The Top 5 Stocks to Buy for 2015

I have learned and employed many successful investing strategies during my three decades of investing. Few have brought higher overall returns on average than finding and investing in stocks that have seen better times but decide and execute successful turnaround plans which deliver outsized shareholder returns.

The strategy is not for everyone. Not every turnaround strategy works and the rate of failure is high – companies would not need a turnaround strategy if everything was going well with the firm’s current business model after all.

Employing this type of investing requires discipline, patience and the willingness to be a contrarian and go against the herd – traits not every investor possesses. However, the huge returns that typically occur when a company executes a well thought turnaround plan makes this investing worthwhile for those are willing to do the work to find these companies and patiently wait and watch as these companies execute against their plans.

I have found over the years that I am quite good about ferreting out these plays. I have also found I am usually early in investing in these turnaround stories. I now slowly build positions in these types of investments over time after catching one too many falling knives. Many of the stocks in my Small Cap Gems portfolio are or have been at various stages considered turnarounds.

Solid turnarounds come in many flavors, forms and sizes. They cut across sectors and industries and run the gamut from A to Z. Over the past few years I have more than doubled my money in Alcoa (NYSE: AA) as it transitioned from a commodity play into a value added seller to the auto and aerospace industries. I also more than tripled my money in a busted IPO called ZELTIQ Aesthetics (Nasdaq: ZLTQ) whose razor and razor blade model took a while to gain traction with investors.

The turnaround that has created the most shareholder value in history is Apple (Nasdaq: APPL) which was on the verge of irrelevancy when Steve Jobs returned to the company he co-founded. He then went on to create the most successful company by market capitalization in the world.

One of my first investments when I was a teenager was a small purchase in Chrysler at the beginning of Lee Lacocca’s efforts to bring the American manufacturing icon back from the brink of bankruptcy. That investment turned out to be my first five bagger in the market. It was also the first of many successful turnaround bets that have benefited my portfolio to a significant degree over the years.

Over the past few years I have more than doubled my money in Alcoa (NYSE: AA) as it transitioned from a commodity play into a value added seller to the auto and aerospace industries. I also more than tripled my money in a busted IPO called ZELTIQ Aesthetics (Nasdaq: ZLTQ) whose razor and razor blade model took a while to gain traction with investors.

Turnarounds have the unique position where investor sentiment is usually so negative on the stock and company that any piece of positive news or traction executing with the firm’s turnaround strategy can cause a significant rally in the shares.

It is these types of gains I am constantly on the lookout for both within my own portfolio and as editor of The Turnaround Stock Report, a service for investors looking for long-term profitability from stocks on the rebound.

In this report I’ll highlight five companies found in my personal portfolio as I believe they can successfully turn around their businesses and deliver outstanding performance to their stockholders. I’ll spend some extra time profiling one of my favorite stocks first, Dynavax Technologies Corp.

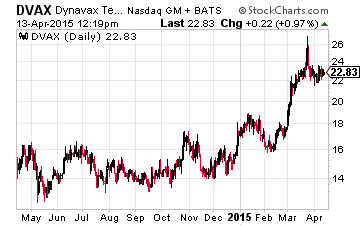

1) Dynavax Technologies Corp. (NASDAQ: DVAX)

With a market capitalization of about $650 million, Dynavax focuses on pioneering a new approach to therapies for multiple autoimmune and inflammatory diseases including lupus, psoriasis, and rheumatoid arthritis. The company’s technology looks to inhibit Toll-like Receptors (TLRs). TLRs are key receptors of the innate immune system that can induce strong inflammatory responses.

The commercial opportunity is quite large. Over 20 million individuals just in the U.S. and Europe have autoimmune diseases such as lupus, psoriasis, and rheumatoid arthritis. Key biologic drugs used to treat these conditions generate over $15 billion in worldwide sales each year.

The company has several compounds in development. However, near-term prospects will be driven by the development of Heplisav-B which is a vaccine in Phase III trials that is targeted at hepatitis B. Hepatitis B is the most common serious liver infection in the world. It comes in two varieties: acute and chronic. Most individuals have the acute version of this disease which affects the individual for 1-4 months presenting symptoms like fatigue, appetite loss, nausea, as well as itching, jaundice, and aches in the liver region. This version of the disease is usually defeated without drugs over a few months.

