NGL Energy Partners LP (NYSE:NGL)

- IPO Date: May 12, 2011

- Market Cap: $2.96 billion

- Annual adjusted EBITDA: $443 million (2015 guidance as of Q1 2015)

- GP/Sponsor: Husky Energy Inc. (TSE:HSE)

Distribution Facts

- Current yield: 9.1%

- TTM distribution growth: 7.3%

- Forecast annual distribution growth rate: 6% – 8%

Business Operations

NGL Energy Partners owns a diverse mix of assets across the energy services spectrum, from upstream to downstream retail. For its size, NGL has its fingers in a lot of pies and provides a wide range of services in each pie. Here is the company’s operating sectors in as concise a form as I can put together:

- Water Solutions (upstream/midstream): Treatment of oil and gas wastewater coming out of wells. Services include water disposal using NGL’s innovative, patented technology and solids processing.

- Crude Logistics (midstream): Purchase and transport crude oil from the wellhead to the refinery. Own and operate storage, pipelines, terminals, and barge, rail and truck logistics assets.

- NGL Liquids (midstream): Transport, handle, store NGLs. Own terminals, storage facilities and railcars. Currently developing largest underground NGL storage in Western U.S.

- Refined Products/Renewables (midstream): Purchase and transport refined products from refinery to rack. Own and operate pipelines and terminals.

- Retail (downstream): Distribute propane/distillates to residential, industrial, and commercial customers.

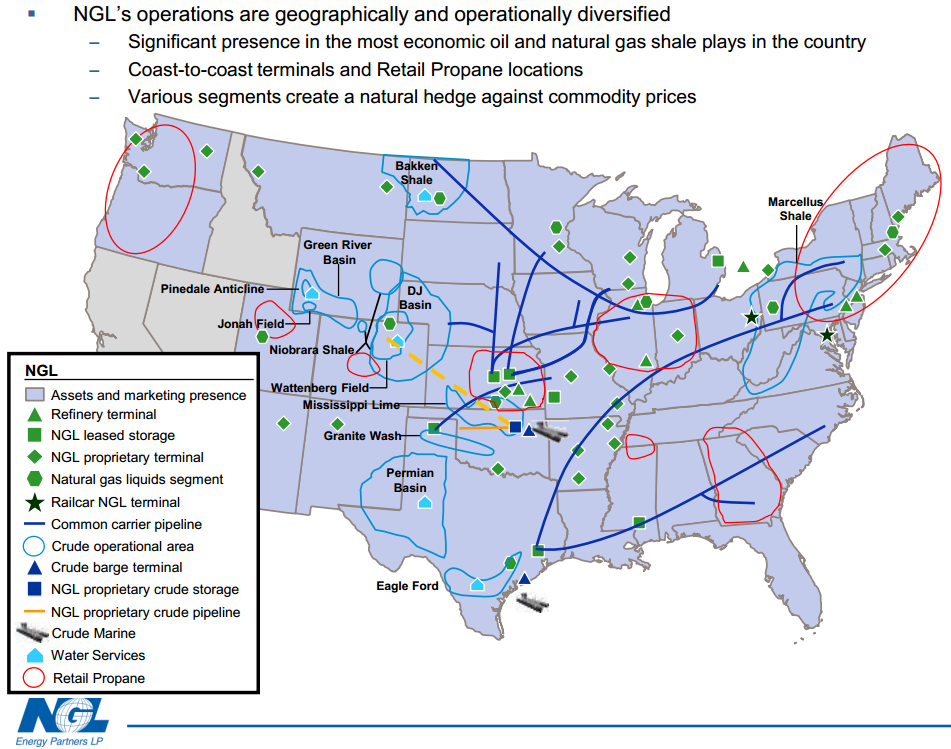

Along with its diverse business line, NGL has a national footprint, as shown in this chart:

EBITDA contributions are fairly evenly balanced across the sectors. Below you will find the company’s sector percentage projections for 2015 and 2016. Current revenues are split about 50/50 between fee-based contracts and margin based operations. Gross margin business includes the retail propane business and the crude logistics, where NGL buys oil at the wellhead to sell to refineries.

Growth and Investment Prospects

Since its May 2011 IPO, NGL has grown its annual EBITDA by almost 20-fold, from $24 million at the launch to a projected $442 million in 2015 and over $500 million in 2016. The company has been built on over 40 acquisitions in the last four years, building up the diversified network of assets discussed above.

The quarterly distribution has been increased every quarter since the IPO, and the payout is now 85% higher than the initial rate. Prior to the 2015 second quarter distribution, which was 7.3% higher than a year earlier, year-over-year distribution increase percentages had been running in the mid-teens.

Now as a mid-sized MLP, NGL has the financial clout to internally develop assets as well as make acquisitions. Self-development of assets should produce a higher annual ROE on invested capital.

For example, the company’s Grand Mesa pipeline is under construction with projected, contract secured, $150 million of annual EBITDA when the pipeline opens in Q3 2016. Firm completion costs are $670 million. The math gives us an initial 22% return on equity. NGL management has announced a goal of $1 billion in annual EBITDA by 2018. That’s a double in the size of the company in its second four-year stretch as a public partnership.

The diverse nature of NGL’s various business should allow the company to generate steady EBITDA and cash flow growth through a wide range of energy price and production swings. The recent sell-off of the entire MLP sector has pushed the unit price down and the NGL yield to over 9%. With distribution growth rate of at least 6%, the yield plus growth combination gives a very attractive cash flow investment return from the NGL units. As the company focuses more on internally developed projects, the distribution growth could reach into that 10% range as new projects come online.

The primary risk for investors is the high volatility of the NGL unit price. Seventy percent of the LP units are held by insiders (11%) and the general partner (59%). The high controlling party ownership gives a high degree of confidence in the continued growth of NGL.

On the flip side, the relatively small public float has resulted in a high level of unit price volatility. Currently, NGL is trading in a wide $26 to $30 range, with occasional excursions outside of those limits. This is an MLP to buy in several bites. Start with a smaller than your regular position and have cash ready to add units when there is a significant price drop.

Recommendation: Buy and Accumulate