Below you’ll find the current monthly issue and back issues, conveniently all on one page. The beginning of each month’s issue is noted by the publication date.

May 31, 2024 - 3:30 pm

June 2024 Issue

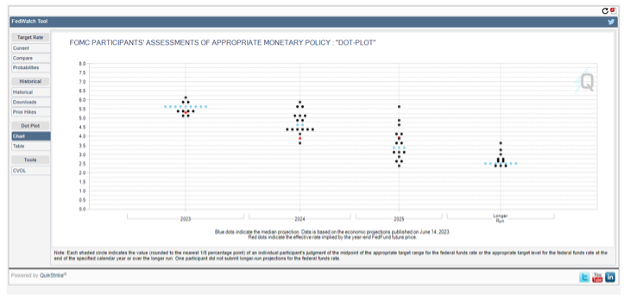

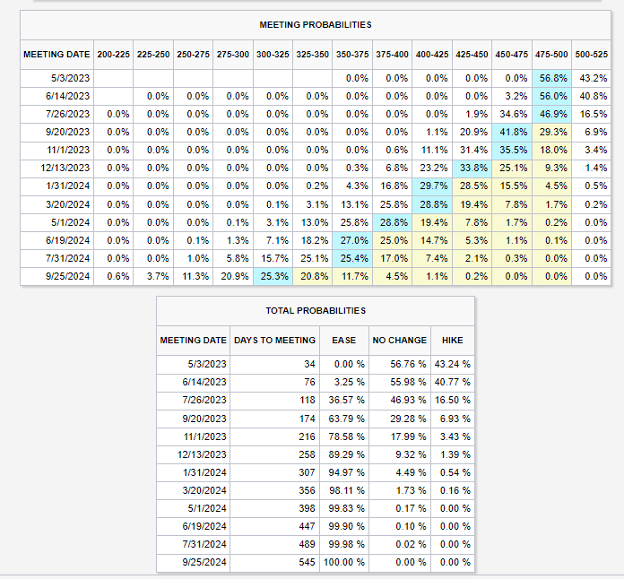

The last month has been fairly eventful for the interest rate markets. We have seen a Federal Reserve meeting, Fed minutes, and countless Fed officials out speaking in public without handlers. If we distill it all down to its essence, the message is simple: we would love to start cutting rates, but it’s not justified by the data. Therefore, rates will remain higher for longer.

As I write this, the U.S. Treasury is struggling with bond auctions that are not going particularly well. The five- and seven-year auctions did not go well, with yields coming in at the top of the expected range. In addition, the Conference Board released its latest consumer confidence numbers, which showed one of the biggest bounces in some time. Despite facing challenges such as high interest rates, inflation, and economic uncertainty, American consumers have demonstrated remarkable resilience, contributing significantly to economic growth in the previous year.

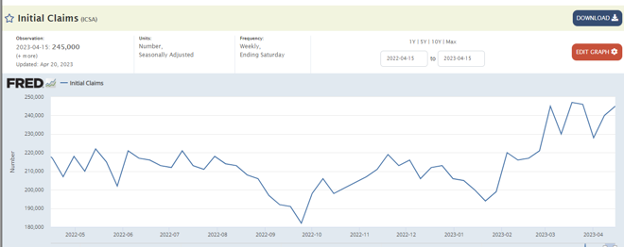

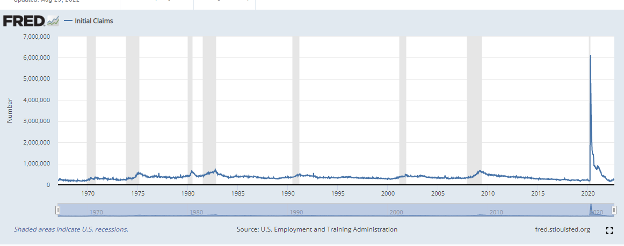

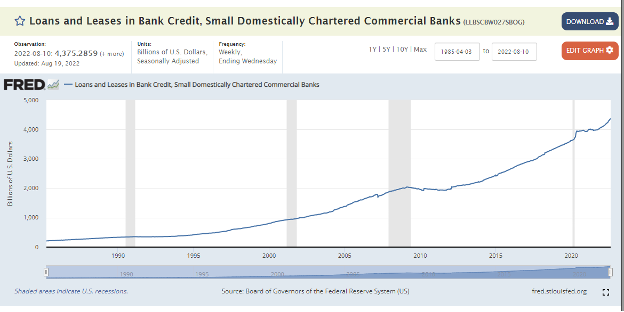

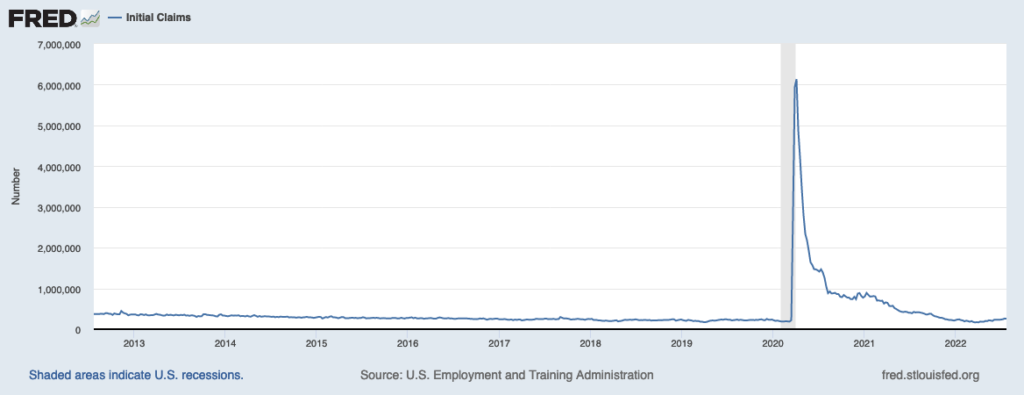

Thanks in large part to waves of government spending related to various programs and policy agendas, the job markets have been fairly robust. Low layoff rates and a tight job market have contributed to income growth and consumer confidence. It has, of course, helped that the consumer market is in much better shape than most of the clickbait hunters and doom-and-gloom crowd want you to believe. Supported by a healthy labor market and rising wages, personal income continues to grow at a pace consistent with previous economic expansions.

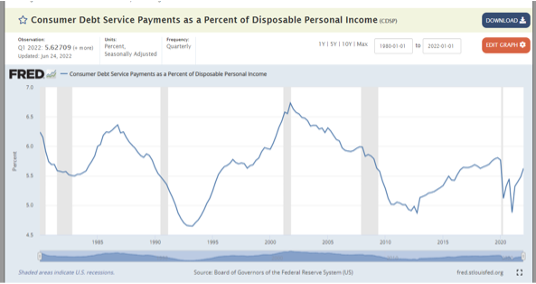

Unlike what the headline writers may want you to believe, there is no consumer debt bomb. Since the great financial crisis, consumers have strengthened their balance sheets and resisted the urge to be stupid. Debt levels have gone up over the past year, but incomes and net worth have gone up even faster.

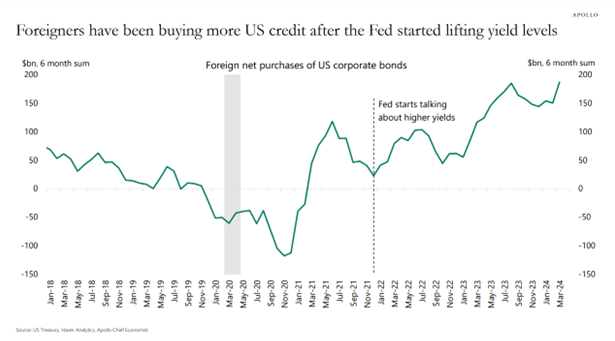

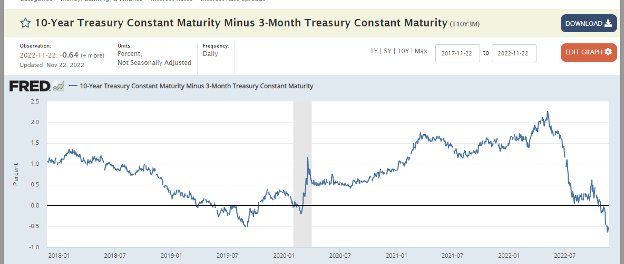

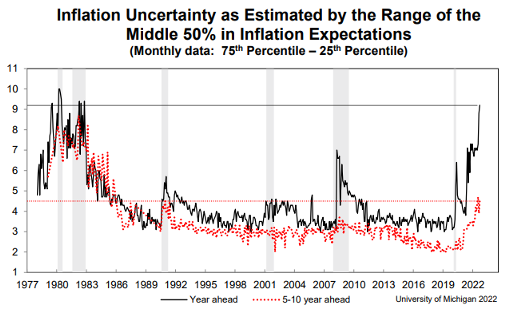

We have seen some signs of developing economic weakness, but it is not enough for the Fed to act. The central bank’s bigger issues are that inflation is sticky, and no one wants to buy our bonds. We have trillions of dollars left to refinance this year, and potential buyers are staying away in droves, due to concerns of political instability and a contentious election. China is out, and Japan has greatly reduced its buying of treasuries. Foreigners looking to buy U.S. credit instruments are increasingly looking to corporate bonds for higher yields and do not feel like they are giving up much in safety when comparing corporate issuers against a dysfunctional government.

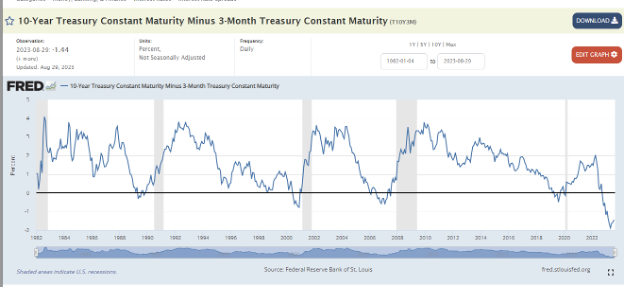

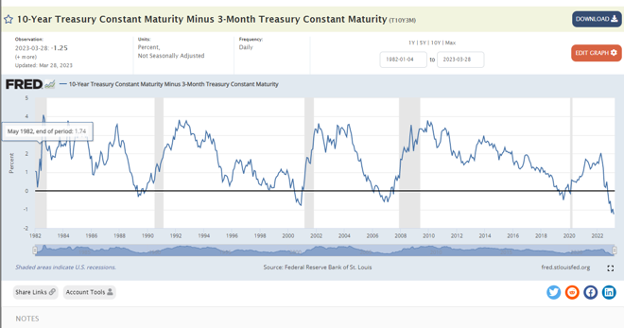

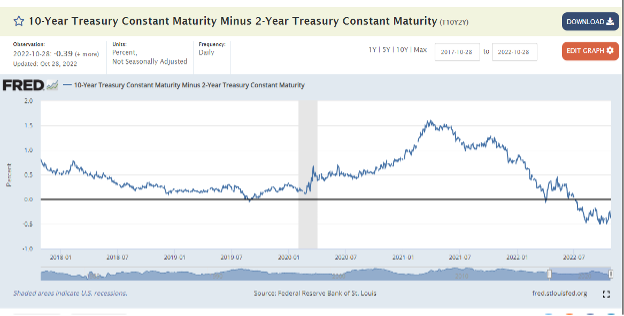

Individual and investment fund demand is also lower than hoped so far this year. The almost constant headlines about the size and growth of the United States budget deficit and debt load are also keeping investors on the sidelines. It probably does not help that the inverted yield curve means notoriously short-sighted, instant gratification-addicted investors can get higher yields in money markets than they can in longer-term bonds.

When something is not selling, you have to lower the price. That is basic economics. In the case of treasuries, you have to lower the price until the yield attracts buyers. Rate hikes and tighter credit have not had the expected impact on inflation and the economy for one simple reason: the government, at almost every level, is spending like drunken sailors with wallets full of back pay, out on a bender. This is an election year, so there is little chance we see a slowdown in spending. Eventually, all of this leads to higher taxes to cure the deficit, but that is a subject for another day. Of course, it is also a great reason to buy the tax-free funds on our buy list.

