FOMO—the Fear of Missing Out—has permeated human behavior long before the term entered popular lexicon. It taps into a universal desire: to seize opportunities, avoid regret, and partake in collective excitement. History offers no shortage of examples of its pull, even among the most disciplined and brilliant minds. Isaac Newton, one of history’s greatest scientists, succumbed to this primal urge during the infamous South Sea Bubble. His experience serves as a cautionary tale about the risks of letting emotions guide investment decisions.

The South Sea Bubble and Newton’s Fall

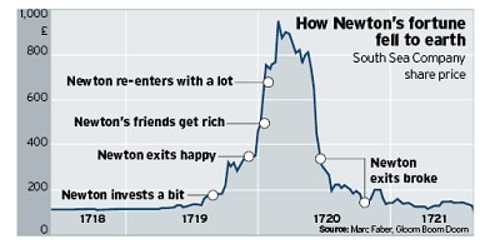

In the early 18th century, the South Sea Company captivated the financial world with promises of extraordinary wealth. Established to manage England’s national debt and trade with South America, it symbolized untold economic potential. Investors, lured by soaring stock prices and widespread enthusiasm, rushed to join the speculative frenzy. Among them was Newton, whose rational mind initially shielded him from the mania.

In 1720, Newton prudently bought shares early and sold them for a handsome profit. Reflecting his brilliance and self-awareness, he declared, “I can calculate the motions of the heavenly bodies, but not the madness of people.” Yet the bubble’s relentless rise proved irresistible. Witnessing his peers reap massive gains, Newton re-entered the market at inflated prices. When the bubble burst, it left him with catastrophic losses, reportedly erasing over £20,000—a fortune in his time.

The Psychological Roots of FOMO

Newton’s experience underscores how even the most logical thinkers are vulnerable to FOMO. Social comparison, one of its primary drivers, is deeply ingrained in human psychology. Watching others succeed—especially when framed as easy, quick, or inevitable—triggers a sense of urgency. Fear of being left behind overrides caution, leading to impulsive actions. Newton, despite his unmatched intellect, could not escape this cognitive bias.

I’m obviously not Isaac Newton. But I have long lived by one of his quotes, “if I have seen further, it is by standing on the shoulders of giants.”

I know that FOMO exists in life and in the markets. I also know that the psychology that drives FOMO should be reflected in the price action of individual stocks.

I’ve long known I realized that we can see what investors are doing, no matter what they say they’re doing, by watching the market action.

When investors are bullish, they buy. When they’re bearish, they sell. Those are obvious facts.

I also know from studies done by the exchanges that most of the trading activity occurs near the of the day. That’s another obvious fact, easily proven by the data.

My insight comes from combining those two facts:

When investors are bullish, the closing price tends to be near the high of the day more often than not. Likewise, the closing price tends to be near the low when we’re in a downtrend.

Again, I saw that this was proven by data.

That’s what I based my indicator on. I look at where the trend in closing prices in. I interpret that by applying an indicator to the indicator.

Bollinger Bands show extremes in behavior. That’s true for prices and indicators.

I noticed on charts that when my indicator falls below its lower Bollinger Band, FOMO is developing in the markets.

Not all signals are perfectly timed. And not all signals are winners. But overall, this has been a profitable trading strategy and I’m watching closely for trades with this strategy.

The story of Newton and the South Sea Bubble reveals that FOMO is as old as human ambition. It transcends intelligence and experience, often leading to irrational behavior. In a world increasingly dominated by instant gratification and social comparison, Newton’s cautionary tale is more relevant than ever.

By embracing discipline and my indicator, investors can avoid the pitfalls of FOMO and make decisions rooted in reason rather than emotion.

On Tuesday I shared with readers how my proprietary ITV indicator is positioned to take advantage of current market conditions. In fact, with all of the market excitement around the income U.S. Presidential administration and the big gains we’re seeing, it’s been going haywire giving me a string of trade recommendations. One that I’d noticed on Friday was already up by 10% on Monday morning. I’ve put all of this into a short presentation for you. Click here to watch.