The COVID-19 crisis-driven stock market crash has investors taking a different approach to stock selection. The economic shutdown has all of us taking a different look at different stocks, compared to what investors were most interested in before the market dived.

Three Questions You Need to Ask First

Here are some factors concerning individual stocks that now have investor attention as the look for investment opportunities.

- How will the economic shutdown affect a company’s business results? Some are entirely or close to completely shutdown. Examples of this are cruise lines and airlines. Other companies see improved business due to the shutdown. Think of grocery stores and online retailers of necessities.

- Which stocks have the best potential for a substantial share price rally when the economy opens up? This question has investors looking in the stock price bargain bin.

- Which companies will be able to sustain dividends, and which companies will reduce or suspend dividend payments? If dividends are suspended, how long will it be until the payments to investors restart?

What investors need to grasp is that this time it is different. Never before has a large portion of the economy been shut down with the entire population told to stay home. It is uncertain when the federal and state governments will let businesses get back to something that looks like normal. The economy may end up with a new normal. Will consumers be ready to get back to restaurants, stores, and travel? Or will the fear of catching the COVID-19 virus lead to a less robust economy as individuals chose to wait and see before they decide to go and spend?

Dividend Investors Are Using The Recent Pullback to Boost Their Income In a Short Time: Here’s How [ad]

I use dividend rates and yields as a guide to stock selection. Over the long-term, companies with dividend growth track records have produced attractive, and reliable total returns.

These three dividend-paying stocks have high current investor interest. I use a dividend-centric approach concerning the investment potential of each.

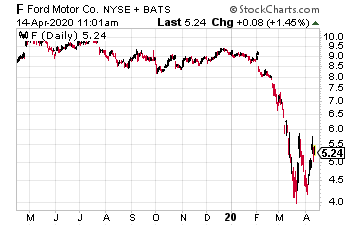

For the last five years, the main reason to invest in Ford Motor Company (F) was the attractive dividend yield. The share price was range-bound between $9 and $12. The $0.60 annual dividend propped up the share price with the above-average 5% to 6% yield.

On March 19th, Ford announced it was suspending the dividend. In the crisis-induced bear market, the stock price has dropped to around $5.00.

Ford has also shut down most, if not all, of its vehicle assembly operations. Ford is a stock that should quickly pop higher on news that the economy has reopened, and factory workers can go back to their jobs.

A resumption of the dividend would give another boost to the share price. I expect Ford to be above $9.00 by the 2020 fourth quarter.

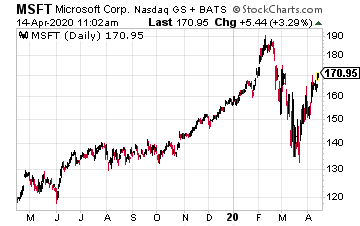

Investors don’t often think about Microsoft Corp. (MSFT) as a dividend stock. Yet, this is a company that has increased its dividend for 16 straight years. The average annual dividend increases have been greater than 10% for the last five and 10-year periods.

Compared to the major indexes, MSFT share price has held up well in this bear market. The stock is down just 13% from its 52-week high. MSFT is a stock to buy if there is another leg down for the bear market.

A $140 share price would put the MSFT yield at 1.5%. That’s a good price target for buying if the bear market continues.

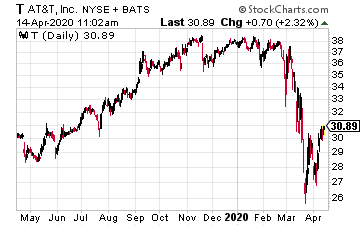

The bear market has whacked 20% off the AT&T (T) share price. The value drop pushed the yield up from 5.3% to 6.8%.

AT&T has grown its dividend for 35 straight years. It’s a Dividend Aristocrat, and the Board of Directors will not give up that title.

Dividend growth averages 2% per year, which is not great, but if the bear market lingers, and stocks don’t have a strong recovery this year, earning a near 7% yield will feel pretty good.