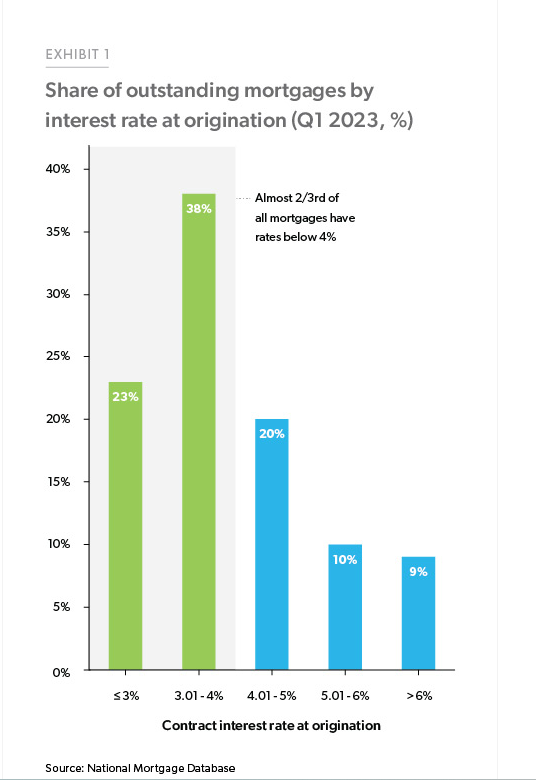

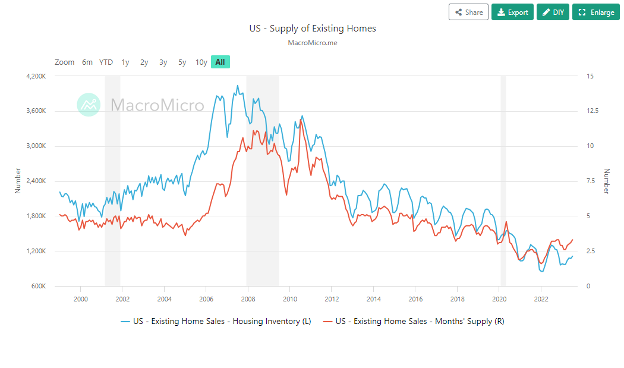

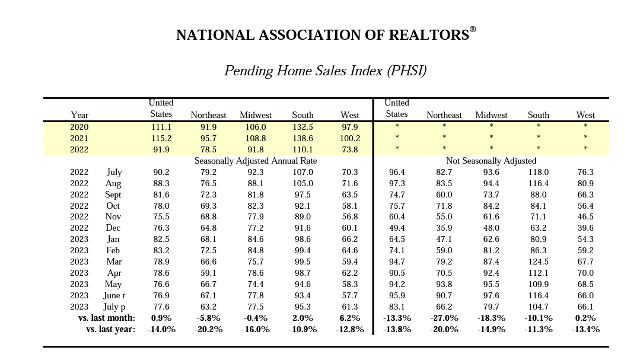

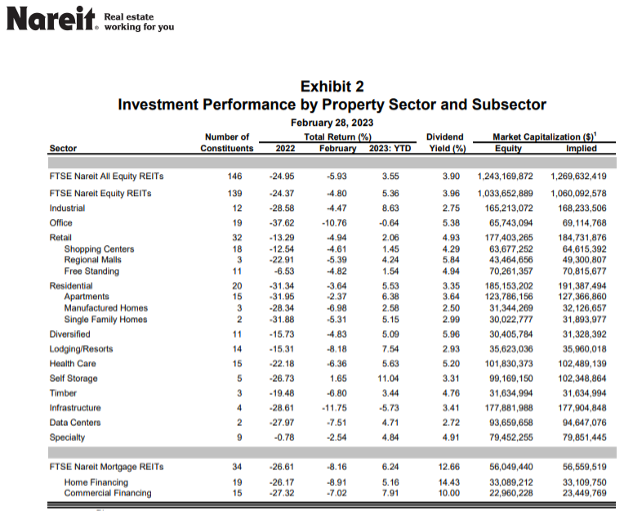

What does higher-for-longer mean for us as income-seeking investors? First, there is no better place to find the income we are seeking than deeply discounted closed-end funds, which allow us to invest in the attractive corners of the fixed-income markets at a discount from the current market prices. There are so many closed-end funds today that we can pick and choose which sectors we own. Right now, real estate-related debt is clearly one of the most attractive segments of the corporate bond market.

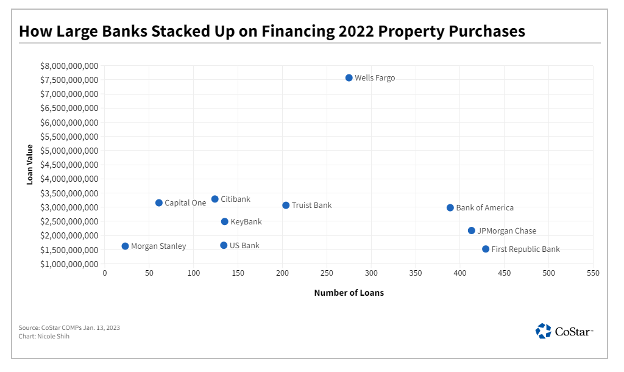

Over the course of my career, I have learned that following the moves of successful private equity funds when they make a big move into a sector is a recipe for success. Blackstone has been on a very aggressive buying spree of real estate-related debt in recent months. As a recent article on KKR’s website pointed out: “Across the market, we are finding that it is possible to lend at a significant discount to replacement cost and often at 50% of peak valuations while earning low-to-mid-teens gross returns on mezzanine-like exposure at loan-to-value ratios near 65%. In other words, it is possible to earn equity-like returns at a favorable position in the capital structure, and the scarcity of debt capital in the market means that these conditions should persist, in our view.”

Last month, the real estate team at Ares Management suggested that a real estate reset was getting underway, with improved property values and real estate-related debt markets beginning to thaw. The alternative credit leader has been raising billions of dollars in recent months to invest in real estate equity and debt opportunities. We have several funds that invest in real estate and CRE debt that are bargain opportunities.

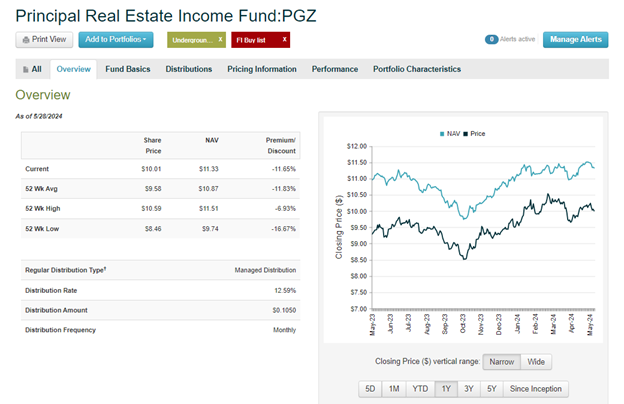

While the activist at the Principal Real Estate Income Fund failed to gain a board seat at the recent annual meeting, we still think the fund is very attractive at current levels. The activists still own a large position and are unlikely to go away anytime soon.

CEFCONNECT.COM

The shares currently trade at a discount of 11.6% with a yield of 12.5%. The fund is invested in real estate-related debt and mortgage-backed securities as well as a handful of REIT equities. You can buy shares of the fund below $ 10.50.

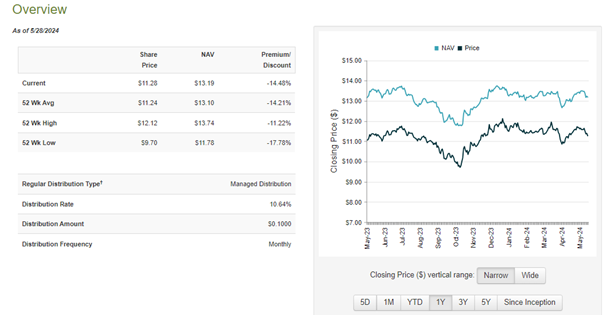

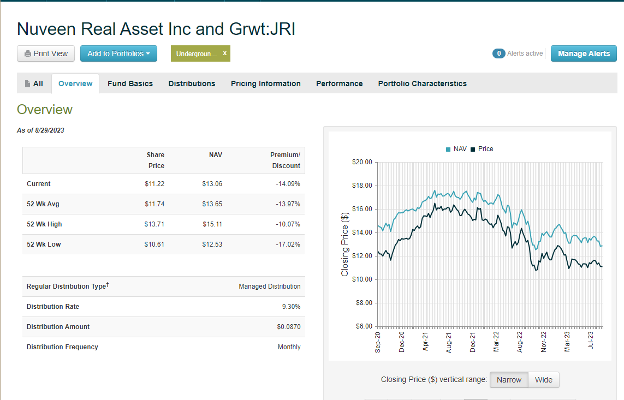

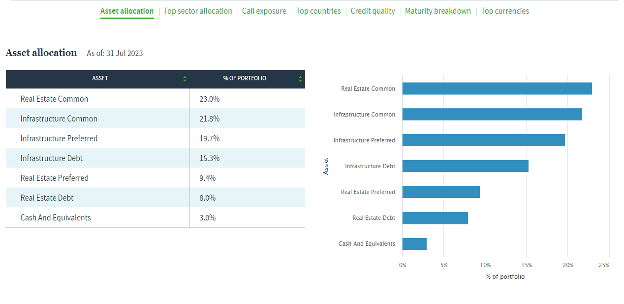

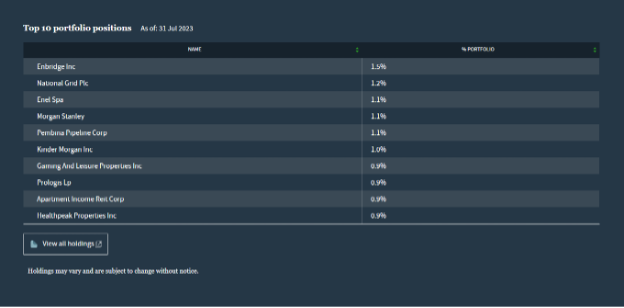

Shares of Nuveen Real Asset Income and Growth Fund (JRI) have recently fallen below the $ 11.55 buy limit.

This fund is trading at a 14.5% discount to NAV and yields 10.6%. The fund has equity positions in companies that own real assets like real estate and energy infrastructure, as well as high-yield debt issued by companies that own real assets. Several activists, including Saba Capital, hold large positions in the shares.

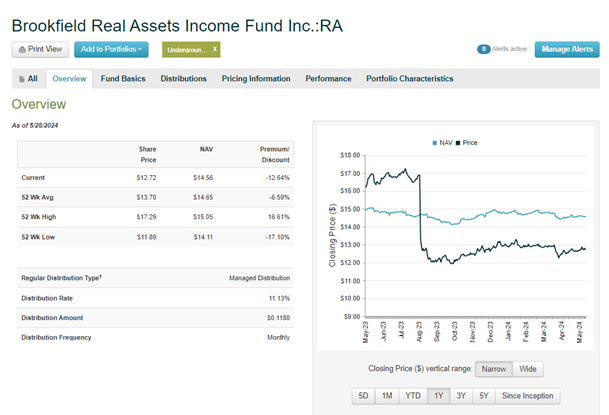

Shares of Brookfield Real Asset Fund are also trading below the buy limit price of $ 13.25.

The fund is trading at a 12.6% discount with an 11.1% yield right now. The fund is invested in real estate and energy-related debt as well as mortgage-backed securities. As is always the case, there are several activist shareholders with sizable positions in the fund.

Higher-for-longer means fixed-income assets are more attractive than ever. Our approach favors buying out-of-favor asset classes with a higher potential for a reversal. That is why we own heavily discounted closed-end funds that own real estate assets. All four conditions are met, and we should see a strong upside from the eventual recovery in the real estate markets.

Remember to tender your shares of ClearBridge MLP and Midstream Fund (CEM). Tender all your shares with the expectation that you will receive 50% redeemed at net asset value. The Fund commenced the offer on May 21, 2024, with an expiration time of 5:00 p.m., New York City time, on June 20, 2024.

May 13, 2024 - 11:41 am

Sell Alert – FT Energy Income Partners Enhanced Income ETF (EIPI)

Sell your shares of FT Energy Income Partners Enhanced Income ETF (EIPI) that you received in the recent merger of First Trust New Opportunities MLP & Energy Fund (FPL). The ETF has traded higher since the opening of trade, and it’s time to extend with a healthy total return of over 30% over the 8-month holding period.

April 29, 2024 - 11:42 am

Buy Alert – Invesco Municipal Trust (VKQ)

Buy shares of Invesco Municipal Trust (VKQ). The fund is at least at a 14% discount. The yield is 5% tax-free and we’re seeing buying by activists in the last week.

Use a limit order near the current price and do not pay over $ 9.45 for shares.

April 26, 2024 - 12:52 pm

May 2024 Issue

The secret to getting rich in the markets is not to focus on always making huge returns.

First, huge returns are damn near impossible.

Second, it is impossible to get big returns for long periods of time without being exposed to the potential for huge losses or drawdowns.

Warren Buffett once said that you have no business owning stocks if you are not prepared for occasional 50% declines.

That will happen to you several times over an investing career just investing in stocks.

Adding options, futures, leverage, trading systems, and other risk-elevating devices in the hopes of accelerating returns and big declines will be far more common.

Most people start wetting themselves when they own a stock that goes down by 10% or more.

I can tell you the topic of conversation that will dominate my inbox by the performance of the stock I have recommended.

If we have one stock that is up 20% and one that is down 30%, we will be talking about the down stock.

I have been doing this a long time, and I know that most people are going to puke and put the money into a money market fund, bills, or a tin can buried under the Rottweiler’s doghouse.

As a species, we are risk and loss-averse.

We will do damn near anything to avoid a large loss and be perfectly happy collecting small gains.

One of the most popular marketing tactics for financial products is to trumpet a high winning percentage.

Even if the winning percentage is not constructed using an enormous amount of smoke, mirrors, and deposits from the southbound end of a northbound moose, it usually does not make sense to invest for a high probability of a small loss.