The chronic version of this type of hepatitis does not go away by itself and can cause a form of liver cancer and death. Children are particularly at risk if they are infected with this type of hepatitis.

The chronic version of this type of hepatitis does not go away by itself and can cause a form of liver cancer and death. Children are particularly at risk if they are infected with this type of hepatitis.

The company also has early stage development for treatment of Lupus within a partnership with GlaxoSmithKline (NYSE: GSK) and an early stage asthma compound is being developed in conjunction with AstraZeneca (NYSE: AZN). Dynavax will receive milestone payments as both compounds reach successive successful endpoints as well as royalty payments should they attain approval and market distribution.

The Turnaround Story:

The stock ran up to almost $50 a share in late 2012 on the anticipation of the approval of Heplisav-B. Unfortunately that is where the company ran into a roadblock. Even though results from its Phase III trials were encouraging, neither the FDA nor its European equivalent would grant approval of the compound. Both agencies cited that there were not enough test subjects in these studies to provide confidence in the efficiency and safety needed to approve Heplisav-B.

It is important to note that the FDA did not say this compound was ineffective, just that it needed a larger sample size for Phase III trials to be approved. Dynavax has spent the better part of a year enrolling more than 8,000 patients in a new Phase III study for Heplisav-B which should be completed by October of 2015.

The enrollment for the study was completed in late 2014 and the stock has behaved more strongly as a result. Also helping the shares is the news that Arrowhead Research Corporation (Nasdaq: ARWR) just posted disappointing results with that company’s experimental hepatitis B drug in Phase II trials.

Obviously the biggest catalyst for Dynavax would be the approval of Heplisav-B. The stock ran up to $50 a share in anticipation of approval previously so logically a floor if approved would be $50 a share. I like the risk/reward of this stock at current levels and want to overlay my own risk mitigation strategy on this position as well.

We are not putting a price target on Dynavax Technologies Corp., but “Jensen’s rules” for biotech investing do apply. This strategy consists of selling 10% of your original stake once a 50% gain has been achieved, 20% if the stock doubles off your entry point and 20% more if the stock triples. This way one books a guaranteed profit while retaining half their original stake riding on the “house’s” money. I have found it to be prudent way to invest in this inherently volatile space.

Click here for more on how to use turnaround stocks in your portfolio for massive gains.

2) Devon Energy (NYSE: DVN)

The mid-cap exploration and production company has been in my portfolio for about a year and has delivered an approximate 30% gain so far, even with the recent turmoil in the energy markets. The company’s strategy is to transition from a primarily a slow growing natural gas producer to a more focused and faster growing production concern that gets a significantly higher percentage of overall production from more lucrative oil.

The company is about halfway through this transition. In early 2014, Devon sold off about $3 billion in natural gas assets and facilities in Canada. It also spun out its midstream assets into a separate entity with a partner. It used these proceeds to start to pay down a $6 billion purchase in the Eagle Ford shale region in Texas late in 2013. This acquisition substantially bolstered Devon’s production growth and boosted its overall oil production as well.

After pulling back recently as the result of oil prices that have fallen $10 a barrel over the summer the stock is offering a solid entry point at just over $60 a share. The consensus has Devon delivering a 10% to 15% earnings increase in 2015. The stock goes for just over 11 times next year’s earnings estimates; a 25% discount to the overall market multiple.

Let’s move on to a couple of emerging turnaround stories in the consumer discretionary space; sectors that have underperformed the S&P 500 all year.

3) Coach (NYSE: COH)

In the retailer sector, I have just taken a small stake in tarnished handbag purveyor Coach. Many investors shy away from retail though it’s certainly not their most hated sector. Newcomer Michael Kors (Nasdaq: KORS) has eaten Coach’s lunch in some of its core segments over the past year. The stock is down some $20 a share this year to currently around $42 a share.

The company has seen better times but still has some things going for it including a strong and recognizable brand. The company is also seeing men’s sales increasing in the low double digits even if it is off a small base. Coach has a strong balance sheet with over $700 million in net cash.

Coach recently brought in a new Chief Operating Officer and is now focusing on returning to best-in-class profitability. The shares sell at around 10 times 2012 and 2013 earnings and the company has solid opportunities for growth in Asia. Finally, the shares yield almost four percent at these levels. I will add more to my initial stake once the company provides more detail and proof that a solid turnaround plan is in place.

