Take-Two Interactive Software (TTWO) shot higher after reporting earnings recently. TTWO fiscal first quarter revenue came in at $831.3 million, growing 54% year-over-year, and representing record Q1 revenue for the video game maker.

TTWO said “recurrent consumer spending”, which is made up of in-game purchases of items, add-ons, and virtual currency used in its games, increased 52% and accounted for 58% of revenue. This type of revenue is particularly important as it represents a more stable source of revenue than one-time game sales.

Not surprisingly, given the move to digital that has been accelerated by COVID-19, TTWO reported digital revenue increased 70%, to $726.2 million, comprising 87% of revenue.

Commenting on the quarter, Strauss Zelnick, Chairman and CEO of Take-Two, said, “Fiscal 2021 is off to a terrific start with first quarter operating results that significantly exceeded our expectations, including fiscal first quarter records for GAAP net revenue and Net Bookings.”

Both a lack of alternative entertainment, with the closure of several major sports leagues, and the impact of COVID-19 on forcing consumers to stay home, had a net positive impact on Take-Two’s earnings.

Buy This One Dividend Stock, Then Hold It Forever [ad]

In its earnings release the company said, “With more people staying at home, we have experienced, and are continuing to experience, heightened levels of engagement and Net Bookings growth-to-date.”

Take-Two was able to quickly pivot to a successful work from home model for its employees during the onset of the pandemic. With their current model in place, the company said, “Although the shift to remote working adds complexity and challenges in some areas of the game development process, based on our work to date, we currently do not expect any additional delays.”

Take-Two raised earnings projections for next year, with Strauss adding, “As a result of our better-than-expected first quarter operating results and increased forecast for the balance of the year, we are raising our fiscal 2021 outlook, which is poised to be another great year for Take-Two.

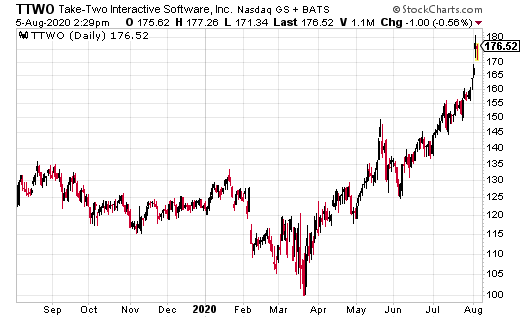

In the days just before earnings, TTWO stock was trading in the $160 area. And, after earnings jumped to the mid-$170s.The stock traded in the $120s prior to the onset of COVID-19, and had traded down to $100 at the market lows in March.

Steven Adams’s personal position in Take-Two Interactive Software: none.