Most of these advertised winning streaks come from selling options, which gives someone else the right, but not the obligation, to buy or sell a stock at a certain price by a certain time. You collect a premium upfront for taking on this risk but you could be forced to buy or sell at a disadvantage if the market moves against you.

If you have sold options on the market since 2007, you have an amazing winning percentage. Your annual return, according to the CBOE data, is about 7%.

Buying the index and reinvesting the dividends would have delivered about 9% returns. Energy infrastructure would have gotten you over 10% a year.

Or you could have bought tax-free closed-end funds at a large discount to net asset value (NAV) that outperformed the more active put-selling strategy.

Some suggest selling put spreads on markets and stocks. But this is picking up pennies in front of a steamroller. You may have a massive winning streak, but when it goes bad, it goes really bad.

In a bear market, selling put spreads will rack up an impressive streak of losses that will test the tolerance of investors who thought they had a low-risk, high-probability path to profits.

Don’t get me wrong. Selling puts is an incredibly effective part of a value-based total returns strategy if properly used. But that strategy must start with the valuation, business fundamentals, and credit condition of the underlying company.

Very few people approach options selling as a total return tool that is secondary to the stock selection process.

Then we have the get-rich-quick approach.

Somehow, folks who know better actually fall for the pitches that suggest there is some surefire way to trade your way to riches.

If I hyped it right, I could have thousands of people sign up for a system that promised 50% gains when you win and only 30% losses when you lose. But you would go broke trading that system.

Every simulation we ran showed that a system with similar levels of volatility would fail in less than ten years.

Consider this strategy. You would have a year of 60% gains followed by a year of 30% losses. That sounds like it should make money, as the gains are twice the losses. At the end of a decade, turns into .76, for an average annual return of slightly less than 6%.

That barely covers the antacid bill.

We ran Monte Carlo simulations that used thousands of simulations of riskier strategies going back to 1986. More than 50% of the time, employing these methodologies went broke.

None of them beat the market, although the top 10% did match the return of the S&P 500.

When we ran simulations with a slight edge over the market and lower volatility, everyone made money, and 75% of them matched or exceeded the S&P 500.

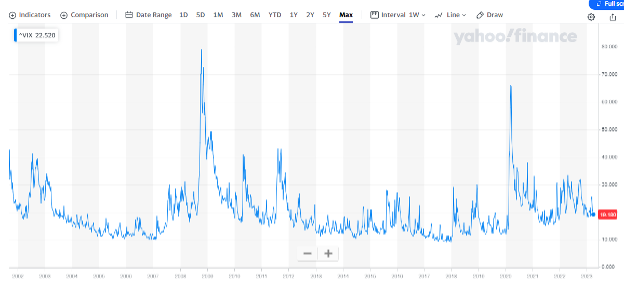

For everyone, the maximum drawdowns were in the mildly aggravating but still sleep-well range across thousands of simulations covering 1986 through last week.

Low volatility returns from a strategy that has an edge over the market is exactly what we are working to achieve with the discount arbitrage strategy we use at Underground Income.

By focusing on the four factors of

- Asset Class Reversion Potential

- Discount to Net Asset Value

- Closed-end fund activist and specialist shareholders

- High Income

We limit our exposure to potentially large drawdowns.

Using concepts that made Richard Rainwater a billionaire, we are not buying funds and worrying about what will blow up. We are buying things that have already declined and have a high probability of reversing course.

We compound the opportunity by only investing in these assets when we can buy them for less than the current quoted price in the secondary markets.

Academic research has shown that closed-end fund discounts often function as a sentiment index, and like all sentiment measures, when they reach extreme points in either direction, prices of the underlying assets or sectors are likely to reverse course.

Popular funds trading at a premium are probably going to move lower over time, and the popularity of the assets they own fades.

Unpopular funds trading at a discount will see the discount narrow as the sell-off stabilizes and bargain hunters and activists begin buying the shares.

There are over 35 years of academic research to prove what I have known for over thirty years: Retail investors will dump closed-end funds when prices fall and the sector falls out of favor.

There are no natural buyers of closed-end funds, so the shares will trade at a discount until bargain hedge funds (like us) begin to buy them.

Over time, the discount will reverse back towards historical norms.

Being impatient patient investors, we want to accelerate the reversion prices, so once the first two conditions are met, we prefer buying funds that have an activist who will work on our behalf to push management to take the steps that will help narrow the discount sooner rather than later.

We also want to collect as much of our return in the form of cash on a monthly or quarterly basis as possible.

We have talked in the past about Hetty Green, known as “The Witch of Wall Street,” a notorious American investor in the late 19th and early 20th centuries. She was known for her frugality, eccentric behavior, and astute investing strategies, which made her one of the wealthiest women of her time.

During the best of times, she invested in income-producing assets, including bonds, such as municipal and railroad bonds. Green was also known for her conservative approach to mortgage lending. She would only lend money to borrowers with excellent credit and substantial collateral, minimizing the risk of default.

When the markets hit a wall, Green would wade in, buying shares of railroads and other critical infrastructure. She would hold them until the markets were hot again and then sell them for massive profits.

If any of her borrowers got into difficulty and missed payments, Green was quick to foreclose during economic downturns.

Despite her eccentricities and sometimes controversial personal life, Hetty Green’s investing approach was ahead of her time. Green often went against popular market sentiment, buying when others were selling and selling when others were buying. This contrarian approach allowed her to find opportunities others missed and avoid overvalued assets.

Take Hetty Green’s income-centric approach that buys what others hate, add a little of the market psychological soup that causes funds to trade at discounts to NAV and a healthy dose of arbitrage, and you have Underground Income.

Flashy returns usually lead to flashy losses. Steady returns with low volatility win the race almost all the time when it comes to investing.

Income, as the heart of the strategy, creates a return stream that cannot be evaporated by market movements.

There will be a time to jump into heavily discounted stock funds. When the time is here, we will act swiftly and aggressively.

Until then, owning discounted energy infrastructure assets, bonds, mortgages and loans that produce huge cash flows offers high returns with low stress.

April 1, 2024 - 3:56 pm

April 2024 Issue

I know many of my competitors are discussing the upcoming elections at length and pointing out how they think candidates may help or hurt the markets.

That sounds awful. We hear enough election and political garbage everywhere else.

In addition, 1600 Pennsylvania Avenue residents have little to do with the stock market’s performance.

The traditional belief that a Republican president is better than a Democrat for the market does not hold water.

Since World War II, the top-performing president, in terms of stock market performance, is Bill Clinton. The second-best performer is Barack Obama.

Following that are Dwight Eisenhower and Ronald Reagan, both Republicans.

Historically, the markets have done better when Democrats are in office than when a member of the GOP sits in the Oval Office.

The best returns result when Democrats have the White House and Congress is either split or controlled by the other side.

Congress, the Federal Reserve, innovation, credit conditions, and geopolitics all have more to do with stock market performance than the president.

Not only is talking about the presidential election and markets awful, but it is also not productive.

We could instead talk about the Fed policy and recent decisions.

Of course, we have done that on most weekly calls and monthly meetings so that would be mildly redundant.

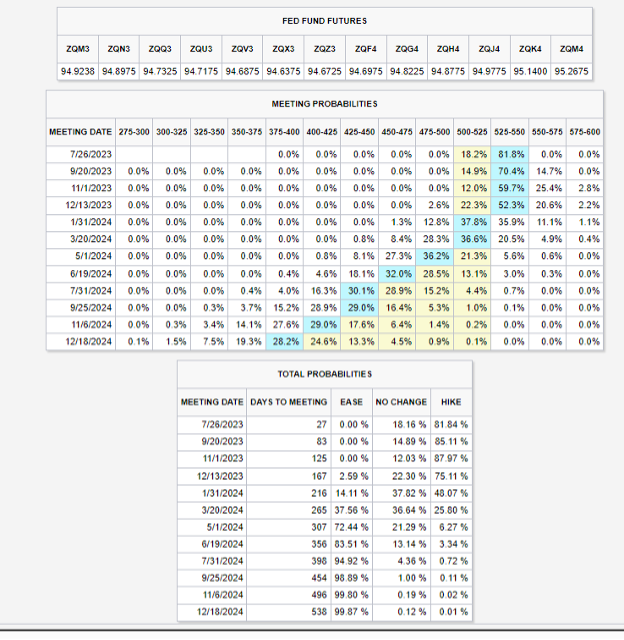

Barring some spectacular event that creates an inflation spike, the next move in the Fed funds rate is down. The only question at this point is when that happens.

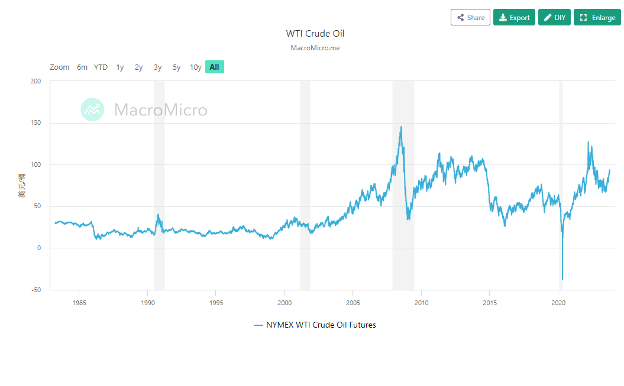

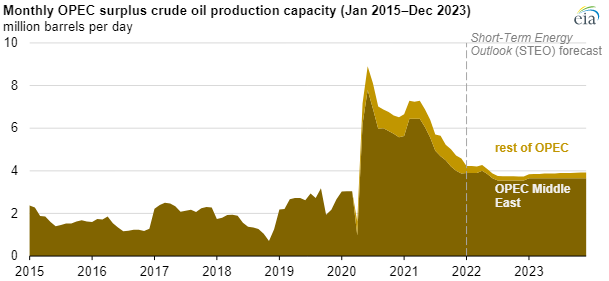

We could discuss OPEC’s recent decision to extend production cuts, but I told you months ago that would happen.

We could discuss the need to refill the Strategic Petroleum Reserve, but that will not accomplish much. We are at levels that strike me as nonstrategic, but no one seems to care.

It must be filled at some point, which could create some buying pressure in oil. But we already knew that and talked about it months ago.

I am pretty sure I have hammered home all the reasons for being long energy and fixed income.

I have discussed at great length why I am not yet rushing to buy stock and real estate-related closed-end funds.

Nothing has happened in the last month that changes the reason for our positions or creates an attractive opportunity to add new funds to the portfolio.

On day one, I promised you this would be a rules-based approach to investing, using closed-end fund discount arbitrage and an activist strategy.

I also promised not to break the rules or force trades to serve the marketing department’s interests.

Here are the four criteria that must be met for a fund to be included in the portfolio, just in case you forgot or have not heard them yet:

- The asset class the fund invests in must have underperformed and been undervalued based on economic and market historical measures. Strong evidence backed by fate and statistical analysis must indicate that the asset class is near a point of inflection where the trend reverses. English, the stuff the fund invests in has been going down and is about to reverse course and go higher.

- The fund must regularly pay an above-average distribution. We prefer monthly distributions but can deal with quarterly when necessary. To abbreviate Henry Hill in the movie Goodfellas, with some editing for a mannerly publication like ours: pay me.

- The fund must have a large discount for net asset value. We want to buy the fund’s stocks, bonds, and cash for less than the market value.

- There must be an activist shareholder willing to act on our behalf and force management to narrow that discount.

This creates a portfolio where every position has three ways to make us money:

- The asset class goes higher, lifting the securities owned by the fund higher in price.

- The discount to net asset value is reduced or eliminated.

- We collect lots of dividends.

This month, I want to discuss requirement number four more. Closed-end fund activists’ presence and activity levels have an enormous influence on the funds we select and the performance that results from our ownership of these funds.

Closed-end funds have become an increasingly popular target for activist investors in recent years.

The frequent disconnect between market price and asset value has attracted activist investors who look to unlock value by pushing for changes at the fund level. Some common closed-end activist tactics include seeking board member representation, advocating for fund conversion into an open-end structure, pushing for tender offers or share repurchases, and even a complete liquidation of assets.

Closed-end fund activism has its roots in the 1980s and early investor battles over discounts to net asset value. However, it remained relatively quiet for several decades after that until gaining significant momentum in the 2010s.

One of the earliest high-profile activist situations involved the Japan Equity Fund in the late 1980s. An investor group led by former SEC Commissioner Phillip Lochner Jr. waged a proxy fight over the fund’s substantial discount to its asset value.

The group won the fight, and the fund was turned into an open-end fund, eliminating the discount.

Throughout the 1990s and 2000s, occasional activists like Bulldog Investors and Western Investment LLC targeted certain closed-end funds, but activity remained relatively low. Given closed-end fund boards’ inherent advantages in defending against activists, this was an uphill battle.

The big firms like Franklin and Nuveen had the resources and legal departments to fight off most activists easily.

The watershed moment occurred in 2009-2010 when activist Carl Icahn took a significant stake in several closed-end funds managed by large mutual fund groups. Icahn railed against the funds’ discounts and ultimately got them to commit to tender offers and open-endings.

