I don’t look at fixed income based exclusively on Wall Street expectations. The news media and large investment firms like to play the interest rate game, investing based on where they think interest rates will go. I prefer using fixed-income investments to generate stable, high-yield cash income streams.

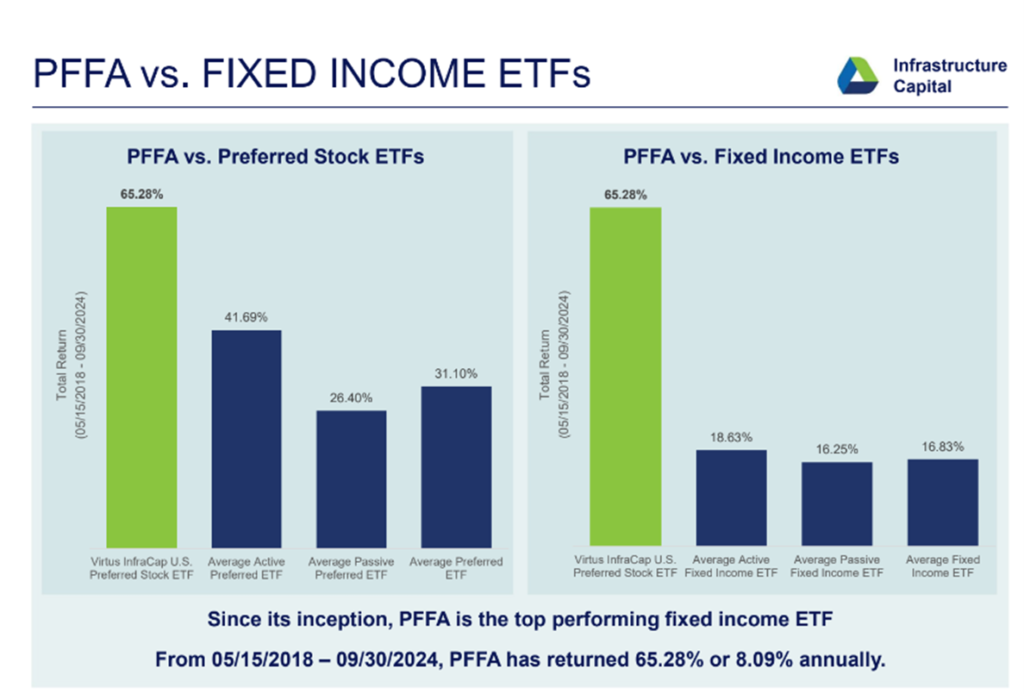

Recently, one of my favorite income ETFs sent out a fascinating graphic. Let’s get right to it.

The Virtus InfraCap U.S. Preferred Stock ETF (PFFA) is actively managed. The chart results speak for themselves. I added PFFA to my Dividend Hunter-recommended portfolio in November 2018. I am in regular contact with the fund managers. Let’s go over a few highlights about the ETF.

- The PFFA managers focus on relative value in the preferred stock world. They seek out undervalued preferred shares and avoid overpriced preferred stocks. The pricing differentials typically occur when preferred stock becomes callable.

- PFFA pays a stable monthly dividend. Retired investors can count on a stable payment every month.

- The PFFA dividend is slowly growing. But it has been increasing every month. The dividend is up 11% since 2020.

The PFFA current yield is 8.9%, close to the 8.09% average annual return highlighted above. Investors can count on the PFFA yield for income and expect their principal value to be stable (over the long run).

PFFA is an excellent representation of the types of investments in my Dividend Hunter service. The newsletter helps investors focus on building a stable, high-yield income stream. If you do that with a suitable high-yield investment, your principal value will take care of itself.

The #1 Plan for Income for Life

To discover my #1 way to take high-yield stocks (like the ones I mention in my articles) and turn it into a lifelong cash machine... click here for my full, free instructional guide.

You can start with as little as you can spare, it only takes a swift 36-months, and it's income that could pay your bills for life. You could even pay off your first bills of the new year in the next few weeks (click here).