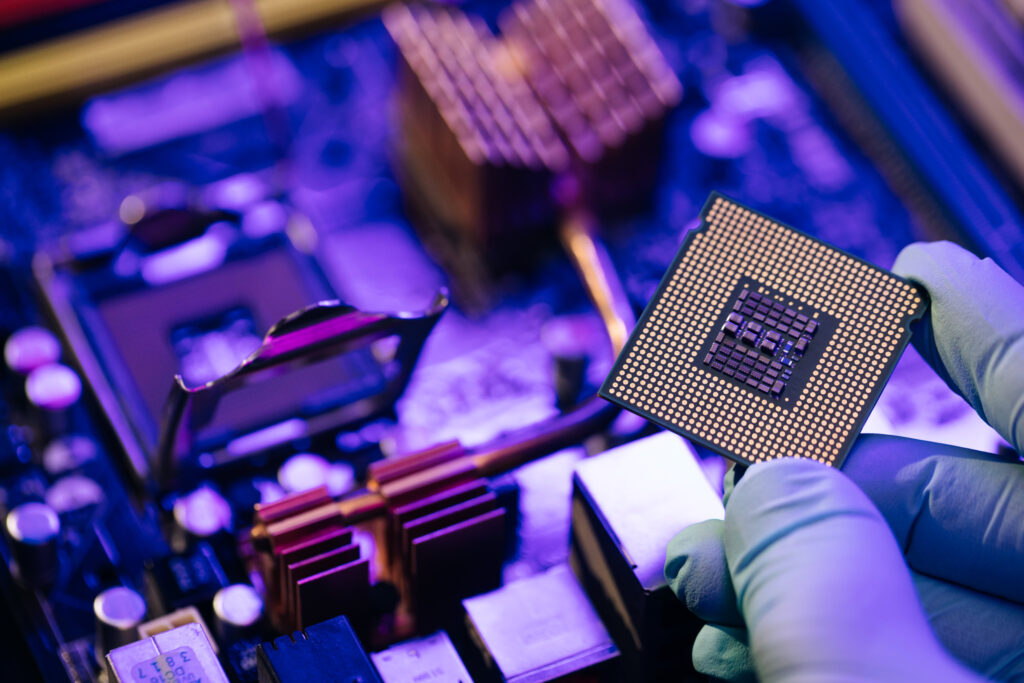

Soaring demand for semiconductors used in smartphones, laptops, and other gadgets during the pandemic has led to an acute chip crunch, keeping order books full at Taiwan Semiconductor (TSM), the world’s most valuable and largest semiconductor manufacturer.

No wonder it reported a record quarterly profit.

Taiwan Semiconductor’s revenue growth went above 20% year on year (to $15.74 billion) in the fourth quarter. It was the highest growth rate since the third quarter of 2020. Growth for the chipmaker’s bottom line was also strong, with earnings rising 16% year on year, to $1.15 per share—topping estimates by double digits.

Another big positive was that operating margins grew by 50 basis points year on year to 41.7%. And the company expects margins to continue to improve in 2022, forecasting a range of 42-44%.

What TSM’s Future Will Be

One of the most notable comments from Taiwan Semiconductor during its earnings call was that it expects capacity to remain tight throughout 2022 as many end markets (such as automotive, PC, data center, and mobile) are creating products with need for more high-end chips. The company forecast that the foundry industry should grow close to 20% for the year.

Taiwan Semiconductor is optimistic that it will outperform this expected industry growth rate. The company forecast its revenue to increase by at least 25% this year. If Taiwan Semiconductor meets that target, it would outperform the broader contract chipmaking industry growth by at least five percentage points and grow at triple the pace of the wider semiconductor market.

And all thanks to what it calls a “multi-year industry megatrend” of strong chip demand boosted by new technologies. The company raised its compound annual growth rate targets for revenue over the next several years to 15% to 20%, up from 10% to 15%.

Over the longer term, Taiwan Semiconductor expects the strong growth to accelerate in coming years due to booming semiconductor demand. Company CEO, C.C. Wei, said the company was entering “a period of higher structural growth.”

Even a year ago, the company said it believed the chip industry was entering a multi-year period of structurally higher growth rates driven by the proliferation of semiconductors throughout various industries and the increase of computing density. Examples include the start of 5G telecom services and the use of artificial intelligence (AI) in everything from entertainment to factory automation, and autonomous driving. These, and more technology growth areas, will continue to boost demand for Taiwan Semiconductor’s chips.

Taiwan Semi Increasing Its Dominance

This increased demand is the major reason why the semiconductor giant said it expects to raise its capital expenditure to $44 billion in 2022. That’s a 46.7% increase from the $30 billion spent in 2021 and triple the amount spent in 2019!

This news from the company highlights two things: the outsized role semiconductors are coming to play in goods beyond just traditional electronics products, from cars to factory equipment; and Taiwan Semicoductor’s dominance of global semiconductor manufacturing.

Of course, the pandemic did add extra momentum for the company by creating unexpected demand for tech gadgets needed for working from home.

Together with global manufacturing and logistics disruptions, the demand leap led to the ongoing chip shortage that had given the company even more leverage over the market. (FYI: speaking of logistics, normally it takes 10 weeks to deliver an order of chips. That wait lengthened to 26 weeks in December 2021.)

Taiwan Semiconductor is using this leverage. For instance, the company has not only raised prices, but also has required many of its customers to pre-pay to secure capacity, a practice rarely used until 2021.

Keep in mind that only two companies manufacture the five-nanometer chips needed for the latest smartphones and EVs as well as 5G, AI, and autonomous vehicles: Taiwan Semiconductor and Samsung.

The rise in Taiwan Semiconductor’s capital expenditures will expand the lead it has over its global rivals, such as also-ran Intel. In fact, upgrading technology and increasing capacity will leave Taiwan Semiconductor in a nearly unassailable position. That makes the stock a buy on any stock market weakness around $130 to $140 a share.