Icahn’s highly public battle brought new attention to the asset class and its pricing inefficiencies. It paved the way for more investors to allocate capital toward closed-end fund activism as a strategy.

Through the 2010s, players like Bulldog, Saba Capital, FrontFour Capital, and others increasingly targeted closed-end funds. Law firms also began to specialize in representing activist investors in these situations.

The pace accelerated further in the late 2010s as capital poured into the strategy. By 2022, there were an estimated 75 activist situations ongoing around closed-end funds according to industry observers.

Discounted closed-end funds tend to revert to the mean. Numerous studies have shown that they trade at a steep discount when the asset class is out of favor, or investors dislike a particular fund.

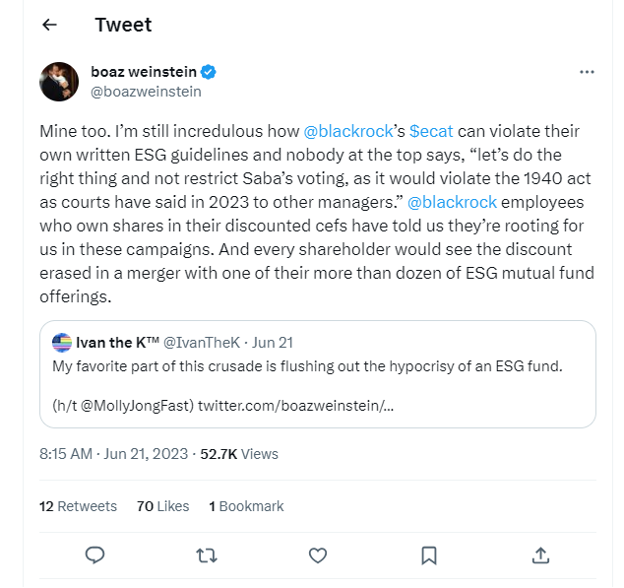

In December, two court cases involving Saba Capital further tipped the scales in our favor in a big way.

In the first case, the Second Circuit Court of Appeals found that Nuveen violated the Investment Company Act (ICA) by adding change-of-control rules to its bylaws.

In the second case, The Southern District of New York found that Blackrock also violated the ICA by adding change-of-control provisions to 11 of its funds.

Now, no firm is too big for the activists.

When the fund IPO is done, there is no marketing, so the shares have no natural buyers and will rise and fall with market sentiment.

Sentiment ebbs and flows, so discounts widen and narrow over time.

Here at Underground Income, we like to accelerate this process by favoring discounted funds with activists helping to move it along.

All our funds have activist shareholders. Many of them are currently involved in an active campaign to make changes that would narrow the discount or proxy fight for board seats.

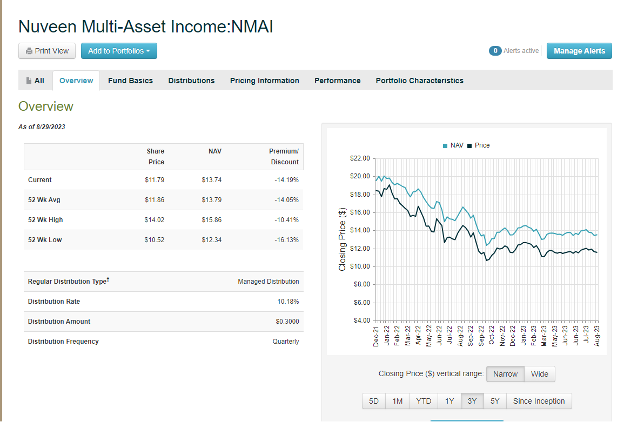

Saba Capital is currently waging proxy fights for Board seats at several Nuveen funds we own. These funds are:

- Nuveen Real Asset Inc and Growth (JRI)

- Nuveen Core Plus Impact Fund (NPCT)

- Nuveen Multi-Asset Income (NMAI)

Be sure to vote for the Saba nominees over Nuveen’s candidates.

Saba has also been buying more BlackRock ESG Capital Allocation Term (ECAT) shares and now owns about 27% of the fund.

The firm has also been adding to MainStay CBRE Global Infrastructure Megatrends Term Fund (MEGI) shares, now owning over 10%.

Bulldog Investors has been buying more Principal Real Estate Income Fund (PGZ) shares and is approaching the 5% level.

Saba already owns over 8% of the fund.

Activist ownership is a must-have in every fund we add to Underground Income. While I am confident that a fund’s NAV will narrow with time, I would instead accelerate the process and force the gains to happen quicker than the usual reversion period.

April 1, 2024 - 11:29 am

Buy Alert – Brookfield Real Assets Fund Inc. (RA)

Buy shares of Brookfield Real Assets Fund Inc. (RA) using a limit order near the current stock price. Do not pay over $ 13.25.

The fund is trading at a 12.76% discount to NAV and yields almost 11% at the current price. The fund holds fixed-income and equity securities issued by companies that own real assets, including real estate, infrastructure, and energy-related assets.

All of these asset classes, including the fixed-income sector itself, are at or near a major inflection point after long downtrends.

After trading at a premium for an extended period of time, we can now own the fund with an attractive discount, and activists have been buying shares.

All the boxes are checked.

March 6, 2024 - 4:34 pm

March 2024 Issue

Your taxes are going up. Everyone will say that’s not the case.

The two nursing home escapees masquerading as presidential contenders will both state that thought-out economic plans will make tax hikes unnecessary. Every lawyer, trust fund baby, grifter, and charlatan running for Congress and Senate will tell you that hikes will not be necessary.

Some of them will express their intention as a desire to raise the taxes on some mysterious group of wealthy people who are not paying their fair share.

Let’s make a few things clear.

First, most of the federal government’s income comes from taxes on the earnings of its citizens.

Second, rich folks are already paying most of the taxes.

The top 50% of earners pay 97% of the taxes collected.

That is not a dream or myth or estimated tax bracket math magic. That is the percentage of dollars collected by the Internal Revenue Service.

This pesky 1% that runs the world and oppresses everyone everywhere all the time? They pay 45% of the taxes collected by the government’s elite and extraordinary combined collection agency and police force.

That amount has been going higher, not lower.

“Soak the rich, tax the rich, eat the rich” has been a constant slogan and practice amongst politicians of all stripes (it’s also the title of a great book by the late PJ O’Rourke that points out that stifling the rich may not actually be a great idea).

The problem is that if you have accumulated any amount of wealth in your life and have the silly idea that you want to use it, the government wants a cut.

If you decide that now that you are older, it is time to take the trips you denied yourself and acquire the luxuries you went without while trying to build a decent nest egg, the government wants a cut.

Like the Sicilian Mafia dons of old (and not so old), they politely insist they be allowed to “Wet their Beaks.”

Of course, should the decreed percentage of the fruits of your labor not be surrendered on a timely basis, the fine people of the government’s gentle revenue collection agency will become far less polite in their request.

According to government watchdogs OpenTheBooks, the IRS has been spending several million a year on guns and ammunition.

The IRS does not have a competition target shooting team. It is a take-and-pay arrangement. You pay it, or they will take it.

The reason your taxes are going up is simple. The people we keep sending to Washington are addicted to spending money. Money buys votes. Votes buy power.

Reducing spending means cutting programs. If you cut programs, the people who lose benefits will not vote for you again. The last time we had a balanced budget was 2001. We have only had a balanced budget or a surplus fourteen times in the last fifty years.

Every year, the thundering herd of fiscal zombies, all 55 of them, return to Washington and propose spending more than they confiscate.

They borrowed money by issuing Treasury bills, notes, and bonds to make up the shortfall. The herd disguised much of it by selling bonds to the Social Security Trust Fund. As long as it had more workers than beneficiaries, there was a significant surplus every year that could be borrowed.

That is coming to an end as the pool of workers shrinks, thanks to an aging population. The ratio of workers to Social Security beneficiaries is expected to shrink from 5.1 in 1960 to 3.4 today to 2.1 in 2030.

The Treasury is becoming more dependent than ever on the marketplace to buy our bonds and pay for the largesse granted by the honest and honorable beings that make up Congress.

It is not getting any better any time soon, according to the Congressional Budget Office. The deficit will total .6 trillion in fiscal year 2024. It is projected to grow to .8 trillion in 2025 and then return to .6 trillion by 2027. After that, the shortfall increases every year, reaching .6 trillion in 2034.

As pointed out on our recent call, we have about trillion of debt to refinance this year. Add in the deficit, and we will need to borrow somewhere between and trillion this year.

We already have trillion in debt. It is going to increase every year.

According to Treasury.gov, as of January 2024, it costs 7 billion to maintain the debt, which is 17% of the total federal spending in fiscal year 2024. That is about triple the global average.

Zimbabwe, Lebanon, and Mexico are among the nations that pay less interest as an expense of the budgets that we do. No other developed nation comes anywhere close to a 17% interest expense.

All the spending and borrowing must be paid for by somebody. Unless you fall in the bottom 50% by income (less than ,000 in household income or ,000 as a single person), that someone is you.

If you have most of your money in a retirement plan that is sheltered from current income tax, you can move your assets into fixed income to take advantage of the massive opportunity that exists in the current economic and market environment.

If you have accumulated a stack of cash outside a retirement plan, moving your cash into fixed income will incur taxes.

Interest from corporate bonds is taxed as ordinary income and is taxed at your total tax rate.

If you use fixed-income strategies with unsheltered money, a full third or more may go to Uncle Sam to pay for studying Russian cats walking on a treadmill, promoting Egyptian tourism, teaching lab monkeys, or gambling (these are actual U.S. government expenditures during the 2023 fiscal year).

If you would prefer to keep the interest you earn and spend it to take your spouse to Paris (or anywhere else), go on a cruise, or buy a vacation home at the beach, another option is available.

Tax-free municipal bonds pay interest that is exempt from federal taxes. If you happen to live in the state where the bonds are issued, the interest may also be exempt from state and local taxes.

Thanks to a quirky twist in the tax code that is in no one’s best interest to fix. bonds issued by Puerto Rico are exempt from federal tax as well as state and local tax in all fifty states.

When I was a broker, tax-free bonds were one of my favorite investments to sell to investors who needed income.

State and local governments issue them, so they are considered almost as safe as U.S. government bonds. Regular as clockwork, the interest check hits the account every six months.

The money raised by tax-free bonds is used to build schools, airports, roads, bridges, hospitals, and everything else our local government provides to make life more efficient and pleasant. Tax-free bonds pay for power plants, universities, water and sewer systems, and other critical infrastructure.

Tax-free bonds are one of the largest subsectors of the closed-end fund industry because they are easy to sell.

Safe, necessary, and tax-free. It is an easy sell.

Once issued, they become subject to the same buying and selling impulses of any other security listed in the psychological soup of the markets.

Tax-free closed-end funds can trade a premium or a discount net asset value.

When they are at a discount, we can buy these very attractive fixed-income securities at a discount to the market value of the tax-free bonds a particular fund owns. Once the discounts get close to 15%, it becomes a massive opportunity,

Add in the fact that we are at the end of a rate hike cycle, and the Fed will start cutting rates later this year, and the opportunity is even more significant.

Now consider that the closed-end fund activists are working harder than ever to narrow discounts, and the opportunity is starting to be turbocharged.

I added two more tax-free funds ot the portfolio this week.

The Nuveen AMT-Free Quality Muni Inc (NEA) invests in high-quality bonds not subject to the Alternative Minimum Tax (AMT).

That is a special tax that the government likes to collect if you are too good at avoiding taxes. I will spare you a lengthy explanation. If you are subject to it, you know what it is. If you are not, it does not matter.

The fund trades at a 14.68% discount to net asset value and has a distribution yield of 4.6% free of federal income taxes. This is the equivalent of a 7.6 % taxable yield.

Several leading activists and closed-end fund specialists own the fund. The largest holdings in the fund are supporting dormitories at Universities in New York, bringing water to Las Vegas, maintaining and expanding a turnpike in Texas, and building a hospital in Colorado.

The fund invests in lingering maturities, so it should appreciate dramatically during a rate-cut cycle from the Federal Reserve.

I also added the BlackRock MuniHoldings Quality Fund II (MUE) to the tax-free portfolio.

This is another fund specializing in high-quality bonds of longer maturities. The shares trade at a discount to NAV of 13.99% and have a distribution yield of 5.4%.

If you have cash outside the protection of a retirement plan, tax-free closed-end funds should be your go-to investment choice in the current economic and market environment.

February 28, 2024 - 11:15 am

Two new positions today for the Underground Income Tax-Free Portfolio:

1. Nuveen AMT-Free Quality Municipal Income Fund (NEA)

I want you to buy shares of Nuveen AMT-Free Quality Municipal Income Fund (NEA) using a limit order near the current price. Do not pay over $ 11.15 per share.

The discount to NAV is over 15%, and the distribution yield is an attractive 4.76%. For the latest on NEA, click here.

2. BlackRock MuniHoldings Quality Fund II Inc. (MUE)

Buy shares of BlackRock MuniHoldings Quality Fund II Inc. (MUE) using a limit order near the current stock price. Do not pay over $ 10.10 per share.

