The hot consumer price index (CPI) number last Friday has caused major damage to the equity markets. Volatility has remained elevated. There seems to be no relief in sight regarding the inflation numbers that we are seeing across industries—and, most importantly, in our daily expenses.

The Federal Reserve will do what it can to increase rates quickly in order to suppress demand, which will in turn (hopefully) put a stop to the inflation pressures we are seeing.

I could see a bullish (near term) as well as a bearish (long term) argument for the market. Therefore, I’d rather not pick a side.

Instead, I want to use the heightened volatility to sell options in order to realize some quick profit (in a risk-controlled manner) if the markets calm down just a bit.

I introduced the idea of an iron condor a while back and I’m revisiting that today.

I am looking at trading the July 1 expiration:

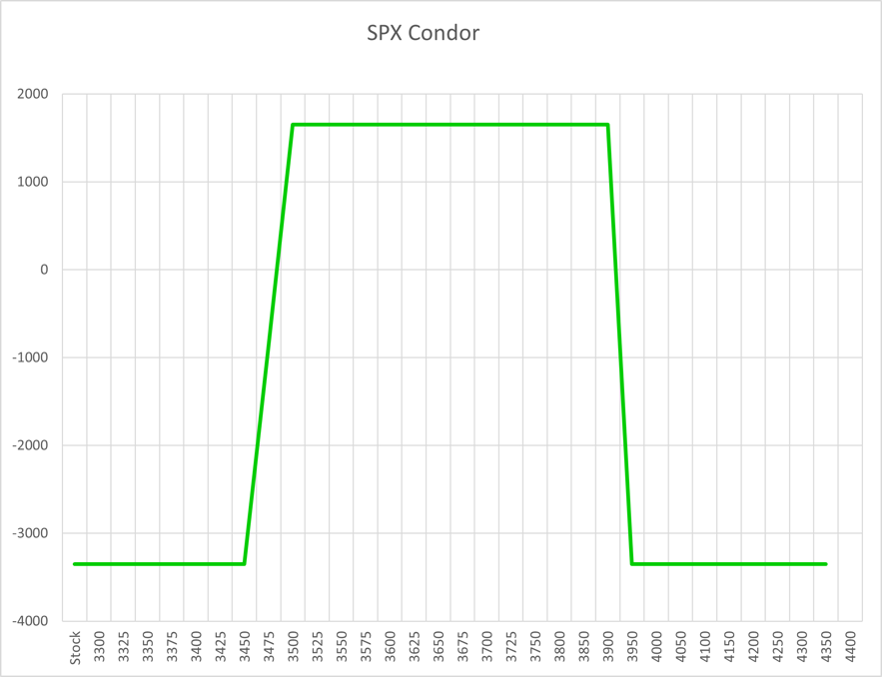

Sell SPX 3950/4000 call spread

Sell SPX 3525/3475 put spread

All-in collect $16.50 (a 1 lot would net you $1,650 at the outset)

You will realize all of this premium as profit if SPX stays between the two short strikes (3525 on the downside or 3950 on the upside) in the next 3+ weeks. Those strikes around 5.6% away from the current level. You could lose $3,350 if the market moves through the long strikes (3475 on the downside or 4000 on the upside… roughly a 7% absolute move in one direction).

As always, manage your risk and cut off the worst-case scenarios. Take profits as you are satisfied with the outcome. Then, move on to the next trade.

Payoff profile of the condor is below: