Thanks to the Selloff, Solar Stocks Are a Bargain

After a long period of downplaying the impact, fears of the coronavirus finally landed in Wall Street. Last week was one of the most dramatic in recent Wall Street history. The S&P 500 went from an all-time high to more than a 10% loss in the shortest time in history.

Let’s review last week’s damage.

On Monday, the S&P 500 lost -3.35% for its worst loss in more than two years. Then on Tuesday, it fell by -3.03%. On Thursday, the S&P 500 plunged for a loss of -4.42%. That was its biggest fall in 8½ years. On Friday, the index lost just 0.82% making it one of its better days during this storm.

And as I write this it lost another 2.94% on Tuesday. It might be worse by the time you’re reading this.

Here’s an example of how irrational markets have been. Shares of ZOOM Technologies (ZOOM) jumped more than 50% on the belief that its video-conferencing technology would benefit from the coronavirus.

One small problem. That’s the wrong company.

The company that makes Zoom is Zoom Video Communications. Their ticker is ZM.

ZOOM Technologies is no longer in business. In fact, it hasn’t been in business for years!

Traders didn’t care. At its high, ZOOM was up more than 56% on Thursday. Let me reiterate, this is a company that’s no longer in business.

Here Comes the Sun

That’s how unhinged the market has become. Fortunately, if you can keep your head about you, then this is a great time to be a disciplined buyer. Thanks to the recent selloff, panicked buyers have given us some good bargains. I’ve been especially impressed by how many bargains there are among solar stocks. This is one of the most exciting and least-understood sectors of the market.

You need to be careful in this arena because some companies are quite good, while others are to be avoided at all costs. (I’ll tell you about my favorite stock in the sector in a bit.)

The need for renewable energy is soaring, and with the advent of the coronavirus, we can see how vulnerable global supply networks truly are. That’s why we need clean, renewable energy, and there’s enormous room for growth for solar. Consider that solar energy currently accounts for just 1.6% of total U.S. electricity generation. In 2018, the U.S. installed 10.6 GW of solar.

Since 2013, solar has ranked first or second in capacity added every year. There are now 1.47 million solar panels across the U.S. The amount of power that’s offset by solar is equal to 70 million tons of carbon dioxide. That’s like planting 1.2 billion trees!

The costs of solar have fallen almost consistently for 10 years. Meanwhile, the S&P 500 Energy index is back to where it was 15 years ago.

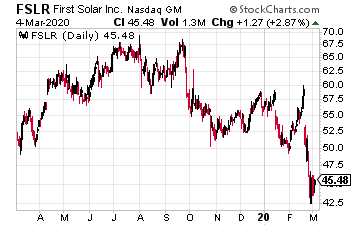

Let’s look at some of the major players in the industry. We’ll start with First Solar (FSLR), which is a solar-panel maker based in Tempe, AZ. This company has gotten a great deal of attention, but I encourage to stay away. First Solar has some serious operational problems.

First Solar focuses on solar panels that are high-efficiency and thin-film. The company was founded in 1999 and went public in 2006. At the IPO, the shares were priced at $20 and rallied to $280 within a year. Soon after, there was a solar crash and FSLR fell all the way back to $11 per share.

First Solar completely bombed its last earnings report a few weeks ago. The consensus on Wall Street was looking for earnings of $2.72 per share. Instead, First Solar earned $2.02 per share. That’s a gigantic miss! Within a few sessions, the stock plunged nearly 30%.

First Solar even said that it’s looking at different options for what to do with its solar farm business. I think they may want to sell it off. Quarterly sales came in at $1.4 billion which was $300 million below Wall Street’s estimate.

For the year, First Solar now expects sales to range between $2.7 billion and $2.9 billion. Wall Street had been expecting $3.36 billion. Stay away!

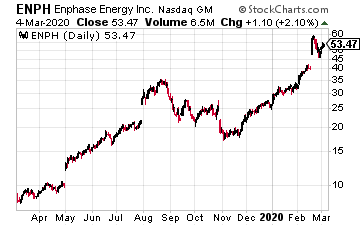

Enphase Energy (ENPH) is another leader in the field of harnessing the sun to power our world. The company makes micro-inverters that convert direct current to alternating current. So far, Enphase has shipped about 20 million micro-inverters.

Lately, shares of Enphase have been hotter than the sun. Around Thanksgiving, you could have picked up a share of ENPH for about $20. Before the coronavirus banged the market, ENPH nearly hit $60. That means ENPH nearly tripled in just a few months.

The last earnings report was outstanding. Enphase crushed estimates (39 cents per share versus 33-cent estimate). While I like this stock a lot, I don’t like the current share price. There’s no reason to blindly chase after a good stock, especially when volatility is so high.

My #1 Solar Stock

But my favorite stock in the sector has invented an intelligent inverter solution that has changed the way power is harvested and managed in a solar photovoltaic (PV) system.

Last month, the company had another blow-out earnings report. Traders must have sensed something. The shares rallied 18% that day. The day after the report came out, it added another 11%.

Quarterly revenues beat expectation and gross margin topped 37%. Sales guidance for Q1 was well above Wall Street’s view. I think Wall Street is finally starting to catch on.

Read here if you want to find out my favorites – and most profitable – solar stock.

Bonus: If you prefer the wide-net approach, there’s the Invesco Solar ETF (TAN). This is an exchange-traded fund that’s invested in a broad array of solar stocks.