Most of the major activists and specialists own shares and the current distribution yield is 5.4%. Click here for the latest news on MUE.

For both of these, I’ll have more details on our next call and in the new issue.

Talk to you soon.

February 7, 2024 - 9:45 am

This month, we are going to venture off into the wilds of the world and the markets.

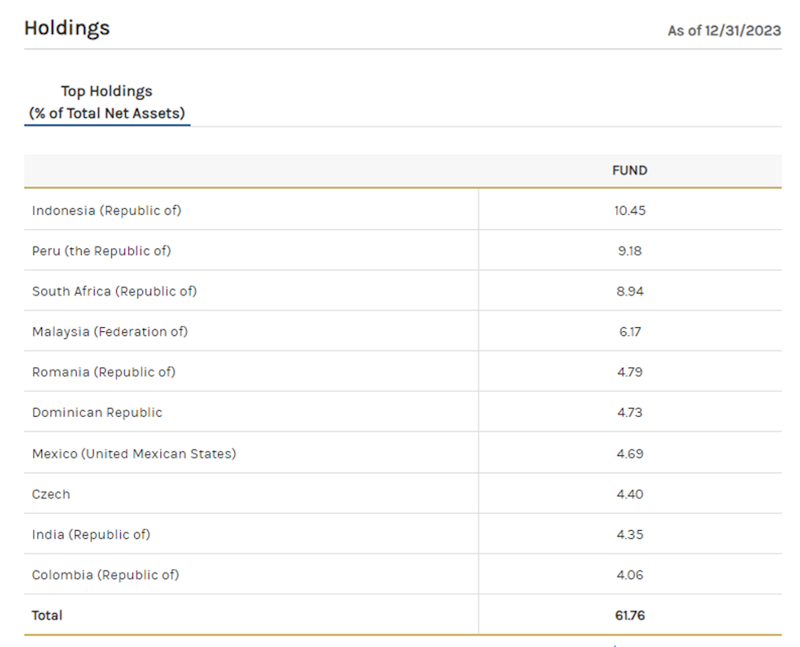

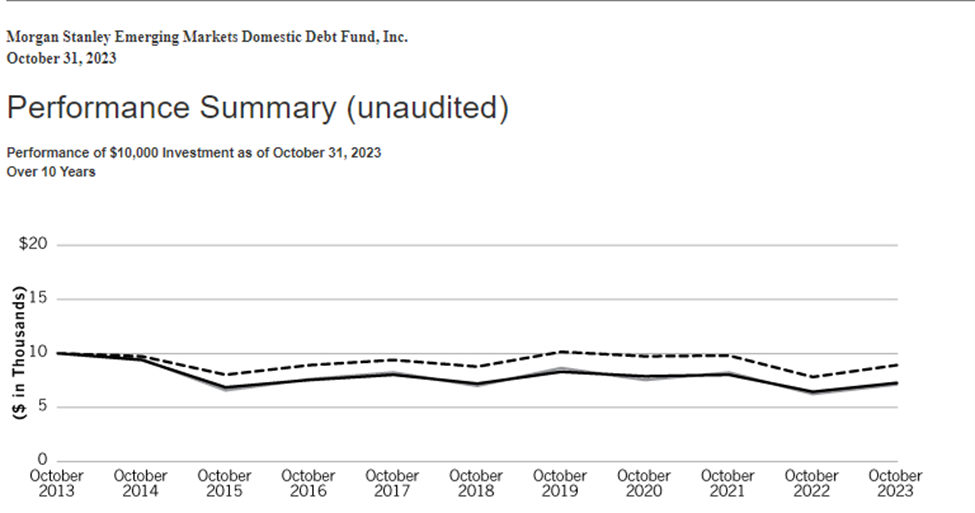

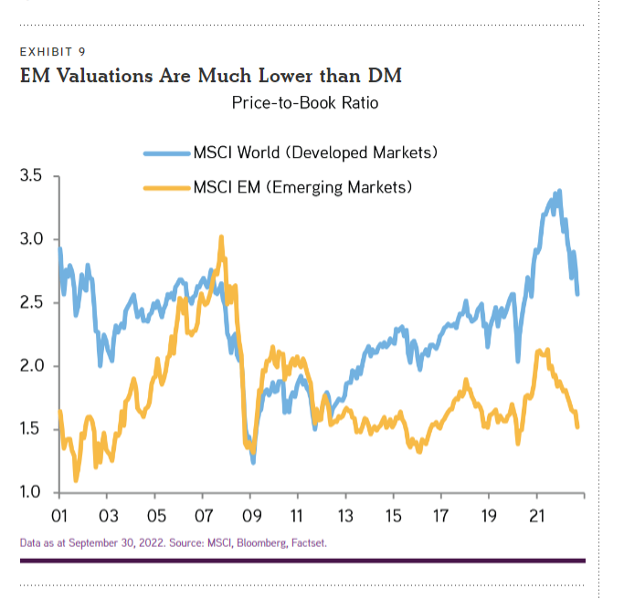

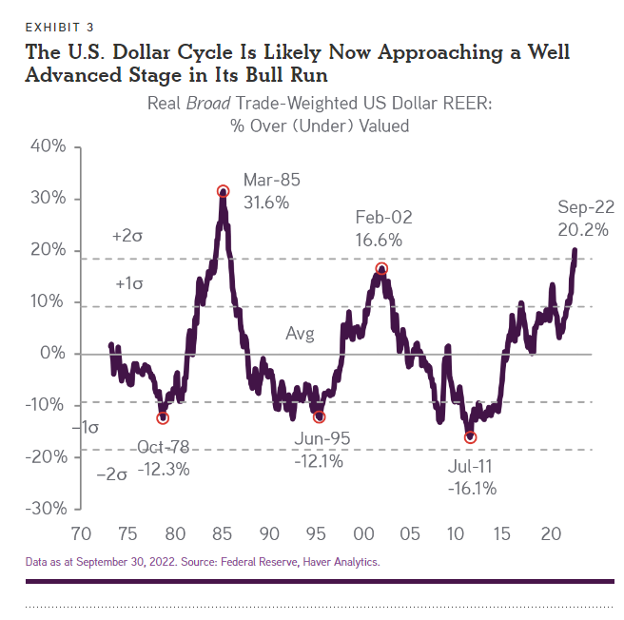

Our first stop is going to be emerging markets. I will reinforce the idea that you need to be sure you own shares of the Morgan Stanley Emerging Market Domestic Debt Fund (EDD). The tailwinds of falling inflation, falling global interest rates, and a weak dollar should combine to deliver fantastic truths. The fund is already up 15% this year, but we are just getting started.

The current conditions for emerging market debt look like they have in previous periods where emerging market local debt has rallied. The currencies are cheap relative to developed markets, and the yields of government and high-quality corporate bonds are higher.

In the past, these conditions have resulted in long-term markets that gave adventurous investors huge returns. The fund returns income only, and the yield is currently 7.84%. The discount to net asset value is 15% right now.

The top ten countries that the Morgan Stanley Emerging Markets Funds is invested in include some places that you might not want to vacation. Still, the economies are growing, interest rates are well above U.S. and European levels, and the fixed-income returns should see strong tailwinds from the three favorable factors.

Emerging market fixed-income performance has been flat for a long time. The U.S. dollar has been strong for more than a decade, which has limited gains.

While the emerging market stories of China and India are well known, that’s not the case for the fund’s top holding, Indonesia. Indonesia is now considered an upper-income country and is a member of the G20. It is currently the seventh-largest economy in the world, ranked by gross domestic product.

Indonesia is expected to keep experiencing solid economic and population growth for several decades. The country is resource-rich, with a large agricultural base producing commodities including rice, palm oil, peanuts, rubber, and other items for domestic consumption and export markets. Seafood is also a massive industry for Indonesia: the country is the world’s largest producer of tuna.

Indonesia is also expanding its mining operations in critical metals, including copper, nickel, gold, and coal. Despite all the climate change discussions, coal is still a growing market, and reports to other emerging markets should continue to be strong. Indonesia will also be a significant player in the transition to green energy, as it is the largest producer of nickel and the second largest producer of cobalt.

While Indonesia may be an emerging market, its credit rating is right up there with many of the more developed nations. S&P assigns the nation a BBB rating with a “Stable” outlook. So does Fitch Rating Service.

I could go through all the top ten nations, but that would take too much time and be far too dull for most readers. Suffice it to say that these countries have vibrant economies and will be able to pay their bills, meaning there is nowhere near the level of credit risk that most investors will automatically associate with the phrase “emerging markets.”

If you do not already own this fund, add it to your fixed-income portfolio as soon as possible. You can pay up to .80 for your shares.

I did add a new fund to the portfolio last week—yet another infrastructure fund.

Private infrastructure is one of the best-performing asset classes available to investors; however, most people skip it because it is not exciting.

But, I’m telling you: it should be exciting.

While infrastructure is not going to offer you the promise of turbocharged get-rich-quick schemes, what it does offer is far more realistic and valuable. Private infrastructure, both energy and non-energy, offer steady returns that allow you to compound your wealth at a high rate for long periods of time. When things go south in the economy and markets and turbocharged promises turn into massive real losses, infrastructure prices hold up much better than the price of stocks and keep throwing off steady streams of cash.

While the Ecofin Sustainable and Social Impact Term Fund (TEAF) owns some traditional energy infrastructure, it also has a substantial interest in renewable infrastructure, including private investments in solar farms and wind assets, as well as water-related assets and other valuable, cash-producing infrastructure projects.

The fund has also been involved in financing not-for-profit senior living facilities. Considering that 10,000 Americans a day are turning 65, the need for these facilities will be enormous.

The lack of new projects has helped the nonprofit facilities maintain high occupancy rates. This model has fared much better than for-profit facilities in recent years.

Financing charter schools is another unique infrastructure investment strategy the fund uses to deliver inflation and economic-proof returns for investors. Charter schools currently serve 3.7 million students in 7,996 schools across the United States, and I expect that number to grow substantially.

While most projects are in the United States, TEAF has infrastructure assets worldwide. The Ecofin fund does own a lot of private investments, but most of them are things like schools and solar farms that are relatively easy to value.

The market’s fear of private investment has caused put the shares at a discount to the net asset value of 23%. At the same time, most of the projects owned by the fund are throwing off large amounts of cash, and the shares are yielding 9.5%. Dividends are paid monthly and are reported on IRS Form 1099. Once again, the magic of closed-end fund accounting turns partnership income into ordinary dividends, with no K1s or tax hassles.

Tortoise is the primary advisor of the fund, which has been a target of SABA Capital and other activists in the past year.

Tortoise was once thought to be too big to tackle for activists, but Boaz Weinstein has laid that idea to rest, and all closed-end fund managers and sponsors are now targets if the discounts to NAV of these funds are too wide.

This is apparent when you consider that Saba and Weinstein have scored yet another win against mutual fund behemoth Franklin Templeton (BEN). Franklin is the parent company of Clearbridge, the sponsor of a portfolio holding ClearBridge MLP and Midstream Fund (CEM).

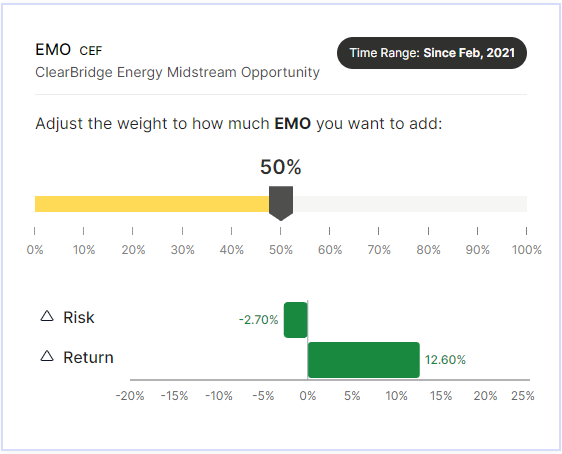

The fund announced last week that it would be merged into ClearBridge Energy Midstream Opportunity Fund Inc. (EMO). The merger value will be based on the NAV of the respective funds at the time of the completion of the deal.

Even with the merger it’s interesting to see what impact adding EMO to your portfolio could have using Magnifi (it’s free for my readers.

Try it now, click here.

Prior to completion of the merger, it will conduct a tender offer for up to 50% of its shares at 100% of net asset value for 50% of the outstanding shares. Make sure you tender 100% to get the maximum 50% acceptance. If you tender 50%, you will only sell 25% of your shares back to the fund.

With the most recent Federal Reserve announcement, Wall Street was shocked that Jerome Powell and his team indicated they were not ready to lower rates yet. The Fed statement proclaimed that: “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

Apparently, traders were surprised by that. But I am not sure how surprised you get to be when government officials tell you something they have been telling you they would say to you for weeks in advance.

While core inflation is down, the Fed wants to see more data, and feel confident that inflation will fall below the target rate of 2%, before signing off on cuts in the fed funds rate.

There is no longer any discussion of possible hikes. Barring some inflation spike caused by energy prices or some other geopolitical disaster, this rate-hiking cycle is over. The question has now shifted to when, not if, on the subject of rate cuts. The timing of the cuts will determine if this is wildly bullish or insanely bullish for our fixed-income funds.

