federal Reserve dropped interest rates to near-zero levels, which is standard practice in times of a crisis. What’s more, interest rates are typically held at near-zero levels for months or even years after the crisis hits, because economic recovery can be a slow and painful process. Keeping rates low helps ease the recovery.

When rates are super low, homeowners have an incentive to refinance their homes, for example. Lowering the mortgage rate or getting a cheap loan on additional equity can create extra spending money, which can then flow back into the economy and create more jobs. Another example is a business getting cheap a loan to expand.

The Fed doesn’t want to cut that process short by raising rates too soon. The central bank carefully monitors job numbers and inflation metrics to help determine when to start raising rates. The question is, will rates begin their climb in 2021?

By the time you read this article, we’ll know what January non-farm payrolls look like—that is, we’ll know more about the job situation in the U.S. The Fed will definitely give the jobs number serious consideration, along with metrics such as initial jobless claims. If these numbers are much different than expectations, you may see interest rate products move quite a bit.

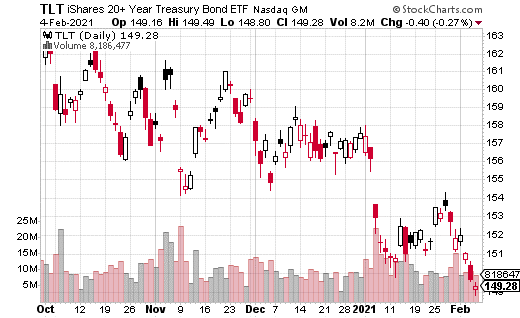

One of the easiest ways to track what traders think of future interest rates is through iShares 20+ Year Treasury Bond ETF (TLT). Long bonds can move significantly when interest rate expectations change.

If the bond traders think interest rates are going higher in the next year, TLT could drop substantially (it will happen over time instead of all at once). Keep in mind bond prices move inverse to rates. As rates go up, TLT (which tracks bond prices) will go down. Moreover, the financial markets are forward-looking, so an expected move in rates/bonds will be built in long before the actual move occurs.

At least one large fund or trader believes TLT could be headed substantially lower by June, meaning rates could be on their way up this year. Specifically, the trade was buying the June 130 puts with TLT trading at $149.33. The puts were purchased 17,500 times for $1.10, which works out to $1.9 million in premium spent. The premium spent is also the potential max loss on the trade. The breakeven for the trade is $128.90 by June expiration.

Of course, there is massive upside potential should TLT dive over the next several months. Each dollar below breakeven will generate $1.75 million in profits. That being said, this may not be a speculative trade. It could be a hedge against a long bond position.

Still, a trade of this size can’t be ignored, regardless of the reasons behind it.