Last week, when Virgin Galactic (SPCE) announced it would be replacing its CEO, the company sent a clear signal that it will be moving from a novel “spaceship company” to a company focused on making money.

The Sir Richard Branson-backed Virgin Galactic is scheduled to launch its first paying passengers into space later this year, and begin monetizing the technology that was born when Burt Ruritan, and his company Scaled Composites, won the Ansari X Prize in 2004.

With the hiring of former Disney (DIS) executive Michael Colglazier, Virgin Galactic is clearly pivoting from a technology development company to one with commercial footing.

Speaking on the hiring of Mr. Colglazier, former CEO, and now Chief Space Officer, George Whitesides, said: “The next decade for Virgin Galactic will be commercially-focused, and it is the perfect moment for us to bring a visionary commercial leader like Michael to take the Company forward.”

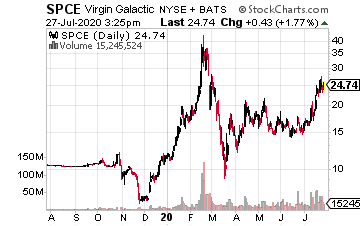

The market applauded the move, with Virgin Galactic stock moving higher, eventually breaking out of the trading range the stock had been in since early April of this year.

As COVID-19 vaccines appear to be getting closer and closer, we can begin to anticipate a day, likely sometime next year, that we’ll once again be looking for entertainment outside of the house.

I think you could do worse than picking up some entertainment companies, like Virgin Galactic on the high end of the entertainment spectrum, or Disney on the lower end.

As I said above, Virgin Galactic is still targeting its first commercial launch for later this year, but with no exact date yet. Mr. Branson is scheduled to be on that first flight as well.

The company is looking to monetize its suborbital commercial tourism business, which it has been selling tickets at $250,000 a pop. And that is why Mr. Colglazier, who most recently ran Disney Parks International, has been brought into the fold.

I like both the addition of Mr. Colglazier and the transferring of Mr. Whitesides to the space side of things. Whitesides will work on the next phase of the company’s growth: point-to-point hypersonic travel and orbital space travel.

Since the company has not yet begun commercial operations, there is no appreciable revenue to speak of, other than some income from engineering work. So, the play here is in trusting Mr. Branson, and the fact that he will realize his many-years-long dream of getting to space.

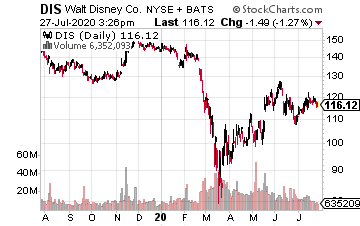

Disney is in the process of trying to reopen its parks, but is running into the issue of U.S. cities and states reopening, and then reclosing. This puts the in-person park business on a slow, but I believe upward, trajectory. The recent swing by President Trump to a pro-mask stance may help here as well.

On the plus side, many professional sports are opening back up—most notably, professional baseball had its opening day on the 23rd. This should help bring viewers back to Disney’s ESPN media property.

The company has done a good job on the marketing front by getting the NBA to have its entire league live in a bubble at Walt Disney World in Orlando. Teams currently plan to live and play at the park for the rest of their season.

In its latest quarter, Disney reported revenue down 93% year-over-year, which was not surprising given the pandemic. Earnings per share came in at $1.44, down from $5.42 year-over-year.

Finally, let’s talk about an entertainment company that just reported earnings, and does not need to wait for a reopening.

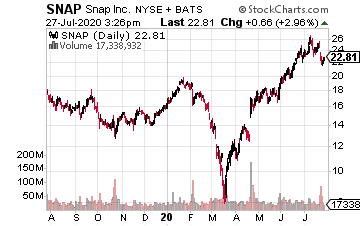

Snap (SNAP), which just reported earnings, has traded lower because the company missed high expectations for increasing users. It’s not surprising to see the stock take a breather, as it’s up from $8 at the March market lows, to over $26 before earnings.

Snapchat has been capturing market share of the all-important “eyeballs” market, as our entertainment options have been curtailed during the pandemic. The company reported revenue increased 17% year-over-year to $454 million.

Daily average users also grew by 17%, with the company picking up 35 million additional users year-over-year. With a number slightly disappointing to the Street, this may be a good place to enter the stock on the pullback.