I would like to get some near-term shock to the interest rate markets to add aggressively to our tax-free funds at better yields. We were just getting started with tax-free promotions when rates began their rally last year and have just recently begun to trend sideways or slightly lower. Hopefully, there will be some news flow that will cause the downward drift to continue.

Our two overweights are infrastructure and fixed income, so we are perfectly positioned for whatever happens next.

While we would love to get more money to work in small-cap funds and funds with significant real estate holding, I will not break the rules to do so.

We have scored multiple wins from activist activities in our funds so far. We continue to collect above-average income streams, and the latest addition to the portfolio increases the amount of cash hitting your account every month.

Be sure to join me for our next live monthly webinar later this month. You can get the link and watch the most recent replay here.

January 2, 2024 - 8:00 am

I am writing this on the 27th of December, and we have more than accomplished my major goals for Underground Income in 2023:

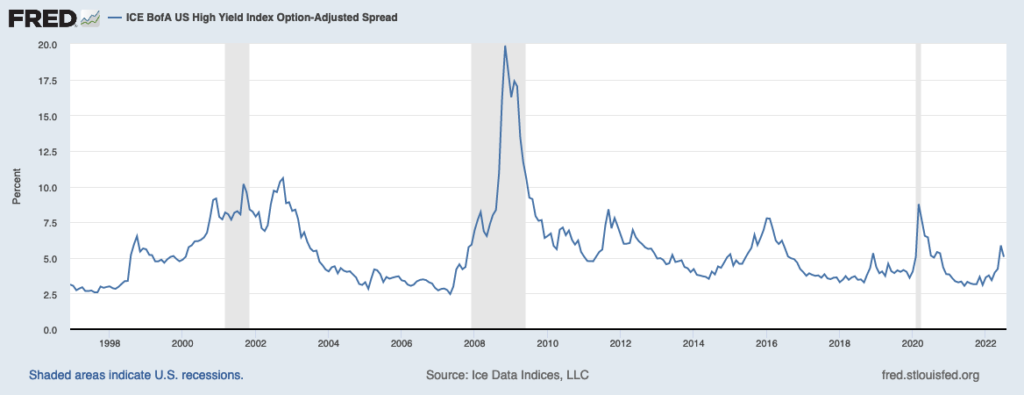

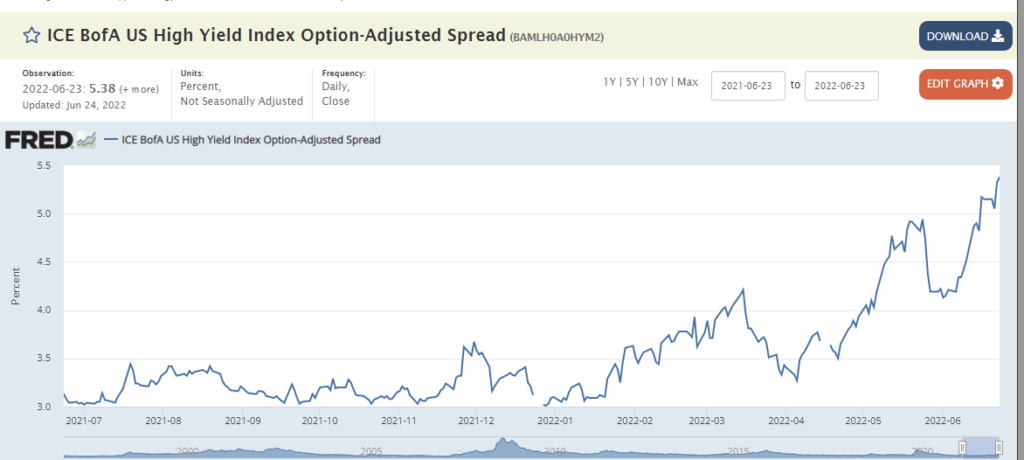

1. We have collected a dividend yield greater than the junk bond market, and with far less risk.

Our total return so far this year is more than 15%.

If we can compound in the mid-to-high teens while ignoring the broader stock market, we should be able to help total return-oriented investors compound their wealth at a pace that helps them reach all their goals and financial dreams.

That does not match the gain of the S&P 500, but that was never our goal – as I’ve grown to appreciate in the years when the markets tank.

2. We easily outperformed the bond and oil markets.

This wasn’t exactly a goal, but it is quite an achievement—especially given that we were massively overweight fixed income and energy assets all year—so it’s worth including here.

While I pay attention to what is happening in the markets and am well-versed in macroeconomic and geopolitical affairs, they are not the driving factor in selecting discounted closed-end funds for the Underground Income portfolio.

There are four factors that go into that decision-making process:

First, we must feel like the asset class is due for a reversal.

This is not based on headlines, opinions, or feelings—it is pure math. We want to buy significantly undervalued assets, and I do not care if they are stocks, bonds, real estate, or commodities.

I am also impartial to the distinction between foreign and domestic assets for the most part. The overriding question is whether the assets are undervalued to the point that a reversal in the near future seems imminent.

The math leads us to favor those sections that bombed out, and that everyone hates. More than three decades of being a deep value investor with a huge contrarian streak has taught me that the math is correct most of the time.

People’s opinions and feelings are much less important than math when it comes to markets and investing. Leave your feelings and opinions for the holiday dinner seating arrangements (although if I could use math for this, I would) and team sports franchise attachments.

Second, the fund must trade for less than the value of the stocks, bonds, real property, and cash it holds.

We are looking to buy discounted dollars. The first thing to consider is the level of the discount to net asset value (NAV). I want to buy funds that trade for much less than the value of the stocks and bonds owned by the fund, and the larger the discount to NAV, the more interested I am in adding the fund to the Underground Income portfolio.

Third, there must be an income stream.

This service is for Income and total return-oriented investors; most of our funds pay monthly dividends, but we have a handful of quarterly payers. Either way, a decent dividend yield is a must.

Finally, there must be an activist shareholder who has a long track record of leaning in management to take the steps necessary to narrow the discount to the net asset value.

I make it a point to know the track record of the activists involved in closed-end funds and prefer the small handful with strong track records of success.

This year, we have seen several activist victories leading to dividend increases, buybacks, trade offers, and mergers, including one pending merger into an exchange-traded fund.

Most recently, ClearBridge MLP and Midstream Fund (CEM) announced that they have reached an agreement with Saba Capital, a prominent activist shareholder, and would be considering a tender offer.

The fund will buy back up to 50% of its shares at 100% of net asset value. In Return, Saba will rescind its nominees for board seats and vote to merge several Clearbridge funds.

When you receive notice of the tender from your broker, tender 100% of your shares. You will get a maximum of 50%, but tender all, or you will get half of what you tender.

This will be another major winner for us, with further gains possible when the merger of the funds culminates after the tender offer concludes sometime in 2024.

Following the four rules above gives us three ways to make money with every fund added to the Underground Income portfolio:

- Asset appreciation: The value of the securities and assets in the fund stops going down and increases in value.

- The NAV discount narrows: This can happen on its own, as fund discounts and premiums tend to be mean-reverting over time. Limiting our preference to funds with proven activists accelerates the reversion process.

- Each fund in the portfolio pays a dividend: You can take it in cash or reinvest in more shares; either way, it is cash paid that cannot be taken back.

You will find that I am a stickler for the rules regarding this portfolio.

I did not pull them out of thin air. Some, I learned from successful, experienced investors who share their knowledge of closed-end discount arbitrage investing with me. Others, I learned through my own experience. I have confirmed all the rules the hard way, by contributing my cash to people who did not bend the rules, tempting as it is to break the rules.

I am not in the camp that thinks all commercial real estate will implode and crash the financial markets. In fact, I have my eye on closed-end funds that invest in commercial real estate. I have owned them before and would love to own them now. However, the discounts never got high enough, and there has been no significant activist activity in the funds.

The same holds true for small-cap value closed-end funds run by the managers I respect. Our conditions were never met, so we never bought a share. I suspect we will get our chance in 2024, but suspicions will not be the deciding factor—we will buy them if and when all four conditions are met. My feelings and opinions will not play a role.

Several of our funds have paid special dividends recently, and as we approach the New year, we have seen a rally of just about every asset class. Stocks, bonds, and REITs have all rallied sharply on the expectation not only that the Fed is done raising rates, but also that cuts are coming sooner rather than later. If that turns out to be the case, then stand by for a sharp reversal of the rallies in stocks and REITs. Rate cuts would mean that the economy is weakening rapidly.

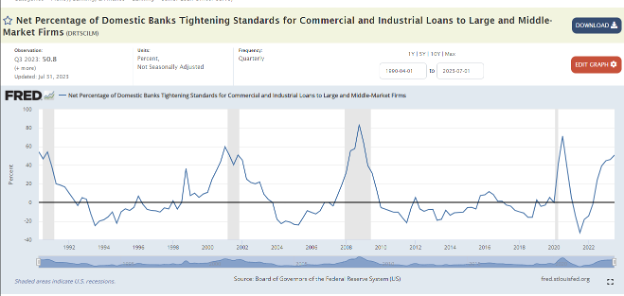

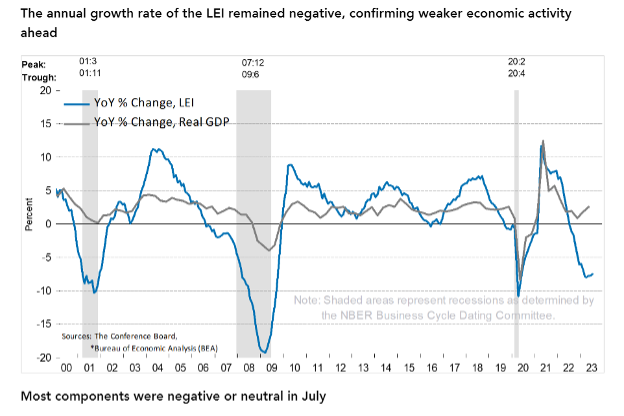

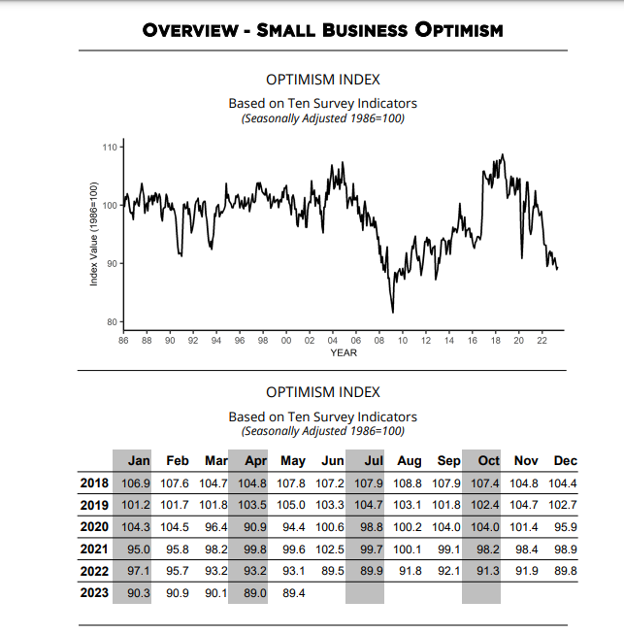

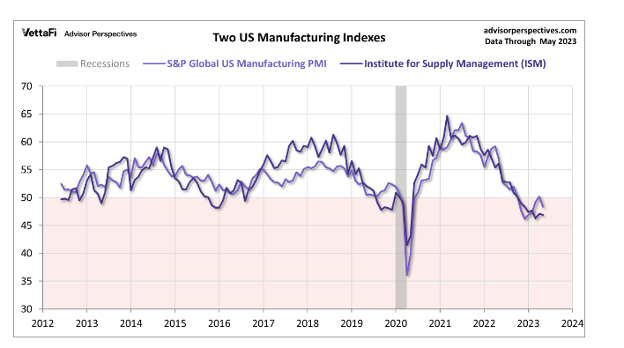

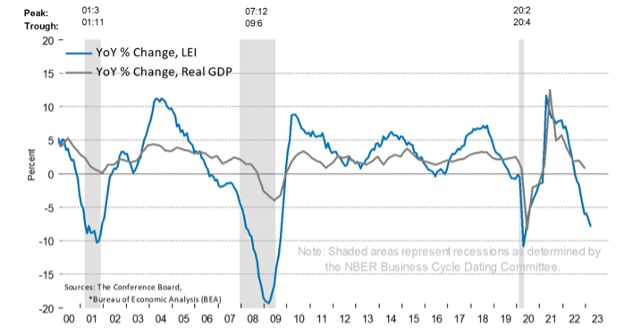

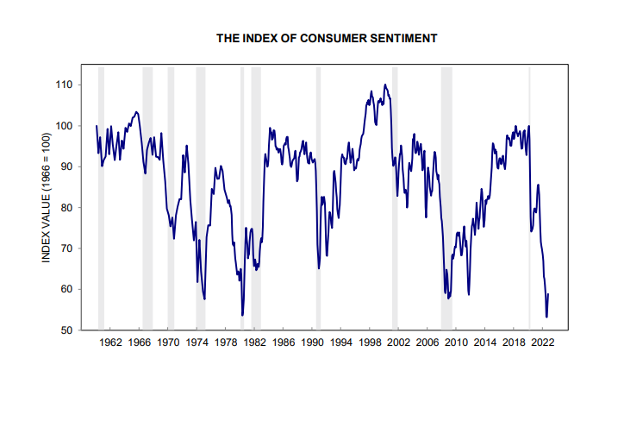

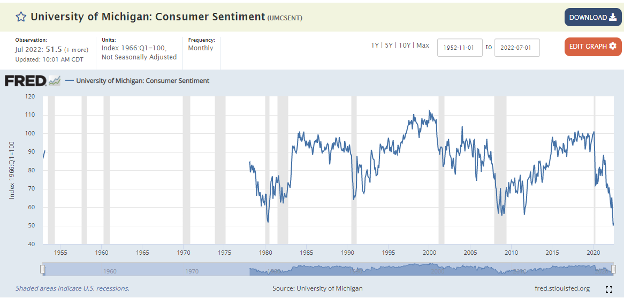

There have been signs of some weakening in things like capital expenditure plans and manufacturing reports from Philadelphia, Richmond, New York, Kansas City, and Dallas. Small business optimism was in the toilet all of 2023. The Index of Leading Economic Indicators was also down all year. However, while the data has shown some weakness, none of it has shown signs of accelerating economic decline that would justify lowering interest rates in the first quarter of the year.

