Another big global automaker has set off in hot pursuit of Tesla (TSLA): the world’s largest carmaker, Toyota Motors (TM).

The company has said it will pour $35 billion into its shift toward electric vehicles (EVs), with the sum split more or less evenly between vehicle development and battery improvement.

Toyota’s investment in electric car batteries is a roughly 30% increase from the plan the company announced in September. Toyota will ramp up its battery production capacity to 280 gigawatt-hours by 2030, a 40% increase over previous plans.

This signals a major change in strategy for Toyota, as well as an increase in its EV targets. The company now aims to sell 3.5 million battery-powered vehicles annually by 2030. Its management envisions the launch of 30 EV models by then, the line-up including sports cars and commercial vehicles.

Toyota CEO Akio Toyoda said the company’s high-end Lexus brand would be at the forefront of the company’s more aggressive EV push, with all Lexus models becoming fully electric by 2035. There is a strong appetite for a rapid shift toward EVs at the top end of the car market, the CEO explained.

Toyota: Thinking About the Future

However, the company stopped short of going all-in on EVs. As Toyoda said: “Leaving options for everyone… is how we can be competitive and survive.”

Overall, Toyota is committing 8 trillion yen ($70.4 billion) by 2030 toward electric vehicles, hybrids, and fuel cell vehicles, meaning the company will be spending $35.4 billion in developing non-EV autos (such as hydrogen engine cars) as well.

Toyota shows it is thinking about the future with its Monet autonomous vehicle services joint venture with SoftBank and other Japanese automakers, such as Honda. The company also has as battery joint venture with Panasonic; there is also Woven City, a Japanese laboratory city of the future run on hydrogen fuel cells. Toyota is also working on solid state batteries for electric vehicles.

Toyota Targets the US

The looming question is whether, after a slow start, Toyota can become a leader in EVs.

The automaker does have history on its side. Toyota shook up the auto industry over two decades ago when it offered the world’s first mass-produced hybrid vehicle, the Prius, in 1997. And when it comes to quality, Toyota’s manufacturing process is the gold standard of the auto industry.

One of Toyota’s main target markets will be the United States, where the vehicles are big sellers. The company’s popularity here in the U.S. has allowed Toyota to offer fewer incentives than Detroit’s Big Three.

Toyota chose North Carolina as the location for its U.S. factory to make battery packs for up to 1.2 million electric vehicles a year. Toyota is investing $1.3 billion to build the factory.

The Greensboro factory is scheduled to begin operation in 2025, with four production lines and a total capacity of lithium-ion batteries for 800,000 vehicles. Capacity will later be increased as demand for EVs rises.

The Electric Vehicle Future

It’s easy to see why Toyota and other car companies are so interested in getting a piece of the electric vehicle pie.

Although still only a small portion of vehicles currently on the road, global electric car registrations in 2020 grew 41% even as the overall auto market contracted by almost a sixth, according to the International Energy Agency (IEA).

So, while electric vehicles still only make up about 1% of the global fleet of passenger cars, sales are taking off rapidly. For example: within four years, a quarter of new cars bought in China and nearly 40% of those purchased in Germany are expected to be electric, according to BloombergNEF. Global sales of EVs are forecast to reach 10.7 million vehicles by 2025, and then 28.2 million by 2030.

I find myself in agreement with the former Nissan executive, Andy Palmer, who helped launch the industry’s first mass produced electric car, the Nissan Leaf, in 2010. Palmer believes the shift from internal combustion engine vehicles toward EVs is “like moving from the horse to the car.”

That’s why we’re seeing such massive investment flows. The electric and connected car industry has attracted more than $100 billion in investment since the beginning of 2020, according to McKinsey.

And this is just the beginning. Carmakers have announced a total of $330 billion of investment into electric and battery technology over the next five years, according to calculations from consultancy AlixPartners, a sum that has risen 40% over the past 12 months. And this was before the Toyota announcement.

Toyota will become a major player in EVs. And I like the fact that it is still pursuing alternative technologies like solid state batteries.

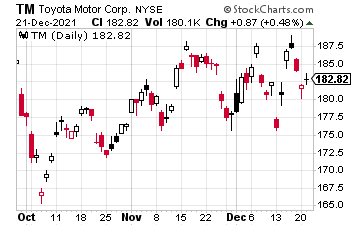

The stock has climbed about 18% in 2021 and is only about 10 points away from its all-time high. I think much more is to come.

Toyota also pays a decent dividend (semi-annual), with a yield approaching 3.6%. A purchase anywhere around $175 a share looks like a good investment.