Wall Street Lays an Even Bigger Egg

Last week was one of the most dramatic weeks in Wall Street history. Twice the New York Stock Exchange had to halt trading because the S&P 500 reached its intra-day down limit. For the first time since the Great Depression, the Dow had back-to-back days where it moved more than 9%. It actually did it for three straight days.

The Federal Reserve gave us a surprise interest rate cut last week, followed by another surprise cut announced on Sunday afternoon. It was for a full point. The new range for the Fed funds rate is 0.0% to 0.25%. There’s even a chance that the Fed may soon do what the rest of the world has done and brings rates in the negatives.

On Monday, the stock market continued to plunge. In fact, the Dow had its second-largest percentage loss in its 124-year history. Only the crash from 1987 stands ahead of it. Thanks to the new circuit breaker rules, the exchange shuts down for the day is the S&P 500 loses 20%. That means the 1987 record may never be broken.

Incidentally, the plunge from Monday edged out the infamous “Black Tuesday” crash from 1929. This crash was celebrated in one of the most famous headlines in American media, “Wall St. Lays an Egg.” Well, we just laid a bigger egg.

This Drop Is Different. Here’s Why

Some of this selling has been so severe that it’s almost impossible to keep up with which stocks have been punished and why. Some stocks are jumping or falling 20% each day. However, the recent selloff in the market is quite different from the previous ones.

This time, the threat to the market is external. It’s not the excesses of a bubble that pulled down the market (though there are excesses). Most businesses were in fine shape once the social isolation policy started. There was little wrong with the fundamentals of the economy.

Here’s a thought exercise. Imagine the stock market is like betting on runners in a race. What drives who wins or loses is the skill of each runner; their training, exercise, nutrition, and strategy.

But what’s happened is that in the middle of the race, say, a 50-pound rucksack gets attached to each runner. Well, the rucksack is the coronavirus and our social isolation policy. Naturally, that dramatically slows down their pace.

Note that there’s nothing wrong with the runners. Once the ruck goes, they’ll be back to normal. That’s similar to what we’re dealing with here. The structure of the U.S. economy is (mostly) sound. Things will change once there’s clear evidence that the virus is losing. There’s little substitute for victory.

Now I want to list three defensive steps that you should consider.

Make Sure You Have Some Fixed Income

Thanks to the Fed’s rate cuts and fears of a recession, bond yields have plunged. Investors in long-term fixed-income have done quite well recently. What’s interesting is that they’ve done well even when long-term yields were already low.

An easy way to get exposure to the long-term bond market is with the iShares 20+ Year Treasury Bond ETF (TLT). Owning a position in fixed income is a smart defensive strategy. TLT usually does well when things look bleak. (Like now!) You want it there for your safety.

How to Short the Market

Another way to protect yourself is buy shorting the market. This is a tricky strategy and can quickly work against you. However, if the market turns out, your short bet can pay off—a lot.

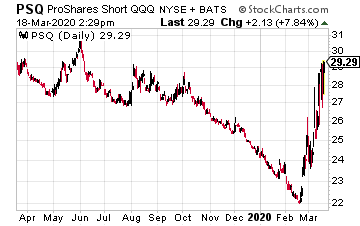

I don’t favor taking an actual short sale. Instead, I prefer vehicles such as the ProShares Short QQQ (PSQ) This is an ETF that’s tied to the opposite of what the Nasdaq 100 does. The Nasdaq 100 is the 100 largest nonfinancial stocks in the Nasdaq Composite. This index is often used as a proxy for large-cap tech stocks.

When the market takes a bit, the big tech companies often fall the most. That’s why shorting them can be a big payoff.

But I have to stress that this is a risky strategy. That’s why I recommend a modest position in PSQ. I also favor keeping a tight stop-loss on it, so you limit your losses if the market suddenly moves against you.

Like with so much investing, their investments are tools. They have different uses. The key is putting them together in such a way that protects your losses while giving you the opportunity for gains.

Buy Consumer Staples

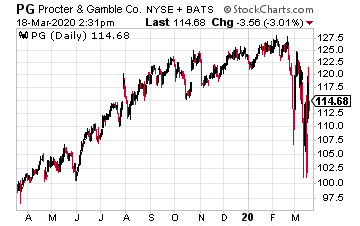

Consumer staples are one of my favorite categories of stocks. These are companies that make products that never go out of style. That means stocks like Procter & Gamble (PG) or Church & Dwight (CGD).

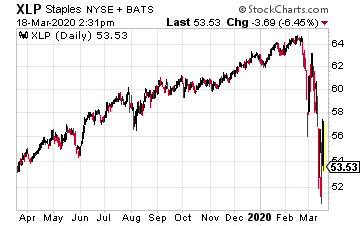

I like that consumer staples have been strong growth stories, but they have a defensive component as well. Consumer staples often start leading the stock market as the economy begins to look shaky.

When the seas get rough, investors flock to the safety of well-established markets. The best ETF for this sector is the Consumer Staples Select Sector SPDR Fund (XLP).

These are three defensive strategies that will help you in this turbulent market.