Optimism abounds if you look at the various predictions and estimates for 2024. And when it comes to economic and market forecasts, anytime anything abounds, a healthy dose of skepticism is in order.

Nothing in a mathematical observation of equity markets suggests the basis for a rally that further extends valuation is in the cards; however, that does not mean it cannot happen. It just means that probabilities suggest that returns for the next several years will be low and possibly even mildly negative for large-cap stocks.

If we look at geopolitics and economics, there is a lot more potential for negative surprises than positive ones. The wave of optimism is dismissing one of the most unsettled global geopolitical situations in a long time.

The math of closed-end funds is keeping us mostly out of non-energy-related stocks and real estate as we enter 2024. In my over three decades of tracking closed-end fund activity, discount levels and activist activity have done a decent job of forecasting what is about to happen in markets.

That track record as a prognosticator is as good as, or better than, most people collecting six and seven-figure paychecks to make predictions.

2023 was an excellent year for Underground Income, and following discounts and activist activity in unpopular and ignored asset classes should lead to another good year in 2024.

The recent court decision involving Saba, Nuveen, and Blackrock has set the stage for a supercharged level of activist activity in closed-end funds over the next several years. The victory for Saba, especially, makes it clear that no fund sponsor is too big to tackle anymore.

We are in the first inning of what will be a massive transformation for the closed-end funds, and enormous profits will be made.

Underground Income investors should expect to collect their fair shares and then some of these profits.

December 6, 2023 - 4:53 pm

Right before I began pulling together my notes for this month’s newsletter, I saw the news that Charlie Munger had died.

For those who do not know, Munger was the Vice-Chairman of Berkshire Hathaway, and Warren Buffett’s sidekick and intellectual companion for decades.

It is impossible not to acknowledge that Buffett is one of the most successful investors and sharpest business people of the last 70 years. We also must admit that he is a master of the PR game. Although the blood of a pirate of the bounding main flows through his veins, he hides it behind the persona of a capitalist Santa Claus.

But just ask anyone who was ever on the opposite side of the table from him how much of a Santa Claus Buffett is in reality. He ended up owning Berkshire Hathaway (BRK-A) because he had a deal to sell the stock back to the company as part of a negotiated tender offer. Then, the CEO, Seabury Stanton, tried to chisel Warren out of an eighth of a point. Buffett backed out of the deal and bought the whole company so he could fire Seaborn.

Santa Claus indeed!

Munger was also a brilliant investor and a thinker of an entirely different level than most people. A few hours of reading Poor Charlie’s Almanac, and some of the talks and discussions published in that volume will quickly make you aware that Munger understood things most people don’t even think about on any level.

I am not going to rewrite Munger’s obituary. There will be several dozen versions of that spinning around the web by now. There will also be countless “How I knew Charlie” and “How I almost met Charlie one time” stories circulating.

I have nothing to add to those. I never even came close to meeting Charlie Munger. I could have met him at a Berkshire meeting, but he and Buffett were always inconsiderate enough to hold it on my birthday weekend. (The great state of Kentucky throws a horse race for the occasion every year, but the Berkshire Bobbsey Twins never bothered to acknowledge the day!)

I would be remiss if we did not touch on some of the principles that made Munger not just a great investor but a great person.

First and foremost, Munger was a prolific reader. He also said at various points that he never met any wise people who were not prolific readers. His kids referred to him as a book with legs.

I can relate and agree: the biggest favor you can do for your kids is teach them not just to read but to love books. And without my own love of reading, my life would follow an entirely different and much less attractive script.

Munger loved biographies and history. He called reading biographies making friends with the eminent dead. And making friends with the right dead people, Munger pointed out, can make an enormous difference in your life.

He was also a huge fan of being different from everyone else. After all, doing the same thing everyone else does achieves the same results as everyone else. So, given that the average individual investor underperforms the market, why would you shoot for average?

Like me, Munger despised trading. He had a discussion as recently as April of this year with Todd Combs, the CEO of GEICO. He said this about trading:

We have a liquid stock market, which is two things at once—it’s a place for people who are doing long-term investment rationally to go and make their transactions, and it’s a place for another bunch of people to do casino gambling. We mix them up totally. It’s an absolutely insane thing for the country. It’s like we mixed up running the army with child prostitution. It’s ludicrously crazy, but everybody that’s making money out of it loves it this way.

He added that making the casino part of the modern form of capitalism was an insane policy.

By the way, the people making money from trading are NOT the retail traders. The ones making money are the market makers and options statistical arbitrage players. It is often the sophisticated volatility traders who you’re seeing prosper—not Joe Sixpack, trading five contracts because of some super special price pattern.

Working around markets and Wall Street, LaSalle Street, and Wacker Drive, I have met plenty of wealthy people. I have had many drinks with many people in the bars of Rush Street in Chicago who made millions in the options market. They were all floor traders, spread traders, or market makers.

For us mere mortals, the secret to investing success is not short-term, lightning-fast, multi-million-dollar gains—those are the stuff of luck, legend, and leverage. Fortunes, instead, are built by steady compounding of returns without any disastrous losses.

Munger and Buffett emphasized the same principles we use here at Underground Income: price, time, and margin of safety. If we buy the right fund at the right price and avoid taking stupid risks, time (with considerable assistance from closed-end fund activists) will help us compound our money over time.

If income is your primary goal, then Underground Income can allow you to collect high levels of income, most paid monthly, and the combination of asset improvement and narrowing discounts can help offset the ravages of inflation.

As I write this, the news is all favorable for inflation and, allegedly, the economy. The GDP number for the third quarter has been revised up to over 5%, and the inflation readings remain modest. I am writing this before the personal consumption expenditure index, the Fed’s favorite measure, comes out, but I do not expect any massive changes from expectations in that number.

Analysts are falling all over themselves to suggest we will have a magical soft landing.

I really do not expect that to happen.

If you go below the headlines of the Beige Book released by the Federal Reserve last week, consumer spending is slowing—big purchases of stuff like furniture and appliances is down. Employment is flatlining. Retail sales are declining, even as we start the holiday season. Black Friday hit record numbers, but sales were clustered amongst the most heavily discounted items. And the four-week average of continuing unemployment claims hit the highest numbers since December of 2021.

A “soft landing,” in which the economy chirps merrily along while the inflation rate falls below 2% still seems highly unlikely.

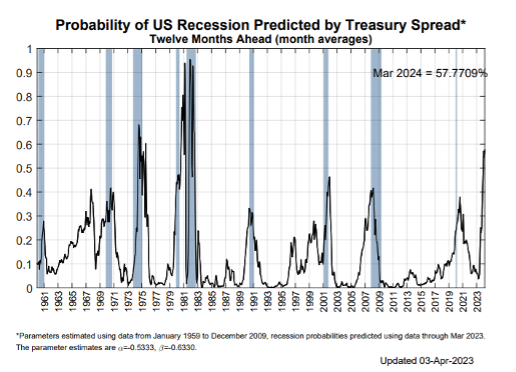

That does not put me in the end of America, imminent depression, and riots in the street crowd. Instead, I expect to see a garden-variety recession, with moderate unemployment, sometime next year.

The biggest threat to the suggestion of an economic slowdown is spending by the government. State and local governments are doing their share, but the real culprit is the Federal government. The spending programs in the laughably named Inflation Reduction Act and tax credits for the Green Energy Grift are doing their best to offset the higher interest rates and tighter bank credit conditions that have been slowing the economy.

That does not smooth the path to a soft landing. In fact, it is far more likely to ignite inflation.

As we go into the holiday season, the markets want to believe in a soft landing. As usual, most participants are only reading the headlines, which in most cases are written to appease those participants.

As we go into the holiday season, the markets want to believe in a soft landing. As usual, most participants are only reading the headlines, which in most cases are written to appease those participants.

Even the soft-landing scenarios include a softer, kinder Fed, lowering interest rates at some point next year. Some scenarios show the Fed delivering cuts at the same pace FedEx delivers packages two days before Christmas, with multiple cuts in 2024.

Whether the cuts come from the kindness of “Uncle Jerome’s” heart or in response to an economic slowdown, they will be outstanding for our fixed-income positions.

There are, however, threats to our outlook.

One is geopolitical. At this point, Ukraine, the Middle East, and China are all still in play. How the markets might react to that is hard to know.

The nice part is that it’s a safe bet that energy and fixed income will react differently and offset each other in the event of an event. Energy moving higher on its own due to market forces or shocks is another risk that could reignite inflation. Once again, if that happens, one part of our portfolio will zig while the other zags, with offsetting price movements.

Under either worst-case scenario, the cash keeps pouring into our account month after month.

The Kayne Anderson Energy Infrastructure (KYN) merger with the Kayne Anderson NextGen Energy & Infrastructure closed this month. As expected, we saw a bump in dividend income, and this is now one of the most attractive funds in the portfolio. The NAV is $ 10.32, and the market price is around $ 8.35—a 19% discount to NAV. For new buyers, the yield is over 10%. And as always, all that K1 partnership income is turned into 1099 dividend income, thanks to the magic of closed-end fund accounting.

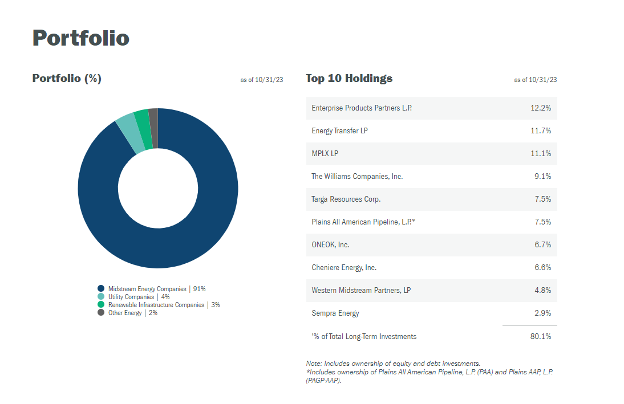

This combined portfolio is a collection of the most attractive energy infrastructure assets in the United States. Click here to see how much KYN you own – and decide whether it’s time to add more.

The Holiday season is fast upon us, and however you celebrate this time of year, I wish all the best to you and yours.

Best wishes for a happy and very prosperous New Year.

Click here to see the current Underground Income Portfolio.

November 1, 2023 - 9:00 am

The stock market returns 10% a year—everybody knows that.

Owning stocks is much better than owning bonds. When you consider inflation and taxes, bonds are just certificates of confiscation—everybody knows that, too.

Timing the markets is always a mistake. It cannot be done.

You should stay in stocks and take your lumps no matter what happens. It is the only way us regular folks can make money.

Everybody knows all of that, too.

In the past decade or so, fueled by a race between the Federal Reserve and Congress to see who can pump the most money at the fastest pace into the economy, everybody’s action junkie cousin has decided that the surest, quickest path to riches is trading.

The more leverage, the better. And even better than that, let’s use options so we have an expiration date and know exactly how long we have before we must cash in our massive gains.

Most mutual funds do not match the index returns. Moist individual investors do not match the returns earned by mutual funds. And most short-term traders lose money—lots of money.

We overtrade and chase stories.

The concept of staying in for the long run can be compelling. The problem is that if you pick the wrong decades to be long-term buy-and-hold investors, you tend not to do well.

The problem for most of us is that the worst decades usually follow the ones that were awesome and got us all excited about owning stocks after years of strong performance.

The problem is that we are all human, and humans get excited about their money.

Excited people favor emotional thinking over rational thinking. But emotions and the stock market are like bourbon and grapefruit juice: they just do not mix.

Ruthlessly applying common sense to stock markets can make you more money than all the trading schemes promoters ever dreamed up.

There are often huge changes in the markets. The hard part is to recognize them when living in the day-to-day world.

After World War II, you did not need to be a rocket scientist to realize that the war had revived the U.S. economy: the depression was over, once and for all, and the United States was the premier power in the world.

