The COVID-19 pandemic may have slowed the implementation of new renewable energy projects but the crisis will prove to be a blip in the long term trend. The trend of the decommissioning of coal-fired power and the growth of renewably sourced electricity will continue for decades. Here are some projections.

In January 2020, the U.S. Energy Information Agency (EIA) forecast that generation from non-hydro power renewable energy sources, such as solar and wind, will grow by 15% in 2020—the fastest rate in four years. Forecast generation from coal-fired power plants declines by 13% in 2020.

In December 2019, S&P Global Market Intelligence released The 2020 US Renewable Energy Outlook. The S&P Power Forecast team projects almost 55,000 MW of new wind and 45,000 MW of new solar installed between 2020 and 2030 to maintain pace with state renewable portfolio standards (RPS) requirements alone. These forecast capacity additions do not account for corporate renewable demand and generic renewable projects not counting toward RPS mandates.

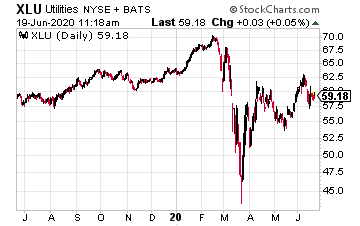

For investing to take advantage of renewable energy growth, public utility stocks first come to mind. However, the growth of utility companies is under the control of state public utility commissions. Also, while utility stocks can be counted on for steady dividend growth, the yields are nothing to write home about. For example, the Utilities Select Sector SPDR ETF (XLU) has a current yield of 3.3%.

Buy and Hold These 3 Dividend Stocks Forever [ad]

For higher yields and better return potential, investors should look for companies that are independent renewable energy providers. Here are three stocks that fit the good for the planet plus an attractive yield investment goal.

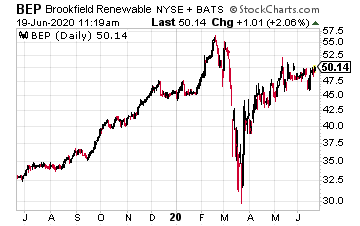

Brookfield Renewable Partners (BEP) operates one of the world’s largest publicly-traded renewable power platforms.

Its portfolio consists of approximately 19,300 MW of capacity and 5,288 generating facilities in North America, South America, Europe, and Asia.

Brookfield Renewable has a stated objective to deliver annualized long term returns of 12% to 15%. The company has a majority focus on hydroelectric power, which accounts for 74% of the portfolio.

Over the last five years, there has been a focus to build scale in wind and solar power. During that period, 53% of the $3.5 billion new equity deployed by Brookfield has gone into wind, solar, and power storage investments.

The company has a stated 5% to 9% annual growth rate for the BEP dividend. The payout was increased by 5.3% in February of this year.

The current yield for BEP is 4.5%.

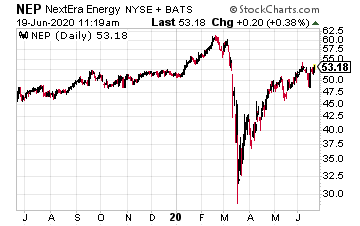

NextEra Energy Partners (NEP) is a growth-oriented yieldco that currently owns 5,330 MW of wind and solar power production facilities and eight natural gas pipelines with 4.3 Bcf of capacity.

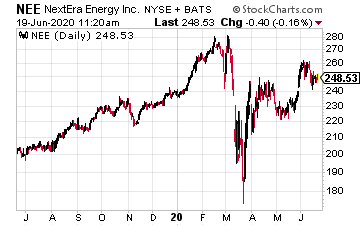

While publicly traded, NEP should be viewed as a controlled subsidiary of large-cap public utility NextEra Energy (NEE).

The Energy Resources division of NextEra energy develops new renewable power assets. These assets are then sold to NextEra Energy Partners at prices that will be accretive to the NEP free cash flow per share. The controlled transactions between NEE and NEP allow NEP to maintain a double-digit dividend growth profile.

The NEP dividend has been increasing every quarter. Current distribution guidance is for 12% to 15% annual growth through 2024.

The shares currently yield 4.25%.

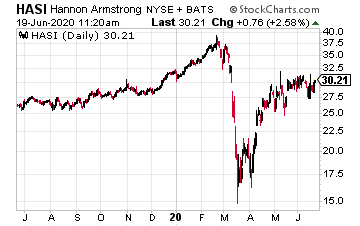

Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI) operates on the finance side of renewable energy growth.

The company makes equity or lending investments to finance energy efficiency, renewable energy, and other sustainable infrastructure projects. The HASI motto is “Investing in Climate Change Solutions.”

The business model is to provide financing solutions to take advantage of tax credits and other government programs. Much of the HASI business is with state and local governments, universities, K-12 school districts, and hospitals.

HASI is a growth company, as well as an attractive income stock. For the 2020 first quarter, core EPS was up 30% compared to a year earlier.

The company has paid a steadily growing dividend since its 2014 IPO.

The current yield is 3.62%.