4) Chicago Bridge & Iron (NYSE: CBI)

I am also building a significant position in engineering and construction firm Chicago Bridge & Iron (NYSE: CBI). The shares have moved from around $85 a share to begin the summer to a current $50 a share. The first $10 to $15 a share of this decline was triggered by an obscure quasi-research firm accusing the CBI of taking liberties with its purchase accounting as it integrated its major acquisition of fellow engineering and construction firm Shaw Group. These concerns have not been echoed by any of the over dozen analysts that cover the shares at major investment shops.

The major part of the pullback in the shares has occurred due to increasingly negative sentiment in the commercial construction sector as well as on the energy industry where Chicago Bridge & Iron gets approximately half of its revenues building huge energy facilities like refineries and storage tank farms.

Despite concerns about the impact of falling oil prices on capital budgets, Chicago Bridge & Iron keeps winning new contracts all across the globe. The company has an enterprise value of approximately $7 billion. In contrast, the firm’s order backlog stands at over $30 billion. In addition, consensus earnings estimates remain pretty much the same as they were three months ago. Earnings for 2014 were just under a 25% year-over-year gain, and this year the consensus has another 15% earnings increase in store. The stock is very cheap at just under nine times this year’s earnings.

5) Darden Restaurants (NYSE: DRI)

I have recently upped my allocation to this restaurant holding company. Starboard Value, an activist fund manager, has taken a substantial stake in Darden and has been pushing hard for changes at the company to unlock shareholder value.

Starboard has pushed for Darden to put its Red Lobster and Olive Garden chains into a separate entity and puts its real estate portfolio in a more efficient capital structure as well as to improve its food menu to offer healthier choices. This will allow the remaining company to concentrate on its faster-growing restaurant chains such as Capital Grille and Bahama Breezes.

Darden has recently divested itself of Red Lobster and announced that its embattled CEO will step down at the end of the year. Darden has also recently agreed to give Starboard some board seats. Same store sales declines at Olive Garden improved in the last quarter.

When I first brought Darden to the attention of Investors Alley readers it was trading at $48. It’s now just below $70. Starboard believes its plan can add $15 to $26 a share in shareholder value to the company. I have a more conservative estimate of $10 to $12 a share and have been encouraged by recent events at Darden. The shares also provides a 3.2% dividend yield which should put a solid floor under the stock near these levels.

My Small Cap Gems portfolio has five more stocks in what most investors would surely have called turnarounds only a year ago. Now they’re all up big in the hottest sector in the market. They’re the kind of stocks I’ve used in the past to accelerate the growth in my portfolio.

Positions (as of publishing of report): Long DVN, DVAX, DRI, COH, CBI

BONUS RESEARCH

Bret Jensen Chief Investment Advisor Small Cap Gems |

Dear Profit Seeker,

This is one of the most important letters you’ll ever read.

What if today – right NOW — I handed you ‘preferred and exclusive access’ to the NEXT Pier 1 Imports (rose 12,700%)… the NEXT Concur Technologies (zoomed up 41,290%)… or the NEXT BJ’s Restaurants (soared up for a towering 47,570% gain)?

I’ll go one better…

Right now, what if I agreed to open my own private portfolio to you for the next 365 days? So you get first dibs at owning America’s most promising and lucrative ‘Superstar Stocks’ for 2015 and beyond.

You’ll see exactly WHEN, WHY and HOW MUCH a former Hedge Fund Manager like me is investing in each of these profit-rich gems. IN MY OWN PERSONAL ACCOUNT.

Sound like something you might be interested in?

Good. Keep reading…

![]()

The Extraordinary Secret Behind

MONUMENTAL Profits

Let’s get to the heart of the big secret I’m revealing today. First, take a peek at a few of the best performing Small Cap stocks of the last decade…

Not surprisingly, nearly all of these breakout stocks started out below the $1 billion threshold.

That is the very definition of a small-cap company.

If you want a shot at enjoying POWERHOUSE PROFITS, you need to find and invest in America’s best SMALL CAP GEMS.

Fact is, it’s much easier for a tiny company to grow at 50%… 100%… even 250% a year.

Compare that to a $100 billion mega-cap that is simply too large, too bureaucratic and too ungainly to be able to seize opportunities quickly enough.

That’s why I’m zeroing in on the most promising small caps! And so should you.

