In the world of business, well-known companies are often in competitive industries, where it may be challenging to stay competitive and profitable. Behind the well-known companies will be suppliers. The supplier world often produces more predictable profits.

Consider the extreme case of Tesla (TSLA). The electric car manufacturer has never reported a profitable quarter. It is only a fervent belief by investors that holds up the TSLA share price. If they lose the faith, the share price will crash.

On the other side, consider the companies selling components to Tesla. I am sure that tire suppliers do not sell their rubber donuts to Tesla at a loss. Tire manufacturers are profitable year in and year out. They get to sell to vehicle manufacturers, and they sell replacement tires when the OEM rubber wears out.

Today I want to highlight three companies and stocks that are suppliers in the healthcare sector. Healthcare covers a large sector of the U.S. economy.

Recent months have put the industry into extreme focus. We have all learned about the supply chain that keeps medical professionals and those getting care protected.

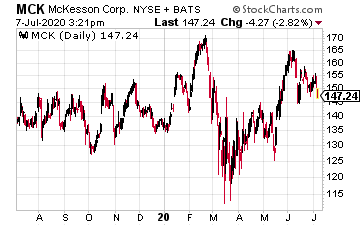

McKesson Corporation (MCK) provides distribution and technology solutions that help the healthcare industry operate more effectively. The pharmaceutical distribution division delivers branded, generic and over-the-counter medications to retail chains, independent retail pharmacies, hospitals, health systems, integrated delivery networks, and long-term care providers.

The medical-surgical division provides a comprehensive range of medical-surgical supplies and equipment to physicians’ offices, post-acute care agencies, and surgery centers. Other McKesson divisions provide technology and supply chain solutions for a broad swath of the healthcare sector.

For investors, McKesson has paid a growing dividend since 2008. Over that decade-plus, the compound annual growth rate of the dividend has been 10%.

The result is a 2020 dividend that is four times what shareholders earned in 2008. The next dividend increase should be announced at the end of July for payment in October. The current yield is 1.09%.

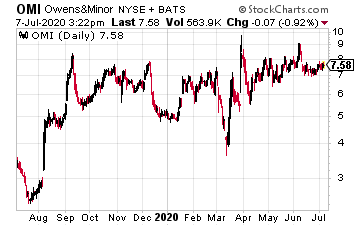

Owens & Minor, Inc. (OMI) is a small-cap company that operates as a middleman between medical supplies manufacturers and healthcare providers.

Owens and Minor offers 200,000 unique products from over 1,000 suppliers. The company also has a proprietary line of products, including such critical elements as single-use surgical instruments, safety products, angiography products, a universal light handle system, temperature probes, procedure tray components, and patient warming blankets.

In a nutshell, Owens & Minor simplifies the product sourcing challenge for the healthcare industry.

The OMI business is profitable. In May, the company affirmed 2020 adjusted net income guidance of $0.50 to $0.60 per share. At the midpoint, the earnings guidance gives a 13.5 forward P/E ratio.

This company is a value stock that should report strong results for the second quarter and through the rest of the year.

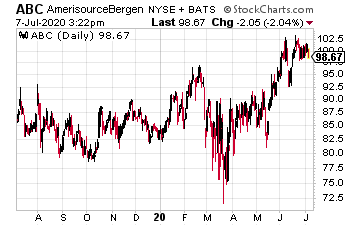

AmerisourceBergen Corporation (ABC) is one of the world’s largest pharmaceutical service companies serving the United States, Canada and selected global markets with a focus on the pharmaceutical supply channel.

The company provides logistical, packaging, and consulting support between drug manufacturers and pharmacies. AmerisourceBergen has 29 distribution centers in the U.S., nine in Canada, and 152 logistics services offices in 52 countries.

With the world gripped by the COVID-19 pandemic, AmerisourceBergen had an excellent second quarter, with year-over-year revenue up 9.5% and EPS up by 13.7%.

Full-year guidance is for EPS of $7.35 to $7.65.

The ABC dividend has grown for 15 consecutive years, with 10% compound annual growth for the last five years. The current yield is 1.68%.