Once the cost of the war began to recede and all those war vets came home and started families and buying things, an economic explosion was inevitable.

U.S. industry learned a lot during the war, and they used that knowledge to turn out cars, washing machines, ovens, bicycles, baby buggies, and just about anything else the new family could wish to purchase. Homebuilders rushed to build neighborhoods with safe streets, good schools, and white picket fences. Jobs were created making all the stuff people did not know they wanted, and the economy boomed.

On the first day of January 1950, stocks yielded about 7%. The P/E ratio of the S&P 500 was just 7, giving stocks an earnings yield of over 14%

By comparison, high-grade corporate bonds yielded just 2.62%. T-Bills were paying out a little over 1%.

It should have been an easy choice, but stocks were still viewed as being too risky for most Americans. So even though, on average, stocks returned 20% annually in the 1950s, most people missed it.

As the 1960s started, stocks had a P/E ratio of 17, and the yield was down to 3.43%. High-grade corporate bonds paid about 4.4%, and the now available 10-year Treasury paid 4%.

Stocks did okay, with a return of about 7.5%, but things were getting ugly as the 1970s neared.

1968 was a brutal year for the United States. Robert Kennedy and Martin Luther King were both assassinated. The Democratic Convention in Chicago turned into a violent affair with riots and so-called “long-haired freaks” being beaten in the street by Richard Daly’s cops. Congress took U.S. currency off the gold standard. The battle of Khe-San, the My Ai massacre, and the Tet Offensive were in the news and all over America’s televisions.

Stocks were soaring as they had been in the go-go years, and corporate mergers were all the rage. The S&P 500 traded at 18 times earnings. Bargains were so hard to find that Warren Buffett wrapped up his wildly successful investment partnership at the end of the year.

Then, for the next 14 years, stocks were a terrible investment.

The 1970s were ugly. We had not one, but two, oil crises involving our friends in the Middle East. We had Watergate and the first resignation of a sitting President. We had to endure what to me was one of our nation’s low points: disco music. Had it not been for the Grateful Dead, the Rolling Stones, and the Baltimore Orioles, the decade would have been even worse than it was.

Nobody who bought into the long-term buy-and-hold concept in the late 1960s earned any returns over this period. Those who recognized that the world was ugly and stocks were expensive could have purchased corporate bonds and earned about 9% on their money while the insanity swirled around them.

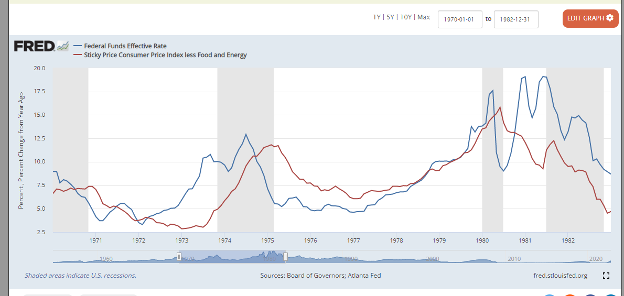

In the early 1980s, there was a massive change in the economy and market, and investors who recognized it made fortunes. Bonds had very high yields, and stocks were very cheap—you could buy high-quality bonds with coupons of over 11% and stocks traded at seven times earnings.

The headlines did not reflect it, but America was ready for change. Paul Volcker was at the Fed, and Ronald Reagan was about to become president. In the first year of the Reagan Presidency, Volcker raised the fed funds rate to 20%, and that was the top in yields. (We have never really come close to that level since.)

Investors in the 1980s who recognized the change in the mood of the country and the waning of inflation made fortunes over the next two decades. But it did not take a rocket scientist to see that valuation had gone beyond high, to stupid levels in 1999 and 2000. Analysts were valuing stocks based on clicks and eyeballs. Earnings were irrelevant.

At the turn of the millennium, we had entered a new paradigm. Stocks had a dividend yield of 1.17%. The P/E ratio of the S&P 500 was 33, giving stocks an earnings yield of just 3%. 10-year treasury bonds paid over 6%, and high-grade corporates yielded 8%. The intelligent choice was bonds over stocks. But no one cared.

If you applied a little logic to economic conditions and valuations, it was clear this could not go on forever.

It is not like there weren’t any warnings.

In 1999, Warren Buffett wrote an article for Fortune magazine suggesting there was no way stocks could live up to public expectations. Jeff Bezos, the founder of Amazon (AMZN), agreed with Warren, telling his employees and the public that they should heed Warren’s warning because a lot of people were going to lose a lot of money betting on the internet.

Over the next ten years, index investors made no money. Tech investors got crushed. As Seth Klarman, the legendary investor who manages the Baupost Fund, wrote in a 1999 report:

Students of financial history can point to historic levels of valuation to suggest that we are in a bubble. However, students of psychology may be needed to complete the picture. For one thing, the financial markets have been so strong for so long that fear of market risk has mostly evaporated. People who used to hold bank certificates of deposit now maintain a portfolio of growth stocks. It is not really within human nature to comprehend that you may not know everything you think you know and, further, that what you believe in could change on a dime.

Investors who applied cold, hard logic and relied on math and not stories could have purchased corporate bonds with yields above 8% and more than doubled their money, while index fund holders lost money.

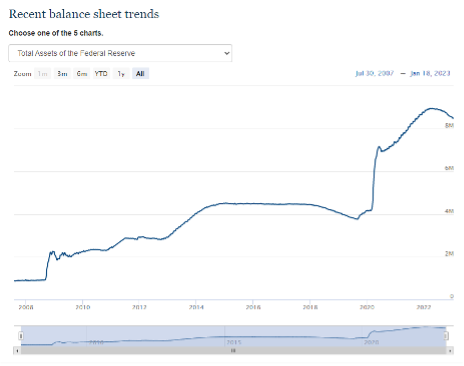

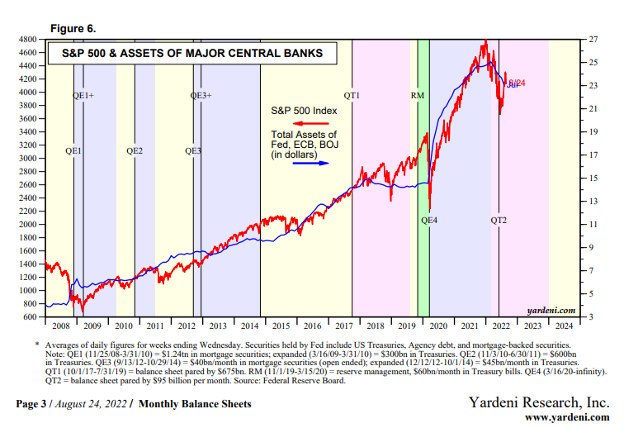

In the aftermath of the Great Financial Crisis, the Federal Reserve under Ben Bernanke began to take more of an activist role in managing the economy and the market. The Fed started responding to moves in the stock market as much as changes in the economy.

Investors who recognized that the Fed was going to keep rates near zero and that it was going to drive asset prices dramatically higher made a fortune over the next 13 years. Stocks went high. Real estate went higher. And bonds went nowhere.

There is probably a book to be written about the Fed’s turn toward economic activism, but it would take far more time than I want to devote to the effort.

We saw more signs of activism intervention under the Greenspan Fed. When Long Term Capital borrowed enough money and stupidly owned enough illiquid securities with that borrowed money to blow up the world, the Fed got involved and brokered a deal that kept financial chaos at bay. We saw more signs of this leading up to the GFC, but the aftermath of that catastrophe brought Fed activism to the forefront.

I can buy the argument that we needed a zero-interest rate policy (ZIRP) in the short term to prevent collapse. ZIRP is a harder sell for seven years.

Harder still is the Fed taking accommodative action every time stocks sell-off. The era of Fed intervention to protect asset prices was a huge change, and those who recognized it made a lot of money in stocks and real estate. But of course, all those changes were difficult to recognize when you were in the moment.

When valuations were low, and we were at the tail-end of hard times, buying stocks paid off a big deal. When valuations were high, and we were at the tail-end of boom times, the smart choice was to buy bonds and ride it out.

Today, the Fed is letting interest rates rise to fight inflation. The market is allowed to set yields for the ten and 30-year bonds without intervention from the central bank. Fed chair Jerome Powell has no intention of saving the stock market and has made that clear.

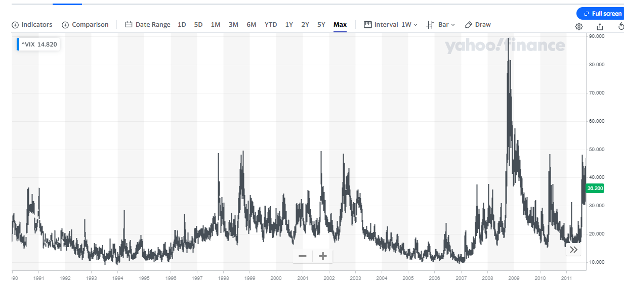

The S&P 500 has a dividend yield of 1.65%. The P/E is 24, giving stocks a yield of 4.1%—assuming earnings do not decline as the economy slows, which is a huge assumption. The yield curve is inverted, so short-term rates are higher than long-term rates. Interest rates have stopped going down, breaking a 42-year trend.

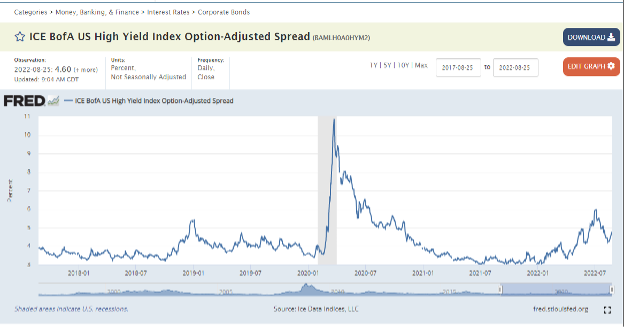

Meanwhile, the money market yield is over 5.25%. The ten-year Treasury is flirting with 5%. We can buy BB-rated bonds all day with yields of around 9%. High-grade private credit loans are yielding around 12%. New residential mortgage bonds yield over 7%.

Valuations are high. The mood of the country is sour. The political situation at would be a comedy if it were not a tragedy. There are signs the economy is weakening. There is conflict in the Middle East.

If you had recognized key turning points in the economy and market in the decades since World War II, you would have made an enormous amount of money: catching the key turns of the last 25 years has made you rich.

We’ve had a great run.

But today, it is time to step back from the stock market and look at where we are right now: returns from the stock market from current levels are likely to be subpar. Fixed income returns will be much higher than stock returns.

There is yet another massive change going on that will drive returns that no one is talking about that will make our Underground Income voyage even more profitable: activists are remaking the closed-end fund (CEF) industry.

For decades now, the biggest funds have gone unchallenged. They had too much money and too many lawyers to make it worth it fight with them. Funds issued by industry giants had steep discounts, and there was nothing anyone could do about it.

That is changing. The activists have more firepower than ever before, and they are talking on even the industry giants like Blackrock (BLK)—and winning. The activists will not kill closed-end funds, but the industry will change over the next several years, and discounts will be much narrower.

Buying fixed-income CEFs with activist involvement is going to be wildly profitable as bond yields eventually peak and discounts narrow. If yields stay higher for long, as may well happen, we’ll collect huge streams of cash and benefit as discounts narrow.

As any sailor knows, you cannot change the direction or strength of the wind. You can only change how you rig your sails. Failure to adjust sails when the wind changes will keep you from getting where you want to go.

In the financial markets, the winds are changing; it is time to set your sails.

Using the strategy deployed in Underground Income gives you the perfect chart book and tell-tales to line up your sails to reach your chosen financial destination.

October 4, 2023 - 10:12 am

Oil is rising.

So are bond yields.

Once again, Jerome Powell and the Federal Open Market Committee have succeeded in disappointing Wall Street.

It has become a dance that the pair have been doing all year. Powell and the FOMC tell markets that inflation is still higher than they want to see, and they will be data-dependent when it comes to making decisions about raising rates.

They are very insistent that they are open to more rate hikes if it is felt it is needed. Interest rates, they tell Wall Street, will stay higher for much longer than anticipated. And yet somehow, Wall Street interprets that as “happy days are here again.”

Strategists raise the earnings estimate and price target for the S&P 500, but no one talks about the multiple payments for these earnings. And anyone who talks about valuations is old-fashioned and does not understand.

At least one enlightened individual will suggest rather strongly that the Fed will be lowering rates sometime in the next few months. Reading the hard data is nowhere near as important as interpreting the surveys of economists and (apparently) business leaders and traders who are fierce advocates of legalized marijuana.

Markets will rally because everything is fine, and interest rates will drop soon. The economy will boom. Consumers will keep spending money, and job growth will continue without wage growth being a problem.

We will have a most wonderful and magical soft landing for the U.S. economy.

But back to reality: let’s talk about soft landings for a minute, shall we?

The only soft landing that I recall was the end of the recession in the mid-1990s.

Sometimes, tossing facts in the face of stories is fun. Occasionally, it upsets the storyteller, but sometimes, the storyteller needs to be angry.