![]()

“All You Need is to Hit Pay Dirt on One Small Cap to Become Independently Wealthy – for LIFE!”

Imagine if a well placed “insider” told you Medifast was on the brink of something big about 10 years ago, and you backed it with a $7,500 ‘bet’…

You’d be $1,215,675 RICHER TODAY! Yes, over a million bucks richer – thanks to the fortunes of a single small cap stock!

I’ve known this Small Cap Super-Leverage Secret for years. How to pick an under-the-radar stock… one hiding a little-known gamechanging trigger… at EXACTLY the right moment.

I used it to line the pockets of my Hedge Fund clients not long ago. Now it’s your turn to share in the spoils. Starting today, you can participate in this extraordinarily lucrative Small Cap Bonanza!

“Small caps are where you find the next Apple (APPL), the next Tesla (TSLA).”

– BusinessWeek

![]()

I’ve had staggering success over the years as a leading small cap crusader. My track record proves it. If you were to ask me, “What have you done lately?”, I’d point to a few big wins already in the bag:

So let me ask you… are you tired of waiting years for paydays that never come? Or would you rather invest your hard earned money in a few promising small cap opportunities with plenty of potential for double- and TRIPLE-digit gains in just a few months?

Please make up your mind quickly. As you’re about to learn, it just happened again…

![]()

Allow Me to Introduce Myself

|

My name is Bret Jensen, editor and founder of Small Cap Gems.

You already know me if you’re one of my 18,000 loyal readers on Seeking Alpha – one of the most highly trafficked sites in the investor community.

Most recently, I launched Small Cap Gems to introduce my readers to companies best suited to prosper from the new economic recovery – and weather the inevitable storms.

My sweet spot? Small caps flying under the radar… and hiding a secret trigger that will let them dominate their niche

What’s so special about these emerging world-beaters? Each has a unique edge — something I’ve spotted that puts them head and shoulders above the competition.

Nope, I’m not a stickler for a particular industry…

Pharma… tech… retail… energy… manufacturing… financial… I cover them all.

Count on me to identify America’s ‘up and comers’ — young, innovative and aggressive companies leading our nation back to the top of the heap, where it belongs.

And guess what? I have a knack for finding these companies just a few months before their transformative nature becomes glaringly obvious for everyone on Wall Street to see — and their price explodes.

Before we go on, there’s one important thing you should know about my style…

![]()

Leading from the Front

In my prior life, I enjoyed a very successful career as a Hedge Fund manager.

I was Chief Investment Strategist (CIS) for Simplified Asset Management, a hedge fund based in Miami, Florida from 2008 to 2011. Our fund was in top 5% of long/short hedge funds for total return in its first full year (2009). And there were over 450 funds in this category.

Now as editor and chief investment advisor for Small Cap Gems, I still like to lead from the front.

Here’s a secret I don’t often divulge. I don’t just roll up my shirtsleeves Monday to Friday – I like to connect with my readers on the weekend, too. I answer reader questions from my living room every Sunday!

Here’s a secret I don’t often divulge. I don’t just roll up my shirtsleeves Monday to Friday – I like to connect with my readers on the weekend, too. I answer reader questions from my living room every Sunday!

You won’t see many other editors for investing advisories making that kind of commitment.

No wonder I just received this certificate from TipRanks on being ranked as a Top 100 blogger of 2013.

I came in at #6… from over 3,700 bloggers!

I don’t like bragging about myself so I’ll share some comments from my actual readers:

![]()

“Seriously, You Are My HERO!”

Small investor, 300 shares up 185%. Great appreciation for me and very first double-bagger!! Enjoying the newsletter subscription very much.

— Paul W.

Bret, I’ve been meaning to thank you for your insightful help with stock selection, during these turbulent times. THANK YOU, VERY MUCH !!

— T.

Every time I read your articles I ask myself, “this author must have a super successful career, how did he become so good?” I admire your wisdom, judgment, and hard work. Only wish I found your name earlier. Thank you!

— Bo

I am a long-time follower and subscriber to your newsletter! You’re the MAN! Thx for all your hard work and expertise.

— Dee L.

Now for some Breaking News I know you’ll be interested in.

Did You Lock In an Impressive +215% Gain on December 2nd?

One of my Top Buys just paid out. But NOT for the reason I expected.

Let me explain.

