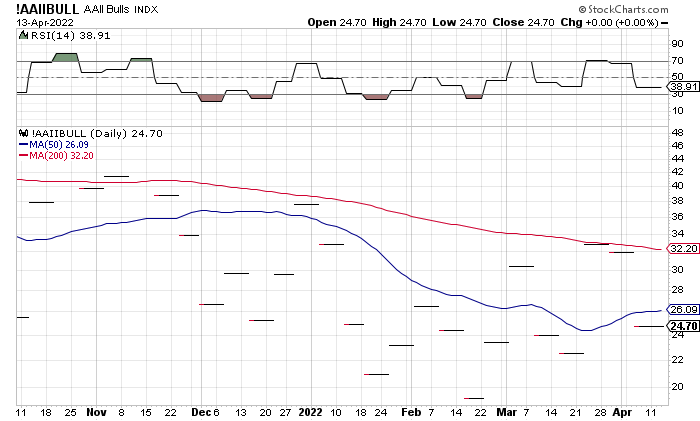

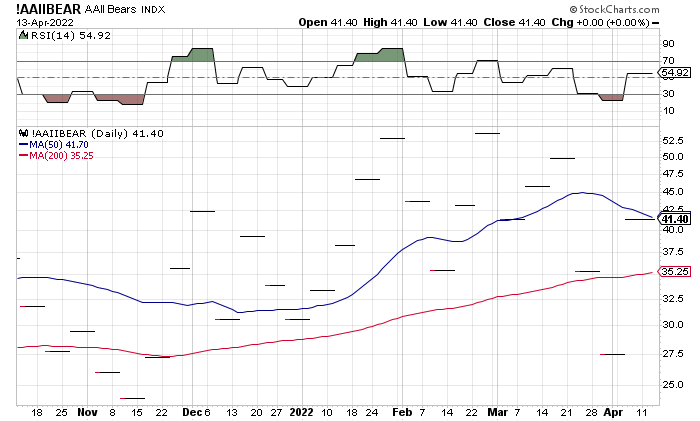

The weekly AAII Sentiment Survey indicates whether investors are “Bullish,” “Bearish,” or “Neutral” on the stock market over the next six months. It can be a useful proxy for market sentiment.

Optimism among individual investors about the short-term direction of the stock market declined last week and remained unusually low. Pessimism rebounded while neutral sentiment declined.

Bullish sentiment—expectations that stock prices will rise over the next six months—declined 7.2%, to 24.7%, at the start of last week. Optimism has remained well below the historical average of 38% for the 21 straight weeks now, since mid-November. The high over this time period was 37.7%, closing out 2021. By comparison, the 52-week bullish peak, 53.8%, was reached at this time last year.

Neutral sentiment—expectations that stock prices will stay essentially unchanged over the next six months—fell 6.7%, to 33.9%, but still remained above its historical average of 31.5% for the third-straight week. The 52-week high for neutral sentiment, 40.6%, was reached in the last week of March.

Bearish sentiment—expectations that stock prices will fall over the next six months—jumped by 13.9%, to 41.4%. Pessimism remained above its historical average of 30.5% for the fourteenth consecutive week.

The 52-week bearish high was at 53.7%, for the week ending February 23 of this year.

As noted above, bullish sentiment remains at an unusually low level. Historically, such readings have been followed by above-average six- and 12-month returns for the S&P 500 index. However, given the possibility of continued rate hikes throughout the year, the historical trends may or may not repeat themselves as the possibility of a recession looms.