For almost a year, the stock market has been brutal for those investors who have tried to time the next upturn or downturn.

Since the bear market first bottomed last June (and then again in October), the stock market rallies have run enough to get investors excited before dashing their hopes by turning down again.

But there’s a time-tested way of making money even in these markets. It’s actually simpler, and even takes less time than trying to find the “hot stock” of the day.

Let me show you…

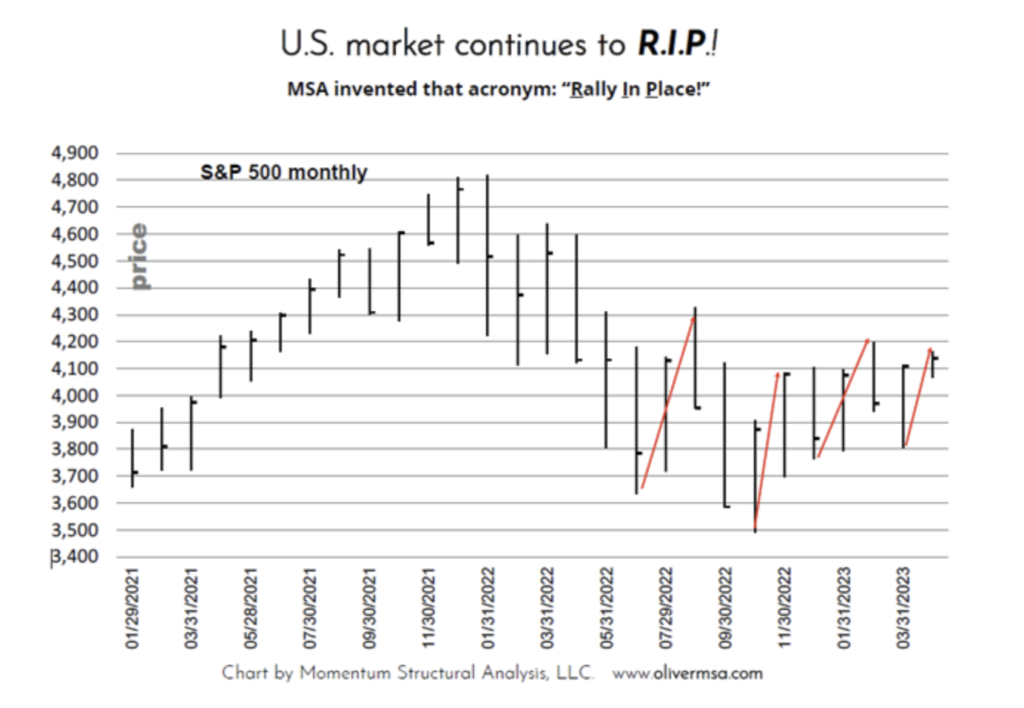

A couple of weeks ago, this chart from the weekly note from the Momentum Structural Analysis technical service caught my eye. The price bars are the monthly ranges for the S&P 500.

The chart really gives a visual of how tough the market has been since early last summer. I expect this pattern to continue until the Federal Reserve decides it has “Whipped Inflation Now.” (That’s a 1970s reference, if you weren’t around then).

In this market, my high-yield Dividend Hunter strategy will give investors a chance to make money while other investing or trading strategies fail. Here are the Dividend Hunter basics:

- Focus on building an income stream by investing in a portfolio of high-yield stocks and other investments. The Dividend Hunter portfolio has a current average yield of about 9%.

- Continue to buy shares by reinvesting a portion or all of the dividends earned. Also, with additional investments if you are in the building stage of your portfolio.

- Portfolio income is the primary tracking metric. As long as income is stable and growing (which it will be), share prices are a negligible concern.

As you reinvest dividends and add new money to your portfolio, you will automatically buy more shares when prices are down (and yields are high) and fewer shares when share prices are up. Over time, the result is a low average cost for your shares and a nicely growing, high-yield income stream.

Then, when the stock market goes into the next bull market, you go, “Heck, where did all this money come from?” as share prices appreciate.

It works. I invest in the same stocks I recommend to Dividend Hunter subscribers. I track my income, and it grows every single quarter. When share prices drop, I get excited to buy more and increase that income.

If you want to get started, look at Hercules Capital (HTGC), which just declared a $0.47 per share dividend ($0.39 regular dividend plus $0.08 supplemental payout). HTGC yields 11.8% on the regular dividend.

For more great high-yield investments, join my Dividend Hunter community.