You see, I’d been telling my readers to buy an up and coming biotech superstar called Avanir Pharmaceuticals since July 18, 2014. Back when it was priced at $5.39 a share. It quickly took off to $10, then $15, which was right in line with my optimistic forecast.

Why was I one of the very few to identify Avanir’s massive untapped potential? Precisely because I had done my homework and saw this California-based company quietly positioning itself with a major triple-threat:

- Avanir owns the ONLY effective and approved drug for a niche disease impacting almost 2 million Americans. This condition (which often leads to uncontrollable laughing or crying) is commonly observed in people with neurological injuries such as brain injury and stroke. It launched this drug in 2011 and has seen tremendous growth so far (see chart here). But it still has only reached 1% of effected individuals. This represents a massive opportunity.

- It also has a new compound for the treatment of adult migraine headaches – and just met its primary endpoints in late trials. The FDA has accepted their New Drug Application (NDA) for the company’s AVP-825 “breath powered” drug-device for treating migraines.

- BREAKING NEWS: As reported by MarketWatch in September 2014, the company just announced a positive Phase II trial result for its revolutionary AVP-923 treatment. The result? “Significantly less agitation” in Alzheimer’s patients.

Talk about having a powerful tailwind at your back.

Brain injury… stroke… migraines… Alzheimer’s disease…

These are HUGE markets with multi-billion dollar potential. Yet one other appealing possibility kept raising its head.

![]()

Here’s the MOST SURPRISING Reason I Gave This Stock my AAA+ Rating

I rarely buy a stock based on it being a buyout candidate, but I made an exception in this case. That real possibility was simply too hard to ignore.

Consider this…

Avanir is still a minnow in this market – with only 150 sales reps divided across 50 states. Kind of pathetic, don’t you think? A larger concern could fold sales of their breakthrough drug into its existing sales force. With an immediate sales force expansion of thousands of reps, they could ramp up their 1% market penetration – and reach 3%, 5%, even 15% and higher in a short period of time.

Remember, biotech and pharmaceutical companies are routinely purchased for 10 to 20 times sales or more.

As an investor, you should look at the buyout of Idenix Pharmaceuticals by Merck. That 200% premium is just one example of the lucrative returns an investor can achieve when things go right in this exciting space.

Good news for everyone… but especially for curious investors with their ear to the ground.

Well, look what happened on December 2, 2014…

Avanir announced a $3.5 billion buyout offer from a Japanese pharmaceutical company looking to tap their expertise and promising pipeline. I exited our position as shares spiked to $17. Not a bad little gain from my entry point of just over $5. – less than 5 months ago!

ALERT: I’m Swapping in Another

High-Growth Upstart

I’ll cut to the chase. Avanir was a great win for us. And there’s really no reason for anyone to be surprised.

It ticks every one of my boxes…

They have a stranglehold on a highly lucrative niche… top-flight management leading the way… a few more potential blockbusters ‘up their sleeve’…… and were happily flying under the radar (until lately)…

These are a few key triggers I use to identify world-beater breakout stocks like this.

And I’ve just added a new world-beater to my Small Cap Gems portfolio.

Guess what. It’s up +49% — in JUST 4 WEEKS!

Sorry, it’s almost impossible to keep this latest one under my hat any longer. Media coverage is on the verge of exploding. So you need to get in FAST to have a shot at blockbuster results in your own portfolio.

This high-flier has already jumped from my buy price of $4.86 to $7.10 today. But you still have a window of opportunity. My target price is $14, and even that may prove to be conservative.

The company has a small $300 million market cap. It barely receives any coverage from the analyst community. Only three analysts have price targets on the shares.

Those with deep pockets already have their eye on this prize. One big fund is a beneficial owner (with over 10% of the float) and added over $7 million in shares in July 2014.

That’s not all…

I can tell you that Company Insiders own over 10% of the shares — and have been net purchasers of the shares over the past 24 months.

All good signs.

Clearly, it’s all about the future here. And that future is potentially MASSIVE. That’s why I’m calling it my #1 Small Cap Stealth Rocket for 2015.

No, I can’t tell you the name of the company here. That wouldn’t be fair to my existing readers.

But I can make it exceptionally quick and easy to get this information and much more besides…

![]()

Now Really is the Perfect Time to Hop on Board!

