Almost any trading or investment strategy can be improved with options. This may seem like a controversial statement, but it very much depends on how you define “improved.” While many would assume “improved” means the ability to produce higher returns, I believe it means the ability to generate more stable returns.

In other words, options can make many strategies better by reducing the volatility of returns. When it comes to the fund level of investing, many investors prefer consistent performance and protection against extreme drawdowns rather than a chance at sky-high returns. The money they invest needs to be there at retirement, ideally growing over the years.

Most strategies that promise the chance for really high returns also risk over-sized losses. That may be the goal of short-term traders looking for excitement, but it’s generally not what the investment industry is focused on.

While institutional traders may be intimately familiar with using options to lower risk, there are plenty of retail traders who could benefit from virtually the same strategies. For example, anyone entering into a large position in a stock or ETF may want to consider using a married put to protect against downside risk.

A married put is quite simple: it’s when the investor purchases a stock and buys a put at the same time. The put goes up in value as the underlying stock drops, so it’s used as a hedge. Sometimes the put may be purchased far out of the money (to hedge against a crash). Other times, it may be bought near the stock price for more robust protection (at a higher price).

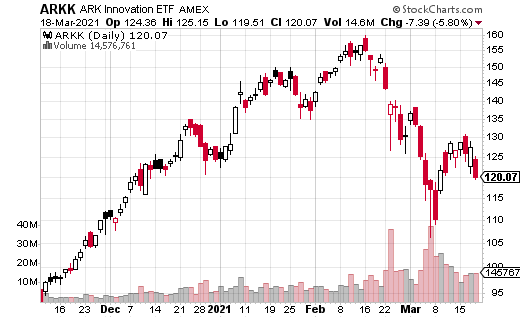

Just recently, a trader likely employed this strategy in ARK Innovation ETF (ARKK). ARKK has outperformed the major stock indices over the last year but has been volatile in 2021. The high volatility is likely why someone felt like the married put trade was appropriate for this ETF.

More specifically, it appears that this trader purchased 200,000 shares of ARKK at $124.15 while simultaneously buying 2,000 of the April 1 115 puts. The put price was $3.20, which is an additional $640,000 in premium (beyond what was paid for the stock).

While this may seem like a lot of money to spend on roughly two-week puts, you have to keep in mind that it’s about $25 million worth of ARKK stock to hedge. If the buyer is concerned about the downside in tech stocks over the next couple of weeks, this will provide significant protection if the bottom falls out.

The breakeven for the puts is at $111.80, and below that, the ARKK shares are fully hedged. As you can see from the chart, ARKK dropped all the way down to $110 just a couple of weeks ago. And, it’s apparent from the graph that it got there in a hurry.

From that perspective, you can see why someone with $25 million in ARKK shares may want to protect their downside risk. What’s more, it would be easy enough (although not necessarily cheap) to roll those protective puts forward while the investor believes downside risk is still on the table.