As I write this, our Small Cap Gems portfolio boasts 10 solid plays… and we’re on our way up to holding a diversified portfolio of 20 exciting stock picks over the next few months. I see dozens of exciting high-growth plays across pharma, energy, tech, consumer favorites, housing and construction, and financial services, just to name but a few.

In short, Small Cap Gems is for you if:

- You’re an investor looking for big, but reasonable gains, from individual stocks.

- You’re seeking “life changing” kind of money… accrued one superior stock at a time.

- You want to join me, a former hedge fund manager, as I put my money where my mouth is and build a practically bulletproof portfolio for 2015 and years to come.

Remember, I deal exclusively in plain old stock buys. No tricky options… complicated setups… or timing maneuvers that require a Ph. D to execute properly.

My picks may be SIMPLE to get into – but they can be downright EXPLOSIVE if my gut instinct is correct. Any one of these “Small Cap Stealth Plays” can juice your portfolio by 75%, 125%, even 250% or more.

![]()

Follow in the Footsteps of America’s Top 1%

“High net worth individuals (HNIs) are considered more investment-savvy than retail investors. Either they have a team of advisors or are quite clued in to the market dynamics.”

“Right now, they prefer to invest more in small and mid-cap than large-caps.”

– Business Standard, Nov. 25, 2014

![]()

SNEAK PREVIEW: 3 Prime Breakout Stocks

for 2015

Small Cap Gems is barely out of the gates and we’ve already chalked up a towering +215% gain on Avanir Pharmaceuticals. And were up +49% on another biotech upstart – in just 4 weeks!

There are plenty more to come. Before you do anything else, I recommend you dip into my Top 3 most lucrative small caps before it’s too late. All three boast seasoned executive teams leading the way… are hiding one or more ‘profit triggers’ that can send their share prices into orbit… and are flying under-the-radar, at least for now.

When you respond today, as an extra incentive, I’ll rush you my complete dossier on these THREE companies whose shares are primed to ‘pop’ in 2015 .

When you respond today, as an extra incentive, I’ll rush you my complete dossier on these THREE companies whose shares are primed to ‘pop’ in 2015 .

You’ll find all the crucial details on these small cap superstars inside your FREE special report called “3 Prime Breakout Stocks for 2015”.

I can’t say much about these until you join. But I can give you this sneak peek:

Breakout Target No. 1: First up is one of my all-time favorite turnaround plays. This “big box” retailer operates 425 sporting goods stores in the western U.S. Incredibly, they produce more sales per square foot than either Dick’s or Hibbett, yet their stock sells at a huge discount to either. Plus their brand spanking new e-commerce site should be up within weeks.

Today’s price: $12.02 a share. My target: $17.00 or higher for a 42% gain!

Breakout Target No. 2: Here’s another small cap I guarantee you’ve never heard of. This $800 million company designs and manufactures key components to enable VoIP solutions, and it is benefiting from the build-out of 4G networks as well. The stock has recently started getting positive coverage from analysts and is seeing substantial new insider buying as well.

Today’s price: $3.34 a share. My target: $8.00 or higher for returns of 139%!

Are you starting to feel my excitement? And of course, there’s also my #1 Small Cap Biotech Play for 2015. We’re up +49% on this one already…

Breakout Target No. 3: This $300 million biotech company is developing a stable of imaging and therapeutic agents to better detect and treat various forms of cancer. They have many other exciting early-stage products as well. I estimate the sum of the parts valuation to be in the $10 to $14 a share range. This is 100% above the current stock price of just over $7 a share.

Today’s price: $7.10 a share. My target: $14.00 or higher! Giving you the chance for a 97% return.

Hot off the presses, my new Special Report is called “3 Prime Breakout Stocks for 2015”. It’s yours absolutely FREE — simply for responding today.

This list price is $129, so you’ve already scored a major bargain by getting it FREE.

Better yet, you can keep it, with my compliments, even if you decide later on that membership is not for you after all.

But hold on. There’s one more thing you need to know …

![]()

Claim Your 100% Risk-Free Subscription

to Small Cap Gems

Normally Small Cap Gems runs $199 for a 12-month membership. That itself is a bargain, when you look at the gains I’ve been churning out for my loyal followers.

But today, I’m putting most of that cash right back in your pocket making this is the easiest decision you’ll make all year.

Please GO HERE for details.

(HINT: You’ll SAVE an additional 50% off today’s introductory price and get immediate access to every single one of my recommendations. For a deep-discount price of only 27 cents a day.)

I’m ONLY doing this so you can experience the raging power of the emerging small cap rally…

So please don’t hesitate. Begin enjoying all this for 50% OFF — in just 2 minutes:

One full year of surprising and sometimes extreme profits on America’s most promising small cap success stories.Not piddling 5% or 10% gains — I’m talking 58%… 86%… 125%… even 215% treasure troves!

One… .. even three brand new Strong Buys every 30 days.You’ll get my latest insights, analysis and recommendations on the most urgent small cap plays. In every issue you’ll get my Market commentary… complete Portfolio update… along with my detailed research report with clear entry and exit prices for each breakout stock.

IMPORTANT: WE’RE IN THIS THING TOGETHER. Never Forget my money is invested right alongside yours. I take a personal position in every Strong Buy I issue. So when I get to cheer about a super-quick 55% profit – so do you!”

![]() Just-In-Time Email Alerts =>On occasion, I may have a super-urgent bulletin that can’t wait until the monthly newsletter is published. These hot, hot, HOT alerts go straight to your inbox. Be sure to open them right away!

Just-In-Time Email Alerts =>On occasion, I may have a super-urgent bulletin that can’t wait until the monthly newsletter is published. These hot, hot, HOT alerts go straight to your inbox. Be sure to open them right away!

![]() 24/7, member-only access to the Small Cap Gems website. Access the current issue, all back issues, and all special reports – right at your fingertips any time day or night.

24/7, member-only access to the Small Cap Gems website. Access the current issue, all back issues, and all special reports – right at your fingertips any time day or night.

![]() Your FREE ”3 Prime Breakout Stocks for 2015” Report worth $129

Your FREE ”3 Prime Breakout Stocks for 2015” Report worth $129

— My ‘Thank You’ for Signing up Today

![]()

RELAX — You’re Covered No Matter What!

There is no reason to hesitate before you hit the big yellow button below.

Let me make it a no-brainer…

I’ll give you valuable insurance in the form of a 60-Day Every-Penny-Back Guarantee.

Take two full months to test drive Small Cap Gems… to kick the tires and make sure you like what you see.

If at any point during your first 60 days you don’t see clear and convincing evidence that I can transform your investment portfolio – providing a radical new foundation for your retirement dreams…

Simply give us a call, and I’ll ensure you are refunded every penny of your subscription. Right then and there. No ifs, ands or buts.

It rarely happens that a reader cancels, but I want you to know I’m 100% committed to making you PERMANENTLY RICHER — beginning right now.

So can I rush you your free Special Report and begin sharing my small cap secrets today?

Welcome aboard,

Bret Jensen

Chief Investment Advisor, Small Cap Gems

P.S. You may never get another chance to get in on the ground floor of my #1 Small Cap Stealth Rocket for 2015 – at such a bargain price. In the meantime, I have a boatload of Small Caps primed for a significant surge. Any one of these could give you a $25,000 ‘royalty check’ before 2015 is out!

P.P.S. ONLY THE FIRST 750 RESPONDERS ARE GUARANTEED THE EXCLUSIVE RATE OF $99 FOR ONE FULL YEAR OF SMALL CAP GEMS. Lock in your Exclusive Savings now… all spots could be gone within 48 hours.

Your Exclusive, 60-Day Money-Back Membership Guarantee:

No, I cannot promise you’ll reap windfall profits on every single trade since all investments carry a certain level of risk. But I DO stand behind this guarantee:

You will be 100% satisfied with the results we achieve together. If you have any doubt whatsoever, you can cancel your membership within 60 days for a refund of every penny you paid for your subscription… and you can keep your free gift with my compliments.

See what I mean? You have absolutely nothing to lose.

[ExitPopup exitpopupurl=”http%3A//www.investorsalley.com/amember/signup/nXC3Lur2″ exitpopupcookiexpdays=”0″ exitpopsplash=”Please%20W%20A%20I%20T%20…%5Cn%5CnIf%20you%20leave%2C%20you%20will%20miss%20a%20SPECIAL%20DISCOUNT%5Cn%20on%20the%20NEXT%20window.%5CnFIRST%20CLICK%20THE%20**Stay%20on%20page**%20BUTTON%5Cnfor%20a%20VERY%20Special%20OFFER%21%5Cn” ] [/ExitPopup]